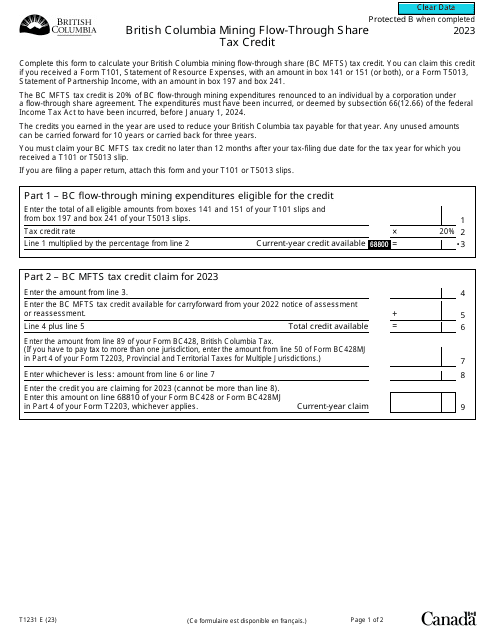

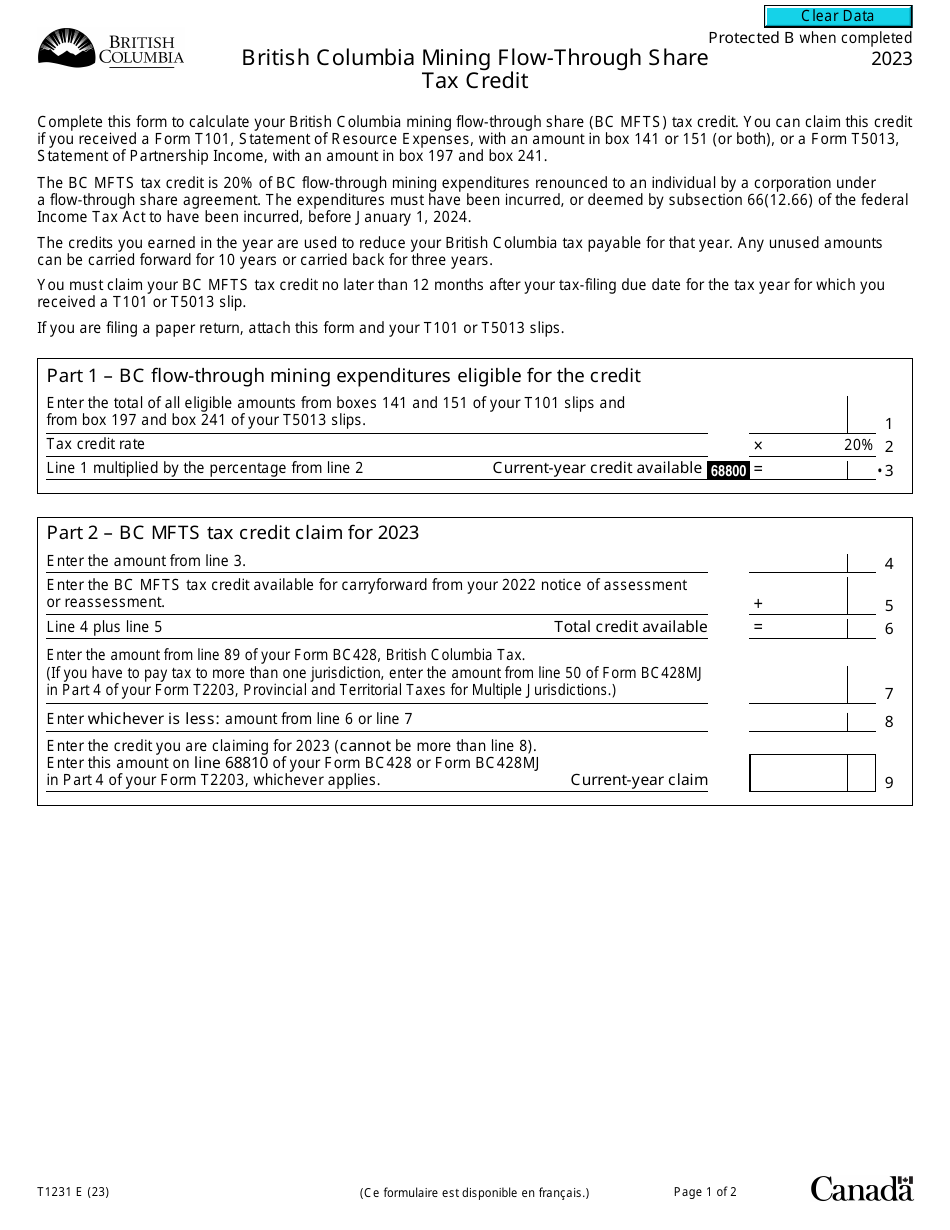

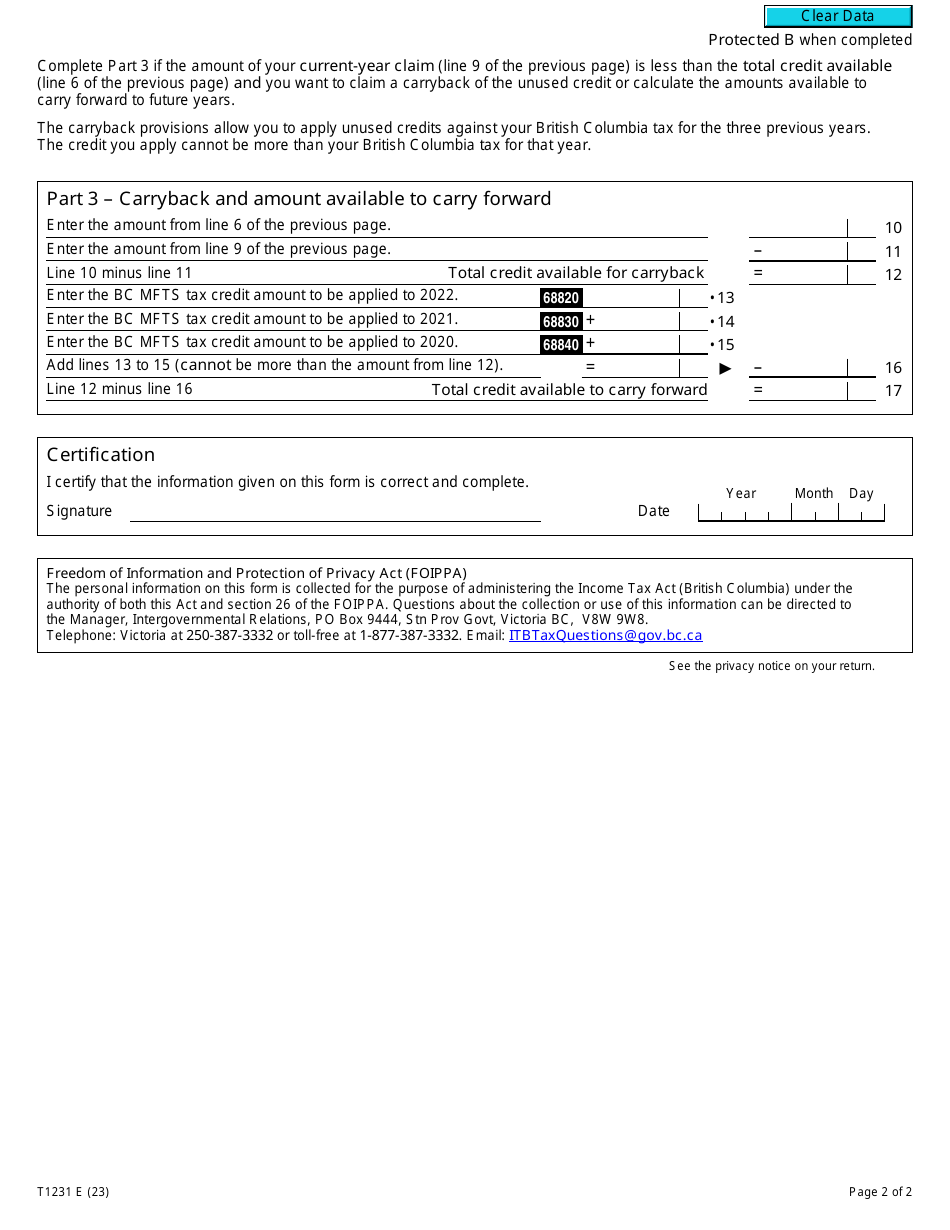

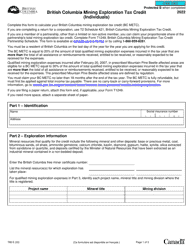

Form T1231 British Columbia Mining Flow-Through Share Tax Credit - Canada

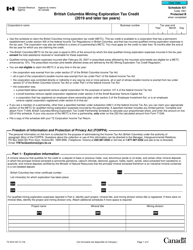

Form T1231 is a tax form used in Canada, specifically in British Columbia, for claiming the mining flow-through share tax credit. This tax credit is available to individuals and corporations who invest in eligible flow-through mining expenses and incur exploration and development costs in British Columbia. It helps to incentivize investments in the mining industry and support mining projects in the province.

The Form T1231 for the British Columbia Mining Flow-Through Share Tax Credit in Canada is filed by individual taxpayers who are eligible for this tax credit.

Form T1231 British Columbia Mining Flow-Through Share Tax Credit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1231?

A: Form T1231 is a tax form used in Canada.

Q: What is the British Columbia Mining Flow-Through Share Tax Credit?

A: The British Columbia Mining Flow-Through Share Tax Credit is a tax credit available in British Columbia, Canada.

Q: Who is eligible for the British Columbia Mining Flow-Through Share Tax Credit?

A: Individuals who have invested in flow-through shares of mining companies in British Columbia may be eligible for this tax credit.

Q: What is the purpose of Form T1231?

A: Form T1231 is used to claim the British Columbia Mining Flow-Through Share Tax Credit.

Q: How do I claim the British Columbia Mining Flow-Through Share Tax Credit?

A: To claim the tax credit, you must complete and file Form T1231 with your annual tax return.

Q: Is the British Columbia Mining Flow-Through Share Tax Credit available in all provinces of Canada?

A: No, this tax credit is specific to British Columbia.

Q: Are there any deadlines for claiming the British Columbia Mining Flow-Through Share Tax Credit?

A: Yes, you must file your tax return and claim the tax credit by the deadline specified by the CRA.