This version of the form is not currently in use and is provided for reference only. Download this version of

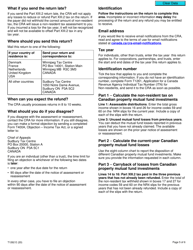

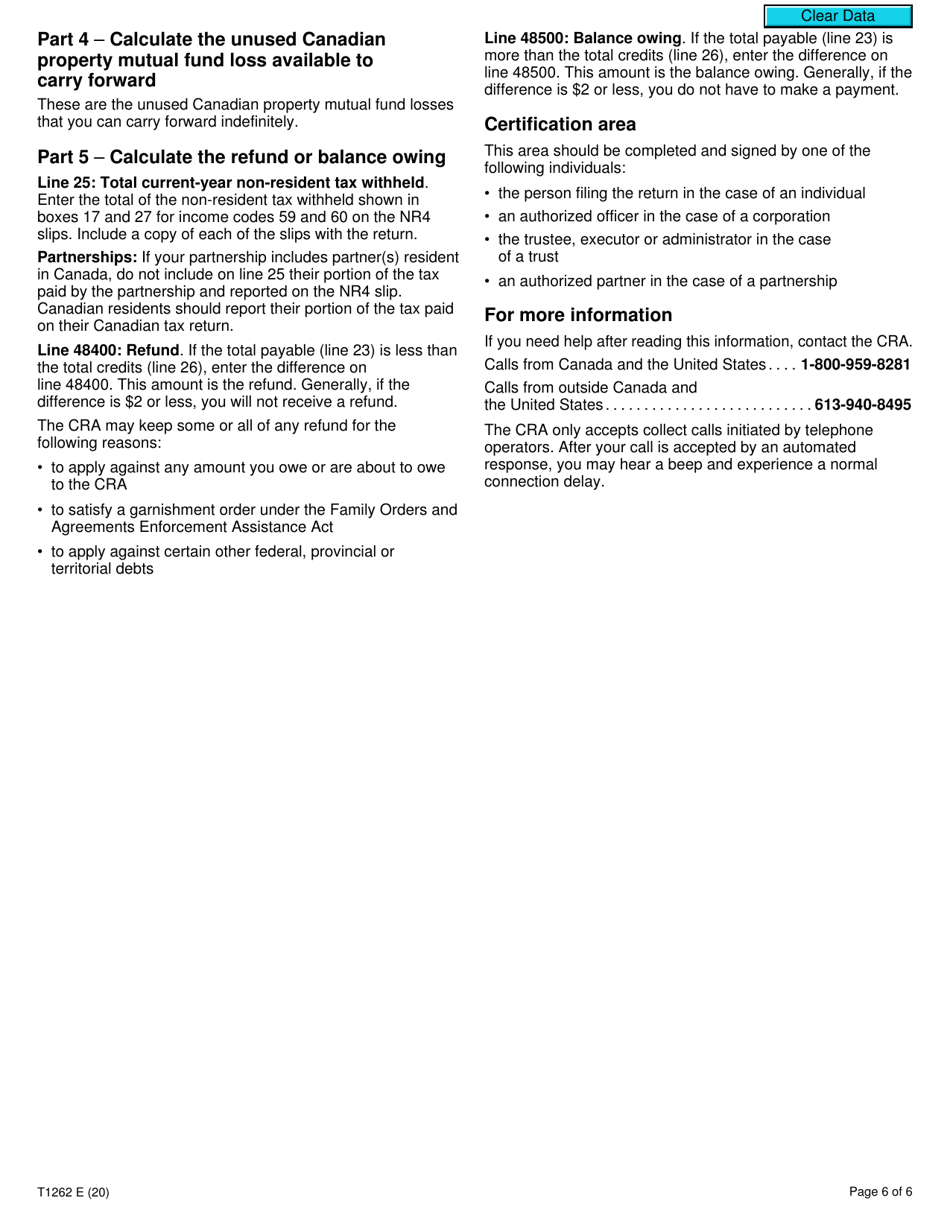

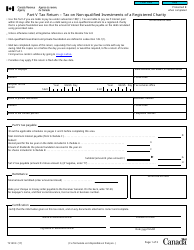

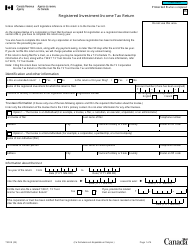

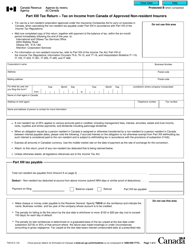

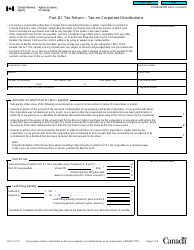

Form T1262 Part XIII.2

for the current year.

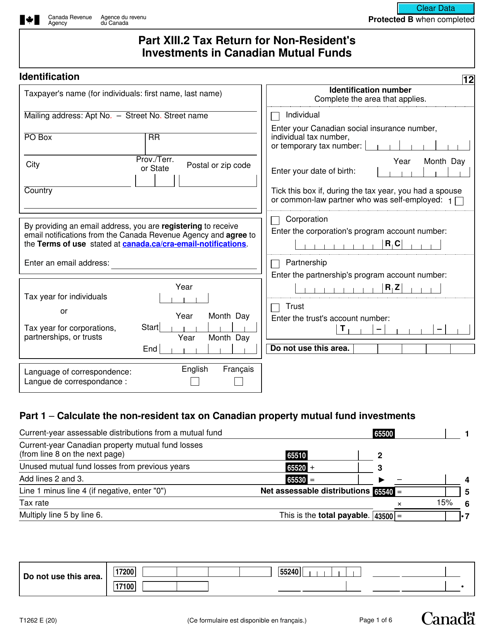

Form T1262 Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds - Canada

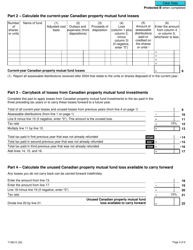

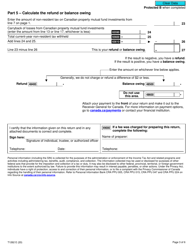

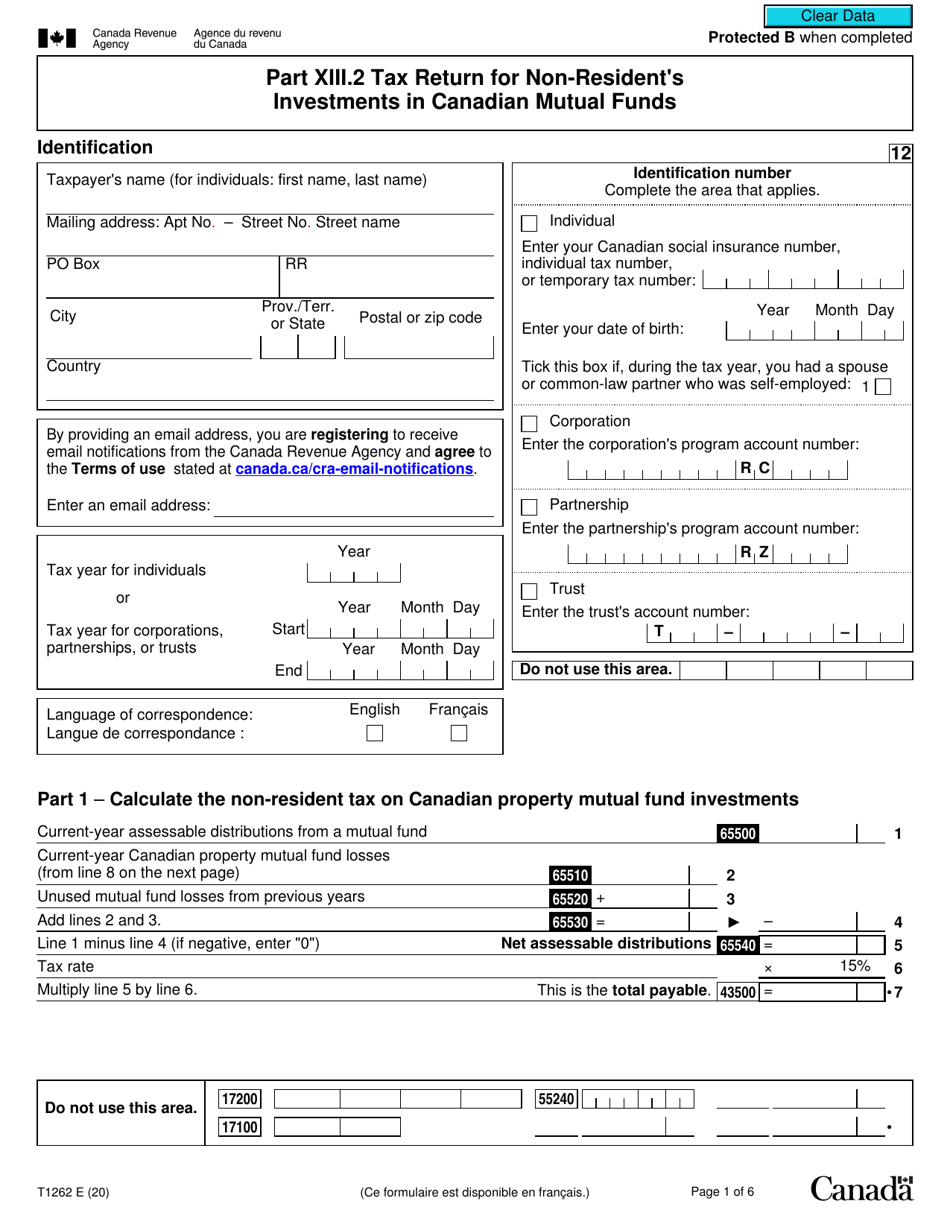

Form T1262 - Part XIII.2 Tax Return for Non-resident's Investments in Canadian Mutual Funds is used by non-residents of Canada to report their income and pay taxes on their investments in Canadian mutual funds. It ensures that non-residents accurately report their investment income and fulfill their tax obligations in Canada.

Individuals who are non-residents of Canada and have investments in Canadian mutual funds file the Form T1262 Part XIII.2 Tax Return.

FAQ

Q: What is Form T1262?

A: Form T1262 is a tax return used by non-residents to report their investments in Canadian mutual funds.

Q: Who is required to file Form T1262?

A: Non-residents who have invested in Canadian mutual funds are required to file Form T1262.

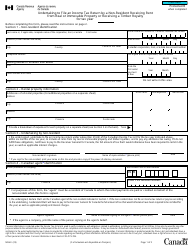

Q: What information is required on Form T1262?

A: Form T1262 requires information about the non-resident's investments in Canadian mutual funds, including income, gains, and losses.

Q: When is Form T1262 due?

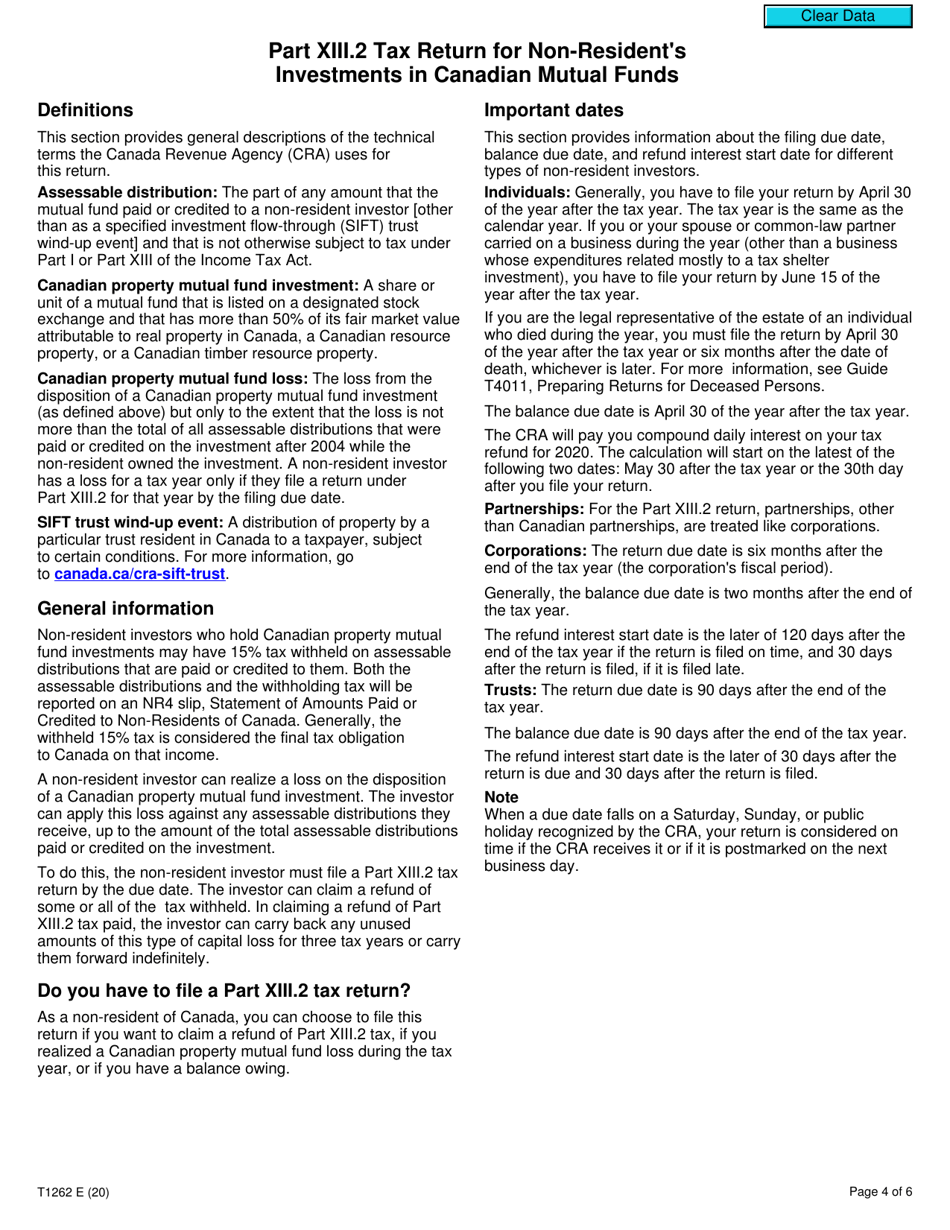

A: Form T1262 is due on or before June 30 of the year following the tax year being reported.

Q: Is there a penalty for late filing of Form T1262?

A: Yes, there may be penalties for late filing of Form T1262.

Q: Are there any exceptions to filing Form T1262?

A: There may be exceptions for certain non-residents, depending on their specific circumstances. It is best to consult with the CRA or a tax professional for guidance.