This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4618

for the current year.

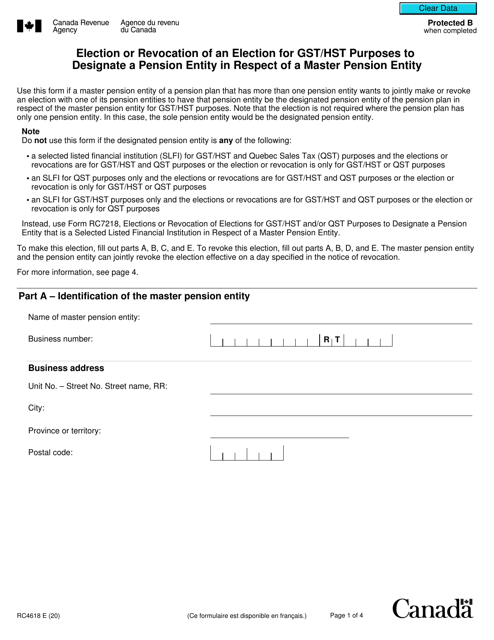

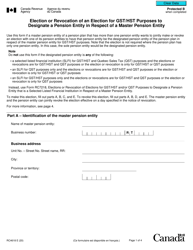

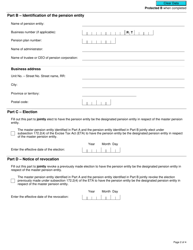

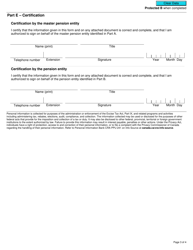

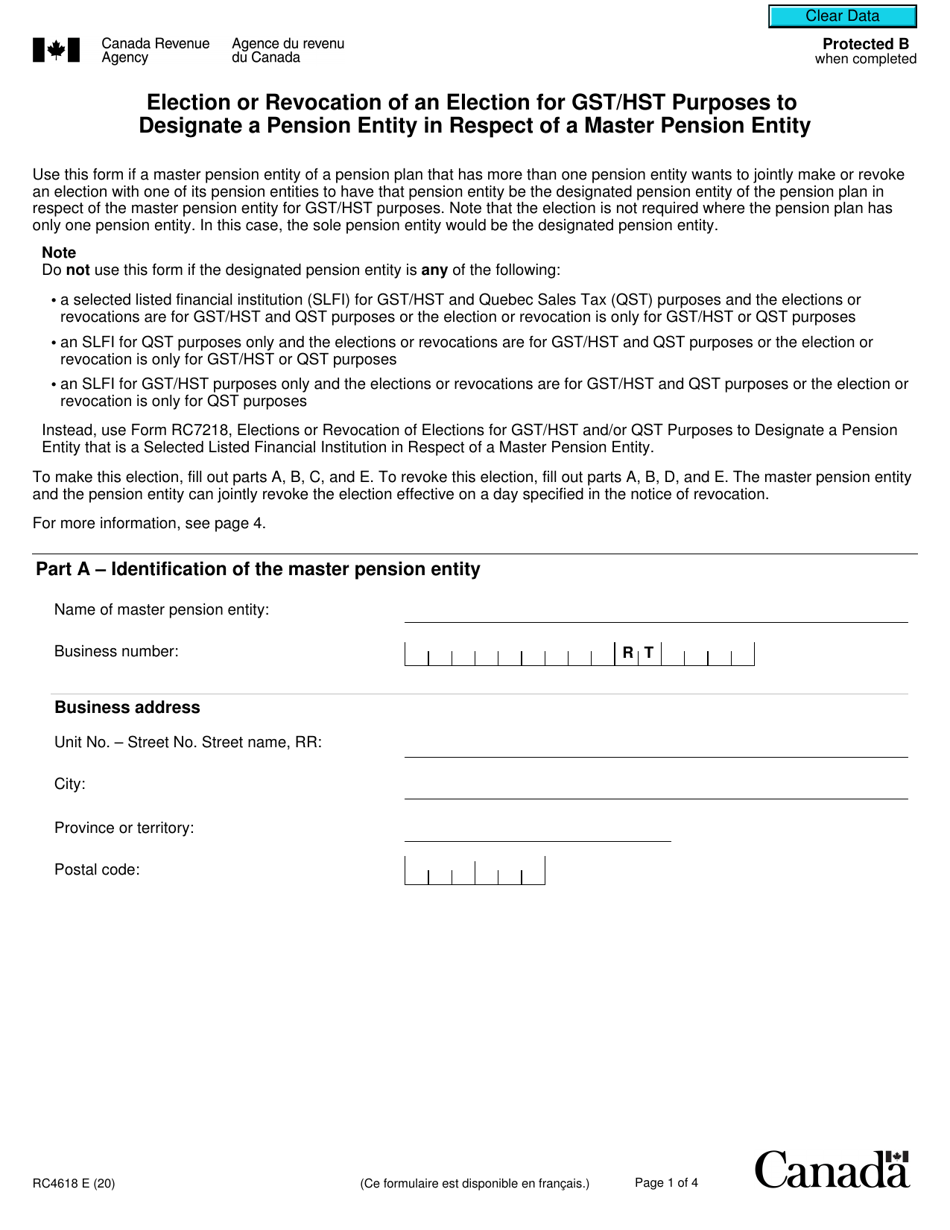

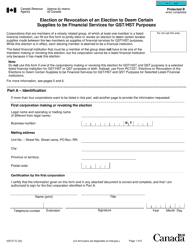

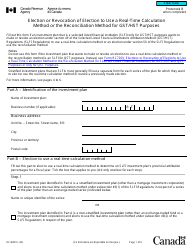

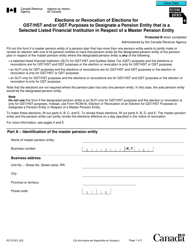

Form RC4618 Election or Revocation of an Election for Gst / Hst Purposes to Designate a Pension Entity in Respect of a Master Pension Entity - Canada

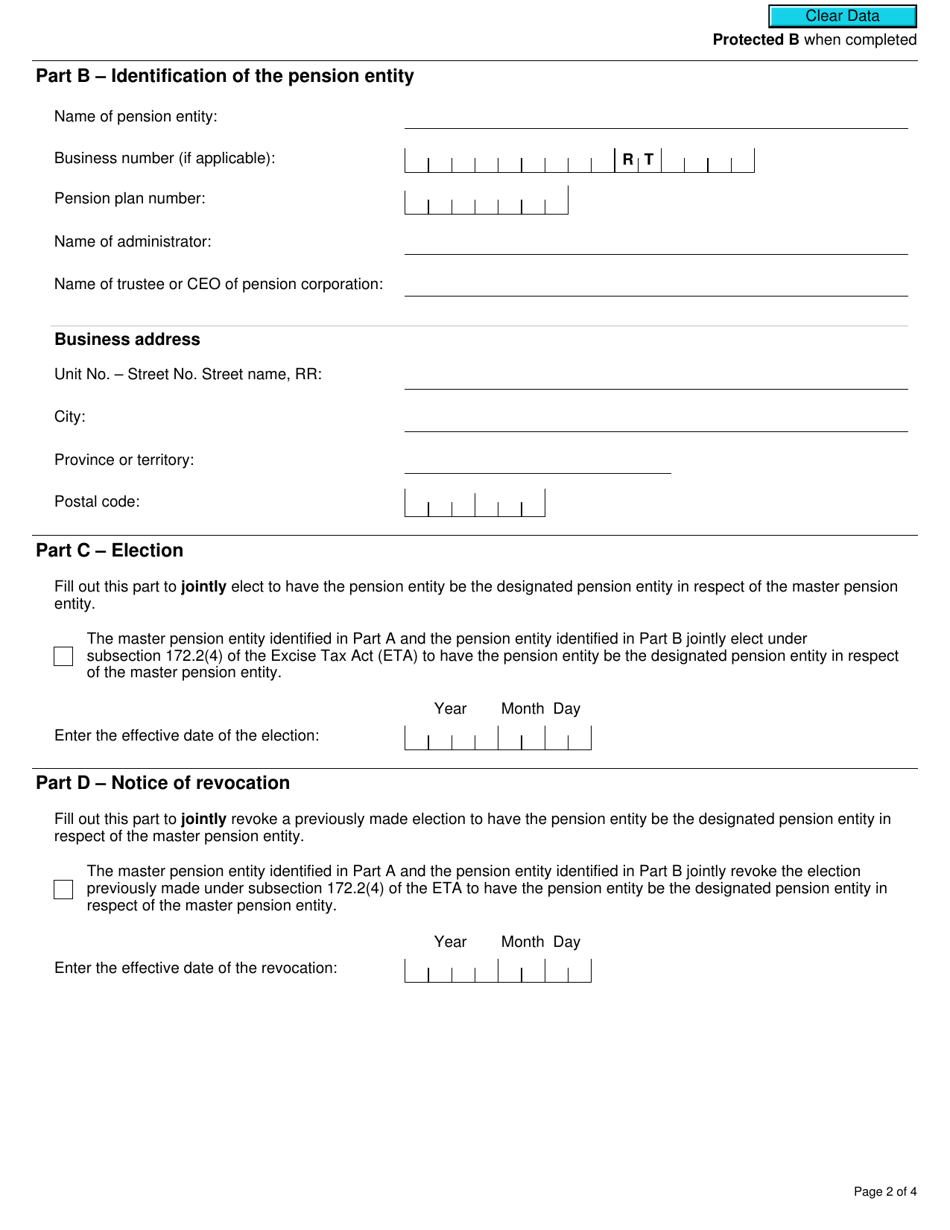

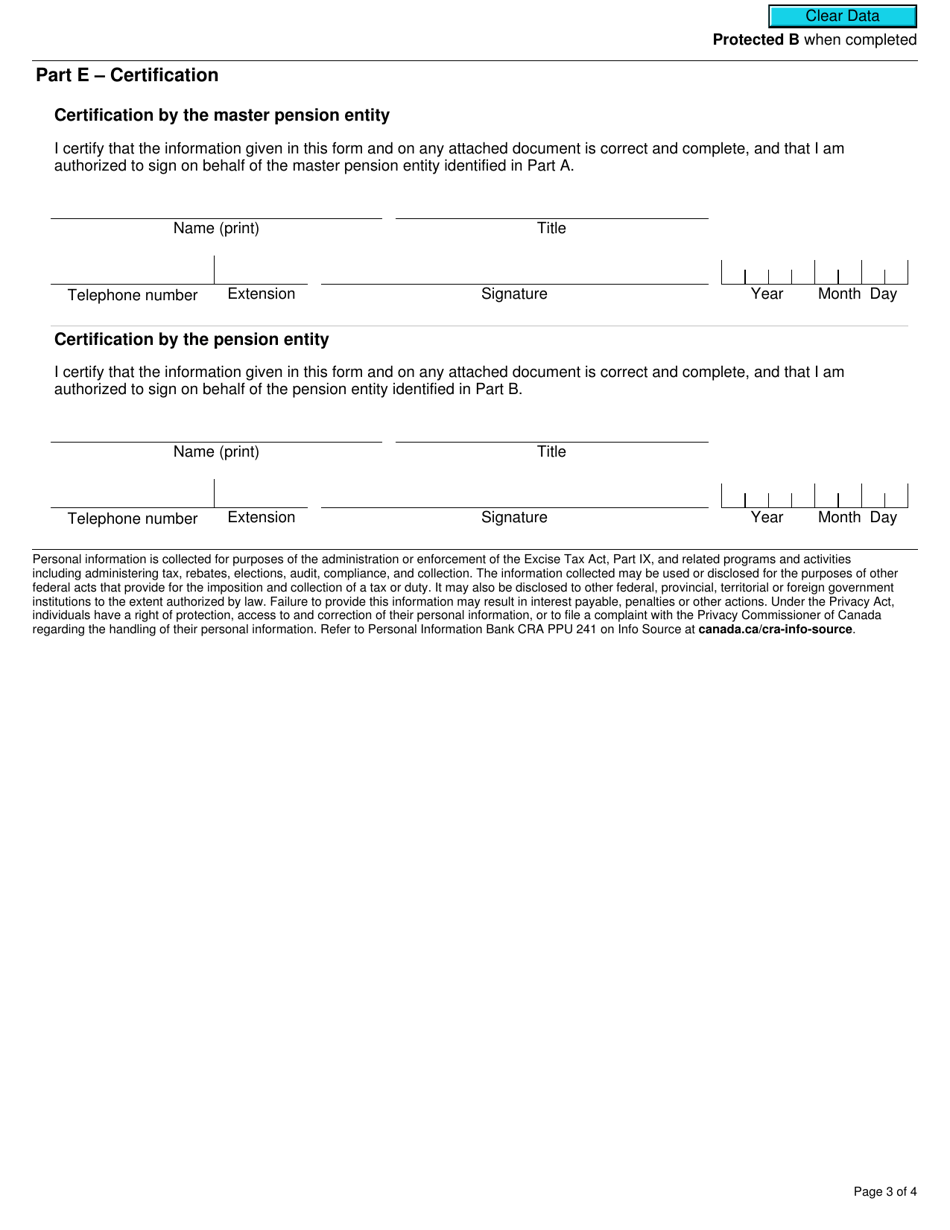

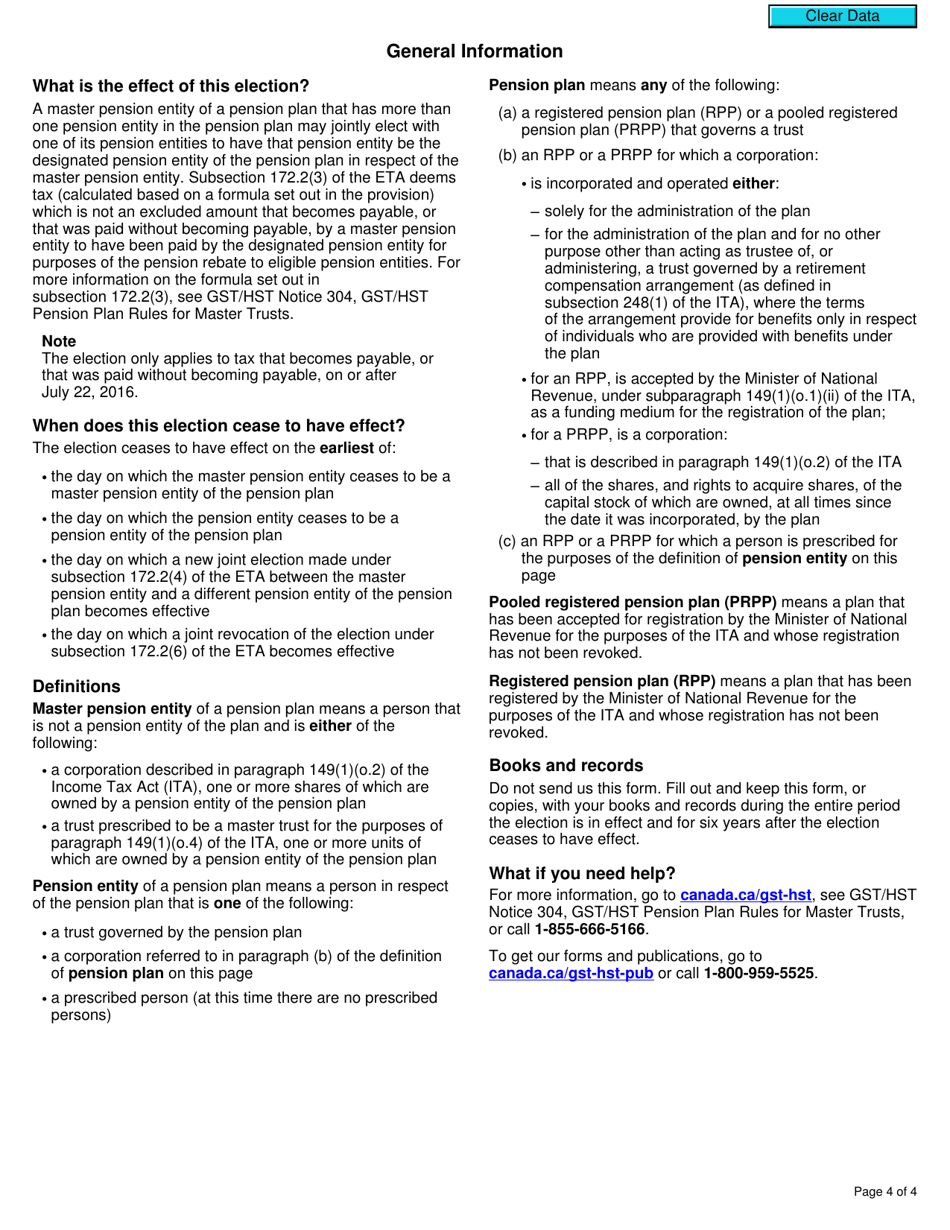

Form RC4618 is used in Canada to make or revoke an election for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes. The purpose of this form is to designate a pension entity in respect of a master pension entity. This allows the designated pension entity to claim GST/HST refunds and recoveries.

The pension entity files the Form RC4618 Election or Revocation of an Election for GST/HST purposes to designate a pension entity in respect of a master pension entity in Canada.

FAQ

Q: What is form RC4618?

A: Form RC4618 is used to elect or revoke an election for GST/HST purposes to designate a pension entity in respect of a master pension entity in Canada.

Q: What is the purpose of form RC4618?

A: The purpose of form RC4618 is to designate a pension entity in respect of a master pension entity for GST/HST purposes.

Q: Who should use form RC4618?

A: This form should be used by pension entities in Canada who want to elect or revoke an election to designate a pension entity in respect of a master pension entity for GST/HST purposes.

Q: What is GST/HST?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. These are consumption taxes in Canada.

Q: What does it mean to designate a pension entity?

A: Designating a pension entity means that it is responsible for GST/HST obligations in respect of a master pension entity.

Q: Are there any fees associated with form RC4618?

A: There are no specific fees associated with filing form RC4618, but the general GST/HST obligations and rules apply.

Q: What should I do if I need help with form RC4618?

A: If you need help with form RC4618, you can contact the Canada Revenue Agency directly or seek assistance from a tax professional.