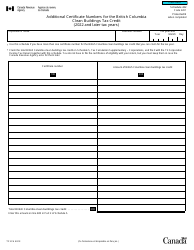

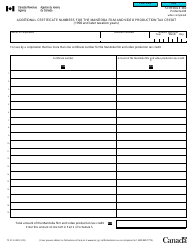

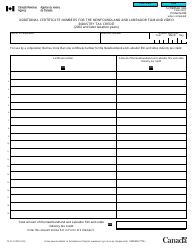

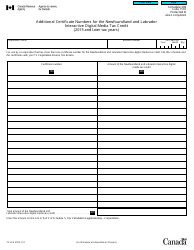

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1172

for the current year.

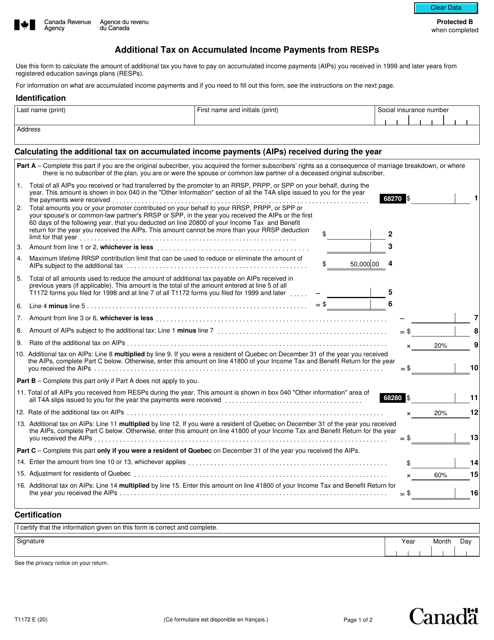

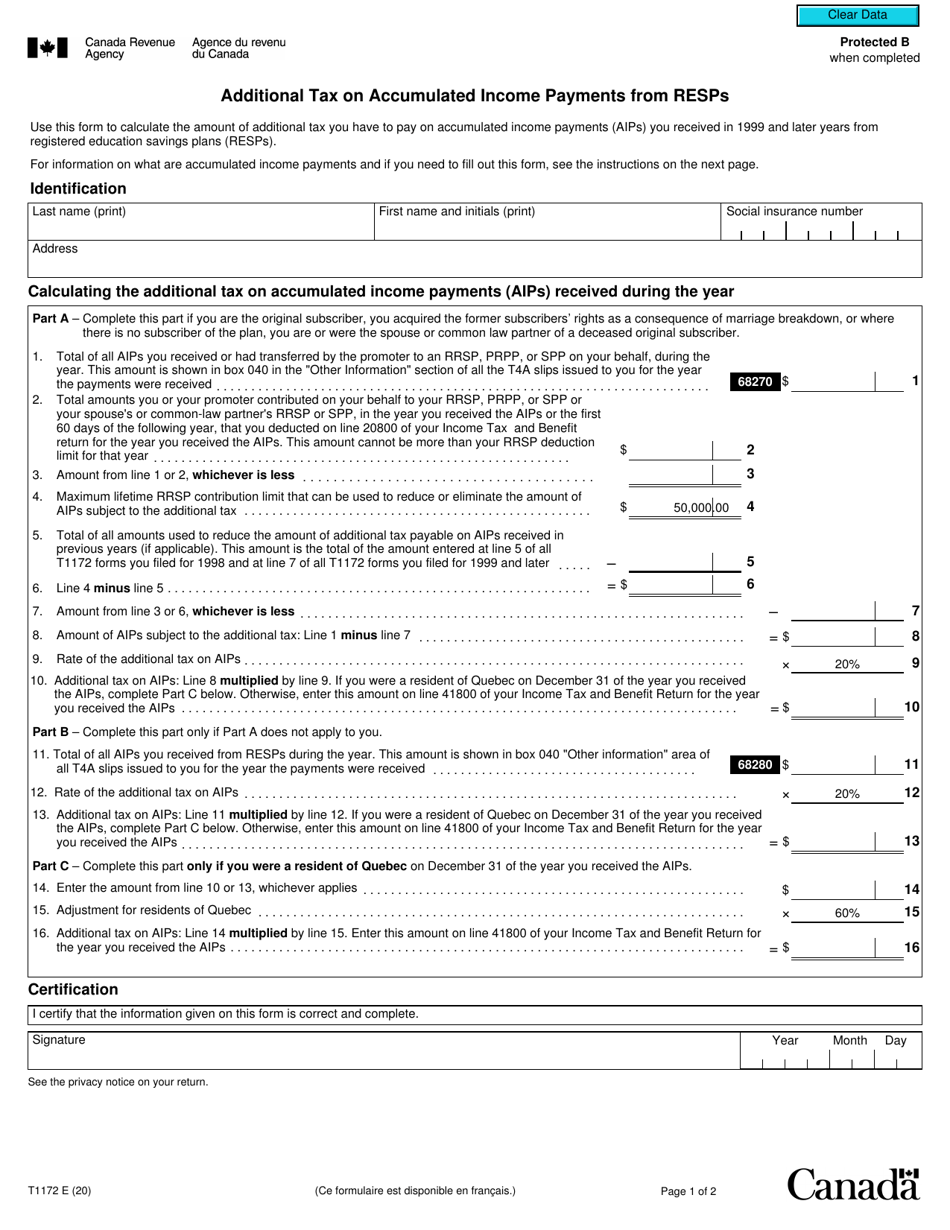

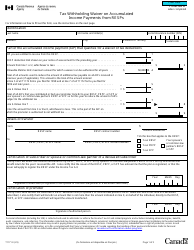

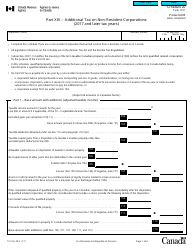

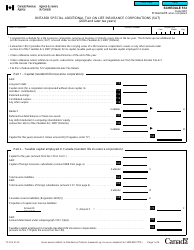

Form T1172 Additional Tax on Accumulated Income Payments From Resps - Canada

Form T1172 is used in Canada to calculate and report any additional tax owing on accumulated income payments from Registered Education Savings Plans (RESPs). It is used when the RESP payments exceed the lifetime limit of $50,000.

The subscriber or successor annuitant of the RESP files the Form T1172 Additional Tax on Accumulated Income Payments From RESPs in Canada.

FAQ

Q: What is Form T1172?

A: Form T1172 is a tax form used in Canada to report and calculate the additional tax on accumulated income payments from Registered Education Savings Plans (RESPs).

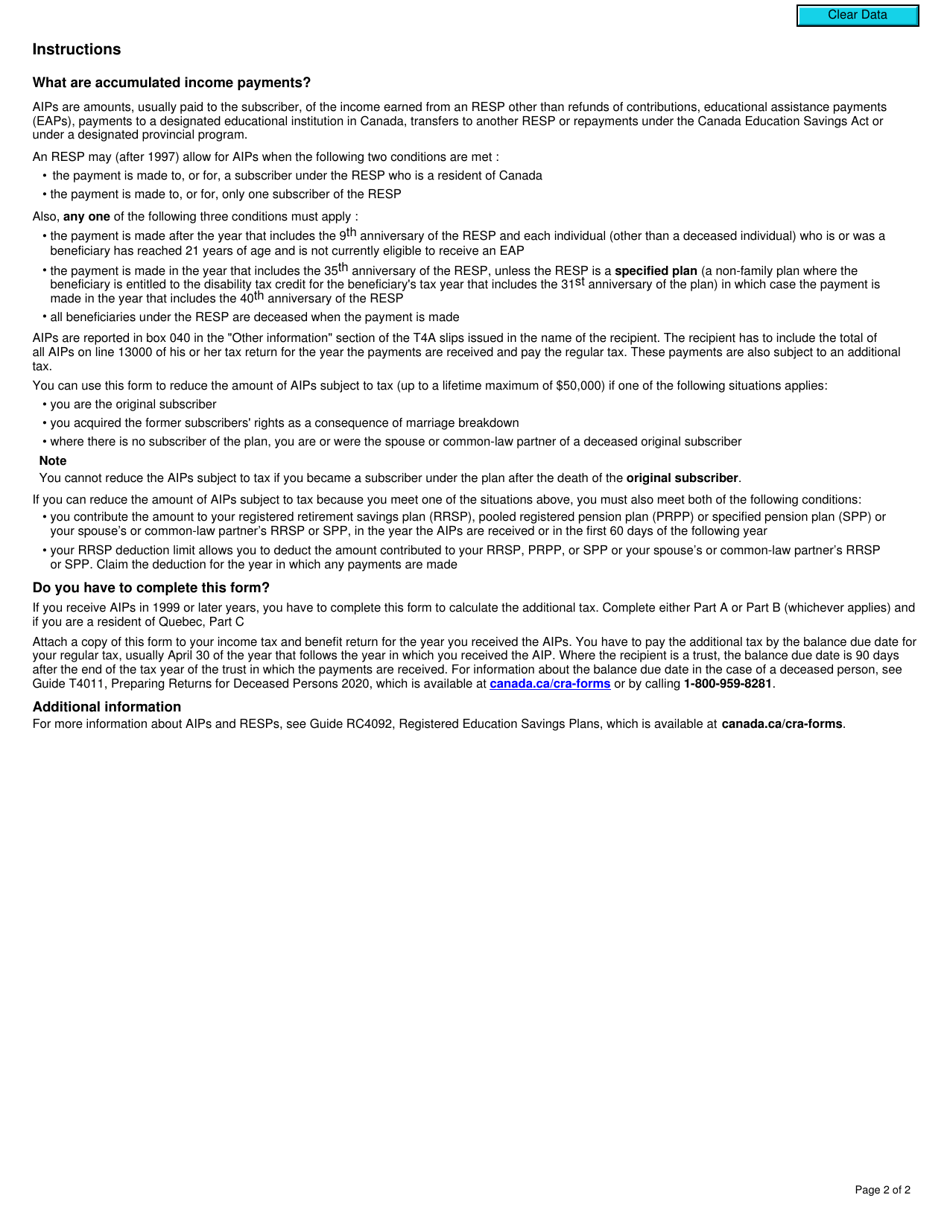

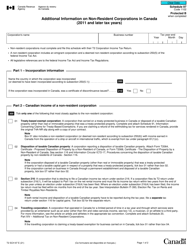

Q: What are accumulated income payments from RESPs?

A: Accumulated income payments are the investment earnings generated within an RESP.

Q: Why is there an additional tax on accumulated income payments?

A: The additional tax is imposed to discourage excessive RESP contributions and to ensure that the RESP is used primarily for education expenses.

Q: Who is responsible for filing Form T1172?

A: The subscriber or the annuitant of the RESP is responsible for filing Form T1172.

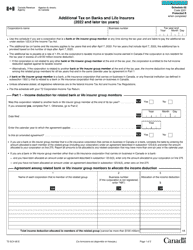

Q: How is the additional tax on accumulated income payments calculated?

A: The additional tax is calculated based on the amount of accumulated income payments received and the appropriate tax rate.

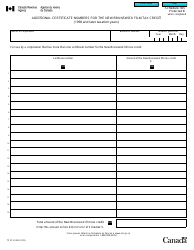

Q: When is Form T1172 due?

A: Form T1172 is generally due on or before the RESP maturity date or the year after the RESP is terminated.