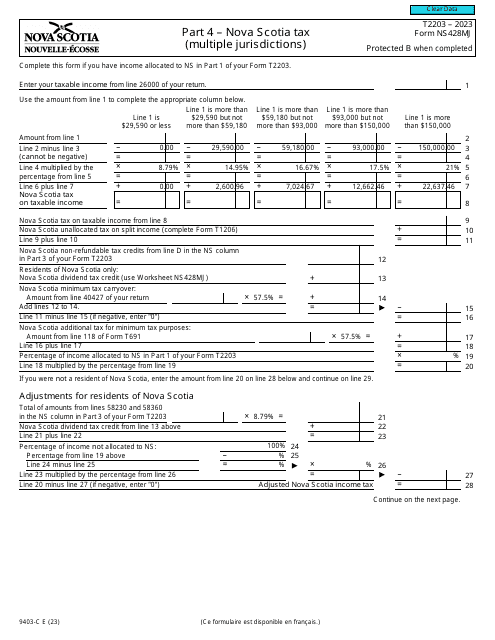

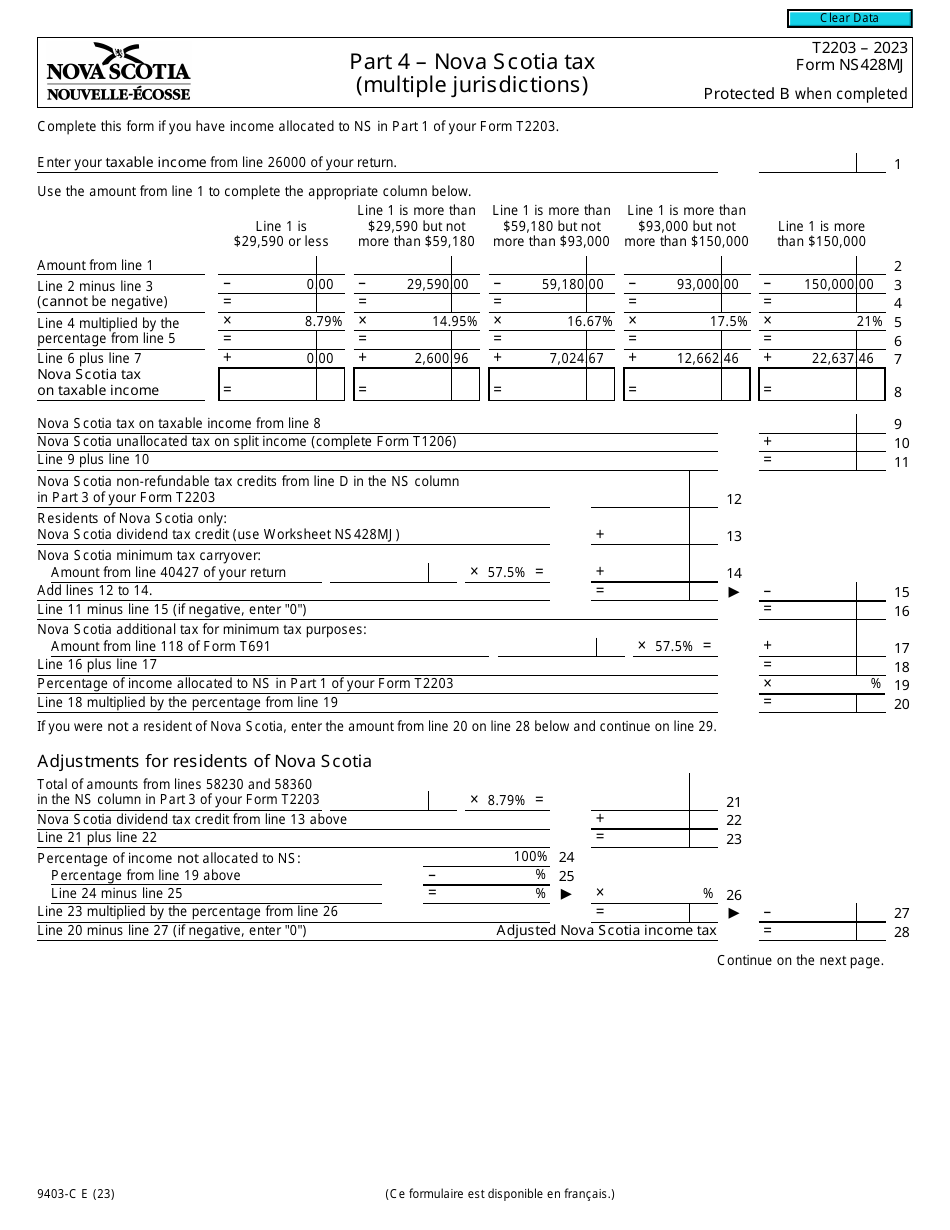

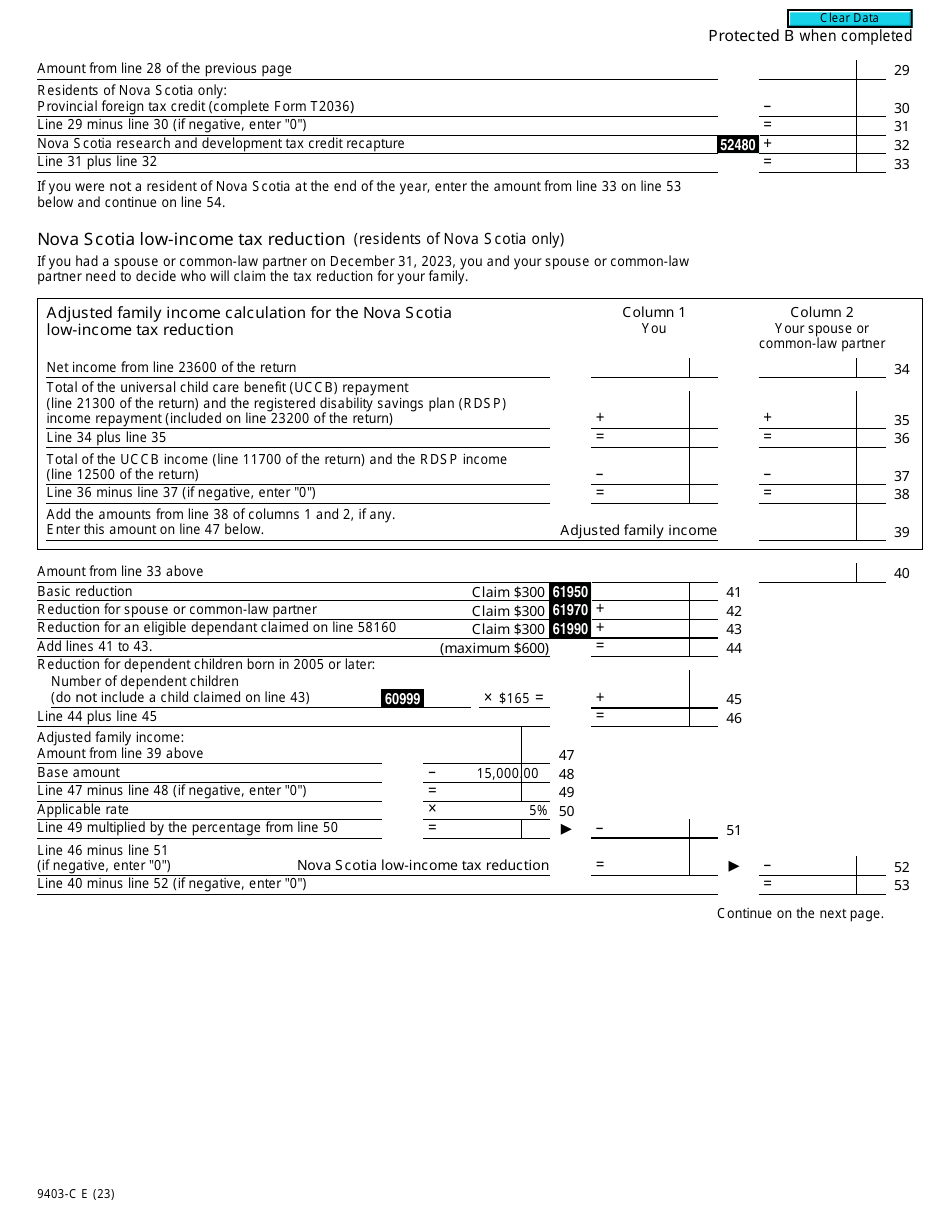

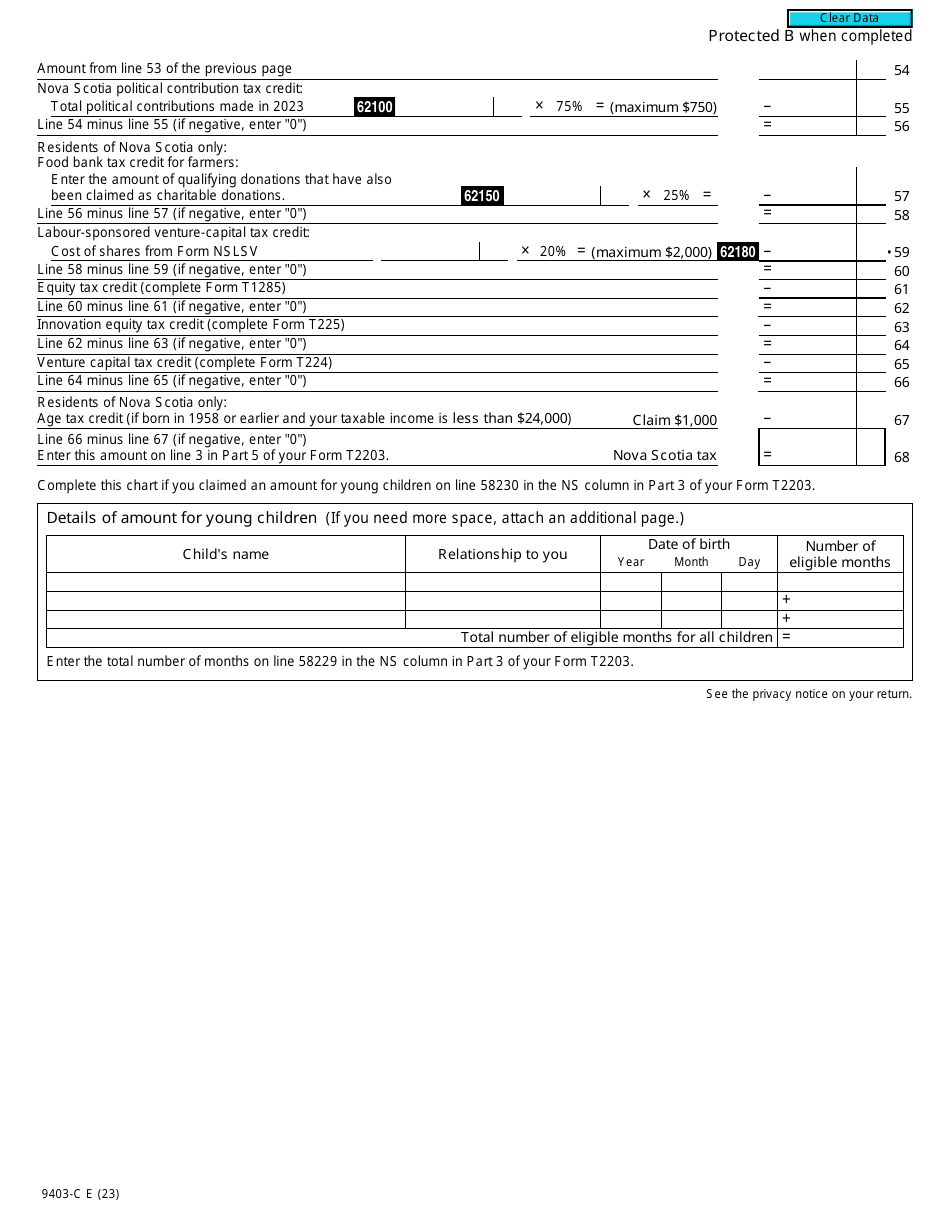

Form T2203 (9403-C; NS428MJ) Part 4 Nova Scotia Tax (Multiple Jurisdictions) - Canada

Form T2203 (NS428MJ; 9403-C) Part 4 Nova Scotia Tax (Multiple Jurisdictions) - Canada is used for reporting income and calculating taxes owed in the province of Nova Scotia, Canada. It specifically deals with situations where a taxpayer has income from multiple jurisdictions within Canada.

The Form T2203 (NS428MJ; 9403-C) Part 4 Nova Scotia Tax (Multiple Jurisdictions) is filed by individuals who are residents of Nova Scotia for income tax purposes.

Form T2203 (NS428MJ; 9403-C) Part 4 Nova Scotia Tax (Multiple Jurisdictions) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada for reporting Nova Scotia Tax (Multiple Jurisdictions).

Q: What is NS428MJ?

A: NS428MJ is the code for Nova Scotia Tax (Multiple Jurisdictions). It is used on Form T2203.

Q: What is 9403-C?

A: 9403-C is the code for the Canada Revenue Agency (CRA). It is used on Form T2203.

Q: What is Part 4 of Form T2203?

A: Part 4 of Form T2203 is the section where you report Nova Scotia Tax (Multiple Jurisdictions).

Q: What is Nova Scotia Tax (Multiple Jurisdictions)?

A: Nova Scotia Tax (Multiple Jurisdictions) is a tax that applies in certain situations where you have income from multiple jurisdictions within Nova Scotia.

Q: Who should use Form T2203?

A: Form T2203 should be used by individuals or businesses who have income from multiple jurisdictions within Nova Scotia and need to report Nova Scotia Tax (Multiple Jurisdictions).