This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC626

for the current year.

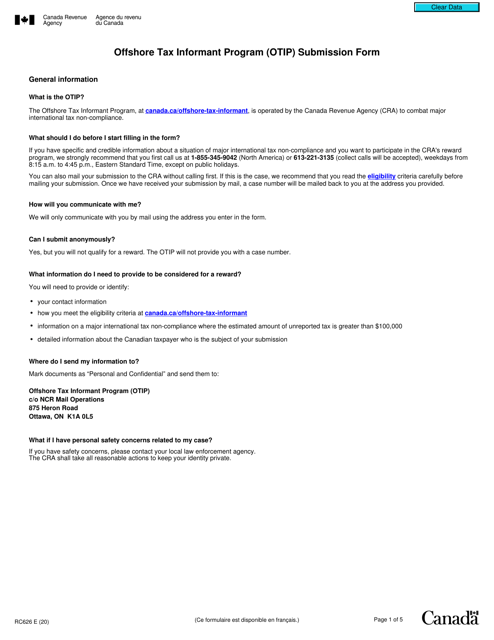

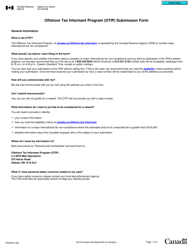

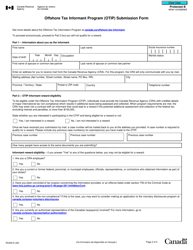

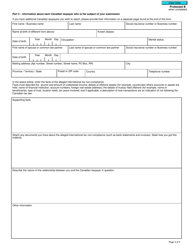

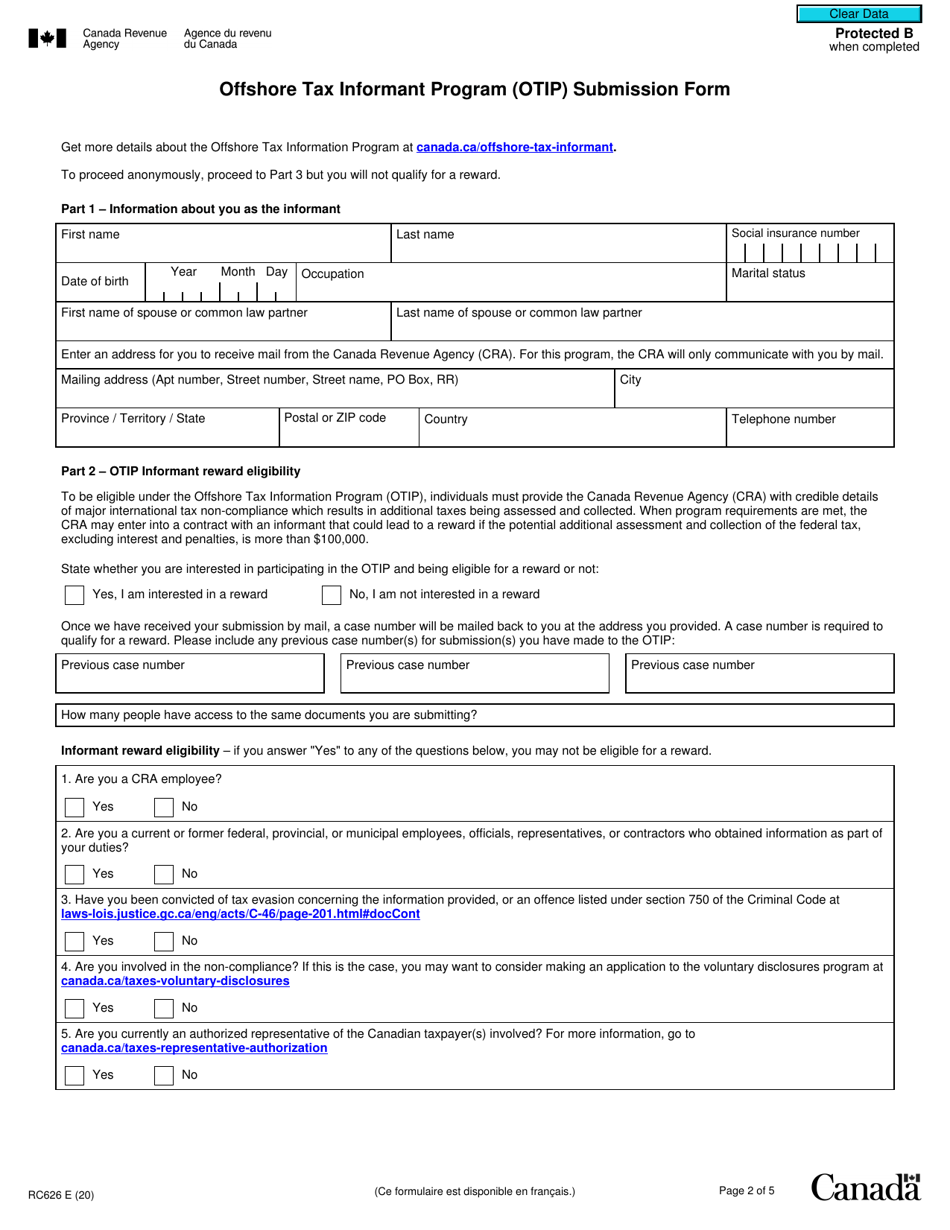

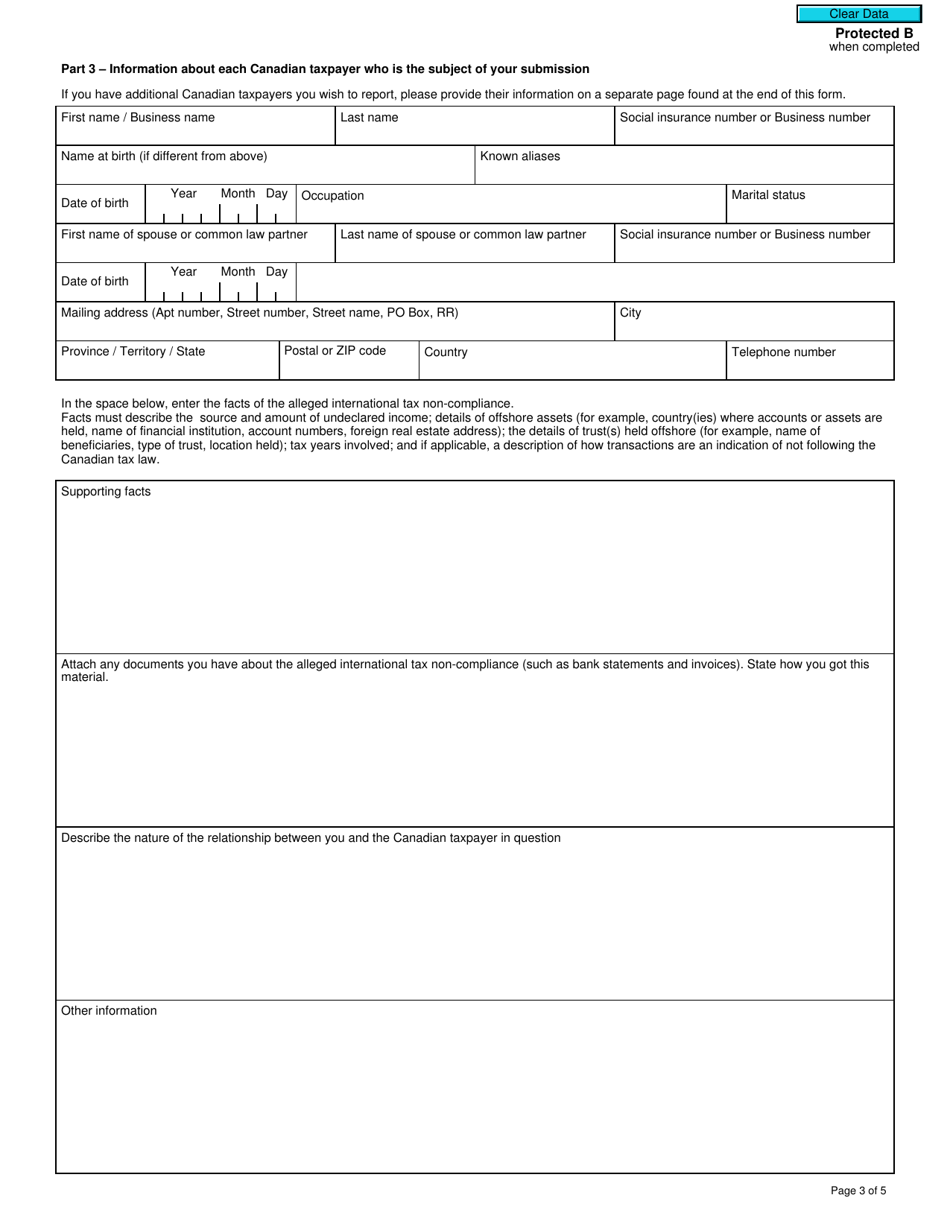

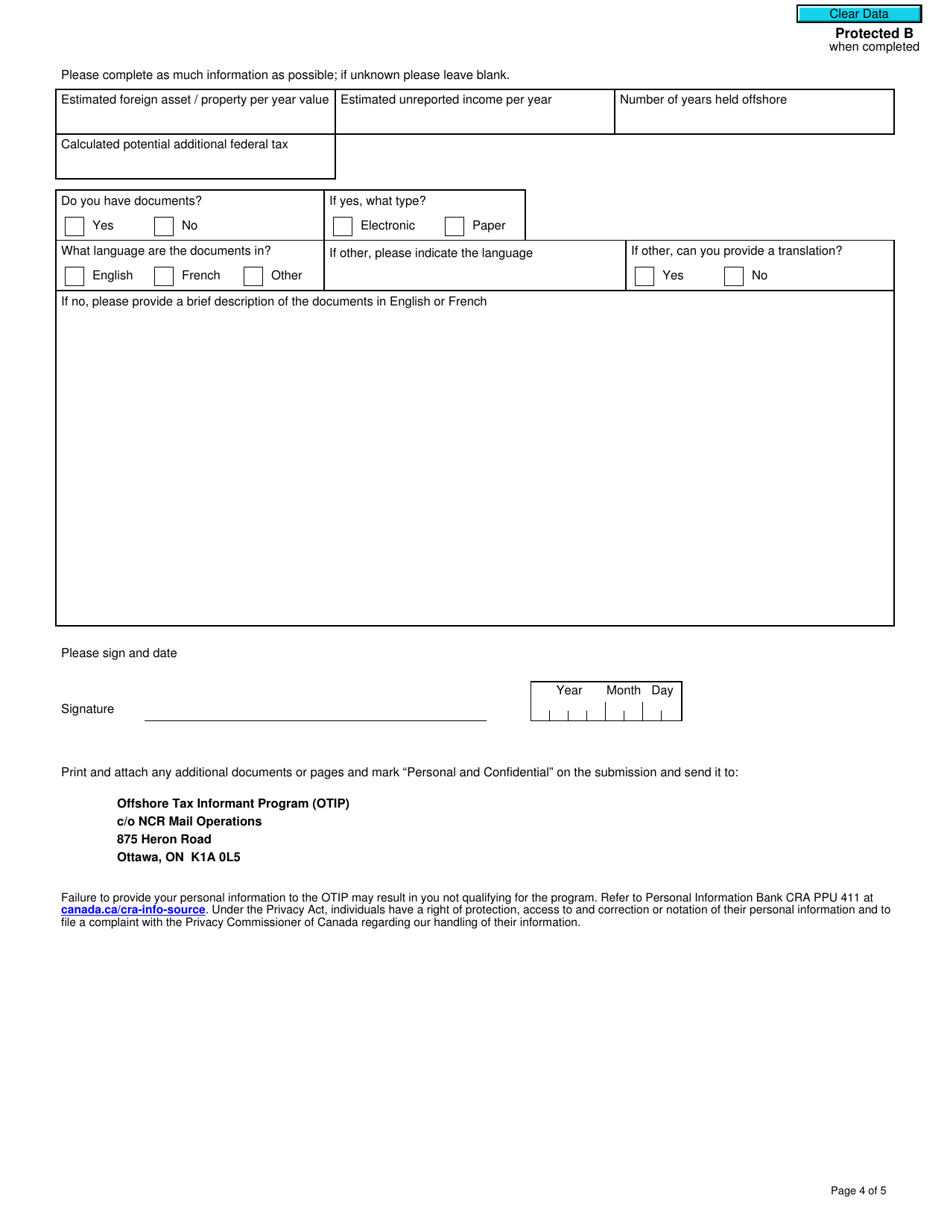

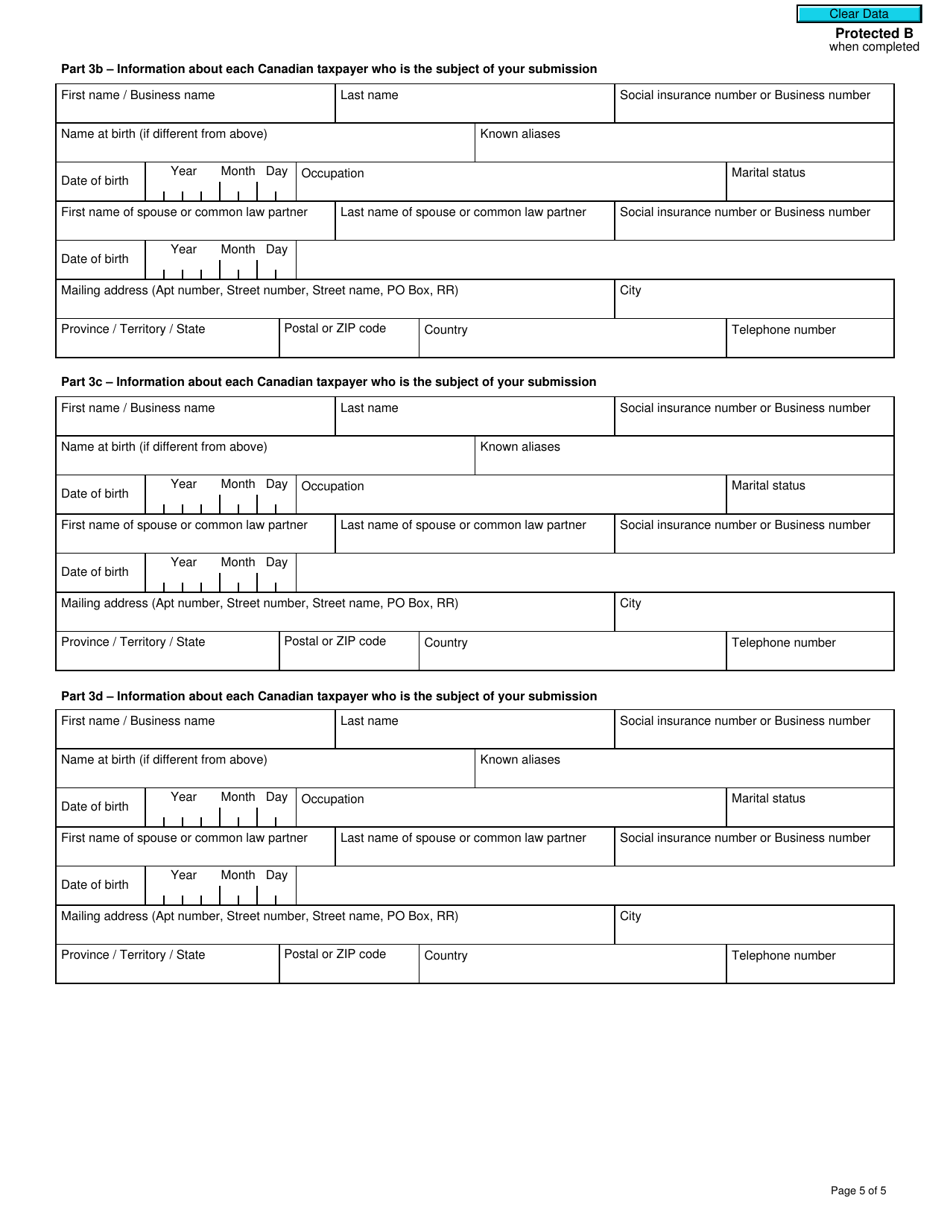

Form RC626 Offshore Tax Informant Program (Otip) Submission Form - Canada

Form RC626, or the Offshore Tax Informant Program (OTIP) Submission Form, is used in Canada for individuals who want to report information about suspected tax evasion or undisclosed offshore assets. This form allows individuals to provide details about the potential non-compliance by others and potentially earn a reward if the information leads to the recovery of taxes owed.

The Form RC626 Offshore Tax Informant Program (OTIP) Submission Form in Canada is typically filed by individuals who want to report information about potential offshore tax evasion.

FAQ

Q: What is Form RC626?

A: Form RC626 is the Offshore Tax Informant Program (OTIP) Submission Form.

Q: What is the Offshore Tax Informant Program (OTIP)?

A: The Offshore Tax Informant Program (OTIP) is a program run by the Canada Revenue Agency (CRA) that encourages individuals to report income and assets that have not been declared for tax purposes.

Q: Who can use Form RC626?

A: Form RC626 can be used by individuals who want to make a submission to the Offshore Tax Informant Program (OTIP).

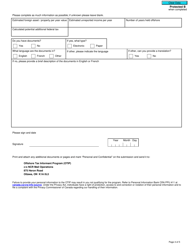

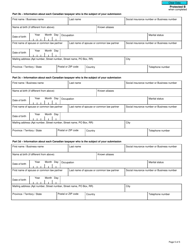

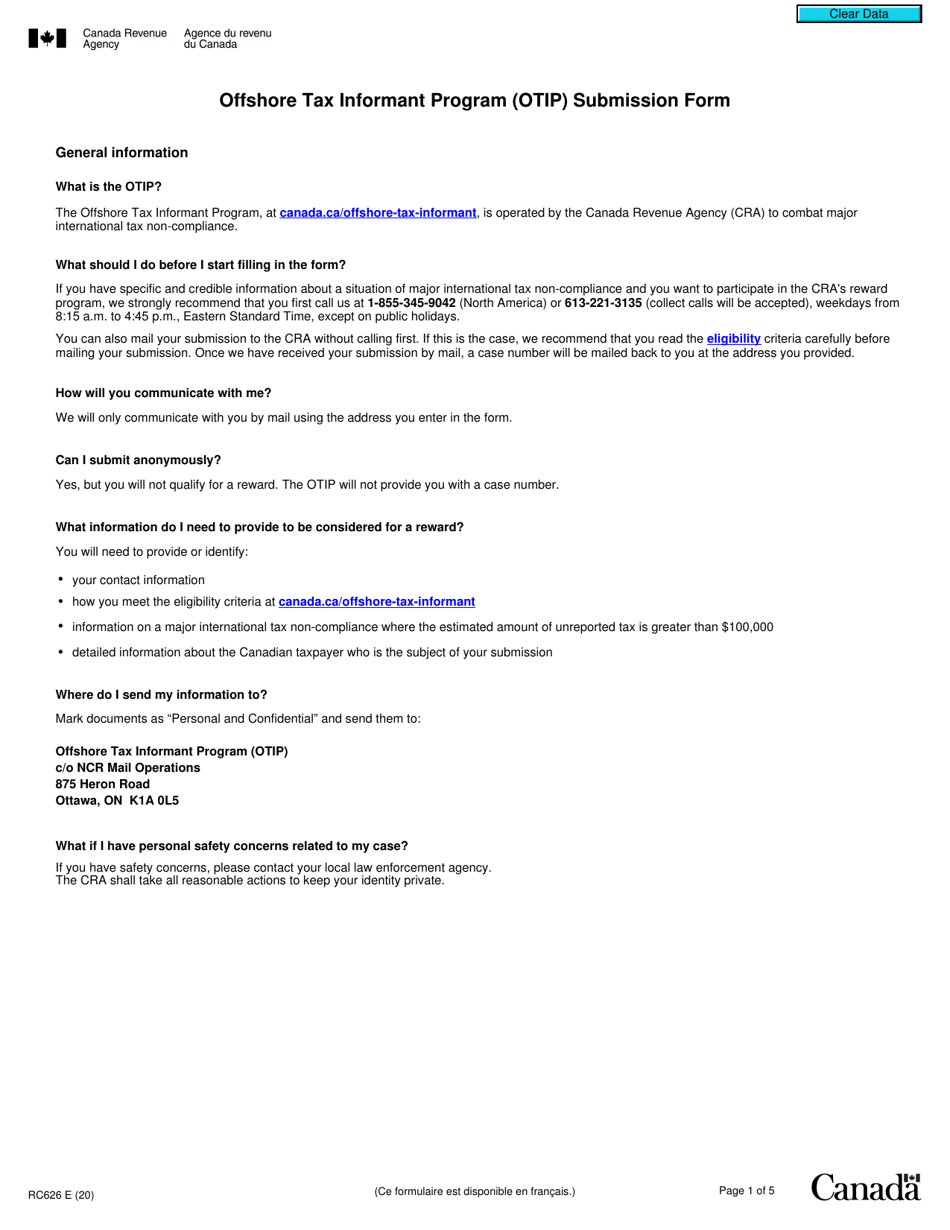

Q: What information is required on Form RC626?

A: Form RC626 requires information about the individual making the submission, the taxpayer being reported, and the income or assets being reported.

Q: Is submitting Form RC626 anonymous?

A: Yes, the Offshore Tax Informant Program (OTIP) allows individuals to make anonymous submissions using Form RC626.

Q: What happens after submitting Form RC626?

A: After submitting Form RC626, the Canada Revenue Agency (CRA) will review the information and may take action if it determines that tax evasion or non-compliance has occurred.

Q: Are there any rewards for making a submission through Form RC626?

A: Yes, individuals who provide information that leads to the collection of taxes owing may be eligible for a reward under the Offshore Tax Informant Program (OTIP).

Q: Can I report someone anonymously using Form RC626?

A: Yes, Form RC626 allows individuals to make anonymous reports to the Offshore Tax Informant Program (OTIP).

Q: Is there a deadline for submitting Form RC626?

A: There is no specific deadline for submitting Form RC626. However, it is recommended to submit the form as soon as possible after becoming aware of the tax evasion or non-compliance.

Q: Is there a fee for submitting Form RC626?

A: There is no fee for submitting Form RC626 to the Offshore Tax Informant Program (OTIP).