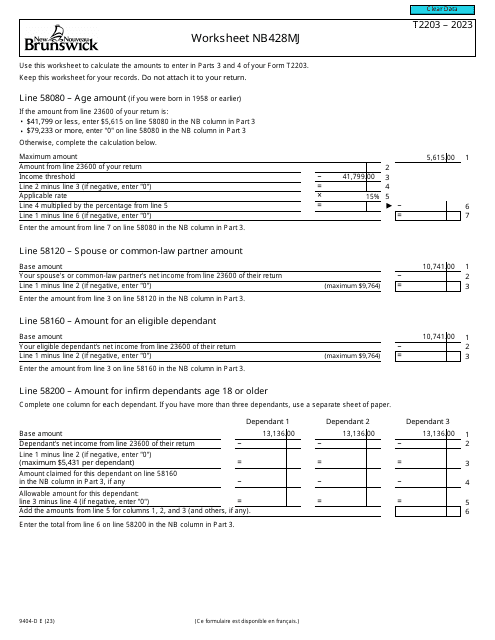

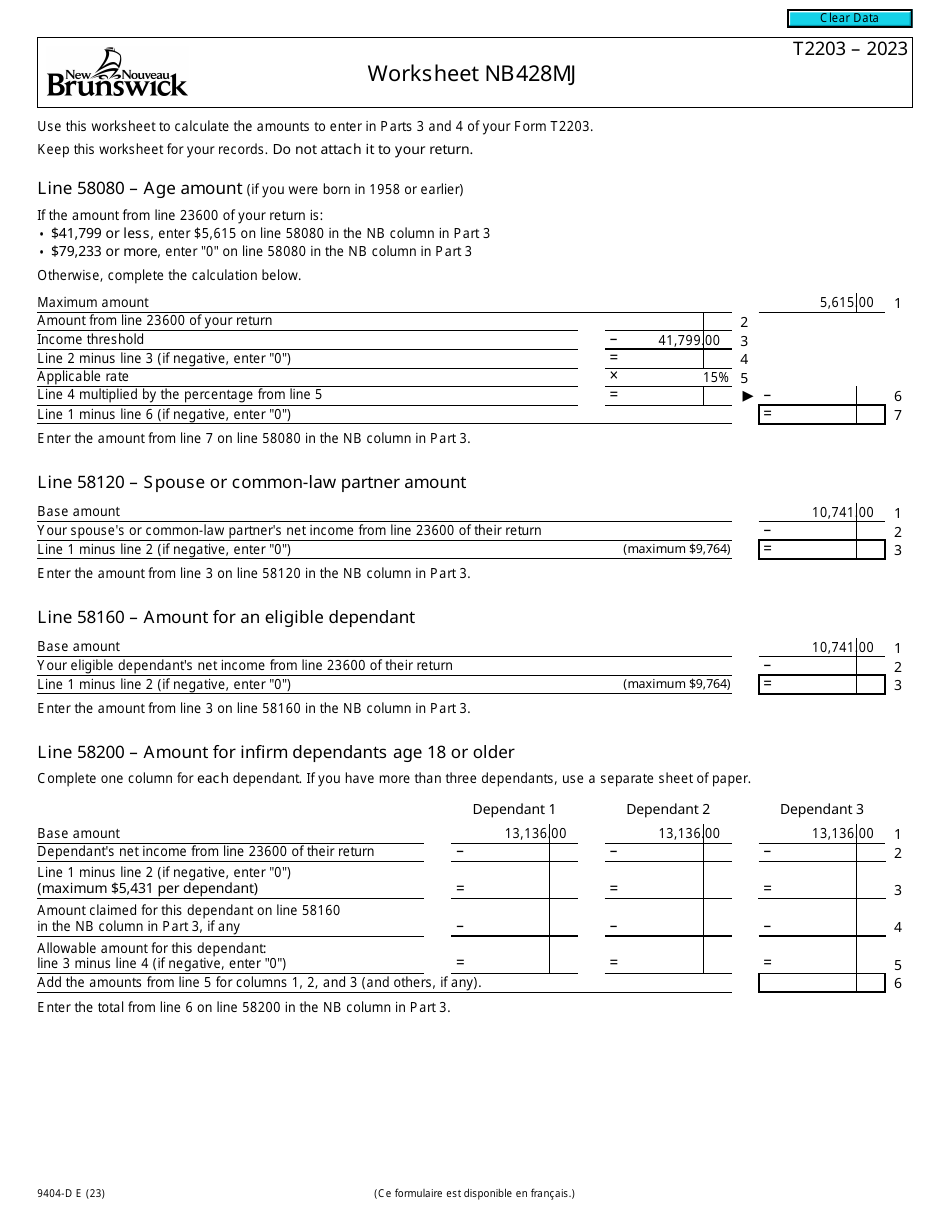

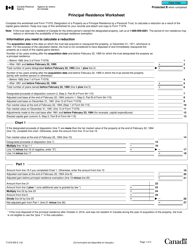

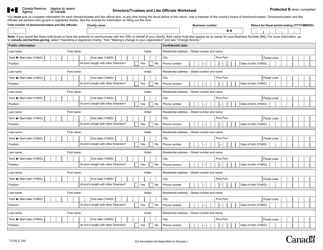

Form T2203 (9404-D) Worksheet NB428MJ New Brunswick - Canada

Form T2203 (9404-D) Worksheet NB428MJ is the Canadian form used to calculate the provincial or territorial tax payable for residents of New Brunswick. It is used to determine the amount of tax owed to the government based on your income and other relevant factors.

The Form T2203 (9404-D) Worksheet NB428MJ is filed by individuals who are residents of Canada for tax purposes.

Form T2203 (9404-D) Worksheet NB428MJ Worksheet Nb428mj - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203?

A: Form T2203 is a worksheet used by Canadian residents to calculate their federal and provincial or territorial non-business foreign tax credits.

Q: What is the purpose of Form 9404-D?

A: Form 9404-D is used to report the federal and provincial or territorial non-business foreign tax credits claimed on Form T2203.

Q: What is Worksheet NB428MJ?

A: Worksheet NB428MJ is a specific version of Form T2203 used in the province of New Brunswick to calculate the provincial non-business foreign tax credit.

Q: What is the purpose of Worksheet Nb428mj?

A: Worksheet Nb428mj is used to calculate the provincial non-business foreign tax credit for residents of New Brunswick.

Q: Who needs to fill out Form T2203?

A: Canadian residents who have paid foreign taxes on non-business income and want to claim a credit for those taxes need to fill out Form T2203.

Q: Who needs to fill out Form 9404-D?

A: Canadian residents who are claiming federal and provincial or territorial non-business foreign tax credits on Form T2203 need to fill out Form 9404-D.

Q: Who uses Worksheet NB428MJ?

A: Residents of New Brunswick who are calculating their provincial non-business foreign tax credit using Form T2203 need to use Worksheet NB428MJ.

Q: What information is required on Form T2203?

A: Form T2203 requires information about the foreign taxes paid, the foreign income earned, and the calculation of the foreign tax credit.

Q: What information is required on Form 9404-D?

A: Form 9404-D requires the breakdown of the federal and provincial or territorial non-business foreign tax credits claimed on Form T2203.

Q: What information is required on Worksheet NB428MJ?

A: Worksheet NB428MJ requires specific information about the provincial non-business foreign tax credit calculations for residents of New Brunswick.