This version of the form is not currently in use and is provided for reference only. Download this version of

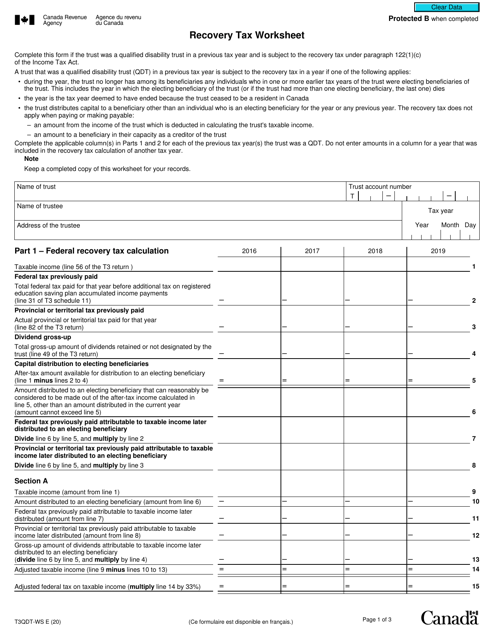

Form T3QDT-WS

for the current year.

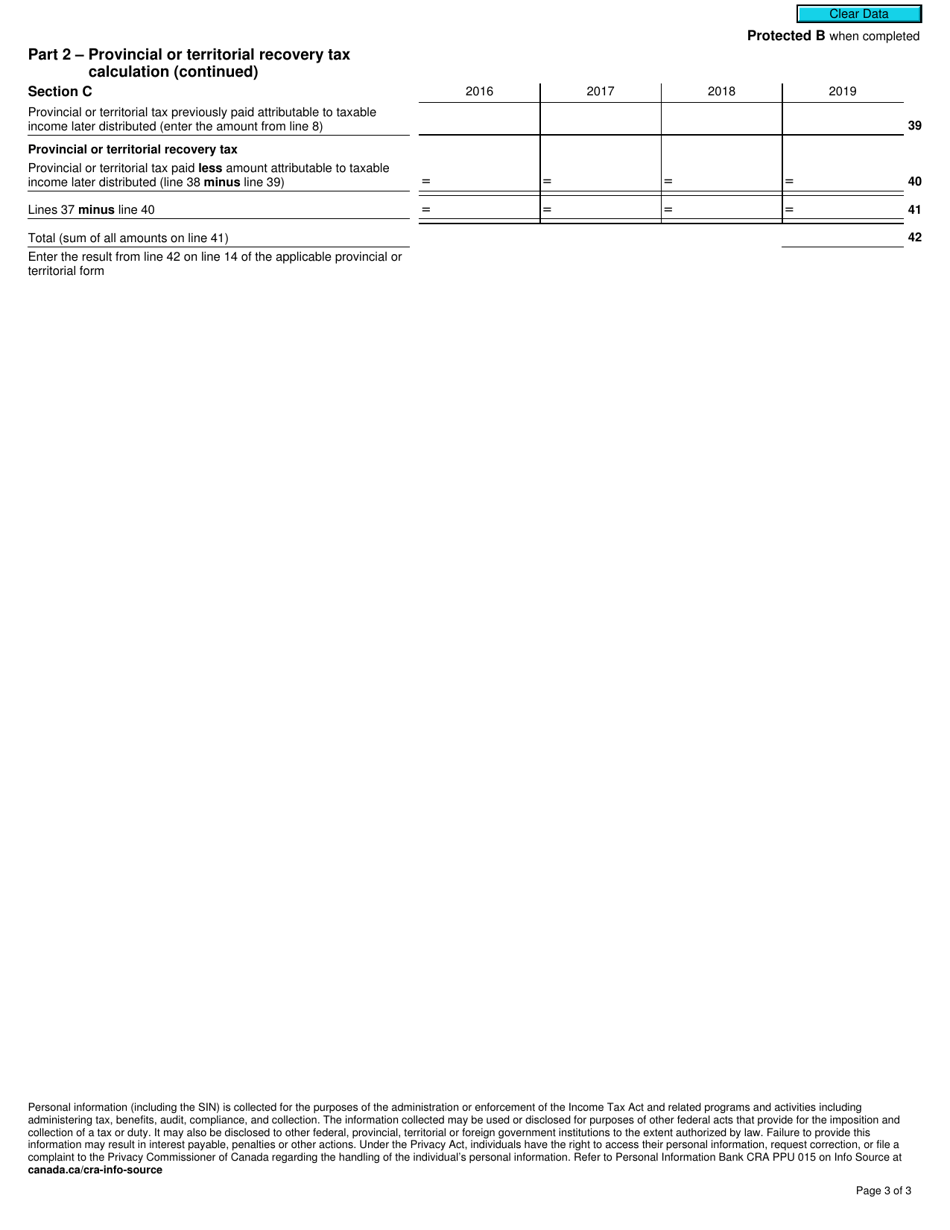

Form T3QDT-WS Recovery Tax Worksheet - Canada

Form T3QDT-WS Recovery Tax Worksheet is used in Canada for calculating the recovery tax for individuals who have received certain income from qualified dividends. It helps individuals determine the amount of recovery tax they need to pay.

Form T3QDT-WS Recovery Tax Worksheet is filed by individuals in Canada who have previously made withdrawals from a Tax-Free Savings Account (TFSA) and now want to recover the related over-contribution tax.

FAQ

Q: What is Form T3QDT-WS?

A: Form T3QDT-WS is the Recovery Tax Worksheet used in Canada.

Q: What is the purpose of Form T3QDT-WS?

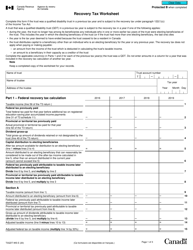

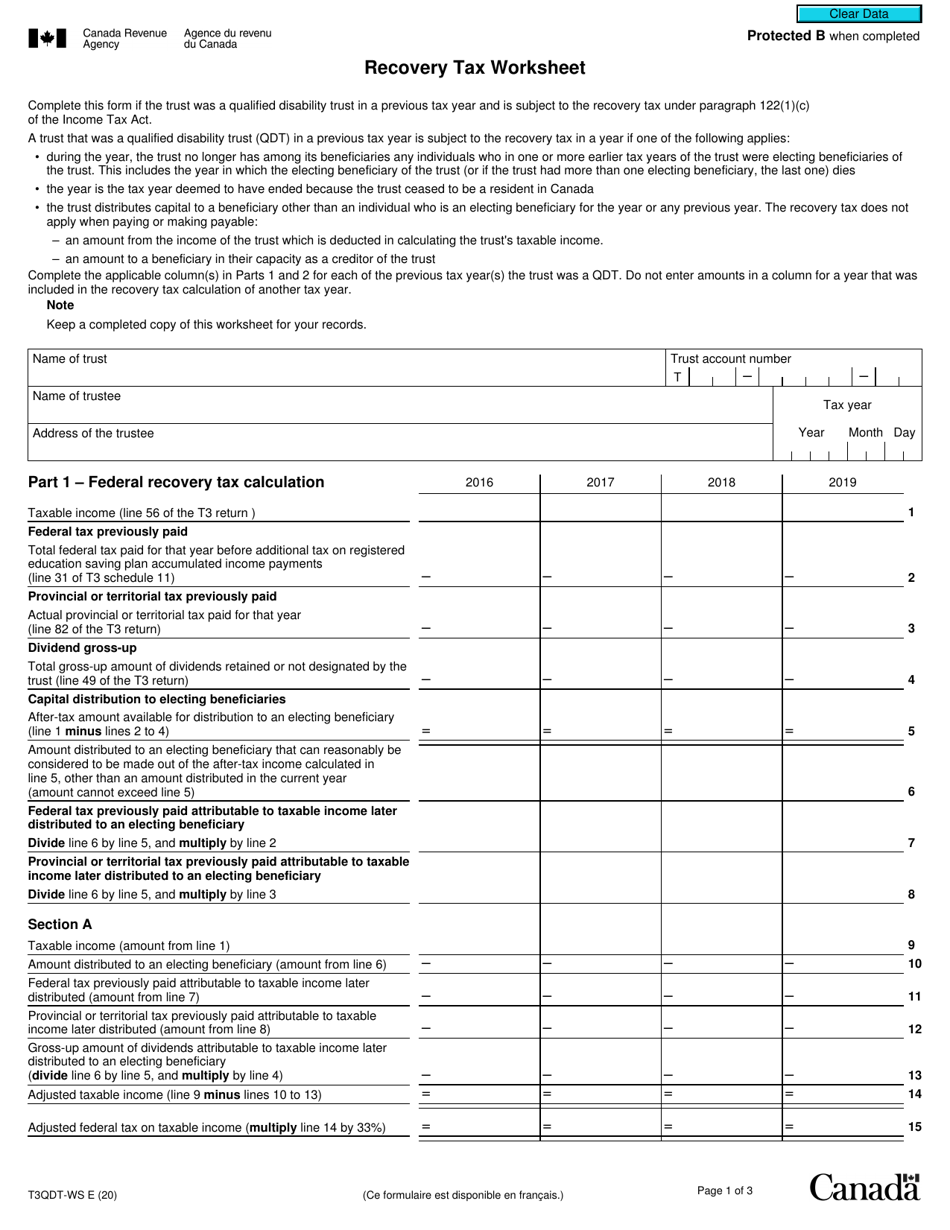

A: The purpose of Form T3QDT-WS is to calculate the recovery tax.

Q: Who is required to use Form T3QDT-WS?

A: Individuals in Canada who have a recovery tax obligation need to use Form T3QDT-WS.

Q: What is the recovery tax?

A: The recovery tax is an additional tax imposed on certain individuals in Canada.

Q: What information is required to complete Form T3QDT-WS?

A: To complete Form T3QDT-WS, you will need information about your income, deductions, and credits.

Q: When is Form T3QDT-WS due?

A: The due date for Form T3QDT-WS varies depending on your specific situation. It is best to consult the Canada Revenue Agency or your tax advisor for the exact deadline.

Q: Are there any penalties for not filing Form T3QDT-WS?

A: Yes, there may be penalties for not filing Form T3QDT-WS or for filing it late. It is important to ensure you comply with the tax regulations.

Q: What should I do if I have questions or need assistance with Form T3QDT-WS?

A: If you have questions or need assistance with Form T3QDT-WS, you can contact the Canada Revenue Agency for guidance.