This version of the form is not currently in use and is provided for reference only. Download this version of

Form T90

for the current year.

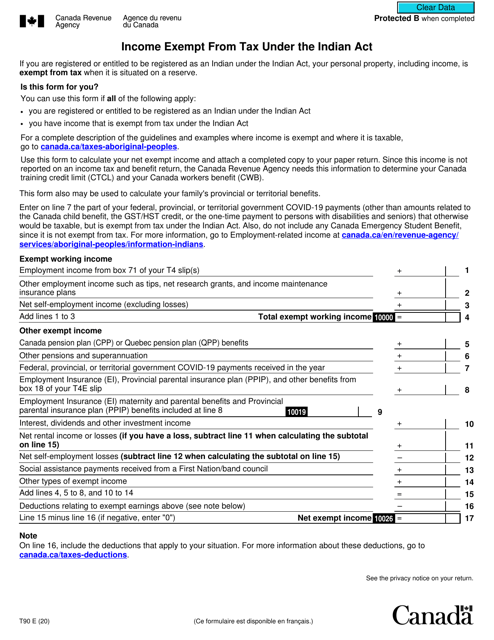

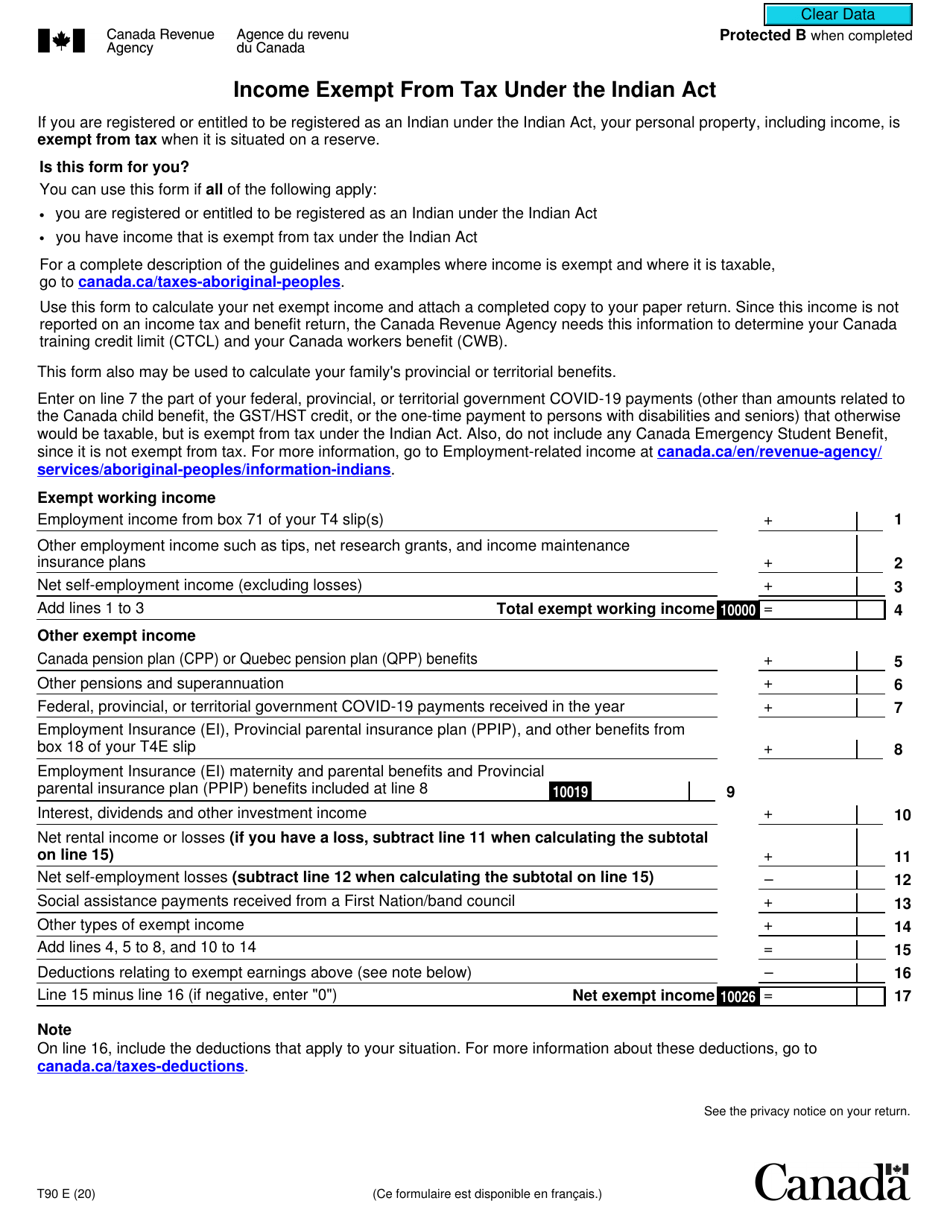

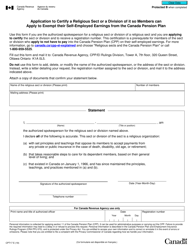

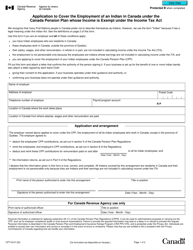

Form T90 Income Exempt From Tax Under the Indian Act - Canada

Form T90 is not a recognized form under the Indian Act in Canada. The Indian Act is a Canadian federal law that governs the rights and status of Indigenous peoples in Canada. However, there may be other forms or exemptions related to income tax under the Indian Act, but Form T90 is not one of them.

The Form T90 for income exempt from tax under the Indian Act in Canada is filed by individuals who are registered Indians or members of an Indian band in Canada.

FAQ

Q: What is Form T90?

A: Form T90 is a form used in Canada to report income that is exempt from tax under the Indian Act.

Q: What is the Indian Act?

A: The Indian Act is a federal law in Canada that governs the rights and status of First Nations people.

Q: What kind of income is exempt from tax under the Indian Act?

A: Income earned on a reserve or by a First Nations individual may be exempt from tax under the Indian Act.

Q: Do I need to file Form T90 if I have income exempt from tax under the Indian Act?

A: Yes, if you have income exempt from tax under the Indian Act, you must file Form T90 to report it to the Canada Revenue Agency.