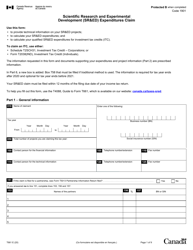

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1129

for the current year.

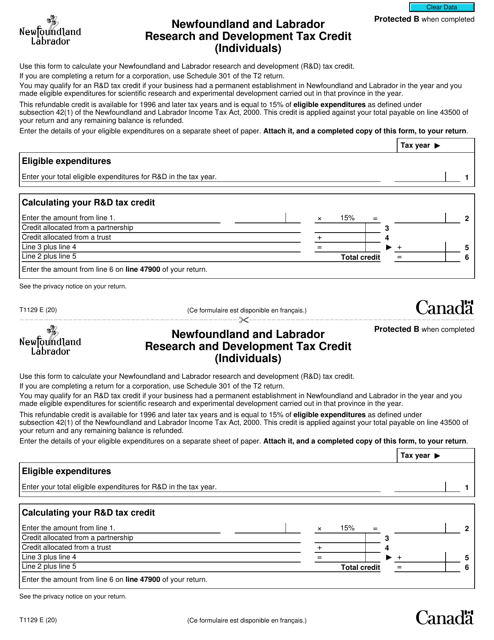

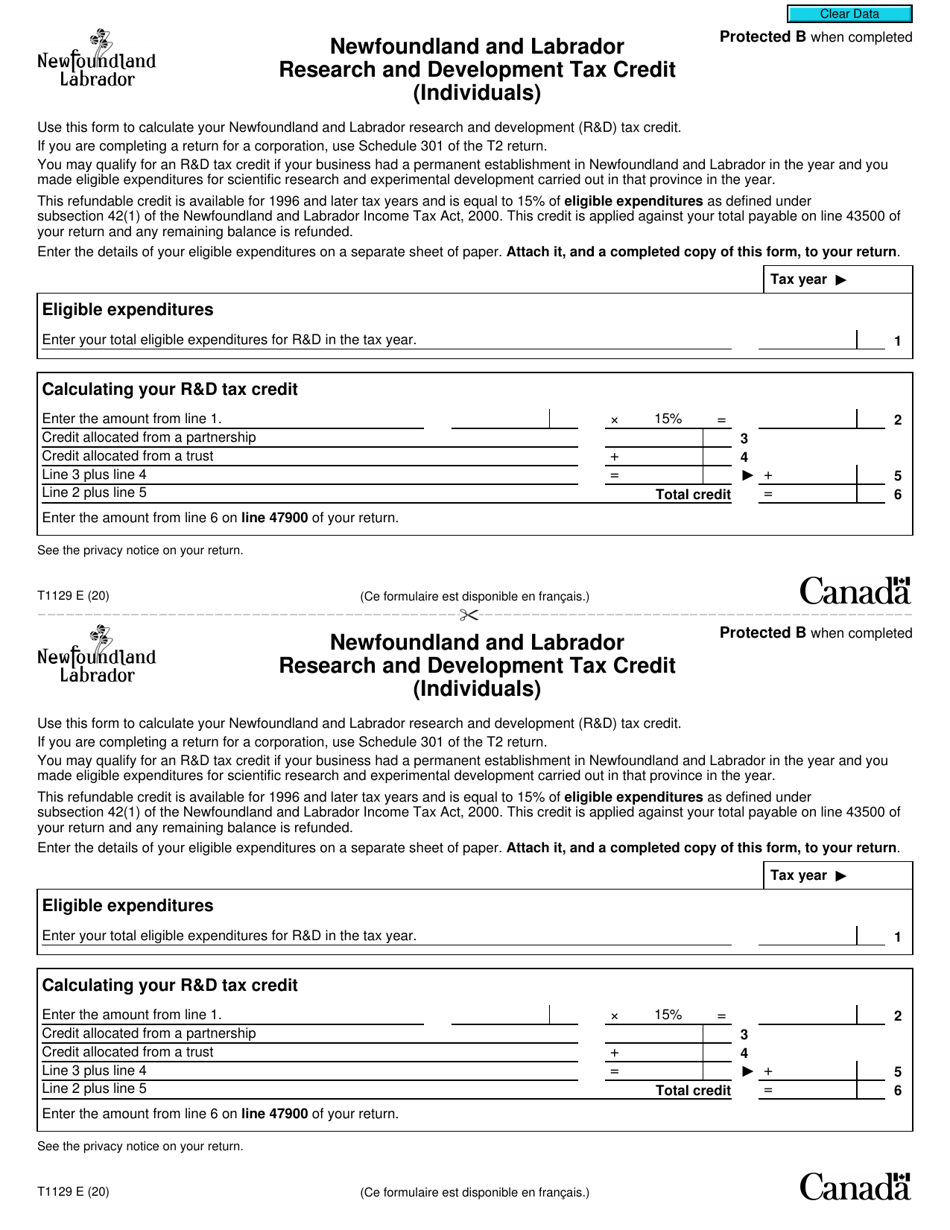

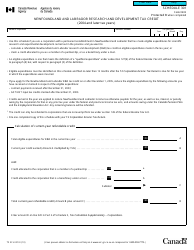

Form T1129 Newfoundland and Labrador Research and Development Tax Credit (Individuals) - Canada

Form T1129 is used to claim the Newfoundland and Labrador Research and Development Tax Credit for individuals. This credit is designed to encourage individuals who undertake qualifying research and development activities in Newfoundland and Labrador. It allows eligible individuals to claim a refundable tax credit for eligible expenditures incurred in carrying out these activities.

The Form T1129 is a tax credit form specific to the province of Newfoundland and Labrador in Canada. Individuals who are eligible for the Research and Development Tax Credit in Newfoundland and Labrador would file this form.

FAQ

Q: What is Form T1129?

A: Form T1129 is the Newfoundland and Labrador Research and Development Tax Credit (Individuals) form in Canada.

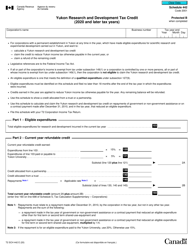

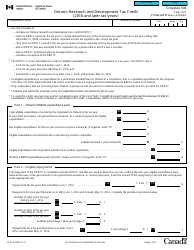

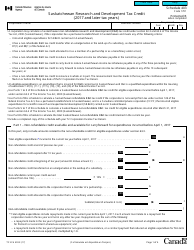

Q: Who is eligible for the Newfoundland and Labrador Research and Development Tax Credit?

A: Individuals who have conducted eligible research and development activities in Newfoundland and Labrador may be eligible for this tax credit.

Q: What is the purpose of the Research and Development Tax Credit?

A: The purpose of this tax credit is to incentivize individuals to engage in research and development activities in Newfoundland and Labrador.

Q: How do I apply for the Research and Development Tax Credit?

A: To apply for this tax credit, you must complete Form T1129 and submit it with your personal income tax return.

Q: What expenses are eligible for the Research and Development Tax Credit?

A: Eligible expenses include salaries and wages, materials and supplies, and overhead costs directly related to qualifying research and development activities.

Q: Is there a deadline to submit Form T1129?

A: Yes, Form T1129 must be filed by the same deadline as your personal income tax return, which is generally April 30th of the following year.

Q: Is the Newfoundland and Labrador Research and Development Tax Credit refundable?

A: No, this tax credit is non-refundable. It can only be used to offset taxes owed.

Q: Can I claim the Research and Development Tax Credit for work done outside of Newfoundland and Labrador?

A: No, this tax credit is only available for eligible research and development activities conducted in Newfoundland and Labrador.

Q: Are there any restrictions on the amount of the Research and Development Tax Credit I can claim?

A: Yes, there are limits and calculations involved in determining the amount of this tax credit. It is recommended to consult the official guidelines or a tax professional for accurate information.