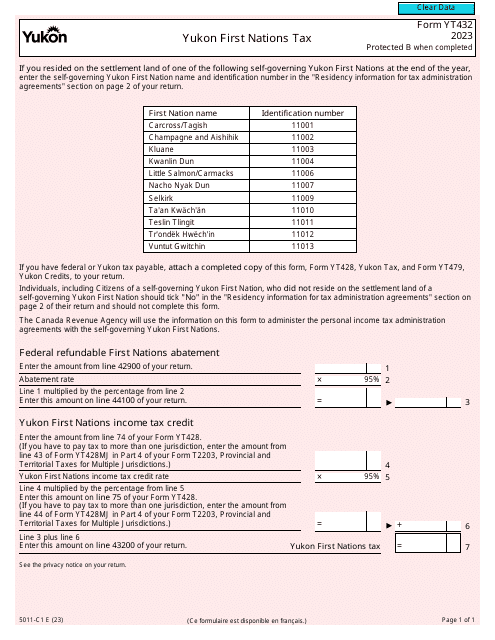

Form 5011-C1 (YT432) Yukon First Nations Tax - Canada

Form 5011-C1 (YT432) is used for reporting and paying the Yukon First Nations Tax in Canada. It is specifically designed for First Nations individuals who reside in the Yukon territory and need to fulfill their tax obligations.

The Form 5011-C1 (YT432) Yukon First Nations Tax in Canada is filed by the Yukon First Nations.

Form 5011-C1 (YT432) Yukon First Nations Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5011-C1 (YT432)?

A: Form 5011-C1 (YT432) is the tax form used by Yukon First Nations in Canada.

Q: What is Yukon First Nations Tax?

A: Yukon First Nations Tax is a tax imposed on certain purchases made by individuals in Yukon First Nations territory.

Q: Who needs to fill out Form 5011-C1 (YT432)?

A: Individuals who are residents of Yukon First Nations and make taxable purchases are required to fill out this form.

Q: What is the purpose of Form 5011-C1 (YT432)?

A: The purpose of this form is to report and remit the Yukon First Nations Tax on taxable purchases.

Q: When is Form 5011-C1 (YT432) due?

A: This form is usually due on a quarterly basis, with specific due dates provided by the tax authorities.

Q: What information is required on Form 5011-C1 (YT432)?

A: This form requires information such as the purchaser's name, date of purchase, amount of taxable purchases, and the amount of tax owed.

Q: What happens if I don't file Form 5011-C1 (YT432)?

A: Failure to file this form or remit the tax owed may result in penalties and interest charges.

Q: Are there any exemptions or deductions available for Yukon First Nations Tax?

A: Yes, certain exemptions and deductions may apply, such as exemptions for essential items or deductions for business expenses. It is important to consult the tax authorities or a professional tax advisor for specific details regarding exemptions and deductions.