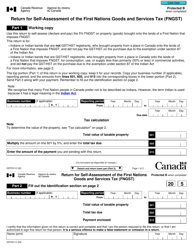

This version of the form is not currently in use and is provided for reference only. Download this version of

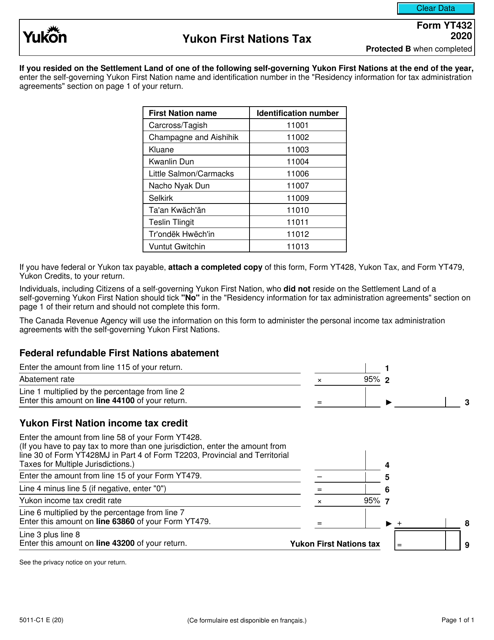

Form 5011-C1 (YT432)

for the current year.

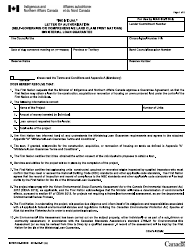

Form 5011-C1 (YT432) Yukon First Nations Tax - Canada

Form 5011-C1 (YT432) is used by the Yukon First Nations in Canada for reporting their taxes.

The Yukon First Nations Tax - Canada is filed by the First Nations communities in Yukon.

FAQ

Q: What is Form 5011-C1?

A: Form 5011-C1 is a tax form specifically for the Yukon First Nations in Canada.

Q: What is Yukon First Nations Tax?

A: Yukon First Nations Tax is a tax imposed on the First Nations people residing in the Yukon territory of Canada.

Q: Who needs to fill out Form 5011-C1?

A: The Yukon First Nations individuals who are subject to the First Nations Tax in the Yukon territory of Canada need to fill out Form 5011-C1.

Q: What information is required on Form 5011-C1?

A: Form 5011-C1 requires personal information, income details, and other specific information related to the Yukon First Nations Tax.

Q: When is the deadline to file Form 5011-C1?

A: The deadline to file Form 5011-C1 varies, and it is best to consult the CRA or the tax authorities for the specific deadline.

Q: What happens if I don't file Form 5011-C1?

A: If you are required to file Form 5011-C1 and fail to do so, you may face penalties and interest charges by the Canada Revenue Agency.

Q: Are there any exemptions or deductions available for the Yukon First Nations Tax?

A: Yes, there may be exemptions or deductions available for the Yukon First Nations Tax. It is recommended to consult the CRA or a tax professional for specific details.

Q: Can I get assistance in filling out Form 5011-C1?

A: Yes, you can seek assistance from the Canada Revenue Agency, tax professionals, or local First Nations organizations while filling out Form 5011-C1.