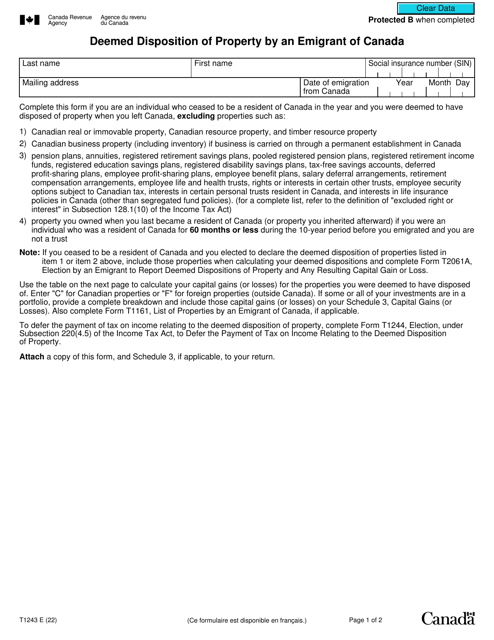

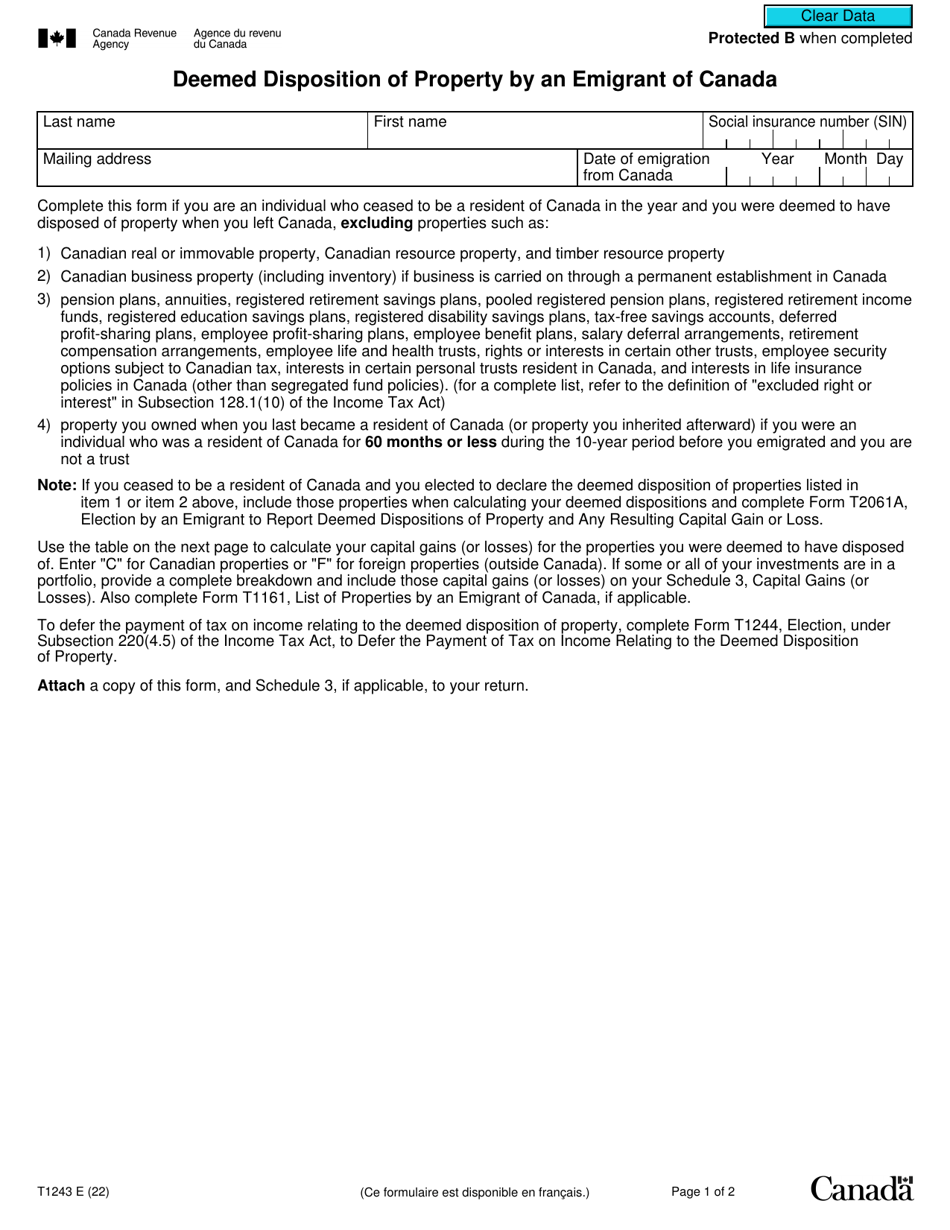

Form T1243 Deemed Disposition of Property by an Emigrant of Canada - Canada

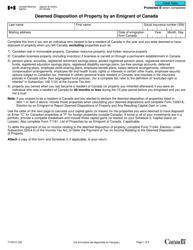

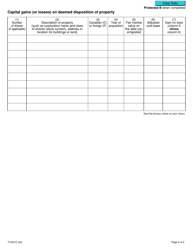

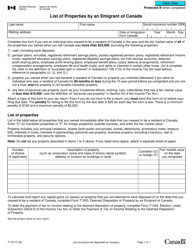

Form T1243 is used in Canada when a Canadian taxpayer emigrates from Canada. It reports the deemed disposition of certain property for tax purposes. In simpler terms, it helps calculate any potential tax liabilities on property that is considered sold when emigrating from Canada.

The individual who is deemed to have disposed of property when emigrating from Canada will file the Form T1243.

Form T1243 Deemed Disposition of Property by an Emigrant of Canada - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1243?

A: Form T1243 is a tax form used in Canada for reporting the deemed disposition of property by an emigrant of Canada.

Q: Who needs to file Form T1243?

A: Form T1243 needs to be filed by individuals who are emigrating from Canada and have property that is deemed to be disposed of at fair market value.

Q: Why do I need to file Form T1243?

A: You need to file Form T1243 to report any deemed disposition of property when you emigrate from Canada. This allows for proper tax treatment of the disposed property.

Q: What is a deemed disposition of property?

A: A deemed disposition of property is a concept in Canadian tax law where it is assumed that certain property has been sold at fair market value, even if no actual sale has taken place.

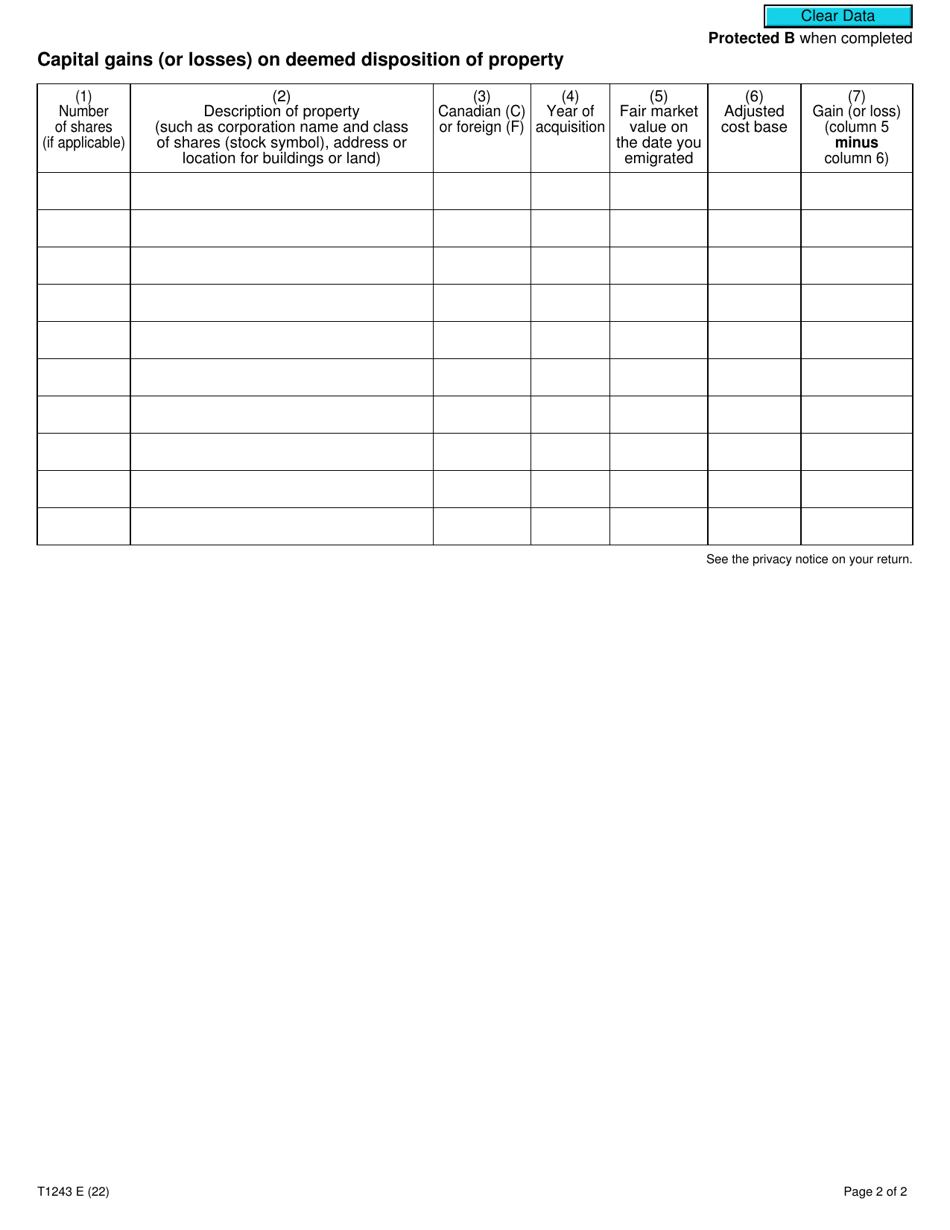

Q: What information is required on Form T1243?

A: Form T1243 requires information about the emigrant, the property being deemed disposed of, and the fair market value of the property at the time of emigration.

Q: Is there a deadline for filing Form T1243?

A: Yes, Form T1243 must be filed within 10 years of the emigration date.