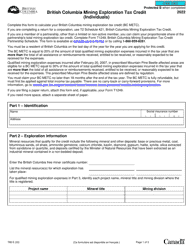

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1231

for the current year.

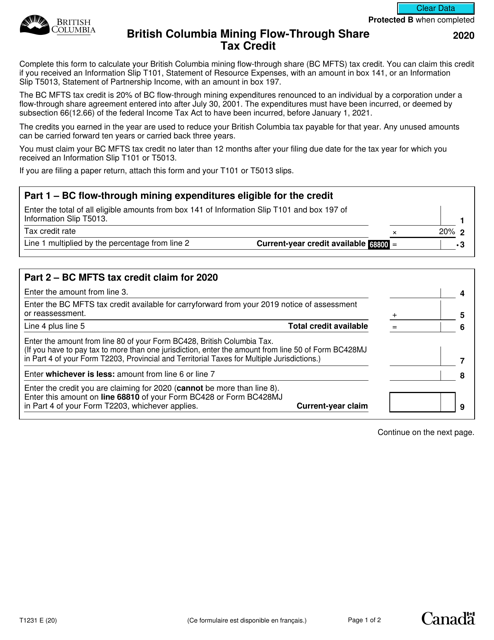

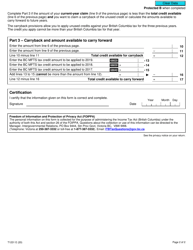

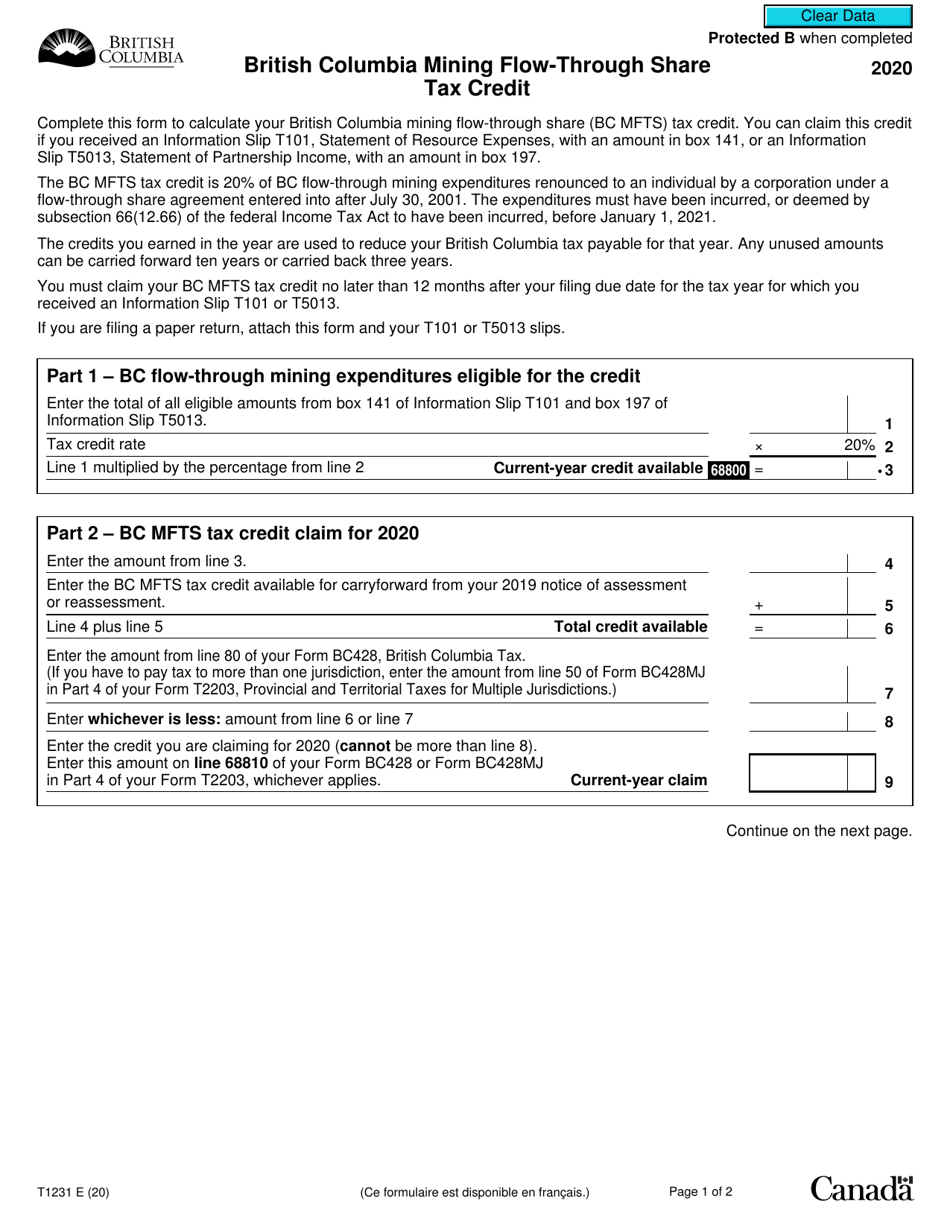

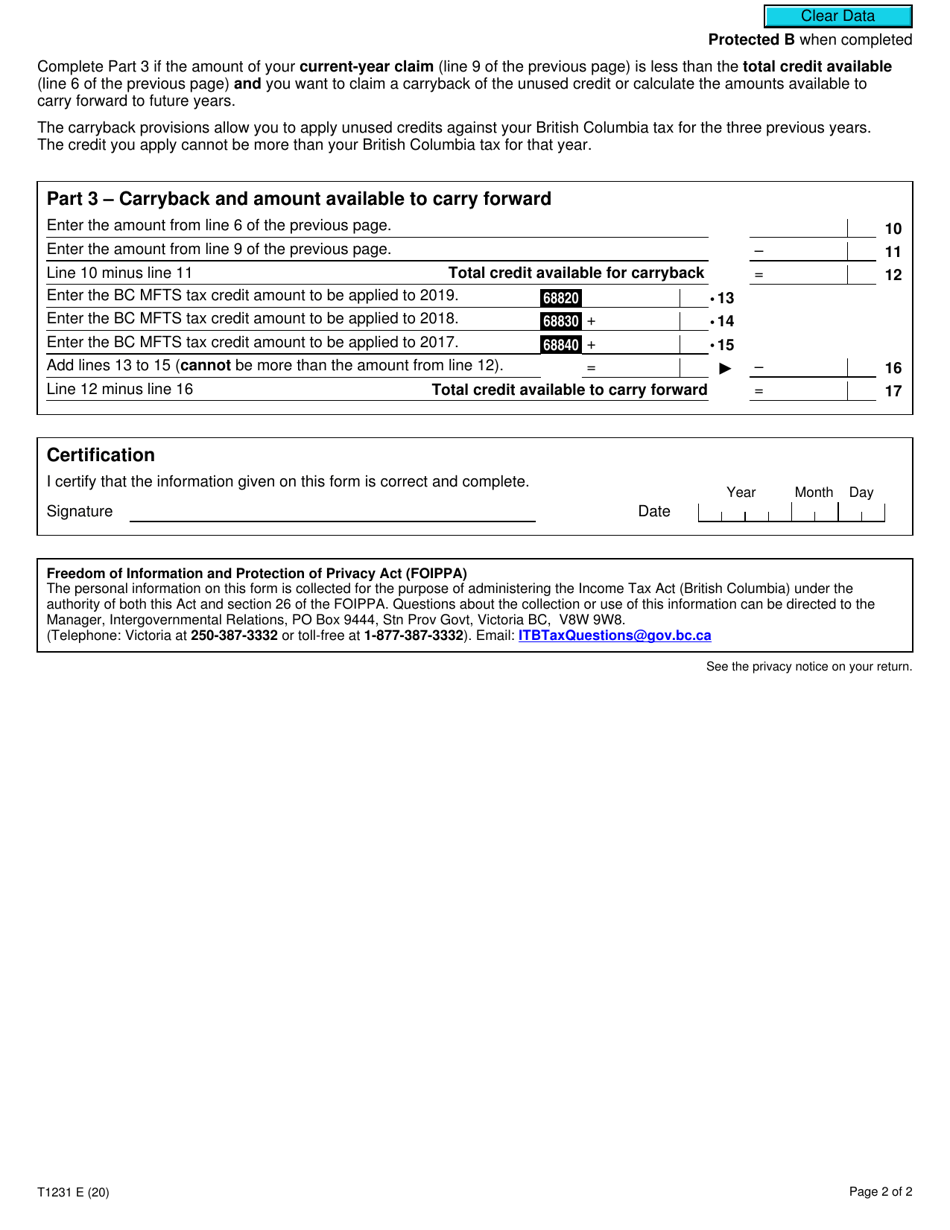

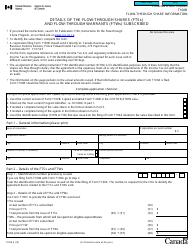

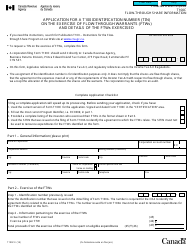

Form T1231 British Columbia Mining Flow-Through Share Tax Credit - Canada

Form T1231 is used for claiming the British Columbia Mining Flow-Through Share Tax Credit in Canada. This tax credit is aimed at supporting the mining industry in British Columbia, by providing incentives to individuals and corporations who invest in eligible flow-through shares of mining companies operating in the province.

The Form T1231 British Columbia Mining Flow-Through Share Tax Credit is filed by individuals or corporations who are eligible for this tax credit in Canada.

FAQ

Q: What is Form T1231?

A: Form T1231 is a form used in Canada to claim the British Columbia Mining Flow-Through Share Tax Credit.

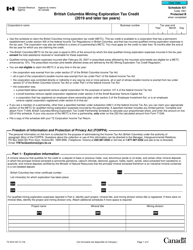

Q: What is the British Columbia Mining Flow-Through Share Tax Credit?

A: The British Columbia Mining Flow-Through Share Tax Credit is a tax credit provided by the government of British Columbia in Canada to encourage investment in mining exploration.

Q: Who can claim the British Columbia Mining Flow-Through Share Tax Credit?

A: Investors who have purchased flow-through shares of eligible mining exploration companies in British Columbia can claim this tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 20% of the flow-through mining expenditures incurred by the exploration company.

Q: What are flow-through shares?

A: Flow-through shares are shares issued by a mining company that allow the investor to deduct certain mining expenditures on their tax return.

Q: How do I claim the British Columbia Mining Flow-Through Share Tax Credit?

A: To claim the tax credit, you need to complete Form T1231 and include it with your annual income tax return. You should also attach the corresponding flow-through share slip provided by the mining company.

Q: Is the tax credit refundable?

A: No, the British Columbia Mining Flow-Through Share Tax Credit is non-refundable, meaning it can only be used to reduce your tax payable for the year.

Q: Are there any limitations or restrictions on claiming this tax credit?

A: Yes, there are certain limitations and restrictions. You cannot claim this tax credit if you are a corporation, if you acquired the flow-through shares as a gift, or if you have already claimed the federal investment tax credit for the same expenditures.

Q: Is this tax credit available only in British Columbia?

A: Yes, the British Columbia Mining Flow-Through Share Tax Credit is specific to the province of British Columbia in Canada.