This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7218

for the current year.

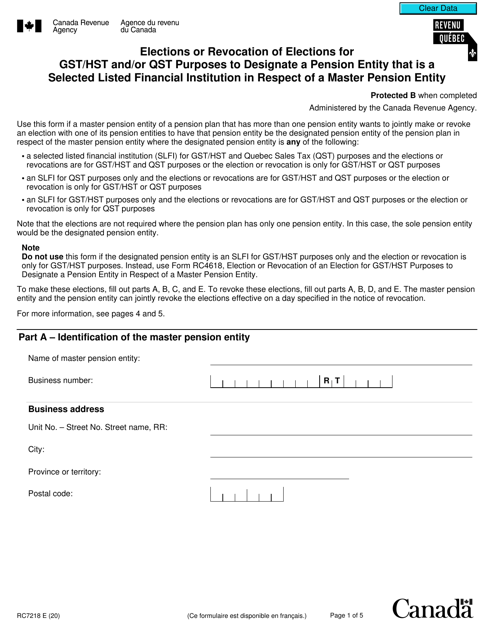

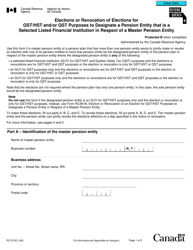

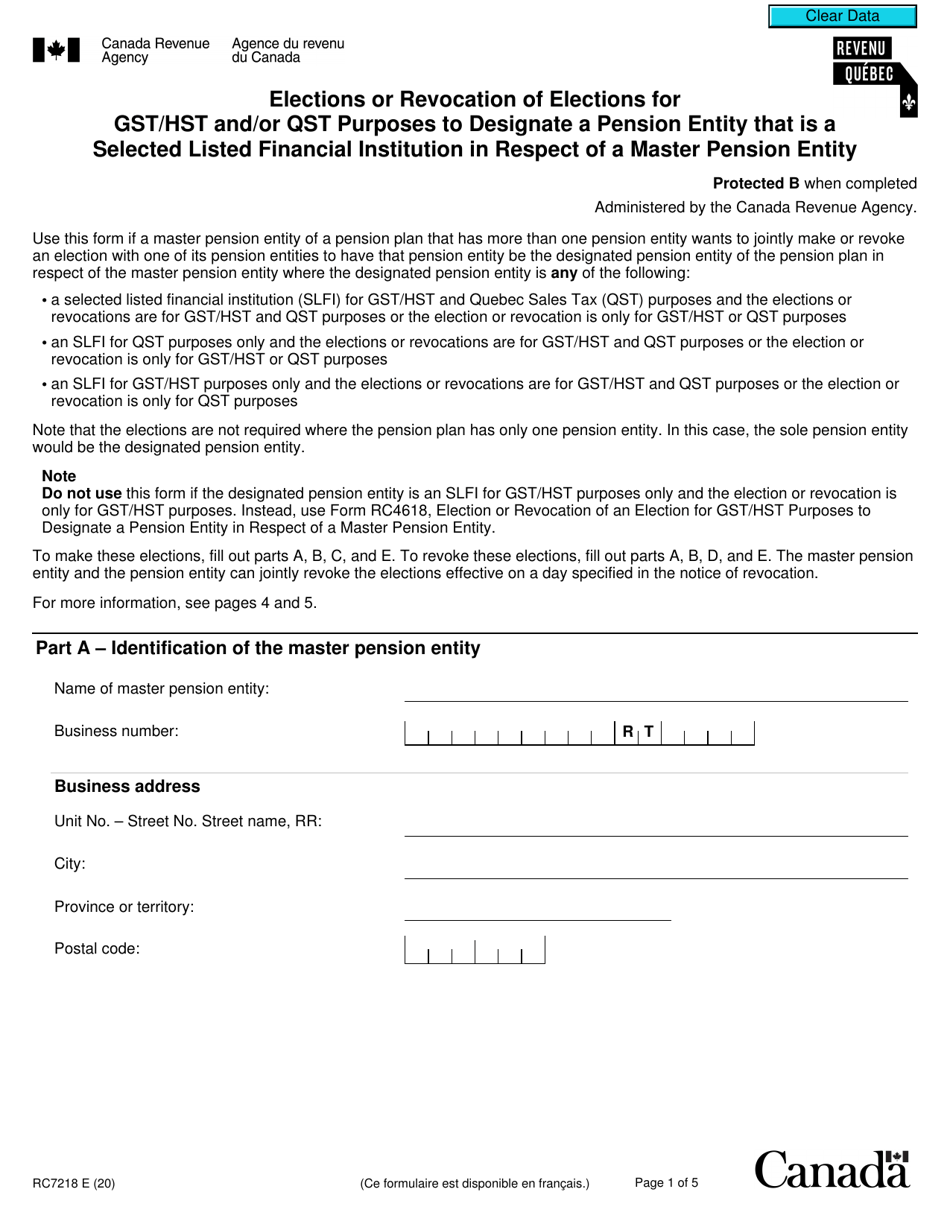

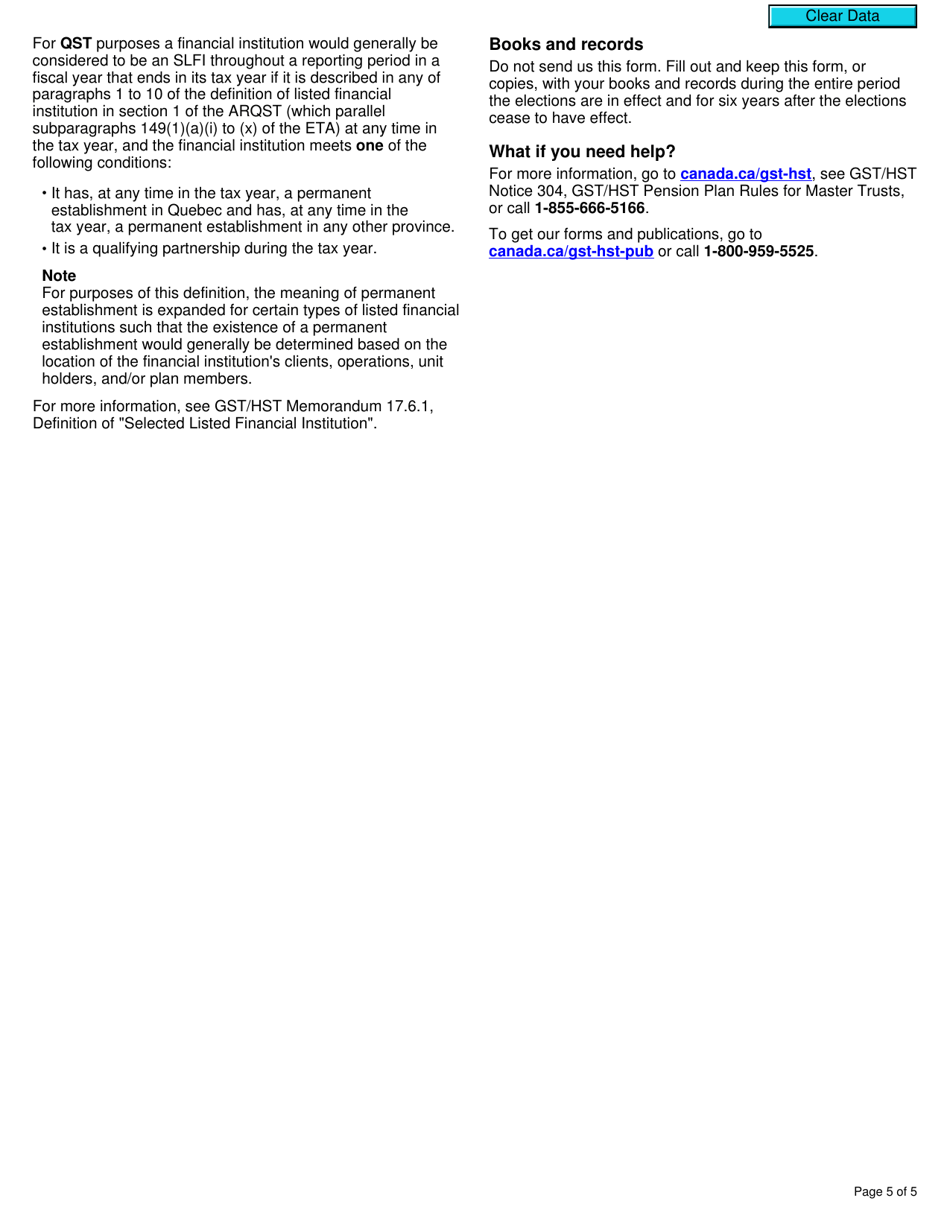

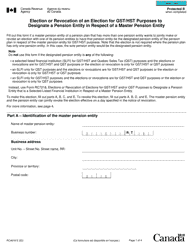

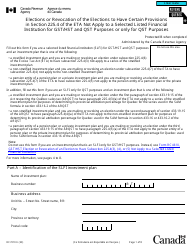

Form RC7218 Elections or Revocation of Elections for Gst / Hst and / or Qst Purposes to Designate a Pension Entity That Is a Selected Listed Financial Institution in Respect of a Master Pension Entity - Canada

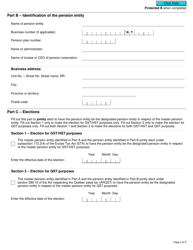

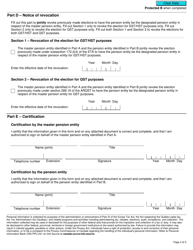

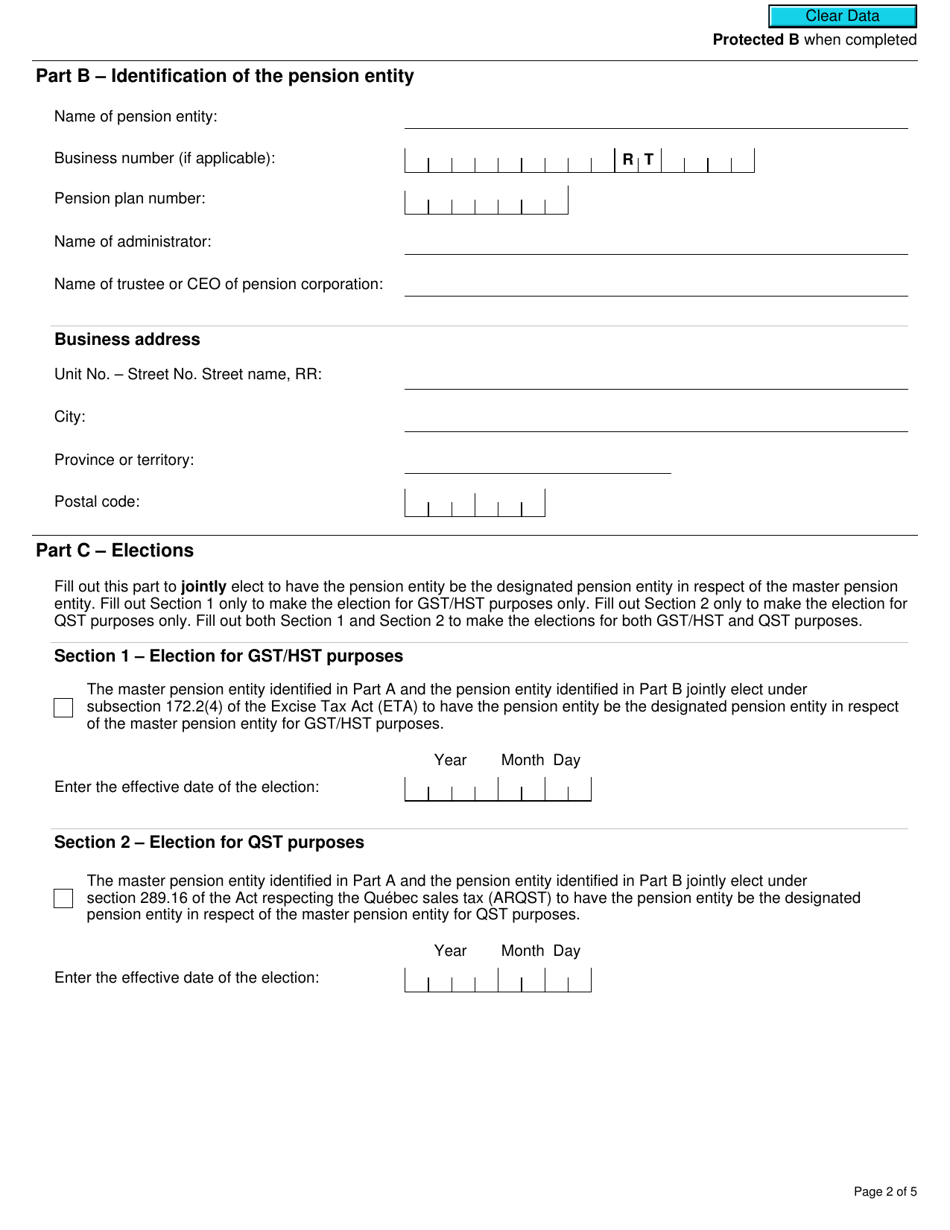

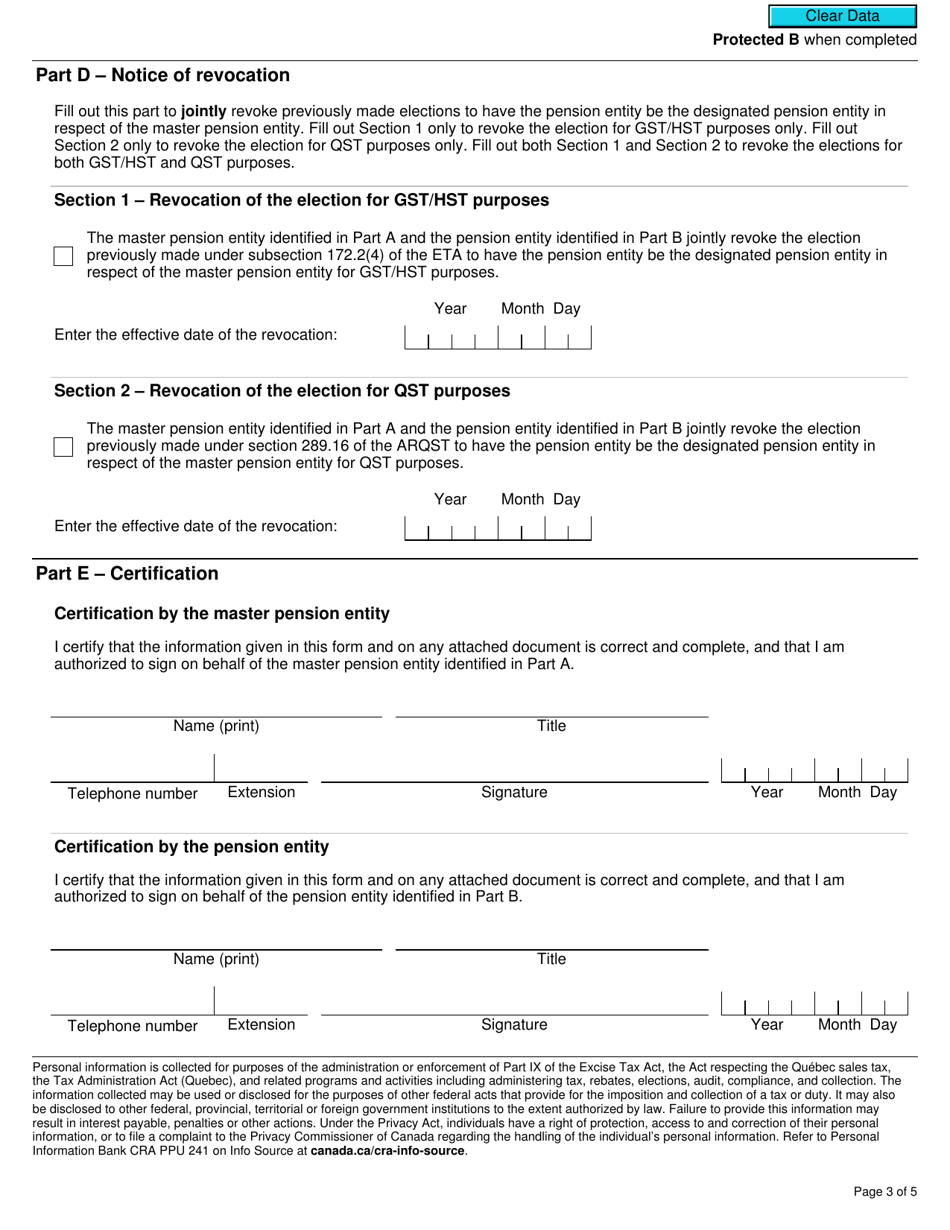

Form RC7218 Elections or Revocation of Elections for GST/HST and/or QST Purposes to Designate a Pension Entity That Is a Selected Listed Financial Institution in Respect of a Master Pension Entity is used in Canada for making elections or revoking elections related to the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and/or the Quebec Sales Tax (QST) purposes for designating a pension entity that is a selected listed financial institution in relation to a master pension entity. This form helps in determining the taxation and reporting requirements for pension entities.

The pension entity itself files the Form RC7218 in Canada.

FAQ

Q: What is Form RC7218?

A: Form RC7218 is a document used in Canada to make elections or revoke elections for GST/HST and/or QST purposes to designate a pension entity that is a selected listed financial institution in respect of a master pension entity.

Q: What is the purpose of Form RC7218?

A: The purpose of Form RC7218 is to designate a pension entity as a selected listed financial institution in respect of a master pension entity for GST/HST and/or QST purposes.

Q: Who uses Form RC7218?

A: Form RC7218 is used by pension entities in Canada.

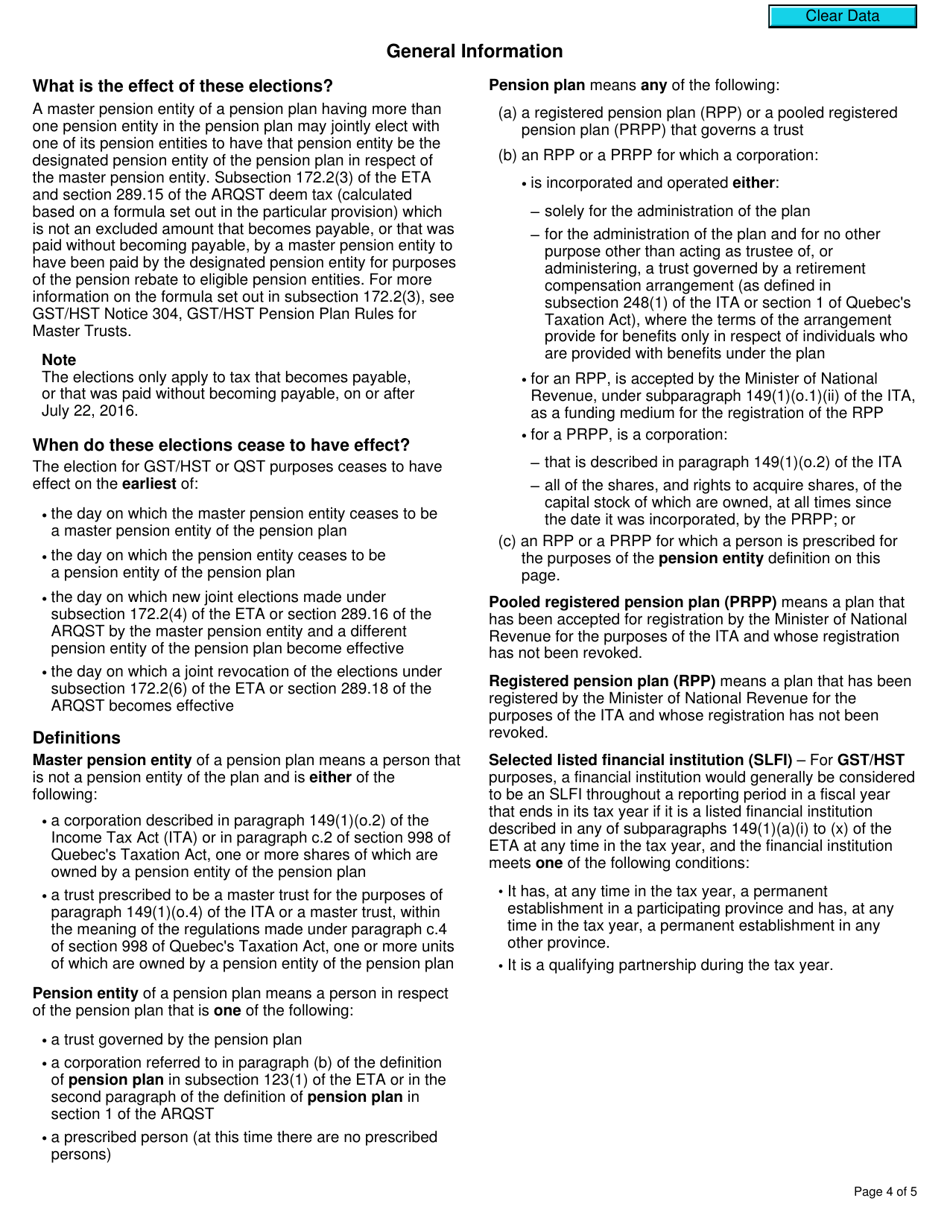

Q: What is GST/HST?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. They are taxes imposed on the supply of most goods and services in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax. It is a tax imposed on the supply of most goods and services in Quebec.

Q: What is a selected listed financial institution?

A: A selected listed financial institution is a designated entity that has met certain criteria set by the tax authorities.

Q: What is a master pension entity?

A: A master pension entity is a pension entity that fulfills certain conditions and can designate other pension entities as selected listed financial institutions.