This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2019

for the current year.

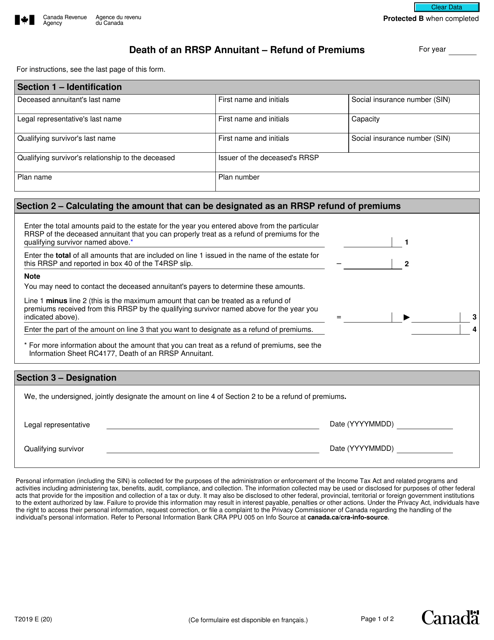

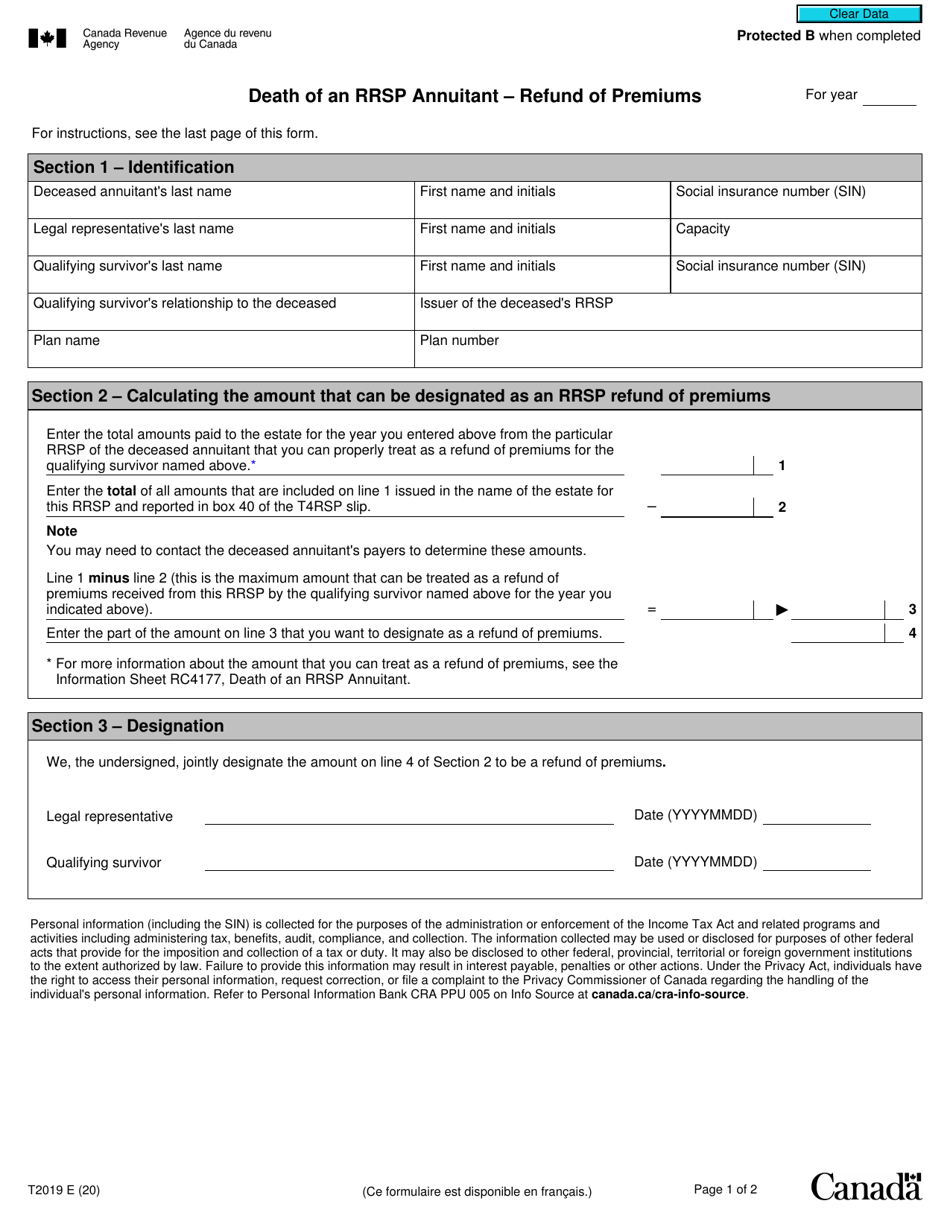

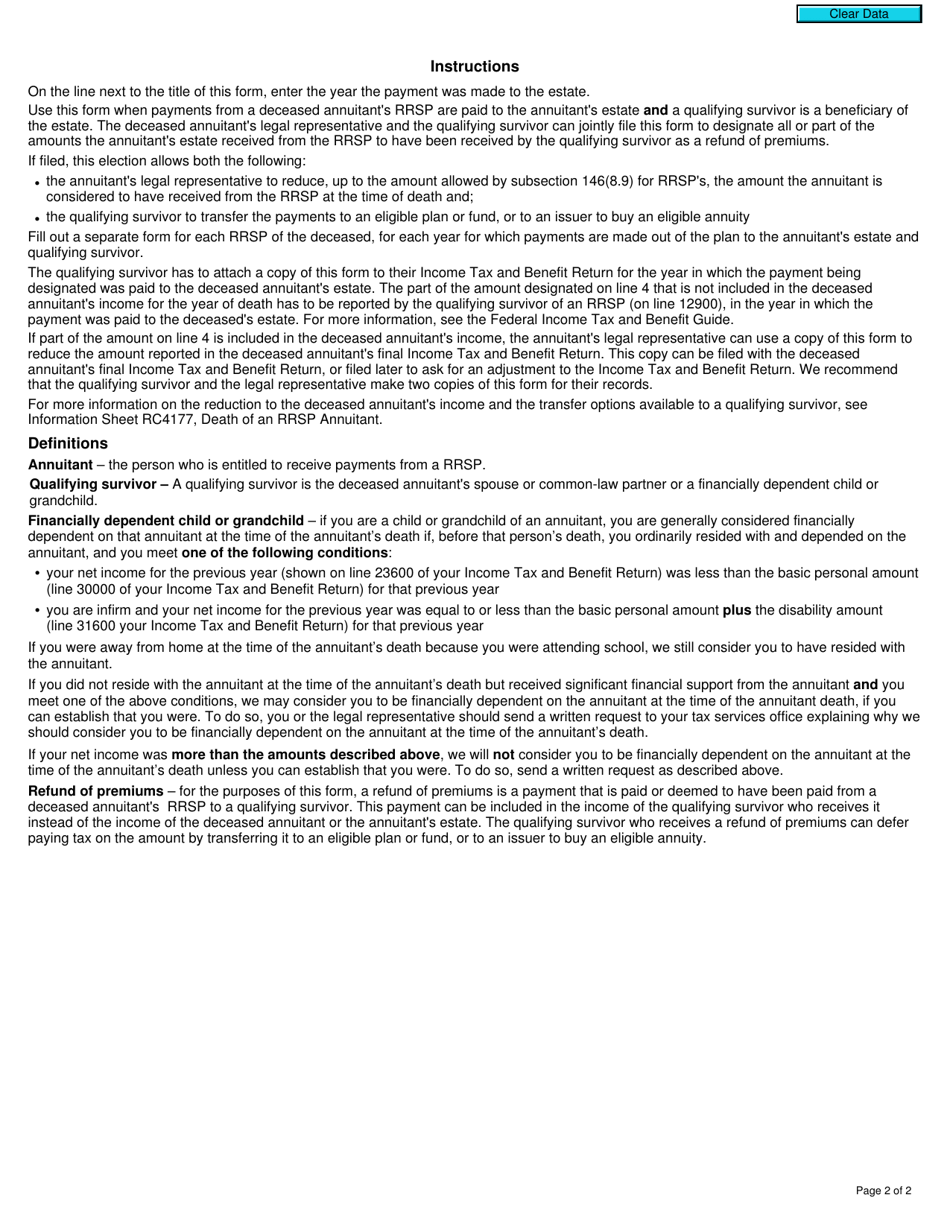

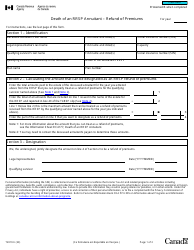

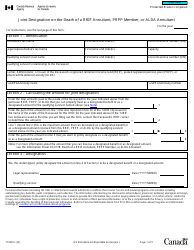

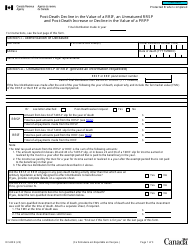

Form T2019 Death of an Rrsp Annuitant - Refund of Premiums - Canada

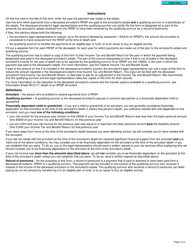

Form T2019 "Death of an RRSP Annuitant - Refund of Premiums" is used in Canada when an individual who had a Registered Retirement Savings Plan (RRSP) passes away, and the annuity contract of the RRSP is terminated due to death. This form is used to claim a refund of the premiums paid into the annuity contract.

The beneficiary or legal representative of the deceased RRSP annuitant files the Form T2019 Death of an RRSP Annuitant - Refund of Premiums in Canada.

FAQ

Q: What is Form T2019?

A: Form T2019 is a form used in Canada for claiming the refund of premiums on the death of an RRSP annuitant.

Q: What is an RRSP annuitant?

A: An RRSP annuitant is an individual who has purchased an annuity with funds from their Registered Retirement Savings Plan (RRSP).

Q: What is the purpose of Form T2019?

A: The purpose of Form T2019 is to calculate and claim the refund of premiums paid into the annuity upon the death of the RRSP annuitant.

Q: Who can use Form T2019?

A: Form T2019 can be used by the legal representative of the deceased RRSP annuitant or their estate.

Q: What information is required to complete Form T2019?

A: To complete Form T2019, you will need information such as the deceased annuitant's name, Social Insurance Number (SIN), and the amounts of premiums paid into the annuity.