This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1243

for the current year.

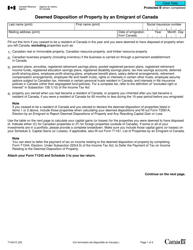

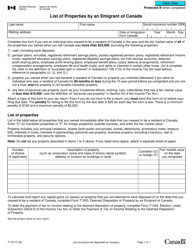

Form T1243 Deemed Disposition of Property by an Emigrant of Canada - Canada

Form T1243, also known as "Deemed Disposition of Property by an Emigrant of Canada", is used in Canada to report the deemed disposition of property for tax purposes when an individual or a trust becomes a non-resident of Canada. It is required to calculate and report any potential capital gains or losses on the property deemed to be disposed of. This form helps the Canada Revenue Agency (CRA) to ensure the correct taxation of emigrants' property.

The individual who is emigrating from Canada is responsible for filing the Form T1243, Deemed Disposition of Property by an Emigrant of Canada.

FAQ

Q: What is Form T1243?

A: Form T1243 is a form used in Canada to report the deemed disposition of property by an emigrant of Canada.

Q: Who needs to file Form T1243?

A: Anyone who is considered an emigrant of Canada and has property that is deemed to be disposed of upon emigration needs to file Form T1243.

Q: What is a deemed disposition?

A: A deemed disposition is when the Canada Revenue Agency considers a taxpayer to have disposed of their property at fair market value, even if no actual sale has taken place.

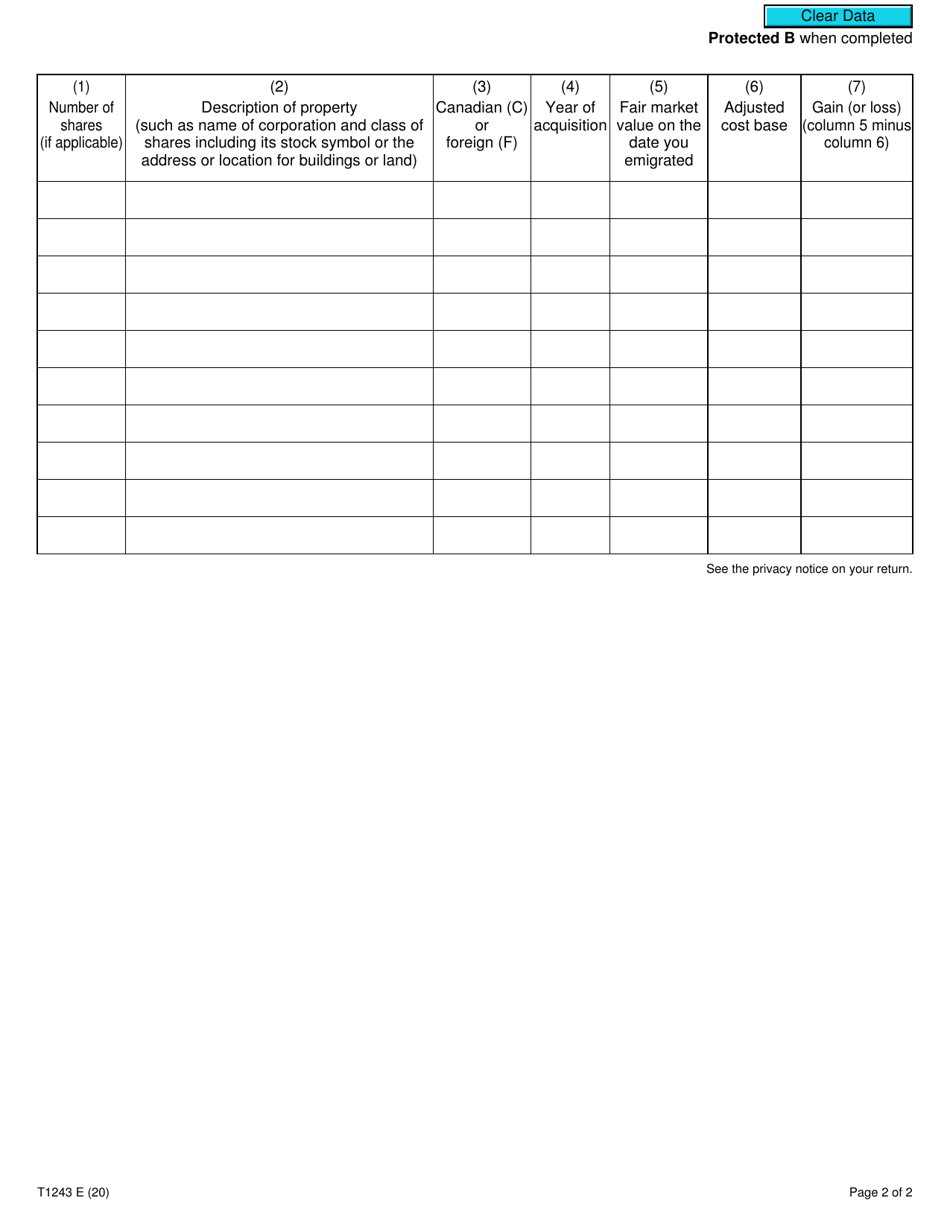

Q: What information is required on Form T1243?

A: Form T1243 requires the taxpayer to provide details about the property being deemed disposed of, such as the description, fair market value, and date of disposition.

Q: When is Form T1243 due?

A: Form T1243 is generally due on or before the filing due date for the taxpayer's final income tax return.

Q: Is there a penalty for not filing Form T1243?

A: Yes, failing to file Form T1243 when required may result in penalties and interest charges.