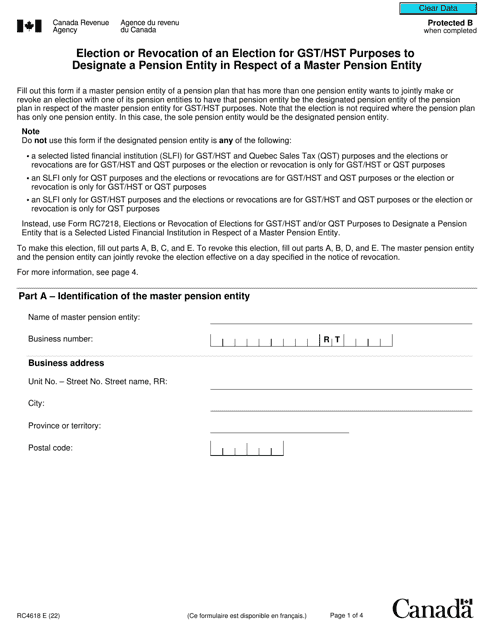

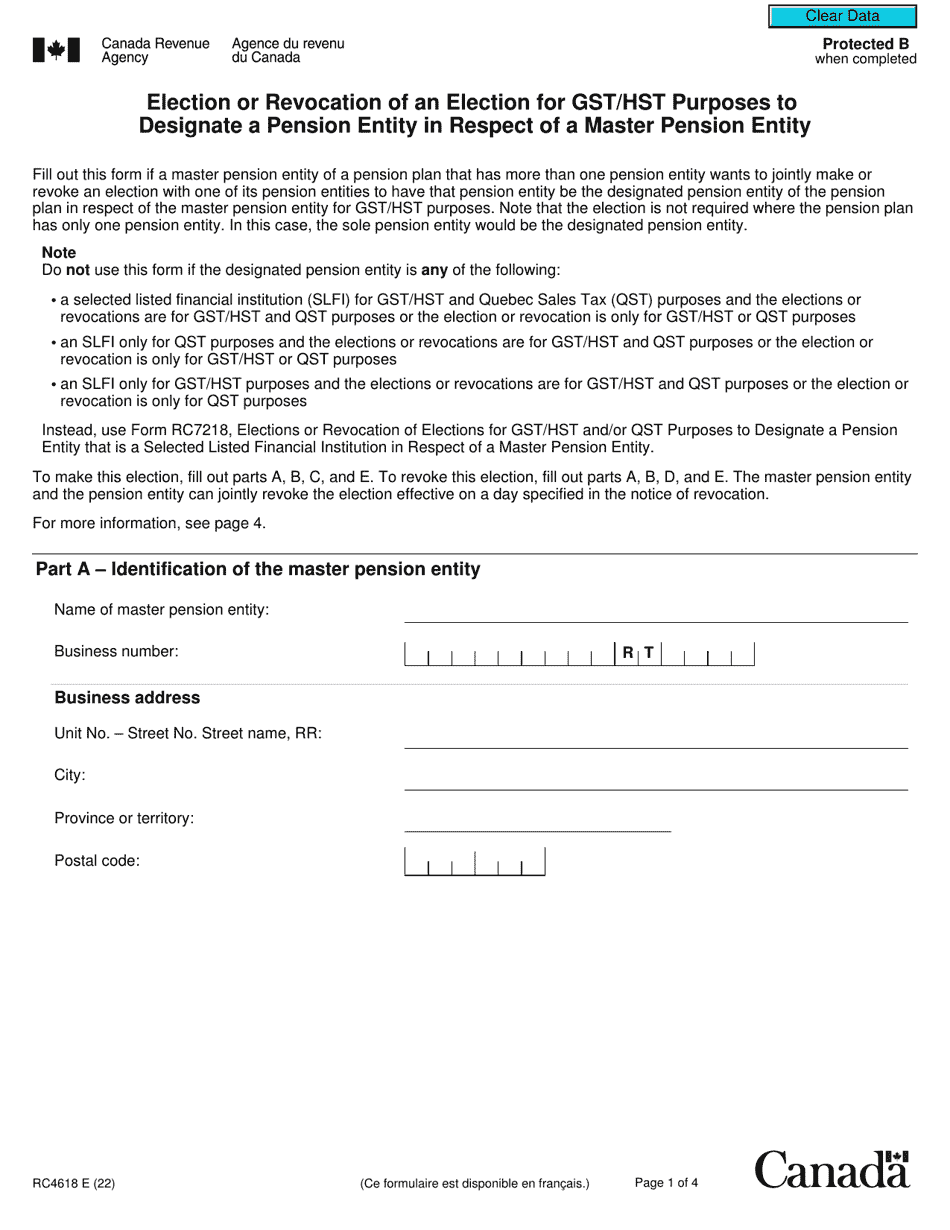

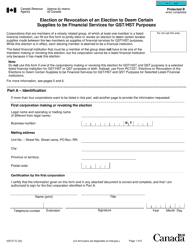

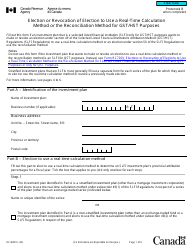

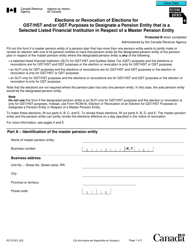

Form RC4618 Election or Revocation of an Election for Gst / Hst Purposes to Designate a Pension Entity in Respect of a Master Pension Entity - Canada

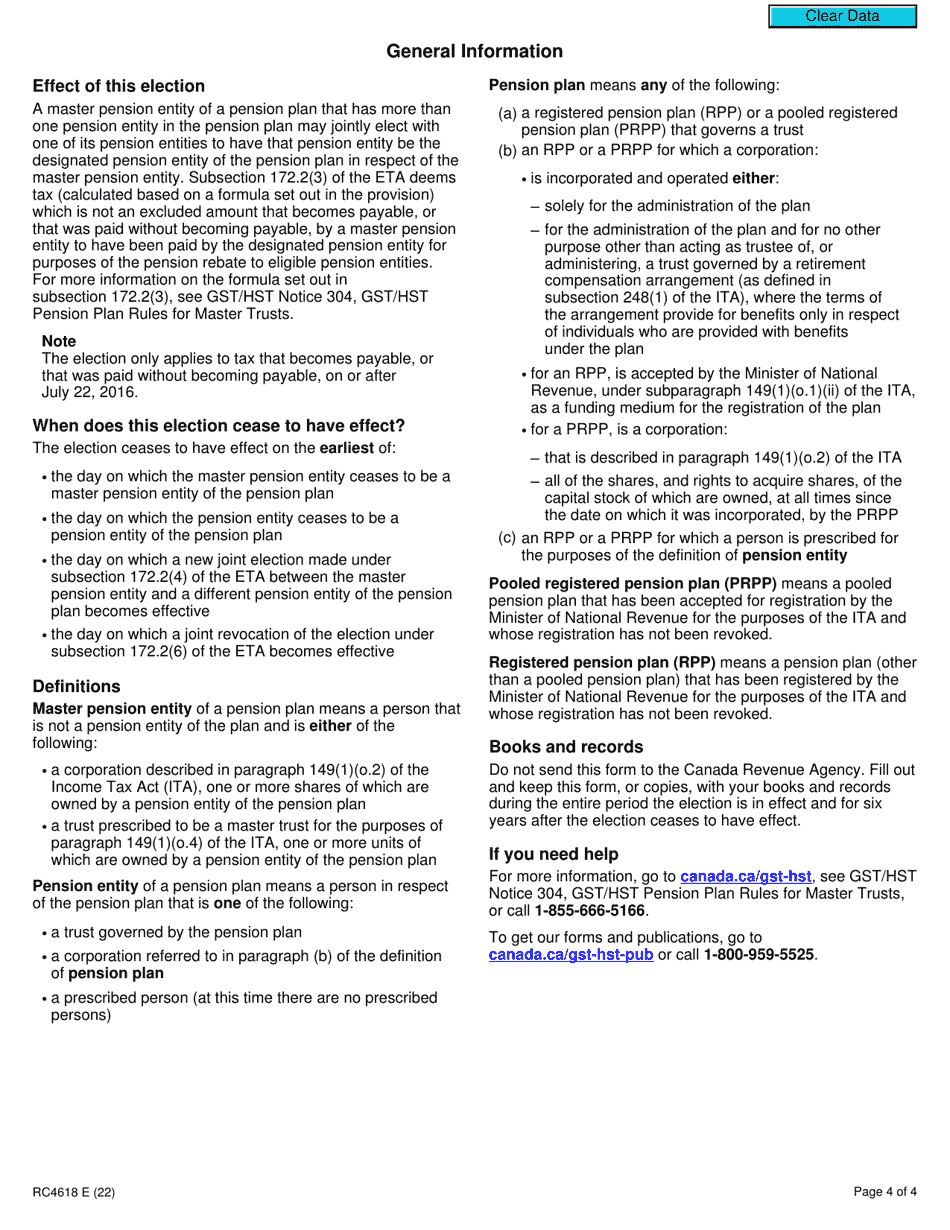

Form RC4618 is used in Canada to elect or revoke an election to designate a pension entity for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes in relation to a master pension entity. This form is used for tax-related purposes in the context of pension plans.

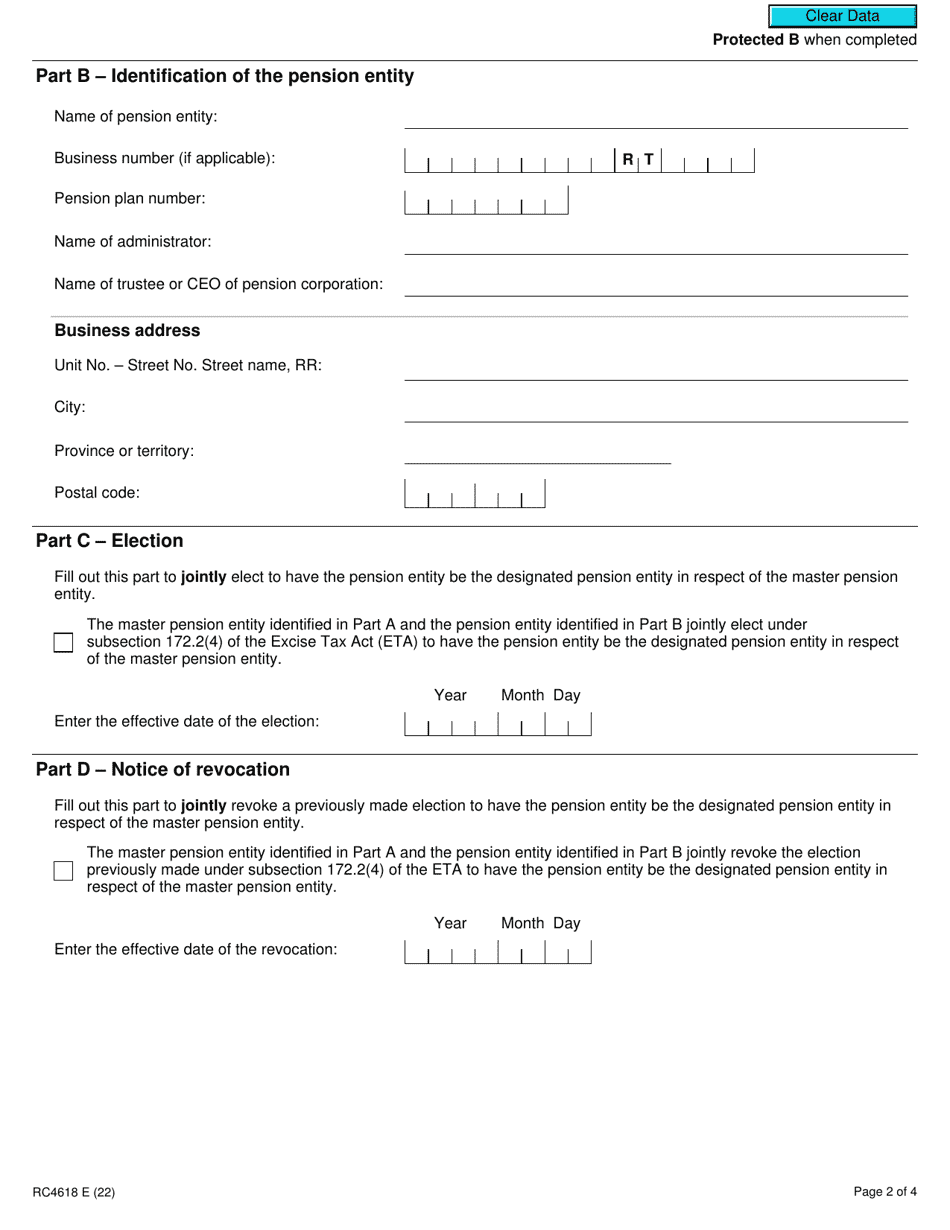

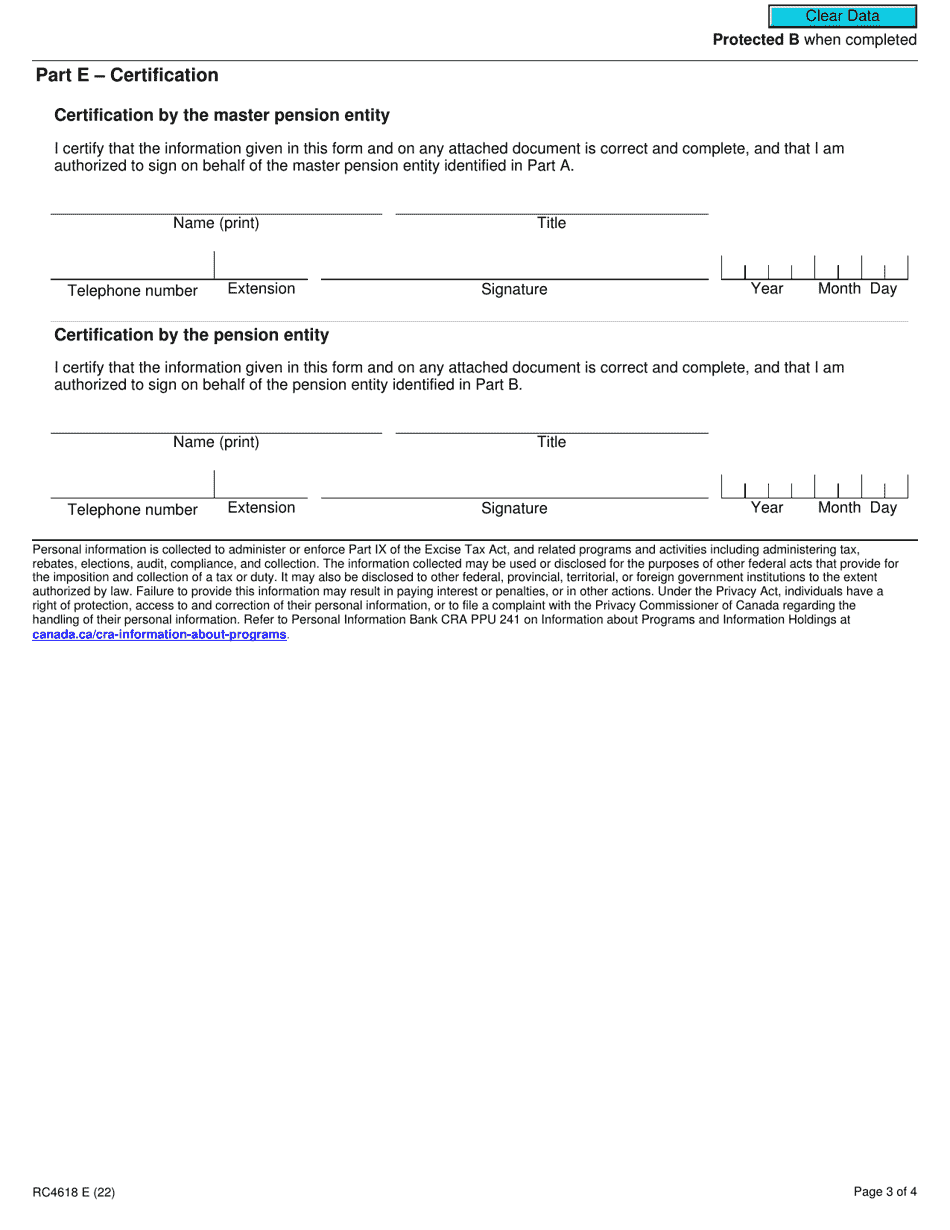

The form RC4618 for the election or revocation of an election for GST/HST purposes to designate a pension entity in respect of a master pension entity in Canada is filed by the pension entity itself.

Form RC4618 Election or Revocation of an Election for Gst/Hst Purposes to Designate a Pension Entity in Respect of a Master Pension Entity - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC4618? A: Form RC4618 is used to make an election or revoke an election for GST/HST purposes in order to designate a pension entity in respect of a master pension entity in Canada.

Q: What is the purpose of this form? A: The purpose of this form is to designate a pension entity in respect of a master pension entity for GST/HST purposes in Canada.

Q: How do I use this form? A: You use this form to either make an election or revoke an election to designate a pension entity in respect of a master pension entity for GST/HST purposes in Canada.

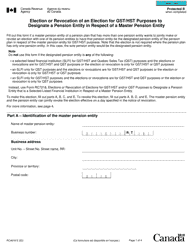

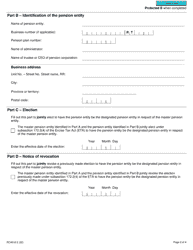

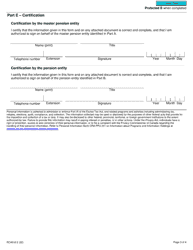

Q: What information do I need to complete this form? A: You will need to provide information about the master pension entity and the designated pension entity, and indicate whether you are making an election or revoking an election.

Q: Are there any fees associated with this form? A: No, there are no fees associated with Form RC4618.