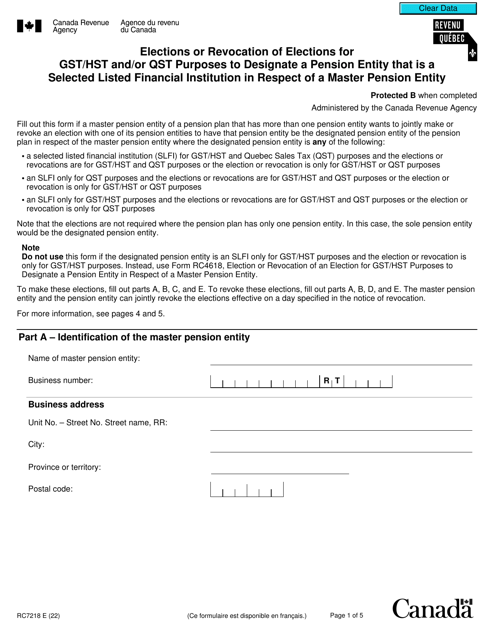

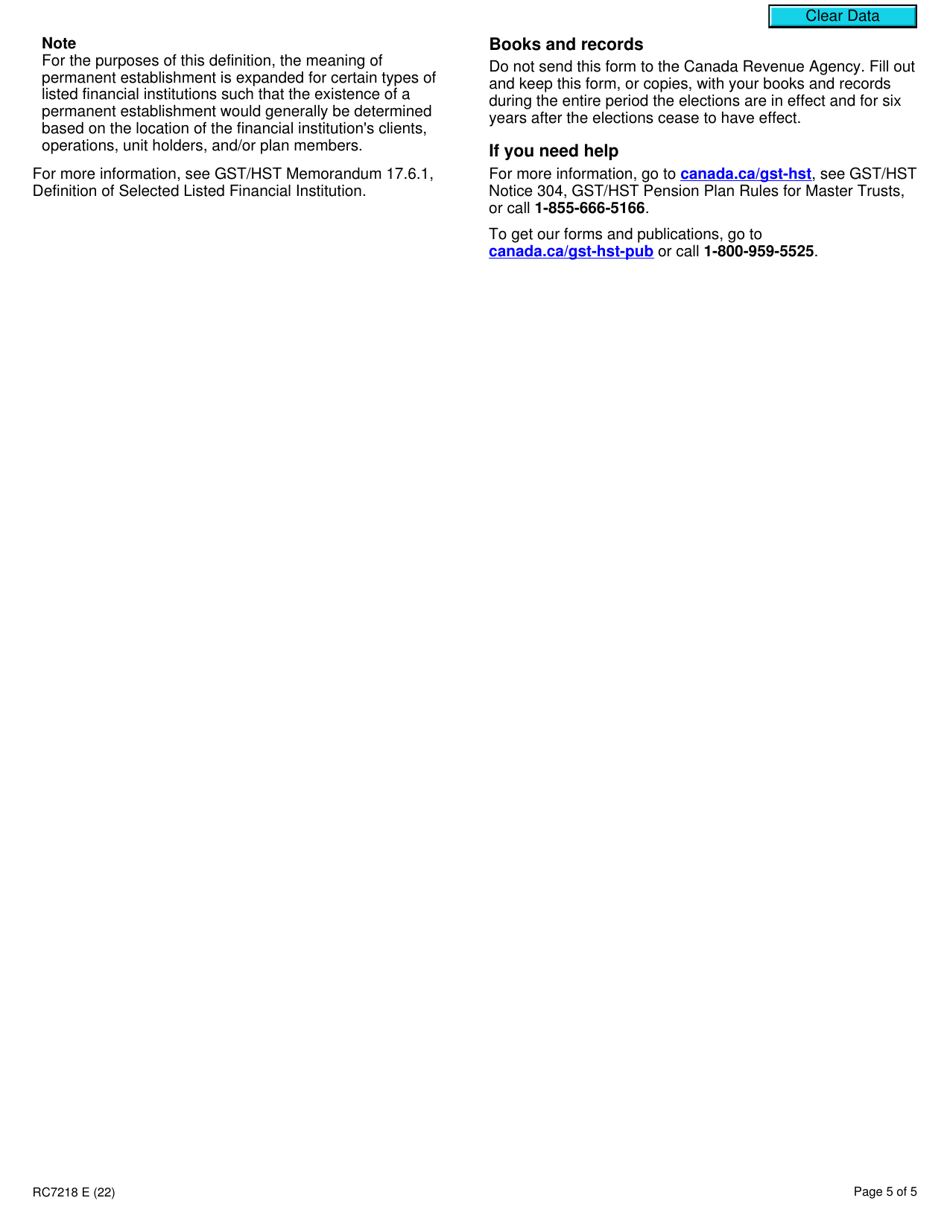

Form RC7218 Elections or Revocation of Elections for Gst / Hst and / or Qst Purposes to Designate a Pension Entity That Is a Selected Listed Financial Institution in Respect of a Master Pension Entity - Canada

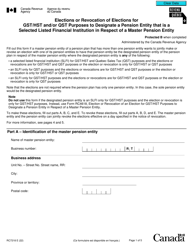

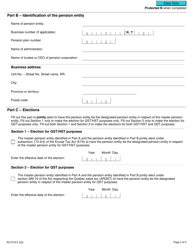

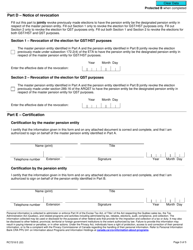

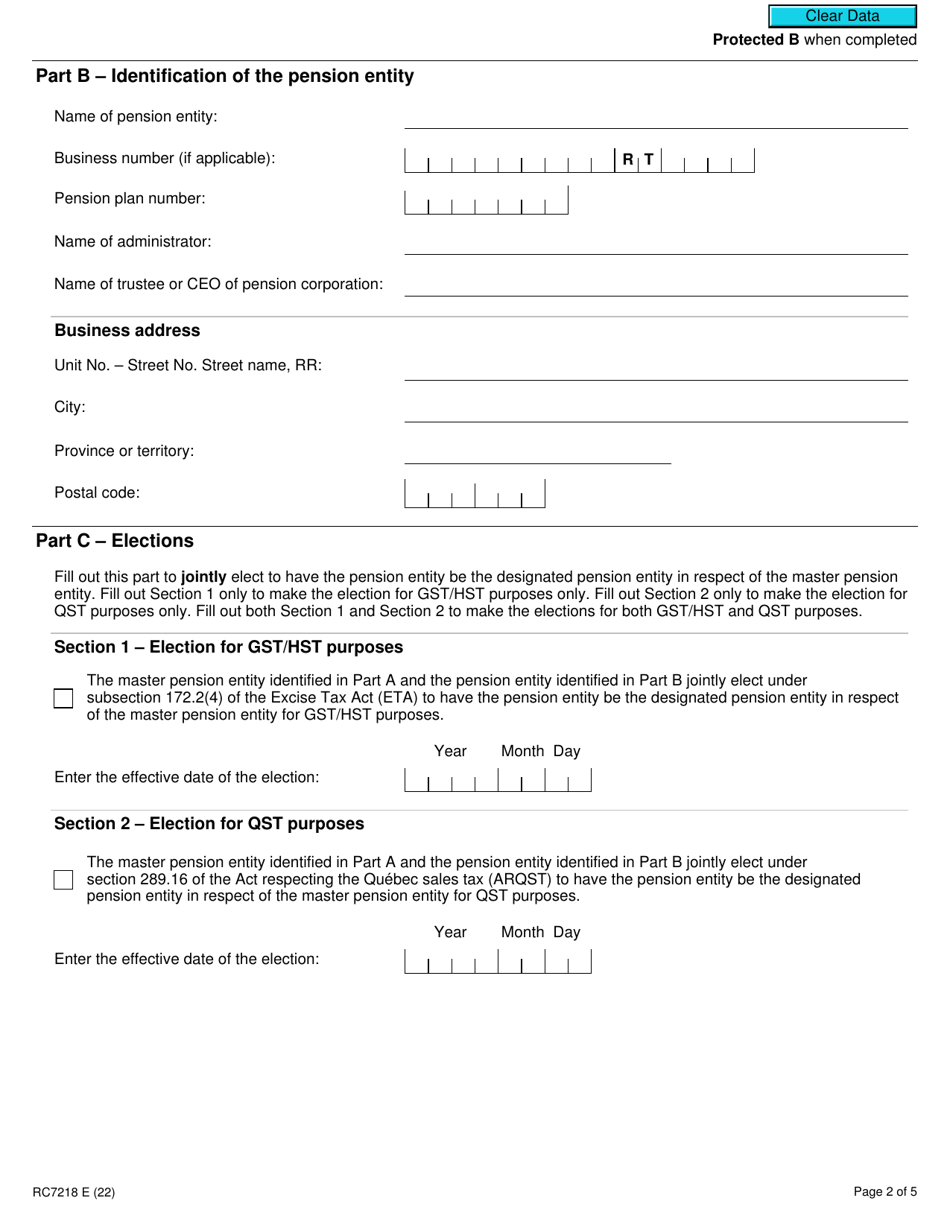

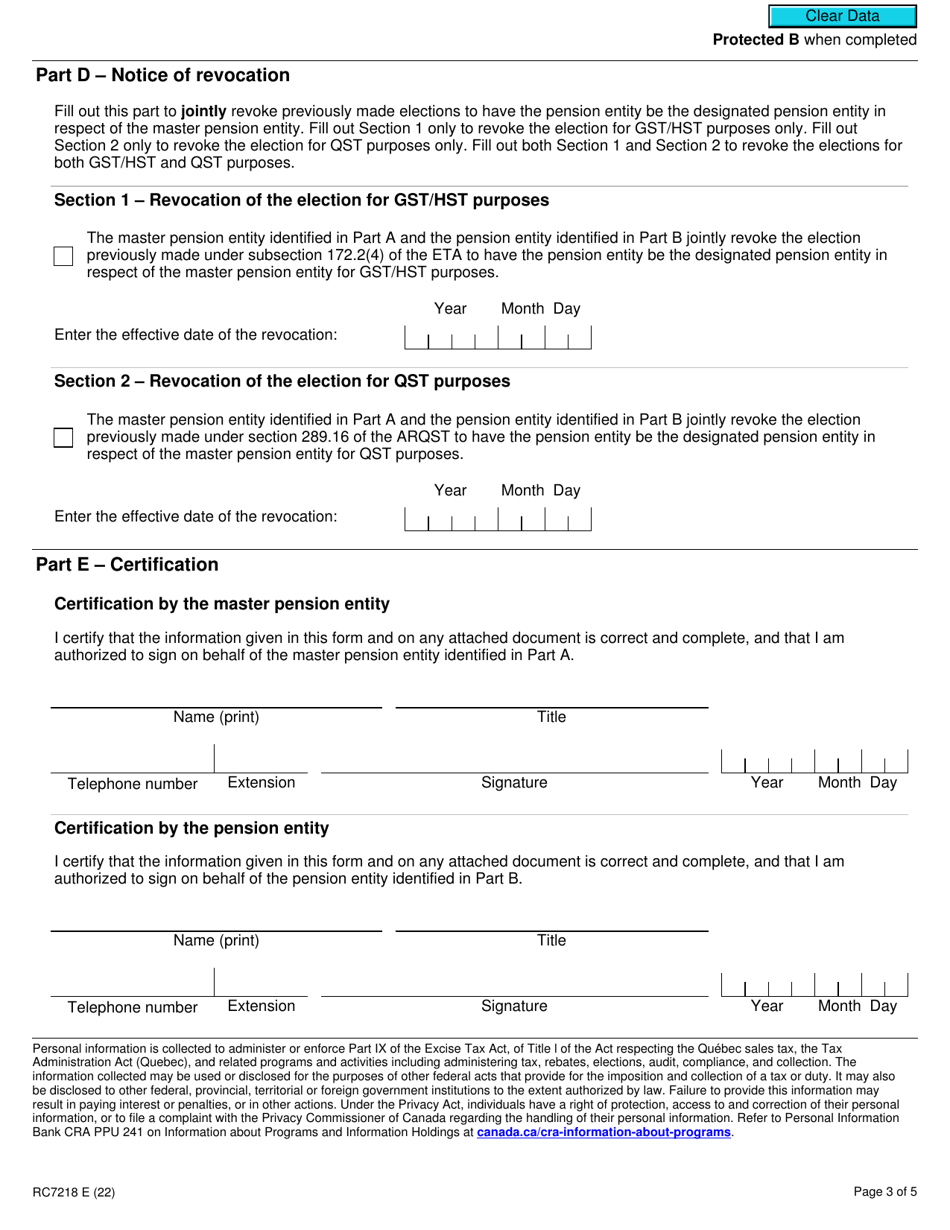

Form RC7218 Elections or Revocation of Elections for GST/HST and/or QST Purposes to Designate a Pension Entity That Is a Selected Listed Financial Institution in Respect of a Master Pension Entity in Canada is used to make or revoke an election for Goods and Services Tax (GST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST) purposes. The purpose of this form is to designate a pension entity that is considered a selected listed financial institution for the master pension entity.

The form RC7218 is filed by a pension entity in Canada to designate another pension entity as a selected listed financial institution in relation to a master pension entity for GST/HST and/or QST purposes.

Form RC7218 Elections or Revocation of Elections for Gst/Hst and/or Qst Purposes to Designate a Pension Entity That Is a Selected Listed Financial Institution in Respect of a Master Pension Entity - Canada - Frequently Asked Questions (FAQ)

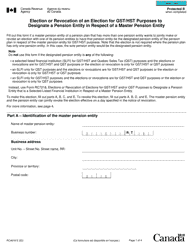

Q: What is RC7218? A: RC7218 is a form used for elections or revocations of elections for GST/HST and/or QST purposes to designate a pension entity as a selected listed financial institution in respect of a master pension entity in Canada.

Q: What is the purpose of RC7218? A: The purpose of RC7218 is to allow pension entities to make elections or revocations of elections for GST/HST and/or QST purposes to designate a specific pension entity as a selected listed financial institution in respect of a master pension entity.

Q: Who can use RC7218? A: Pension entities in Canada can use RC7218 to make elections or revocations of elections for GST/HST and/or QST purposes.

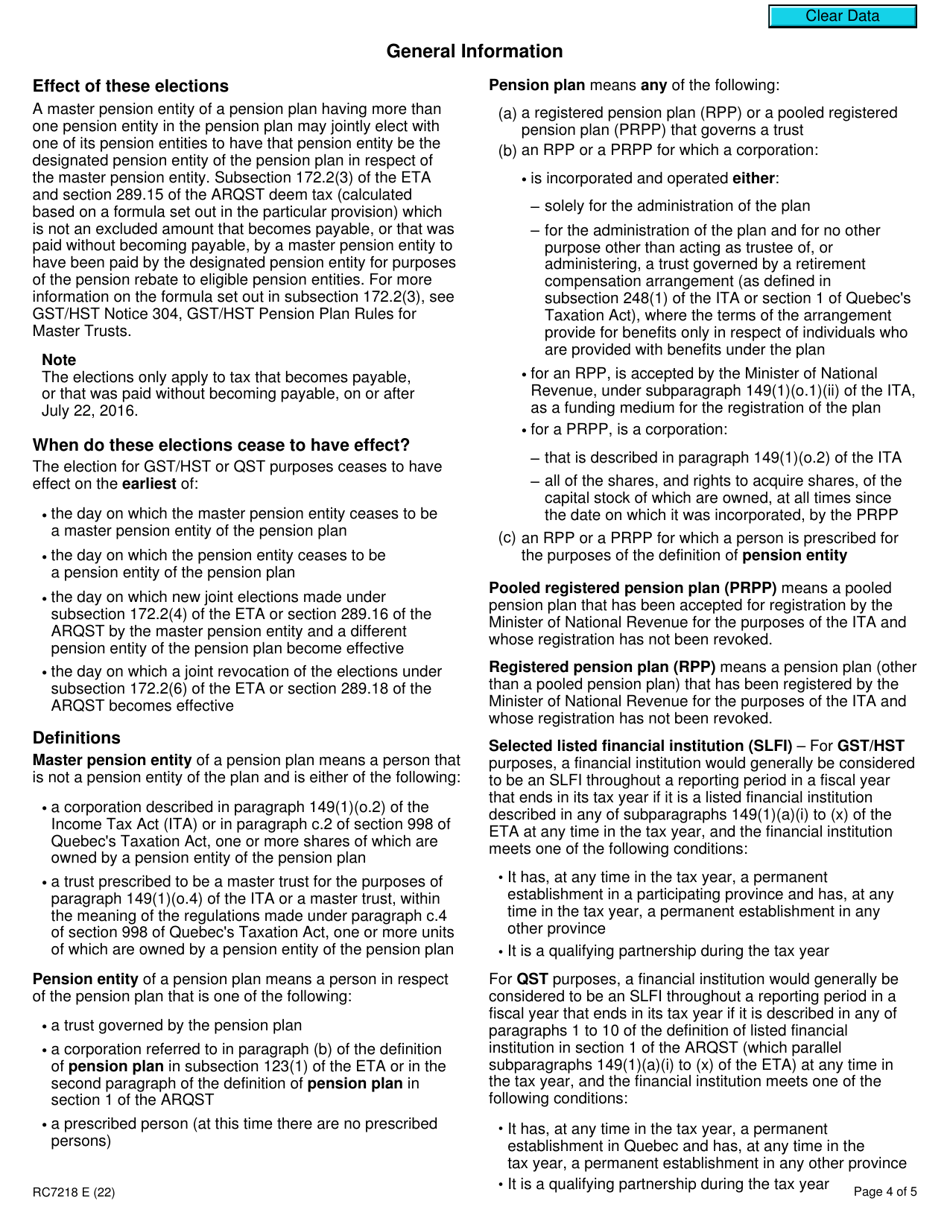

Q: What is a selected listed financial institution? A: A selected listed financial institution is a designated entity that is eligible for certain exemptions and benefits under the GST/HST and/or QST regulations.