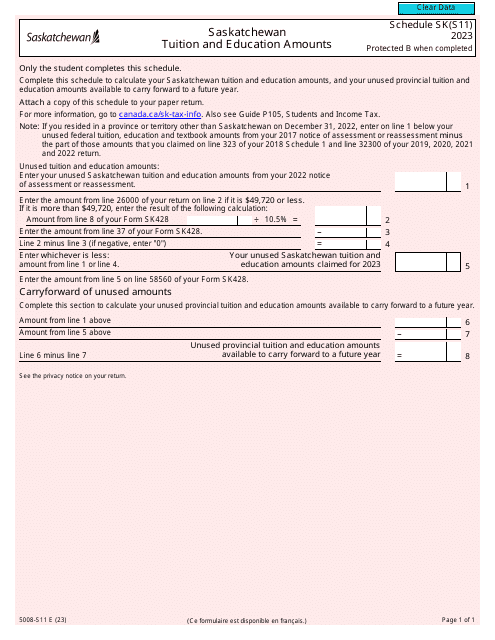

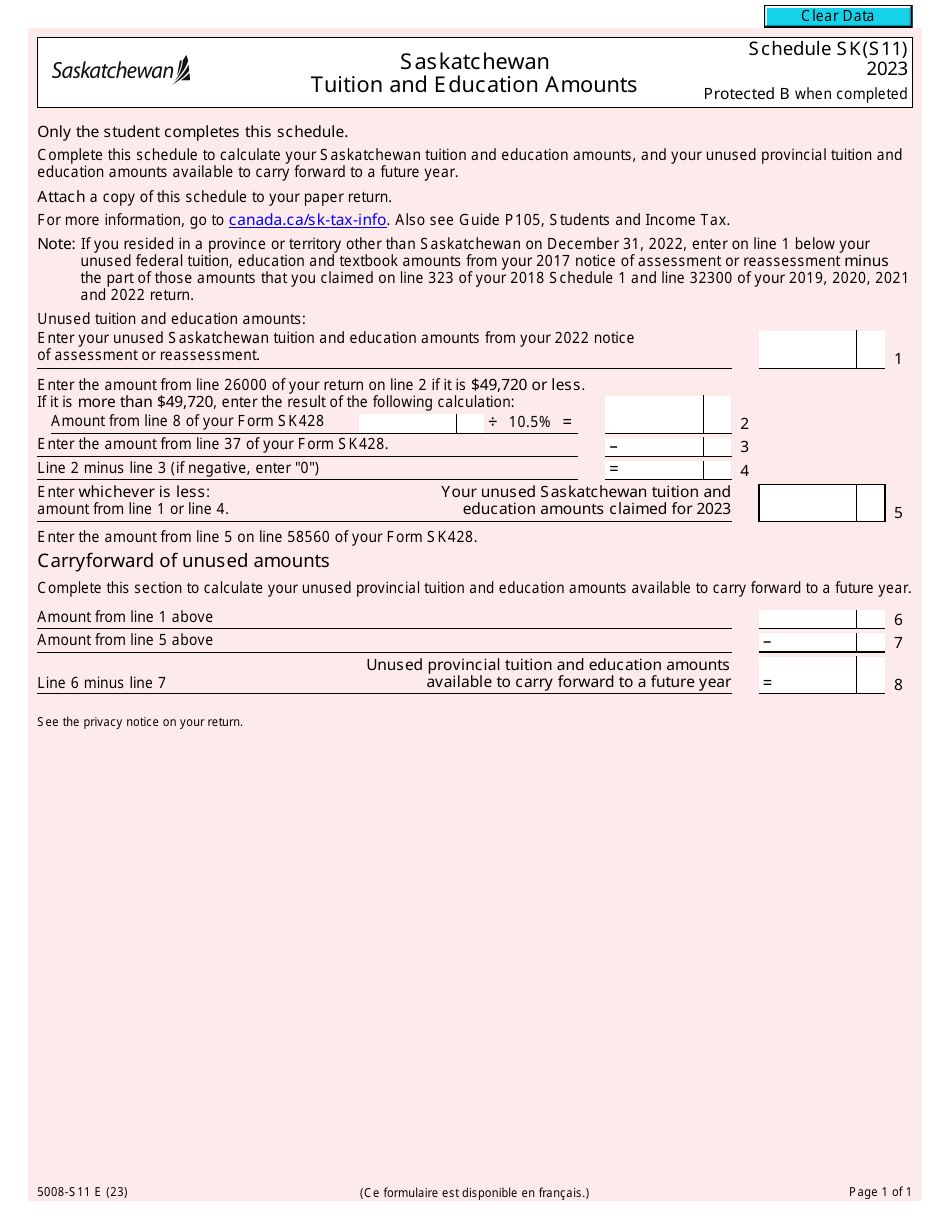

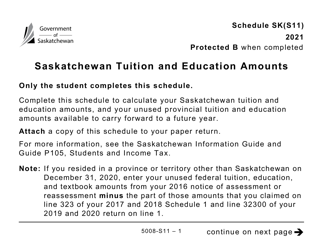

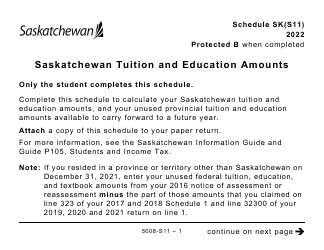

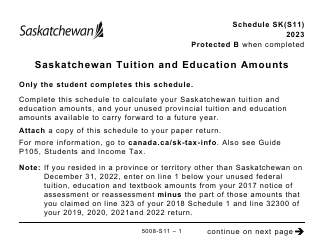

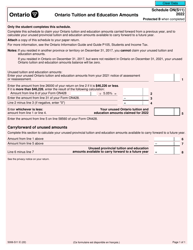

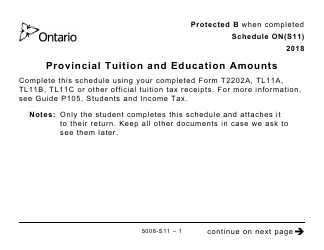

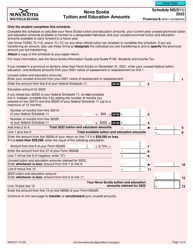

Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts - Canada

Form 5008-S11 Schedule SK(S11) is used in Canada for claiming tuition and education amounts specific to the province of Saskatchewan.

The individual who would file Form 5008-S11 Schedule SK(S11) for Saskatchewan Tuition and Education Amounts in Canada is a resident of Saskatchewan who is claiming tuition and education amounts for themselves or their dependents.

Form 5008-S11 Schedule SK(S11) Saskatchewan Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5008-S11?

A: Form 5008-S11 is a form used in Canada to claim tuition and education amounts for residents of Saskatchewan.

Q: What is Schedule SK(S11)?

A: Schedule SK(S11) is a specific schedule within Form 5008-S11 that is used to claim tuition and education amounts for residents of Saskatchewan.

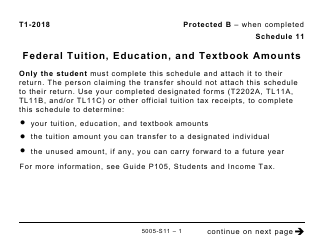

Q: What are tuition and education amounts?

A: Tuition and education amounts refer to expenses related to post-secondary education that may be eligible for tax credits or deductions.

Q: Who is eligible to use Form 5008-S11?

A: Residents of Saskatchewan who have incurred eligible tuition and education expenses are eligible to use Form 5008-S11.

Q: How do I fill out Schedule SK(S11)?

A: To fill out Schedule SK(S11), you will need to provide information about your tuition and education expenses, as well as any applicable scholarships or bursaries.

Q: Are there any deadlines for submitting Form 5008-S11?

A: The deadline for submitting Form 5008-S11 is usually the same as the deadline for filing your income tax return, which is April 30th of each year.

Q: What should I do if I have questions or need help with Form 5008-S11?

A: If you have questions or need help with Form 5008-S11, you can contact the Canada Revenue Agency (CRA) or seek assistance from a tax professional.