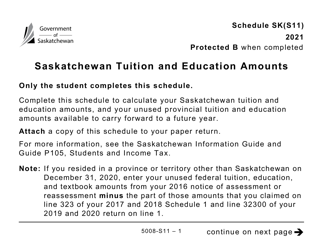

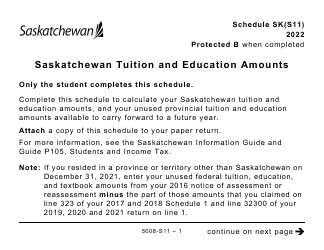

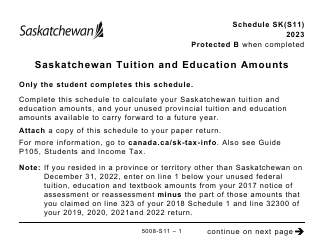

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5008-S11 Schedule SK(S11)

for the current year.

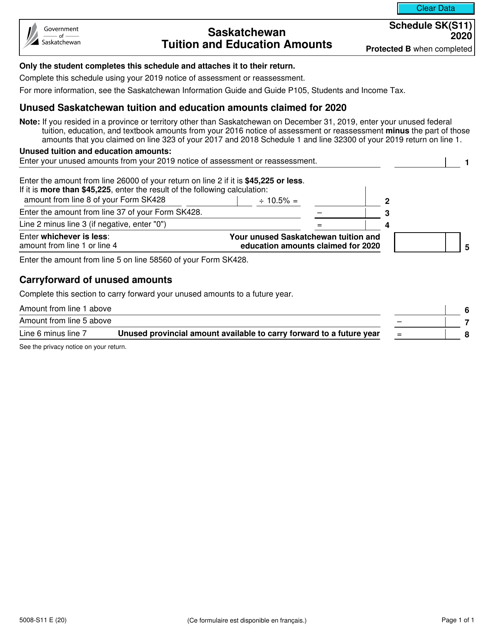

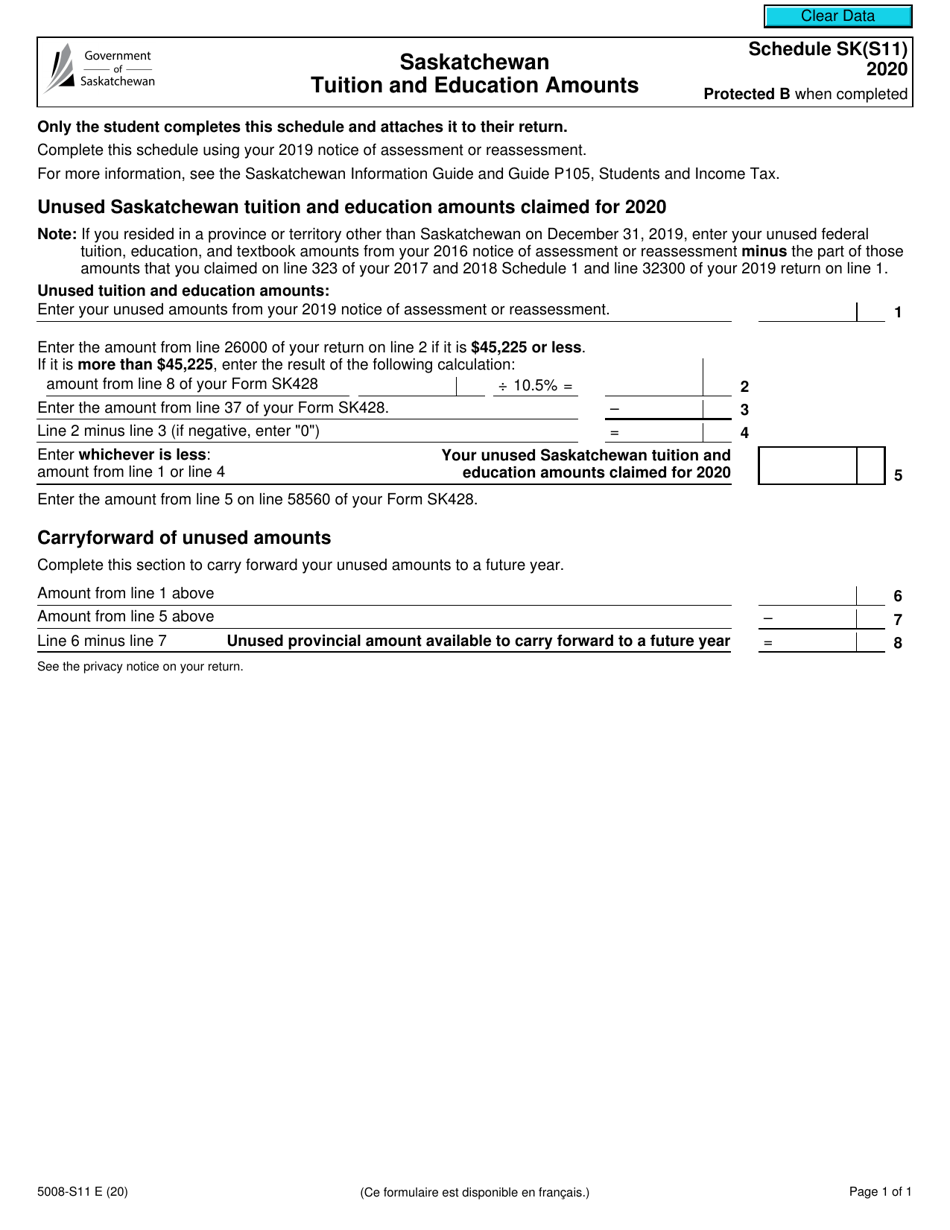

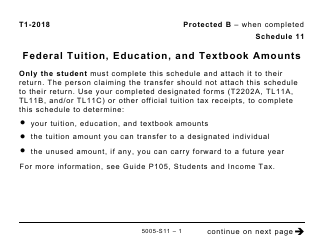

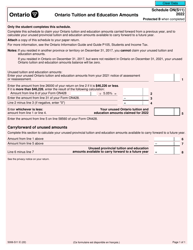

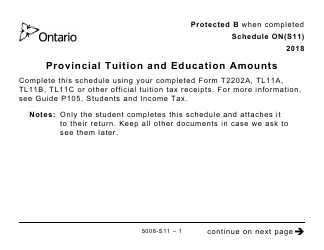

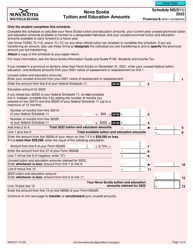

Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts - Canada

Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts is used to claim tuition and education amounts for residents of Saskatchewan, Canada.

The individual taxpayer files the Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts in Canada.

FAQ

Q: What is Form 5008-S11?

A: Form 5008-S11 is a tax form used in Canada to claim the Saskatchewan tuition and education amounts.

Q: What is Schedule SK (S11)?

A: Schedule SK (S11) is a specific section of Form 5008-S11 that is used to calculate the Saskatchewan tuition and education amounts.

Q: What are the Saskatchewan tuition and education amounts?

A: The Saskatchewan tuition and education amounts are tax credits that eligible individuals can claim for education-related expenses.

Q: Who is eligible to claim the Saskatchewan tuition and education amounts?

A: Canadian residents who have attended an eligible educational institution in Saskatchewan, or individuals who are supporting a student attending such an institution, may be eligible to claim these amounts.

Q: What expenses can be claimed for the Saskatchewan tuition and education amounts?

A: Eligible expenses include tuition fees, examination fees, and textbook costs.

Q: How do I claim the Saskatchewan tuition and education amounts?

A: To claim these amounts, you will need to complete Form 5008-S11, specifically Schedule SK (S11), and include it with your income tax return.

Q: Are there any restrictions or limitations to claiming the Saskatchewan tuition and education amounts?

A: Yes, there are specific rules and limitations that apply. It is recommended to consult the official tax resources or seek professional tax advice for guidance specific to your situation.

Q: Can I claim the Saskatchewan tuition and education amounts if I am not a resident of Saskatchewan?

A: No, these amounts are specifically for residents or students attending eligible educational institutions in Saskatchewan.

Q: What is the benefit of claiming the Saskatchewan tuition and education amounts?

A: By claiming these amounts, you may be eligible for tax credits that can reduce the amount of income tax you owe or increase your tax refund.