This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9403-C; NS428MJ) Part 4

for the current year.

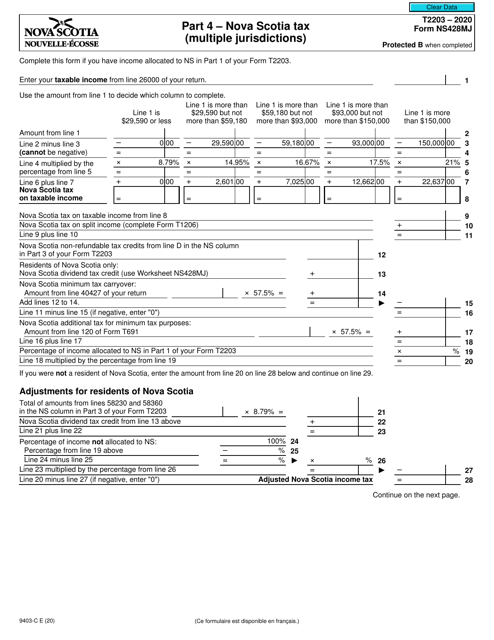

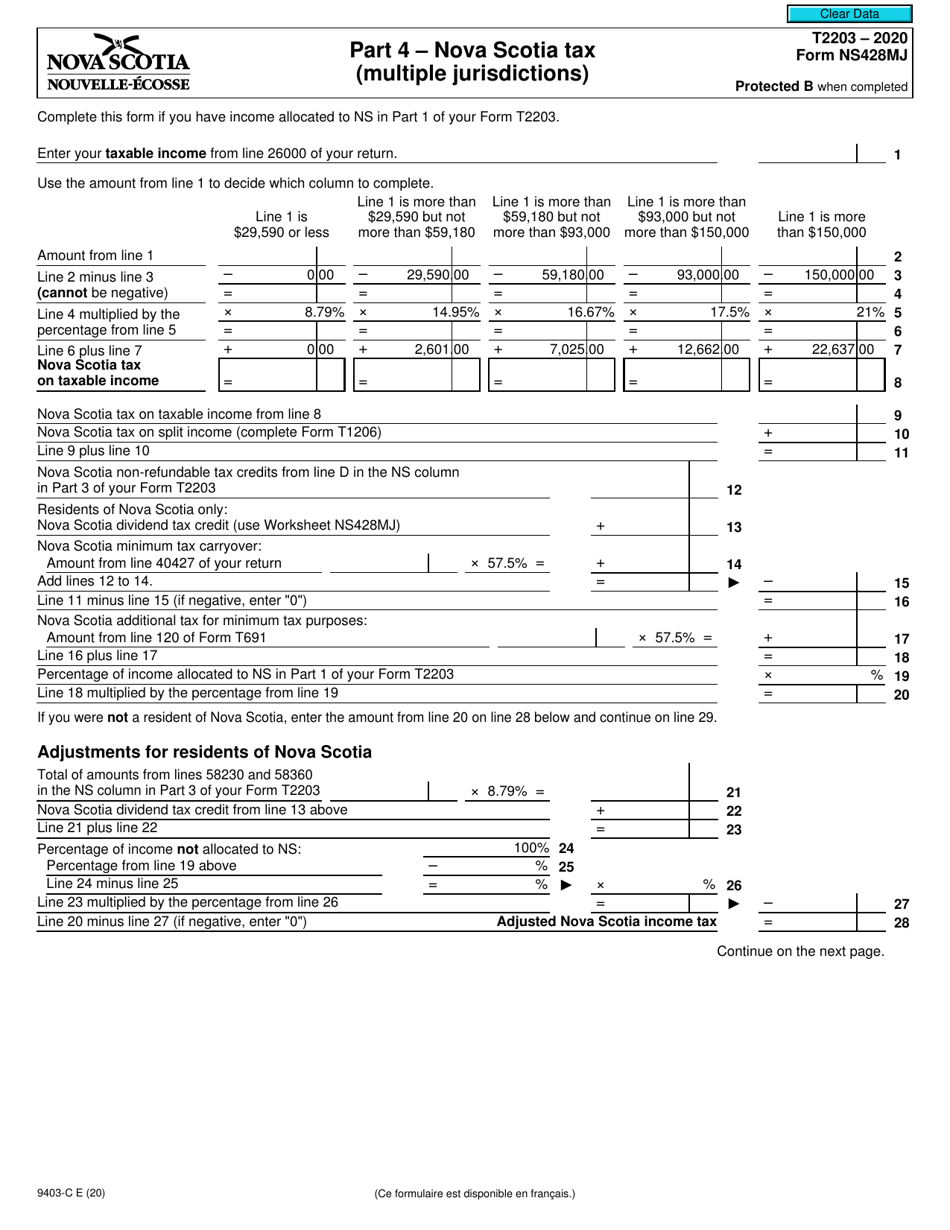

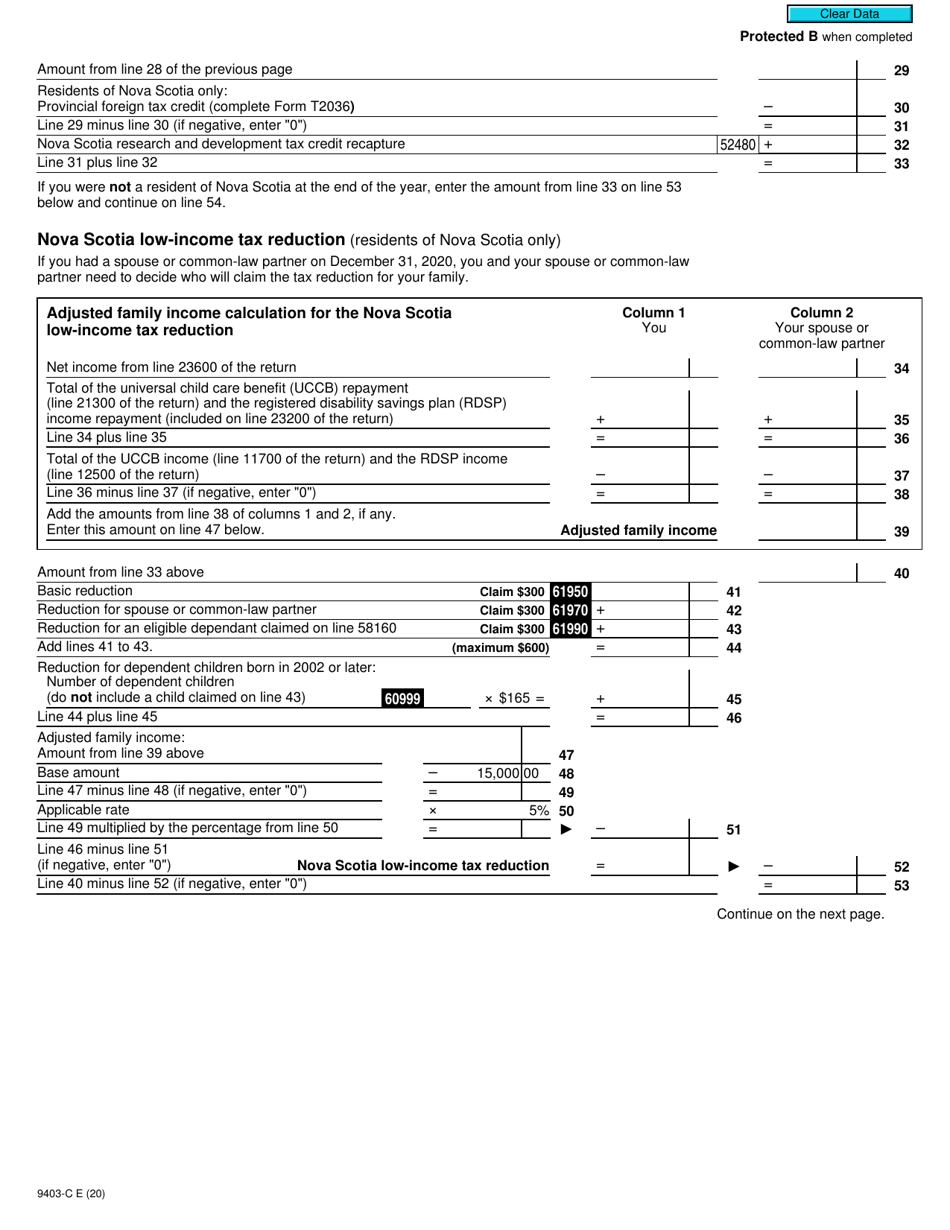

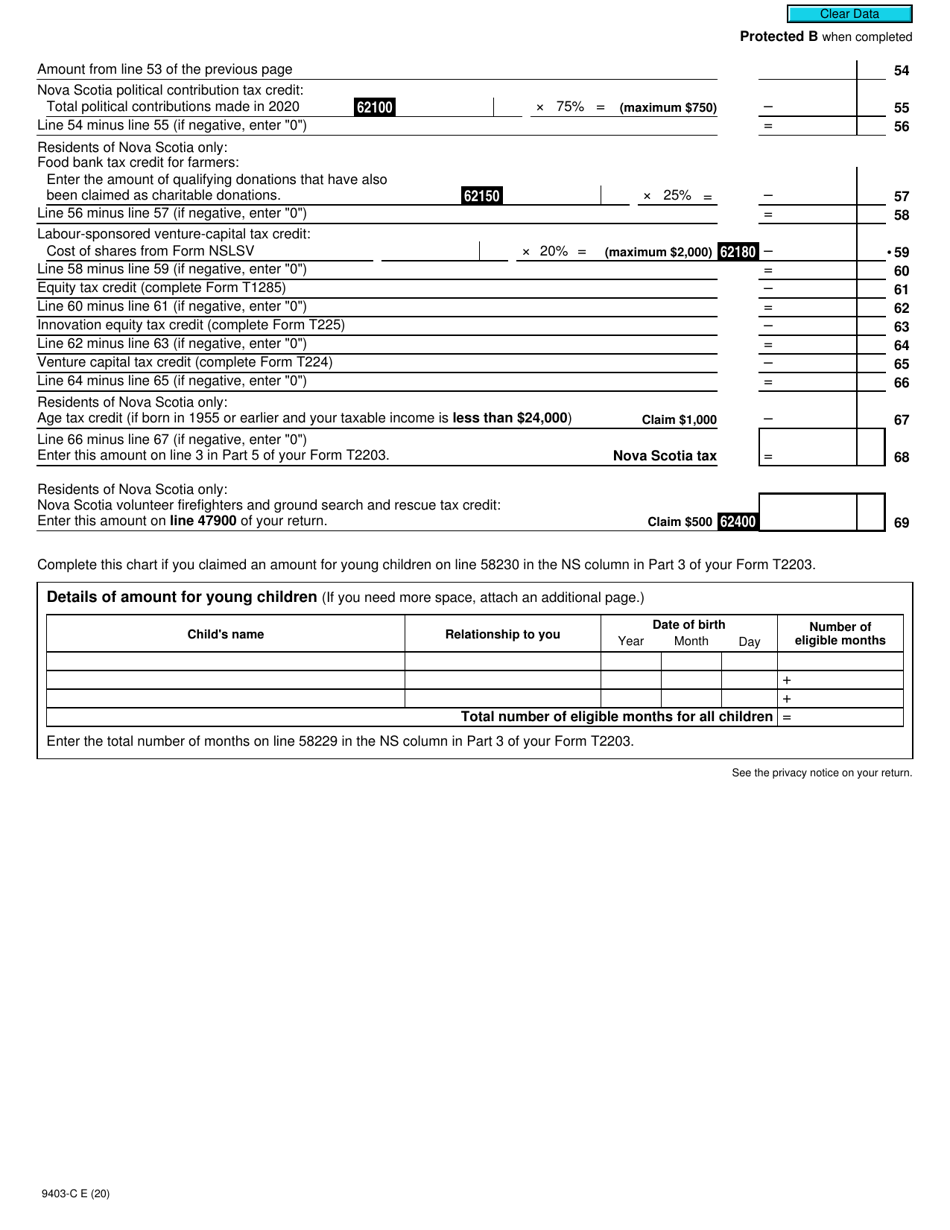

Form T2203 (9403-C; NS428MJ) Part 4 Nova Scotia Tax (Multiple Jurisdictions) - Canada

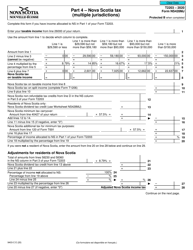

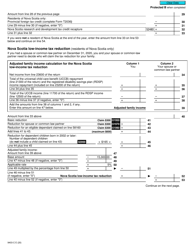

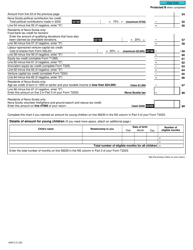

Form T2203 (9403-C; NS428MJ) Part 4 Nova Scotia Tax (Multiple Jurisdictions) is used in Canada for reporting and calculating provincial taxes specifically for the province of Nova Scotia. It helps individuals and businesses determine their tax liability and accurately file their tax returns.

The form T2203 (9403-C; NS428MJ) Part 4 Nova Scotia Tax (Multiple Jurisdictions) in Canada is filed by individual taxpayers who have income from multiple jurisdictions, including Nova Scotia.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada for reporting Nova Scotia tax liabilities.

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to calculate and report Nova Scotia tax liabilities in cases where an individual or corporation has tax obligations in multiple jurisdictions in Canada.

Q: What does the term 'Nova Scotia tax' refer to?

A: The term 'Nova Scotia tax' refers to the specific tax obligations and liabilities that individuals or corporations have in the province of Nova Scotia in Canada.

Q: What are the other forms referenced in Form T2203?

A: Form T2203 references other forms such as 9403-C and NS428MJ, which pertain to specific tax regulations and calculations in Nova Scotia.

Q: What is the significance of Part 4 in Form T2203?

A: Part 4 of Form T2203 specifically deals with the calculation and reporting of Nova Scotia tax liabilities in cases where there are multiple jurisdictions involved.