This version of the form is not currently in use and is provided for reference only. Download this version of

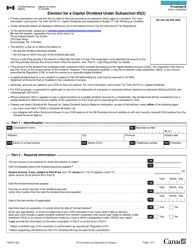

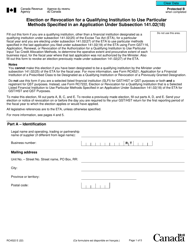

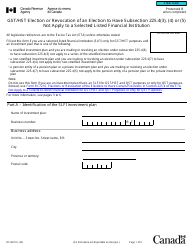

Form T1244

for the current year.

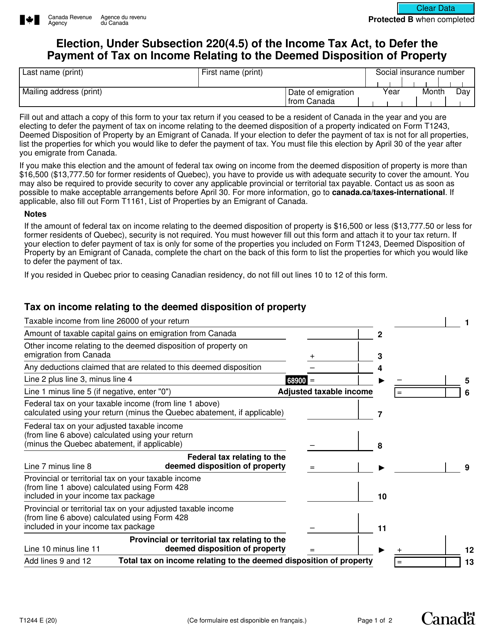

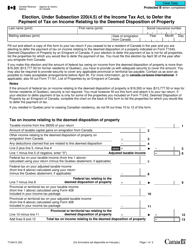

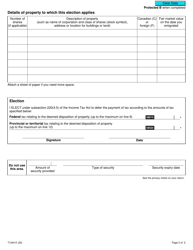

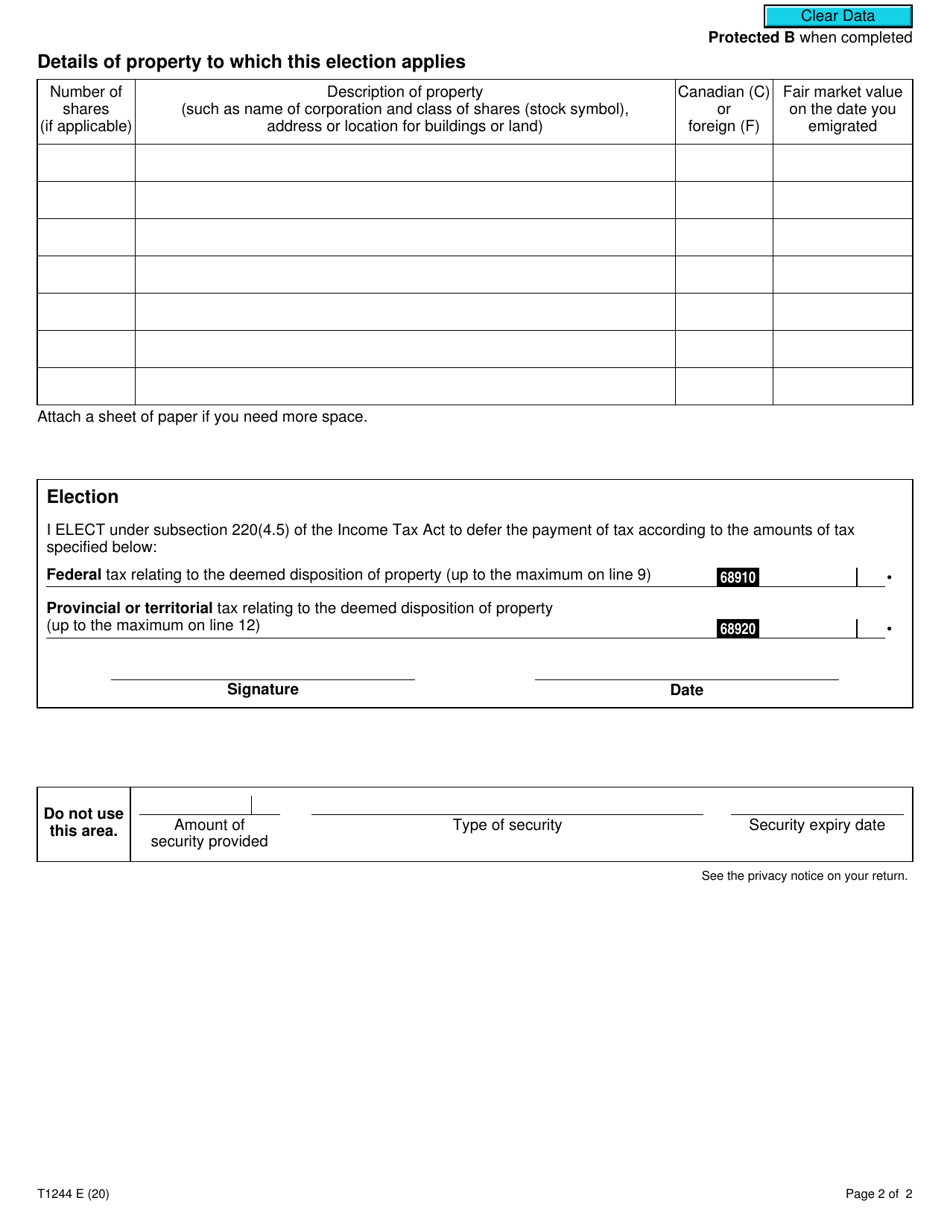

Form T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property - Canada

Form T1244 is used in Canada for electing to defer the payment of tax on income related to the deemed disposition of property. This election, as provided under Subsection 220(4.5) of the Income Tax Act, allows individuals to defer paying taxes on the capital gains they've made from the deemed disposition of certain assets. By using this form, taxpayers can delay the tax payment until a future date.

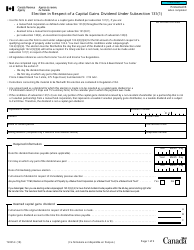

Individuals or corporations who meet the criteria specified in Subsection 220(4.5) of the Income Tax Act in Canada can file the Form T1244 election to defer the payment of tax on income relating to the deemed disposition of property.

FAQ

Q: What is Form T1244?

A: Form T1244 is an election form in Canada that allows taxpayers to defer the payment of tax on income relating to the deemed disposition of property.

Q: What is the purpose of Form T1244?

A: The purpose of Form T1244 is to provide taxpayers with the option to defer the payment of tax on income resulting from the deemed disposition of property.

Q: What is a deemed disposition of property?

A: A deemed disposition of property refers to a situation where the Income Tax Act treats a taxpayer as if they have sold or disposed of a property, even if no actual transaction took place.

Q: How does Form T1244 work?

A: Form T1244 allows taxpayers to elect to defer the payment of tax on income resulting from the deemed disposition of property by spreading the tax liability over a period of up to 10 years.

Q: Who is eligible to use Form T1244?

A: Any taxpayer in Canada who has incurred income from a deemed disposition of property can use Form T1244 to defer the payment of tax on that income.

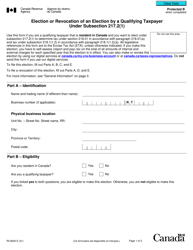

Q: Is using Form T1244 mandatory?

A: No, using Form T1244 is optional. Taxpayers can choose whether or not to use this form to defer the payment of tax on income relating to a deemed disposition of property.

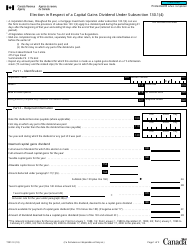

Q: Are there any limitations or conditions for using Form T1244?

A: Yes, there are certain limitations and conditions for using Form T1244, including the requirement to report the deferred income on the taxpayer's tax return for the year and the need to make any required payments of tax installments.

Q: Is there a deadline for submitting Form T1244?

A: The deadline for submitting Form T1244 is the same as the taxpayer's income tax return filing deadline for the year in which the deemed disposition of property occurred.