This version of the form is not currently in use and is provided for reference only. Download this version of

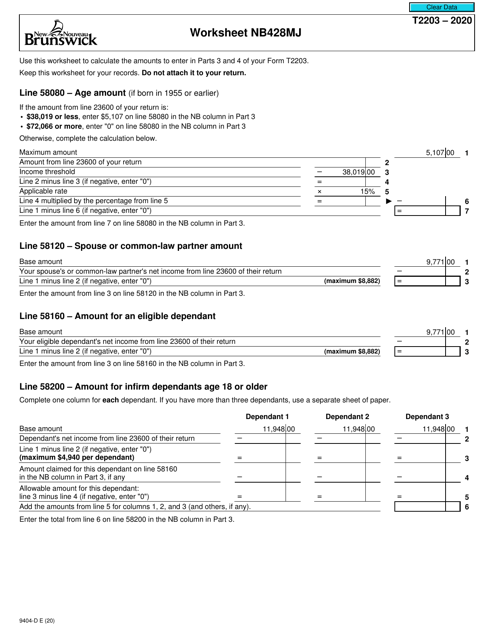

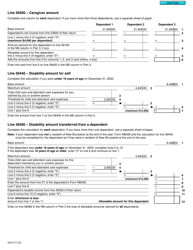

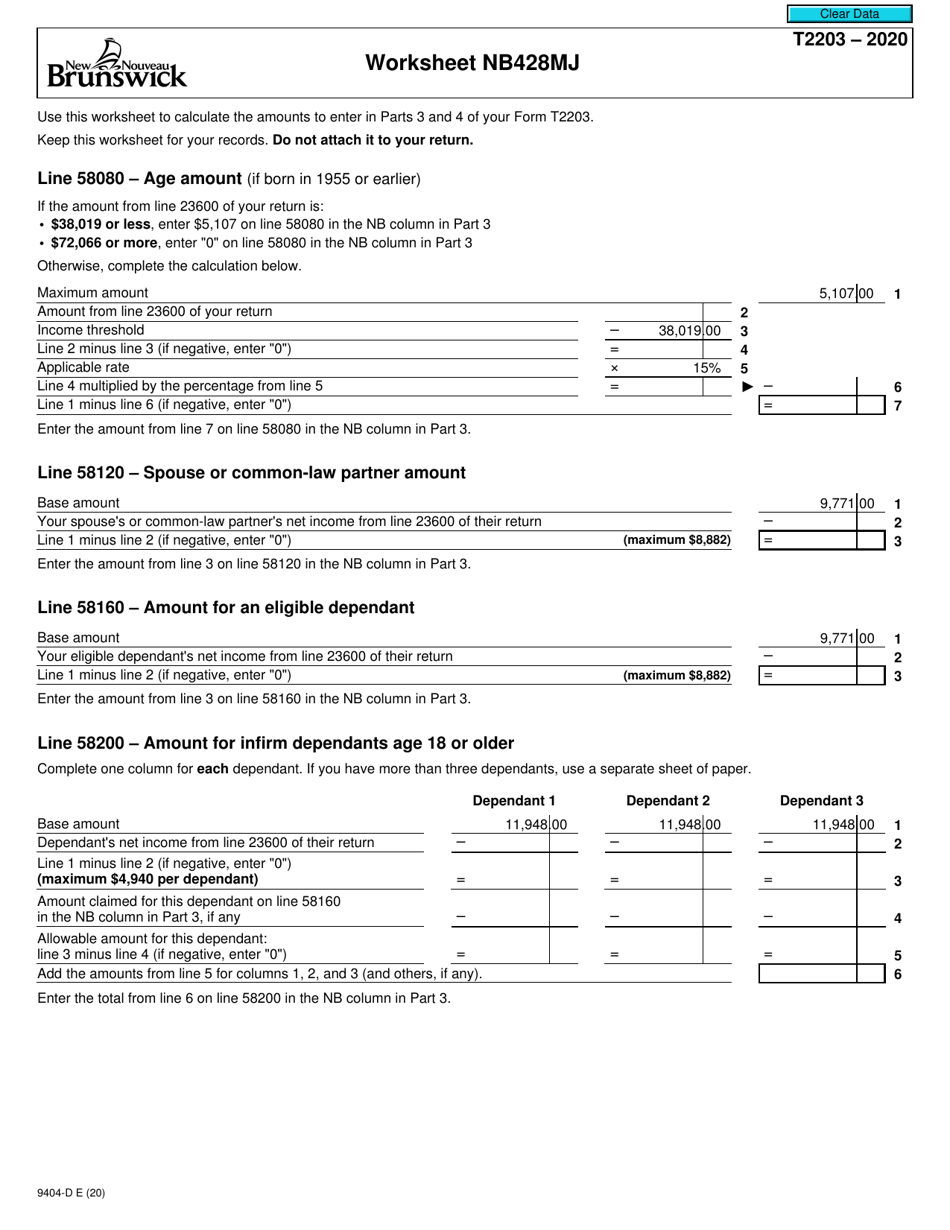

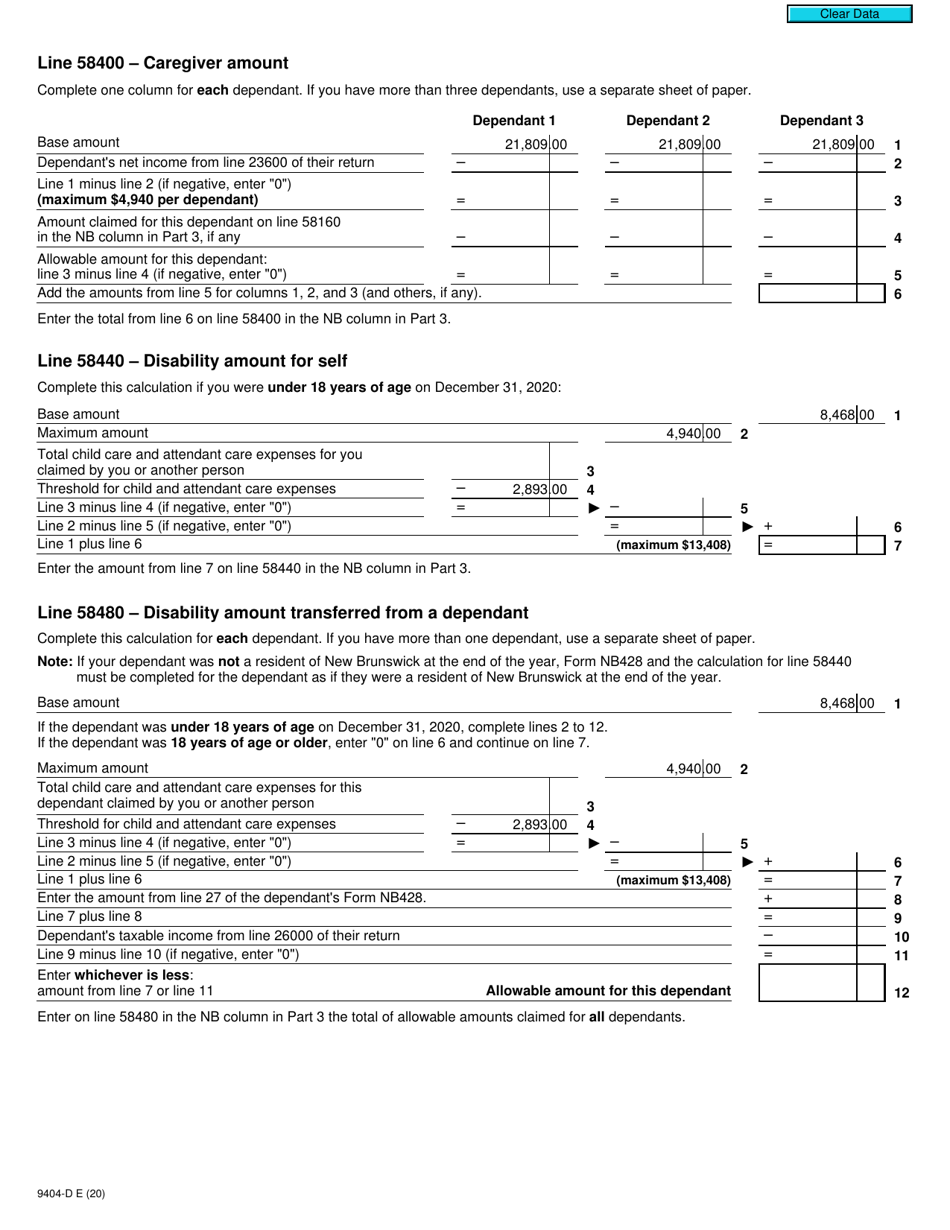

Form T2203 (9404-D) Worksheet NB428MJ

for the current year.

Form T2203 (9404-D) Worksheet NB428MJ New Brunswick - Canada

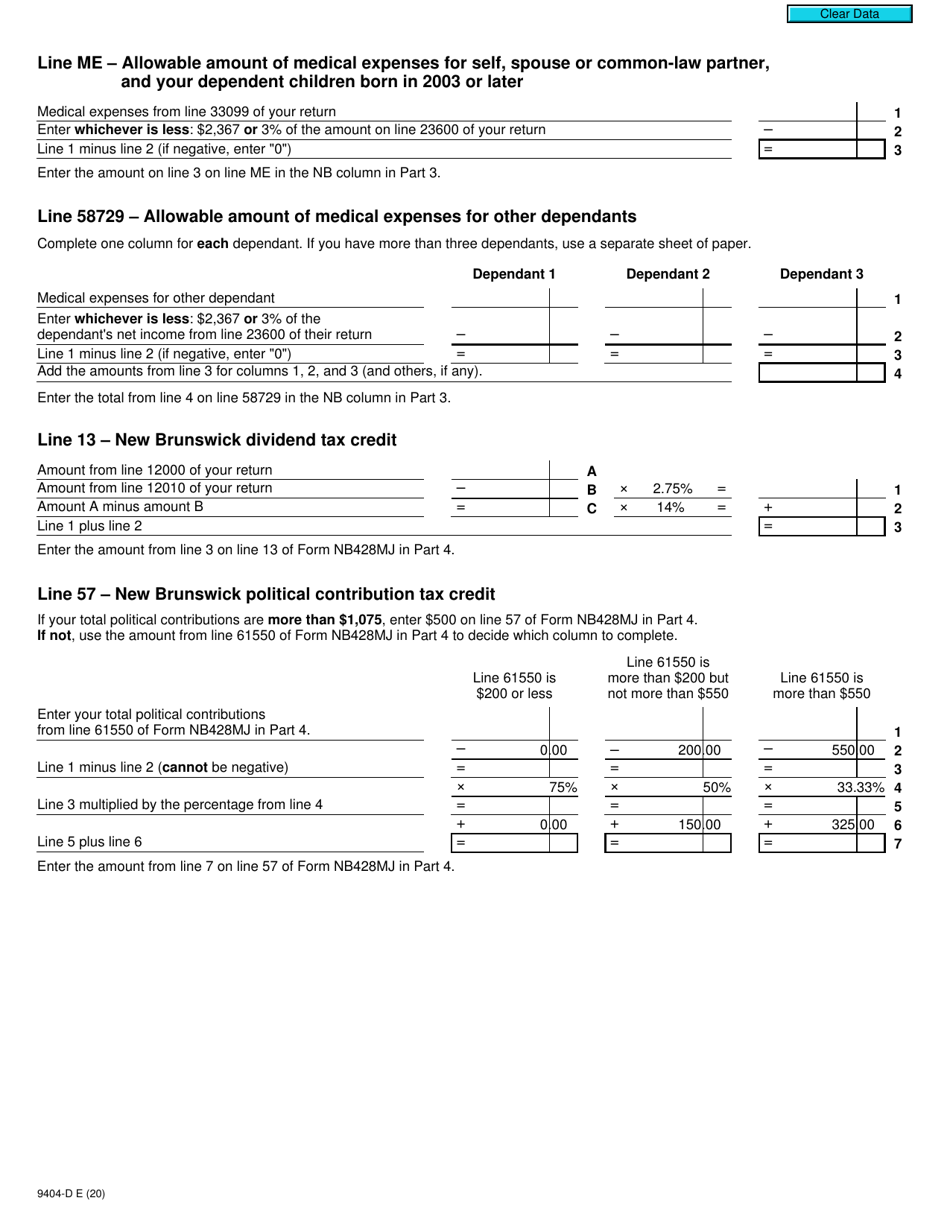

Form T2203 (9404-D) Worksheet NB428MJ is specifically used in New Brunswick, Canada for determining the provincial income tax payable by residents. This form helps individuals calculate and report their provincial tax liability in addition to their federal income tax. The form takes into account various factors such as income, deductions, and credits specific to New Brunswick.

The Form T2203 (9404-D) Worksheet NB428MJ in New Brunswick, Canada is filed by individuals who need to calculate their provincial tax credits for residents of New Brunswick.

FAQ

Q: What is Form T2203 (9404-D)?

A: Form T2203 (9404-D) is a worksheet used for calculating the provincial tax credits for residents of New Brunswick, Canada.

Q: Who should use Form T2203 (9404-D)?

A: Form T2203 (9404-D) should be used by residents of New Brunswick, Canada who are filing their taxes and want to claim provincial tax credits.

Q: What is the purpose of Form T2203 (9404-D)?

A: The purpose of Form T2203 (9404-D) is to calculate the provincial tax credits that can be claimed by residents of New Brunswick, Canada.

Q: What information do I need to fill out Form T2203 (9404-D)?

A: To fill out Form T2203 (9404-D), you will need information such as your income, deductions, and credits for the tax year.

Q: How do I fill out Form T2203 (9404-D)?

A: Follow the instructions provided on Form T2203 (9404-D) to correctly fill out the worksheet and calculate your provincial tax credits.

Q: Can I claim provincial tax credits on my federal tax return?

A: No, provincial tax credits cannot be claimed on a federal tax return. You must file a separate provincial tax return, using Form T2203 (9404-D) to claim the credits.

Q: What are some common provincial tax credits in New Brunswick?

A: Some common provincial tax credits in New Brunswick include the New Brunswick Workers' Compensation Act Pension Income Tax Credit, New Brunswick Disability Supports Deduction, and the New Brunswick Low-Income Individuals and Families Tax Reduction.

Q: How do provincial tax credits affect my overall tax liability?

A: Provincial tax credits can help reduce the amount of tax you owe to the government. By claiming eligible credits, you may be able to lower your overall tax liability.

Q: When is the deadline to file Form T2203 (9404-D)?

A: The deadline to file Form T2203 (9404-D) is usually the same as the federal tax return deadline, which is April 30th for most individuals.