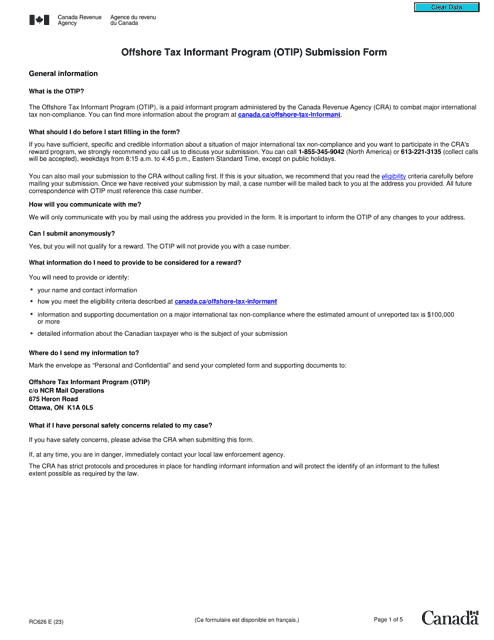

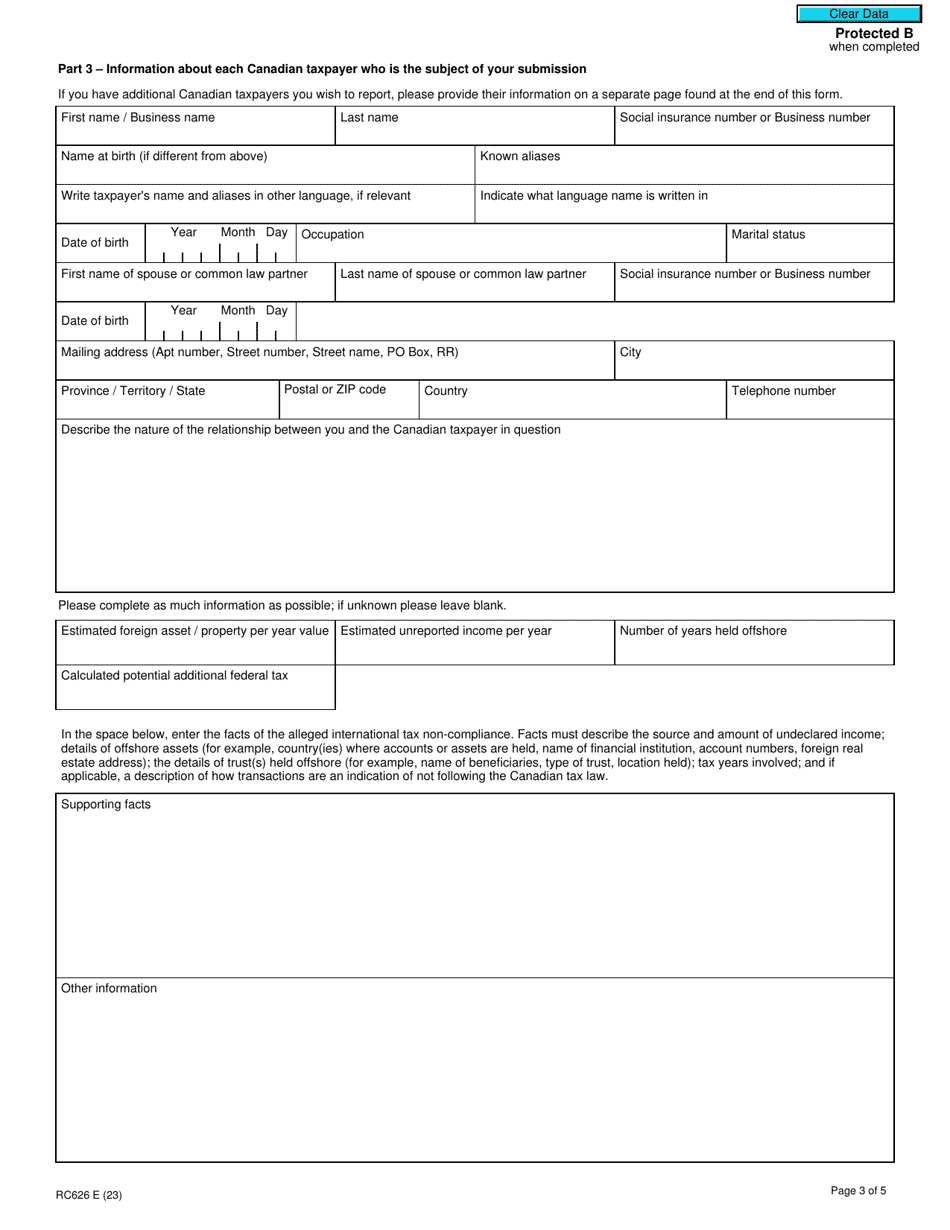

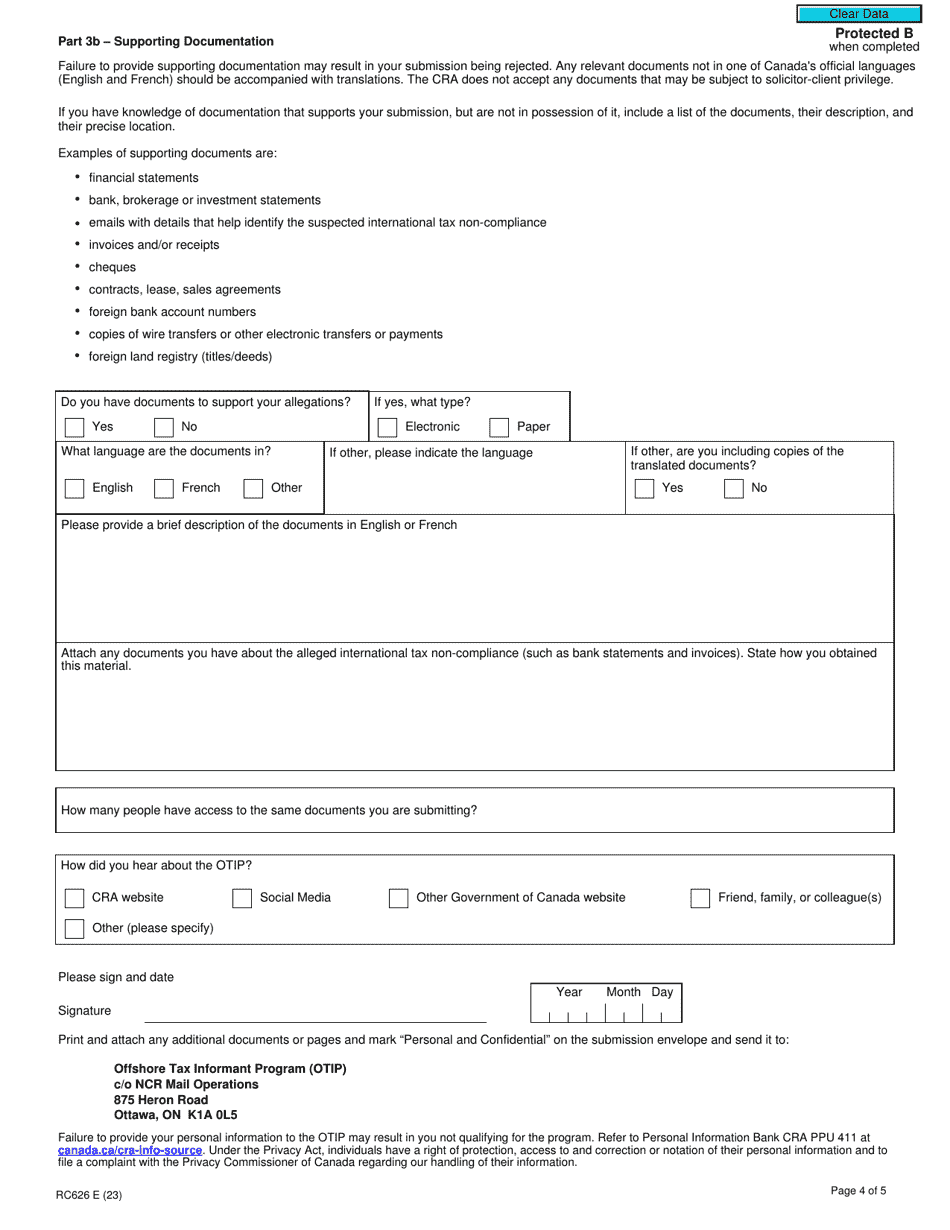

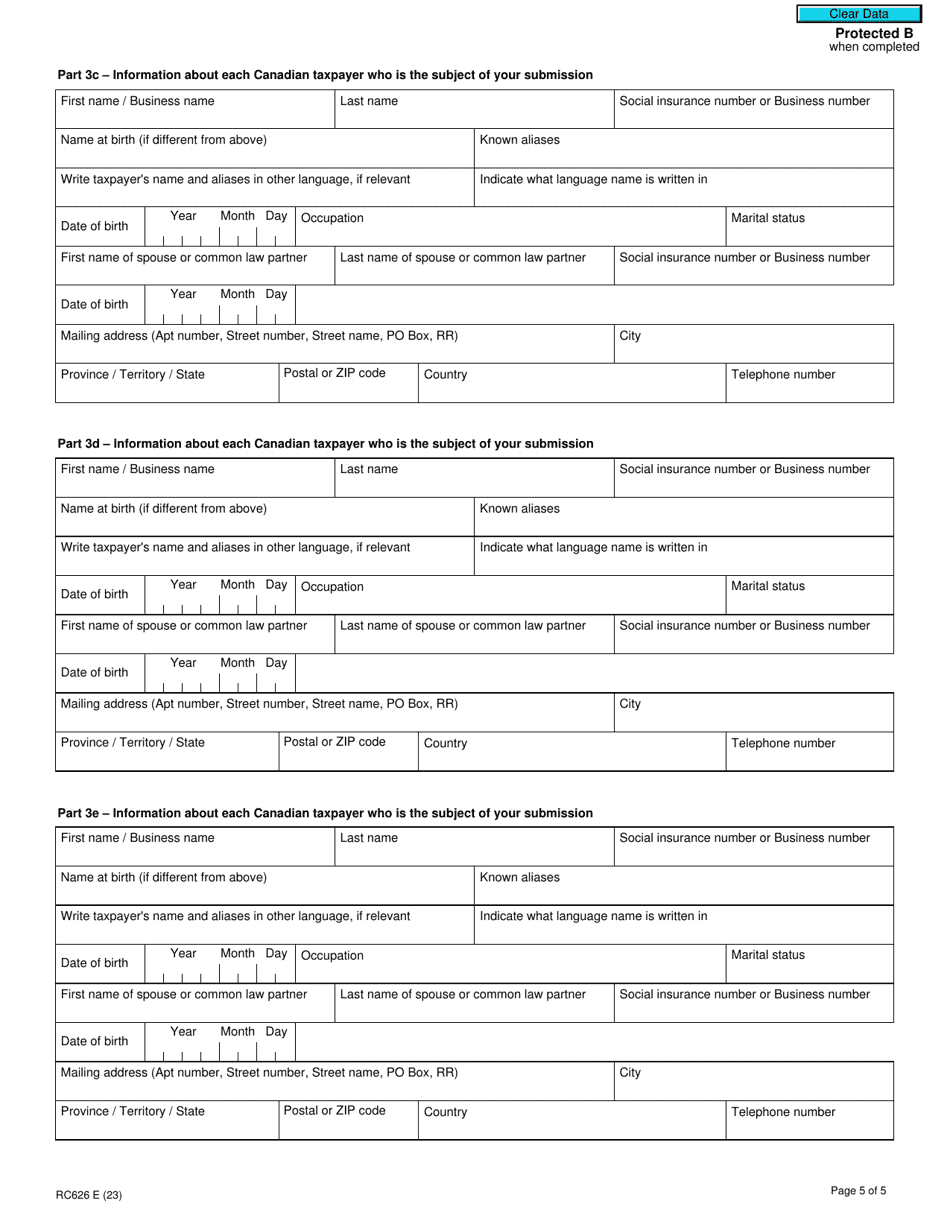

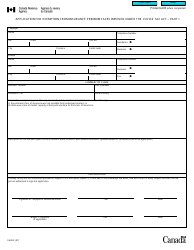

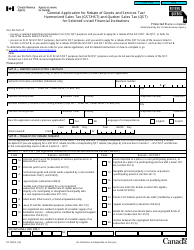

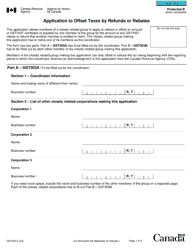

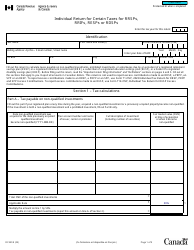

Form RC626 Offshore Tax Informant Program (Otip) Submission Form - Canada

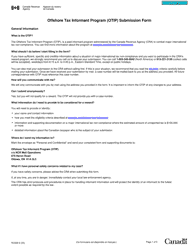

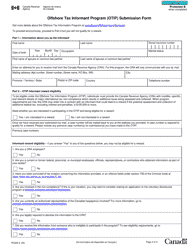

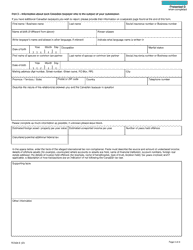

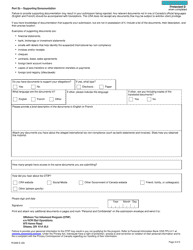

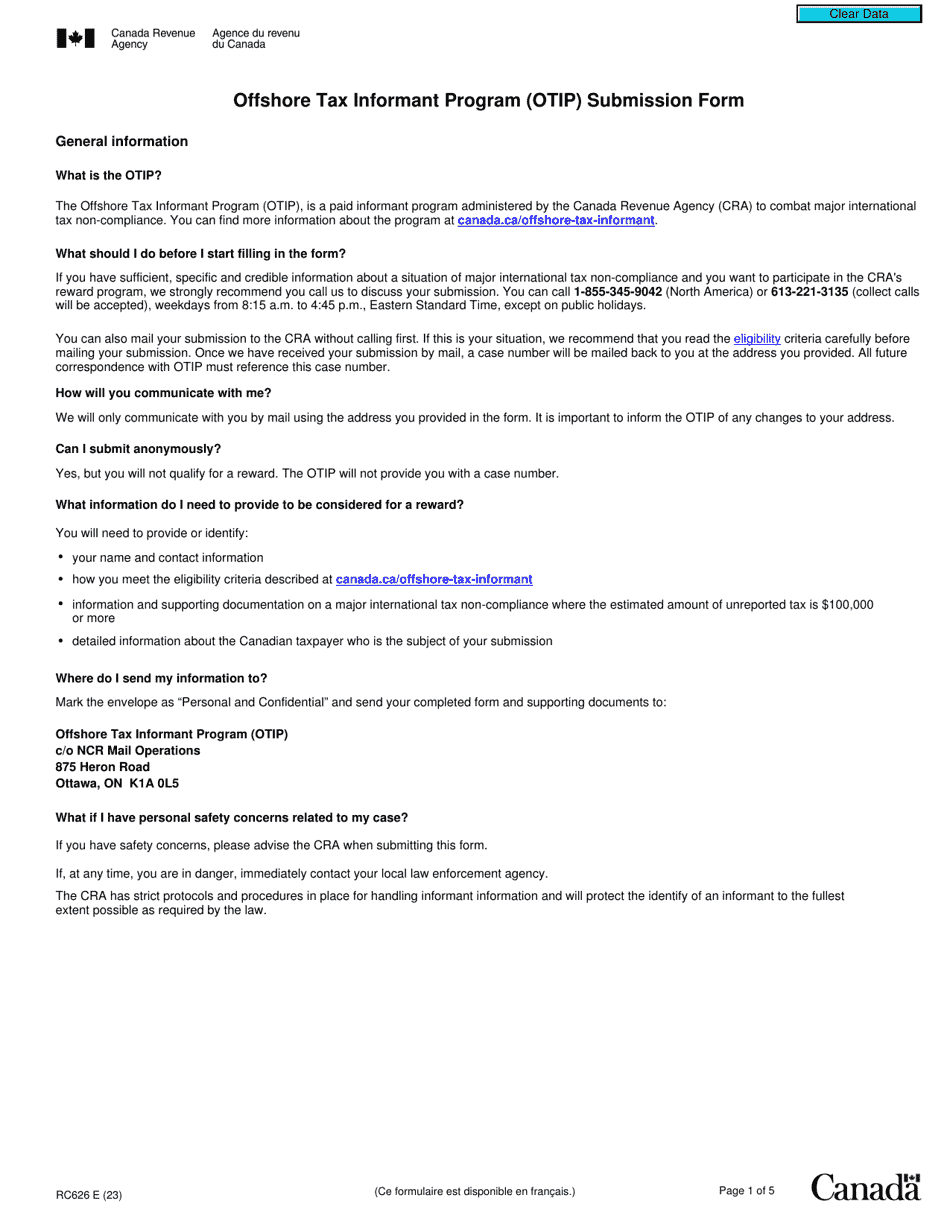

The Form RC626 Offshore Tax Informant Program (OTIP) Submission Form is used in Canada to report information about offshore tax evasion or aggressive tax planning. It allows individuals to provide details about non-compliance with Canadian tax laws in relation to offshore accounts or assets.

The Form RC626 Offshore Tax Informant Program (OTIP) Submission Form in Canada is filed by individuals who wish to report information related to potential tax evasion activities.

Form RC626 Offshore Tax Informant Program (Otip) Submission Form - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC626? A: Form RC626 is the Offshore Tax Informant Program (OTIP) Submission Form in Canada.

Q: What is the Offshore Tax Informant Program (OTIP)? A: The Offshore Tax Informant Program (OTIP) is a program in Canada that encourages individuals to report international tax non-compliance by offering financial rewards.

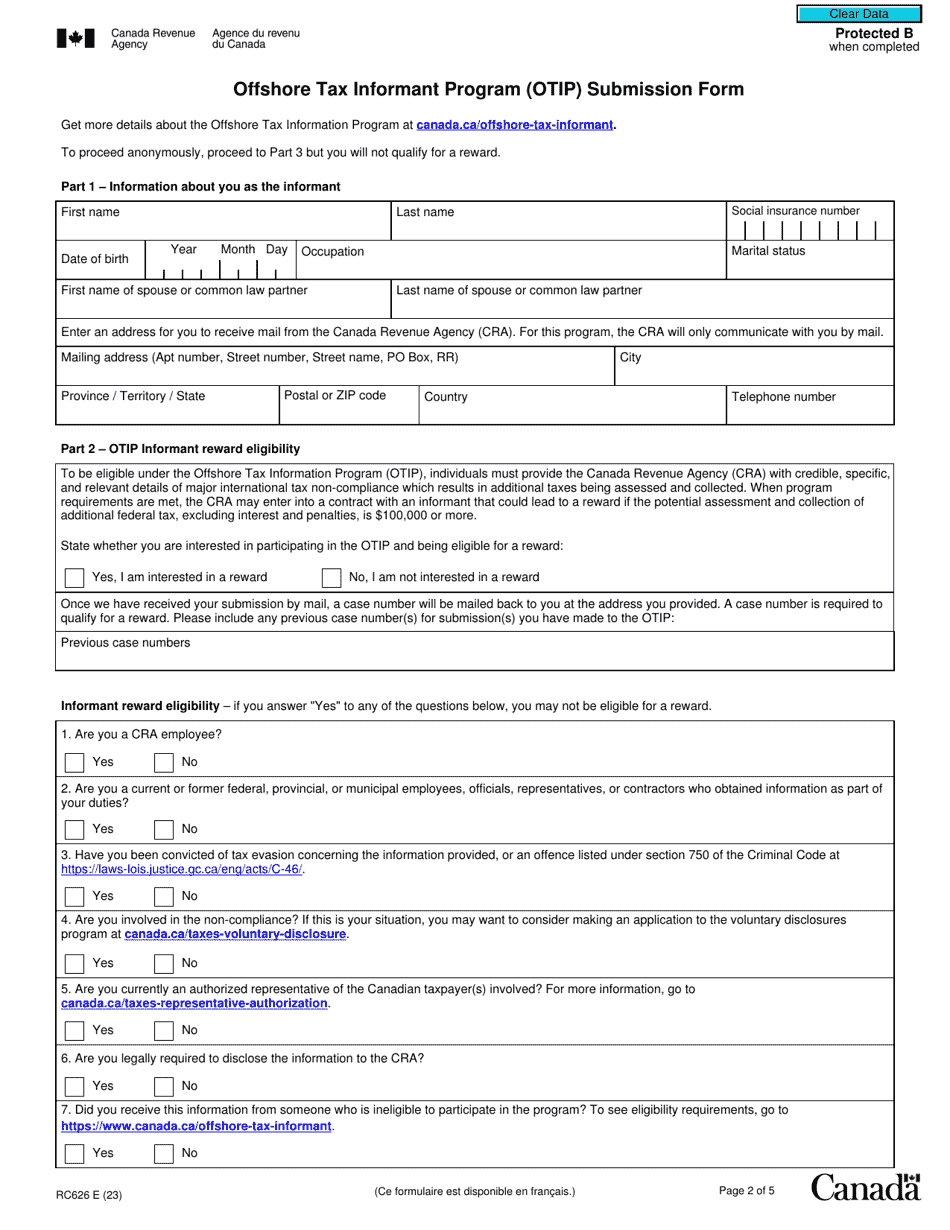

Q: Who is eligible to submit Form RC626? A: Any individual who has information about someone evading taxes offshore can submit Form RC626.

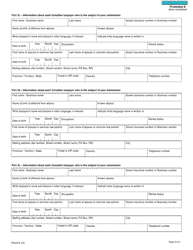

Q: What information is required on Form RC626? A: Form RC626 requires information about the individual submitting the form, as well as details about the tax evasion and the person involved.

Q: What happens after submitting Form RC626? A: After submitting Form RC626, the Canada Revenue Agency (CRA) will review the information provided and determine if further action is necessary.

Q: Is there a reward for submitting information through Form RC626? A: Yes, the OTIP offers a financial reward to eligible individuals who provide information that leads to the collection of taxes owed.

Q: Is the information provided on Form RC626 confidential? A: Yes, the information provided on Form RC626 is treated as confidential and is protected by Canadian privacy laws.

Q: Is there a deadline for submitting Form RC626? A: There is no specific deadline for submitting Form RC626, but it is recommended to submit the form as soon as possible after acquiring the information.