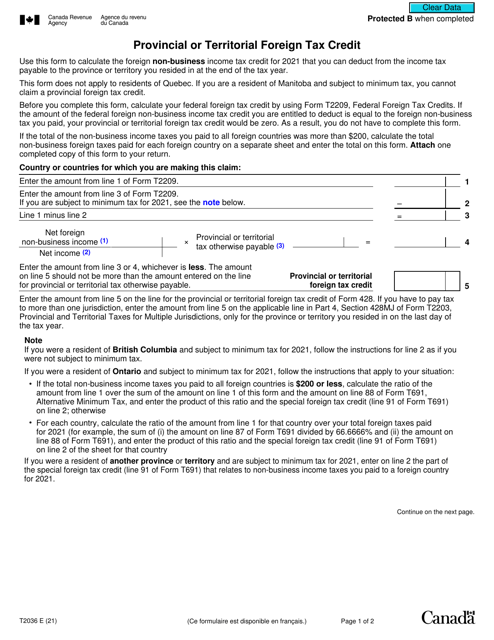

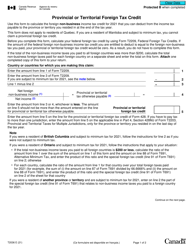

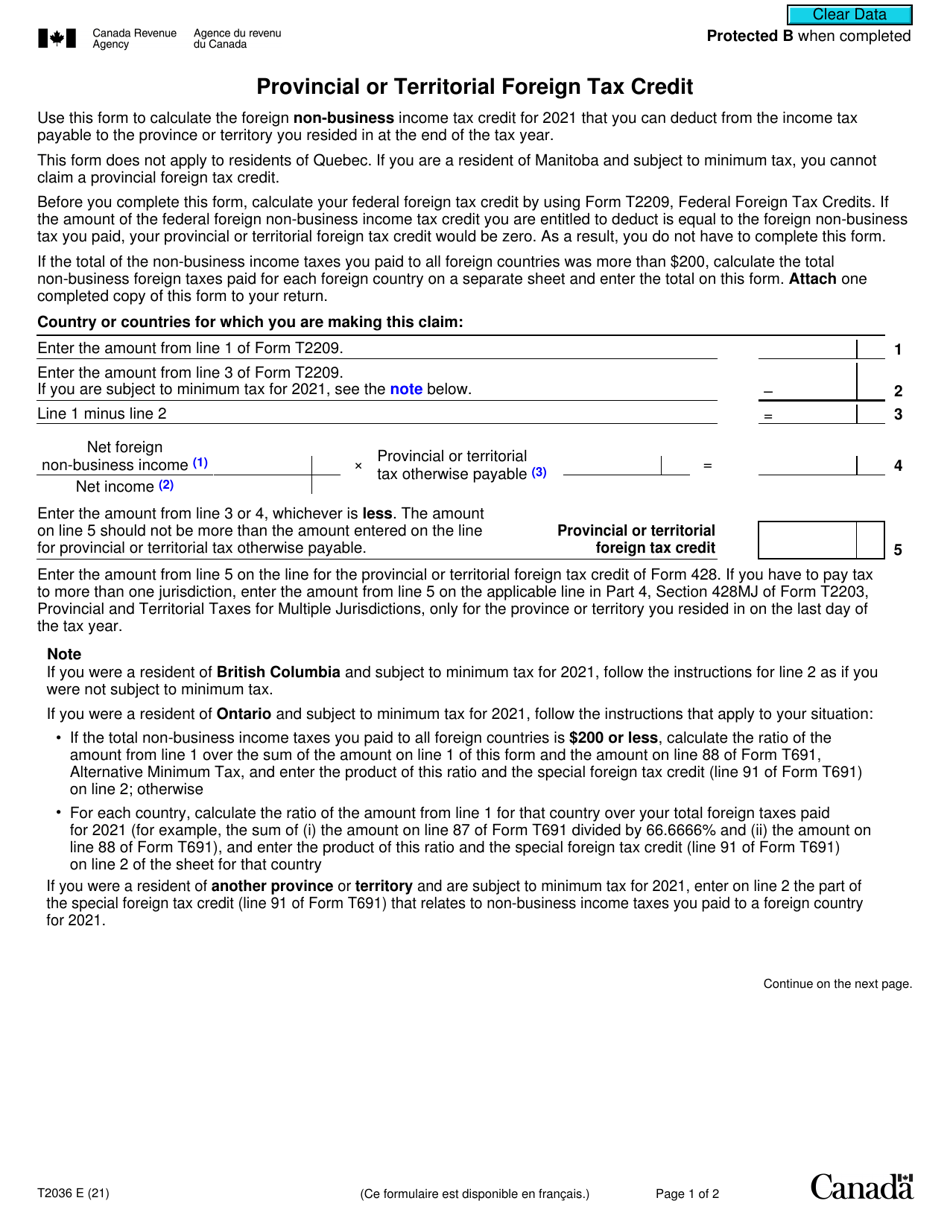

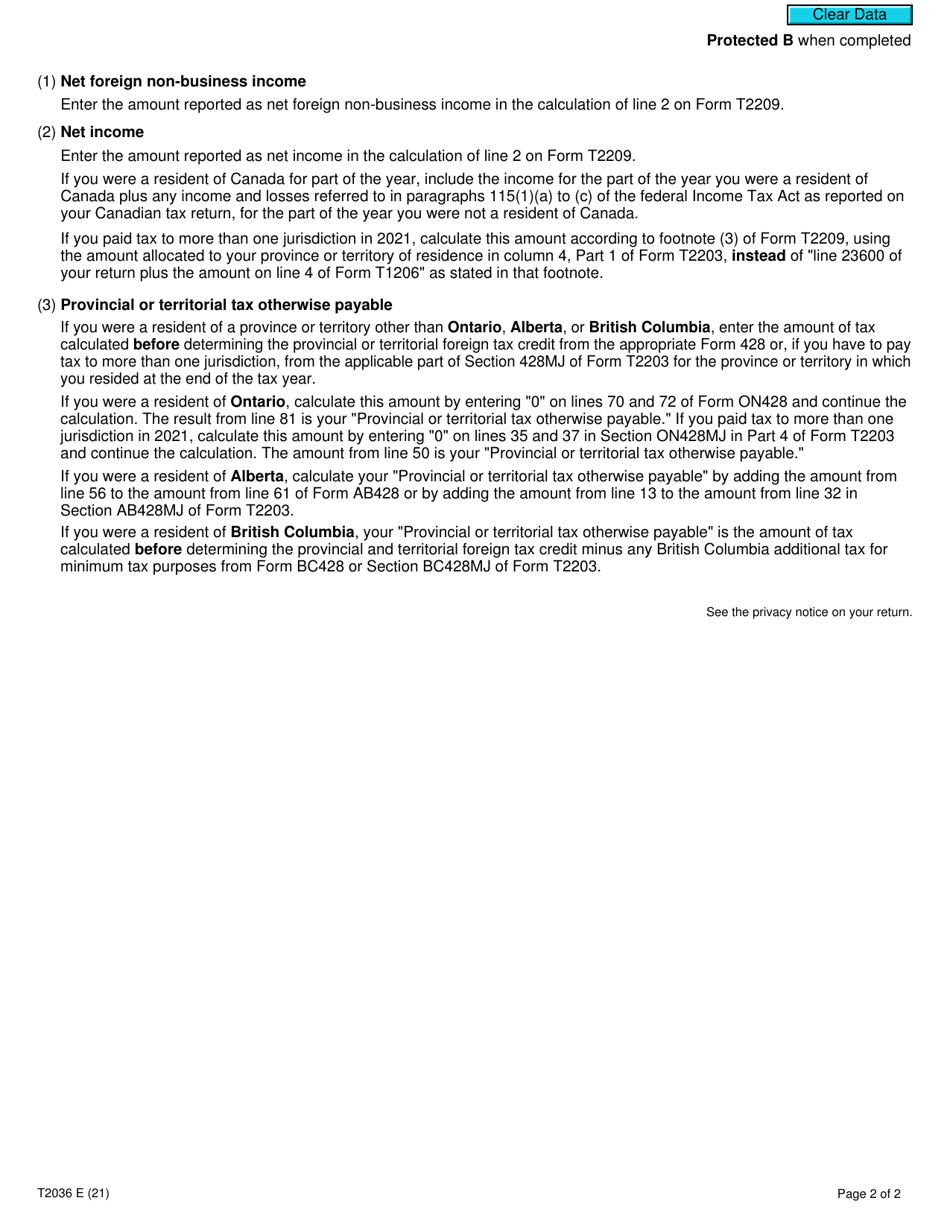

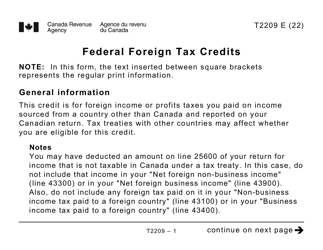

Form T2036 Provincial or Territorial Foreign Tax Credit - Canada

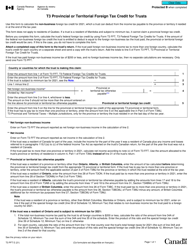

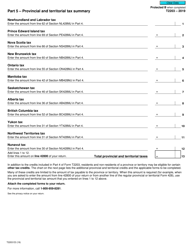

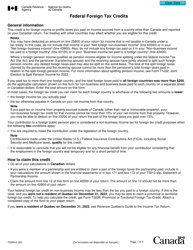

Form T2036 Provincial or Territorial Foreign Tax Credit in Canada is used to claim a tax credit for foreign taxes paid to another country on income that has already been taxed in a Canadian province or territory. It is meant to prevent double taxation on the same income.

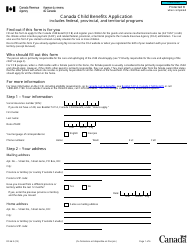

The Form T2036 Provincial or Territorial Foreign Tax Credit is filed by individual taxpayers who have paid foreign taxes on income earned from provincial or territorial sources in Canada.

Form T2036 Provincial or Territorial Foreign Tax Credit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2036?

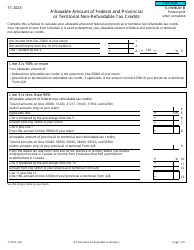

A: Form T2036 is a tax form used in Canada to calculate and claim the provincial or territorial foreign tax credit.

Q: What is the provincial or territorial foreign tax credit?

A: The provincial or territorial foreign tax credit is a credit that can be claimed by Canadian residents to reduce their taxes payable on foreign income that has already been taxed by a foreign province or territory.

Q: Who can use Form T2036?

A: Form T2036 can be used by Canadian residents who have paid foreign taxes in a province or territory outside of Canada.

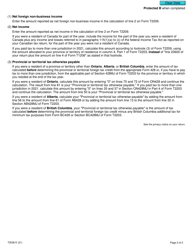

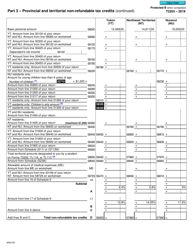

Q: How do I calculate the provincial or territorial foreign tax credit?

A: To calculate the provincial or territorial foreign tax credit, you need to determine the amount of foreign taxes paid in the province or territory, convert the foreign taxes to Canadian dollars, and calculate the credit using the applicable tax rates.

Q: Is there a deadline for filing Form T2036?

A: Yes, Form T2036 should be filed on or before the filing deadline for your Canadian income tax return, which is usually April 30th.

Q: Can I claim the provincial or territorial foreign tax credit if I have already claimed a foreign tax credit with the federal government?

A: Yes, you can still claim the provincial or territorial foreign tax credit even if you have already claimed a foreign tax credit with the federal government.

Q: Are there any limitations or restrictions on claiming the provincial or territorial foreign tax credit?

A: Yes, there are limitations and restrictions on claiming the provincial or territorial foreign tax credit. It is important to review the specific rules and guidelines provided by the Canada Revenue Agency to determine your eligibility and any applicable limitations.