This version of the form is not currently in use and is provided for reference only. Download this version of

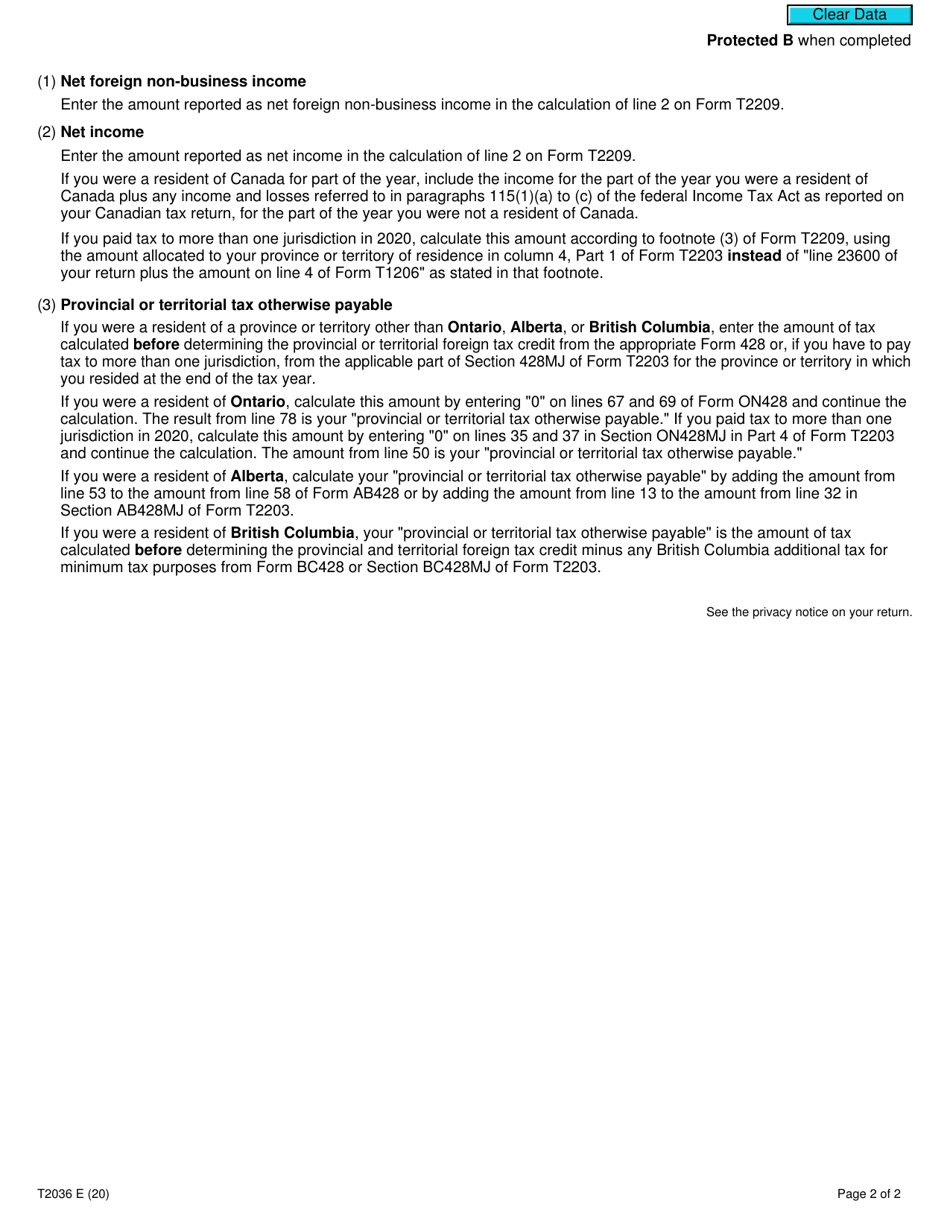

Form T2036

for the current year.

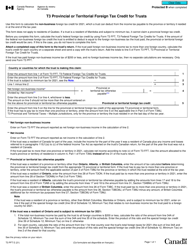

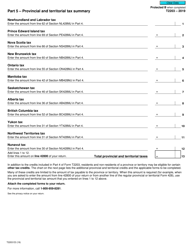

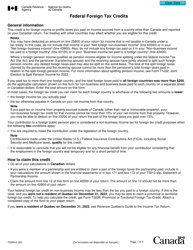

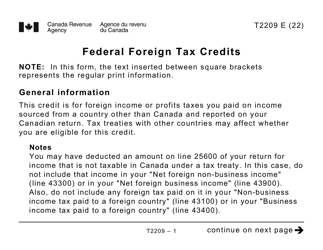

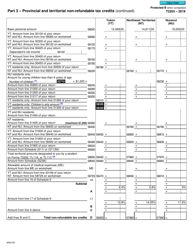

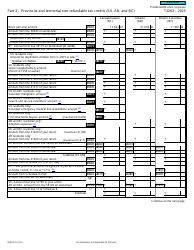

Form T2036 Provincial or Territorial Foreign Tax Credit - Canada

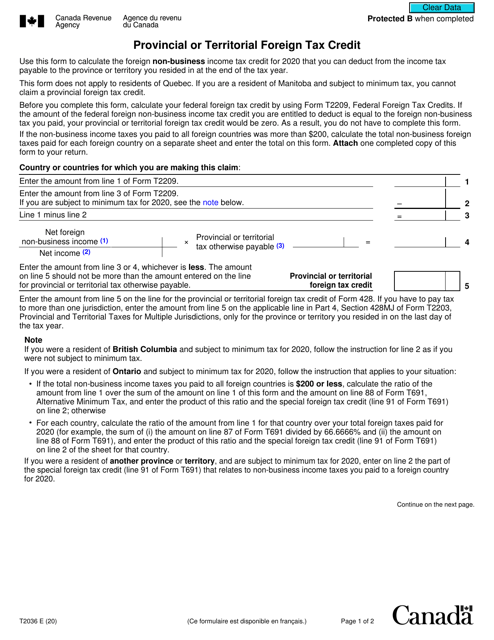

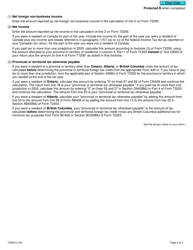

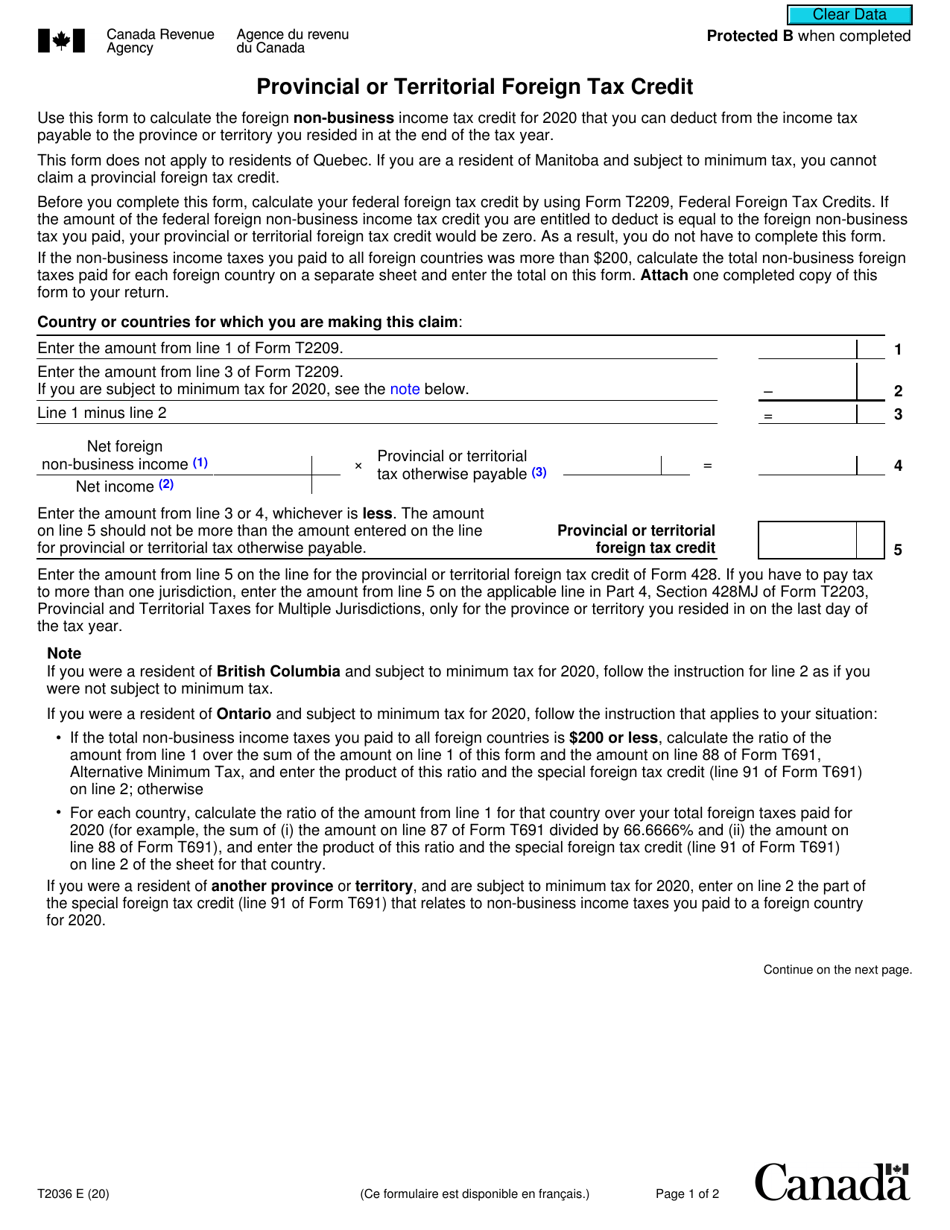

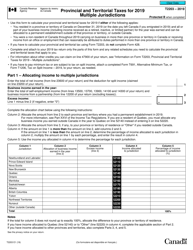

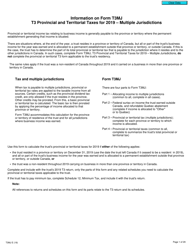

Form T2036 is used to calculate the amount of provincial or territorial foreign tax credit available to you as a resident of Canada. This credit is meant to help offset the taxes you have already paid to a foreign country on income that is also subject to Canadian taxation. The form is used to determine the eligible amount of foreign tax credits that you can claim on your Canadian tax return.

The Form T2036 Provincial or Territorial Foreign Tax Credit in Canada is filed by individuals who want to claim a foreign tax credit for taxes paid to a Canadian province or territory.

FAQ

Q: What is Form T2036?

A: Form T2036 is a tax form used in Canada to claim the Provincial or Territorial Foreign Tax Credit.

Q: What is the Provincial or Territorial Foreign Tax Credit?

A: The Provincial or Territorial Foreign Tax Credit is a tax credit that allows taxpayers in Canada to offset taxes paid to foreign jurisdictions against their provincial or territorial taxes.

Q: Who can claim the Provincial or Territorial Foreign Tax Credit?

A: Canadian taxpayers who have paid taxes to a foreign country on foreign income can claim the Provincial or Territorial Foreign Tax Credit.

Q: What is the purpose of Form T2036?

A: Form T2036 is used to calculate and claim the amount of the Provincial or Territorial Foreign Tax Credit that a taxpayer is eligible for.

Q: When is Form T2036 due?

A: Form T2036 is typically due by the same deadline as your personal income tax return in Canada, which is April 30th or June 15th for self-employed individuals.

Q: What supporting documents are required for Form T2036?

A: You will need to provide documentation to support your claim, such as foreign tax slips, proof of payment, and any relevant tax treaties.

Q: Can I claim the Provincial or Territorial Foreign Tax Credit for taxes paid to US?

A: Yes, if you are a resident of Canada and have paid taxes to the United States, you can claim the Provincial or Territorial Foreign Tax Credit.

Q: Do I have to file a separate Form T2036 for each foreign country?

A: No, you can include taxes paid to multiple foreign countries on one Form T2036.

Q: Can I carry forward unused Provincial or Territorial Foreign Tax Credit?

A: Yes, you can carry forward unused credits for up to 10 years to offset future provincial or territorial taxes.