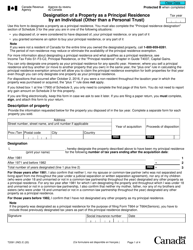

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1079-WS

for the current year.

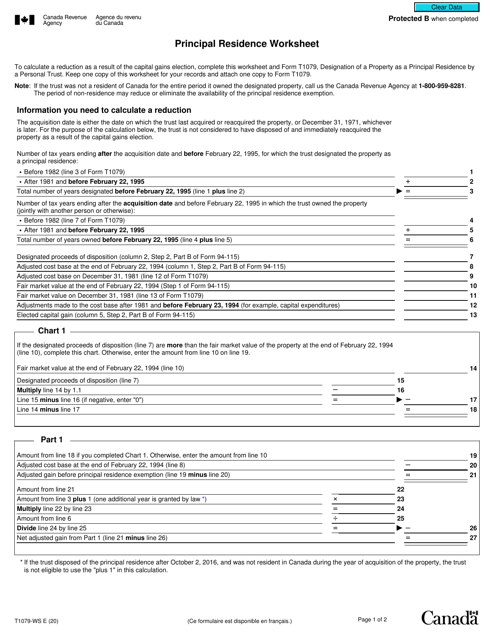

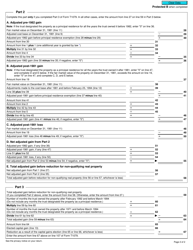

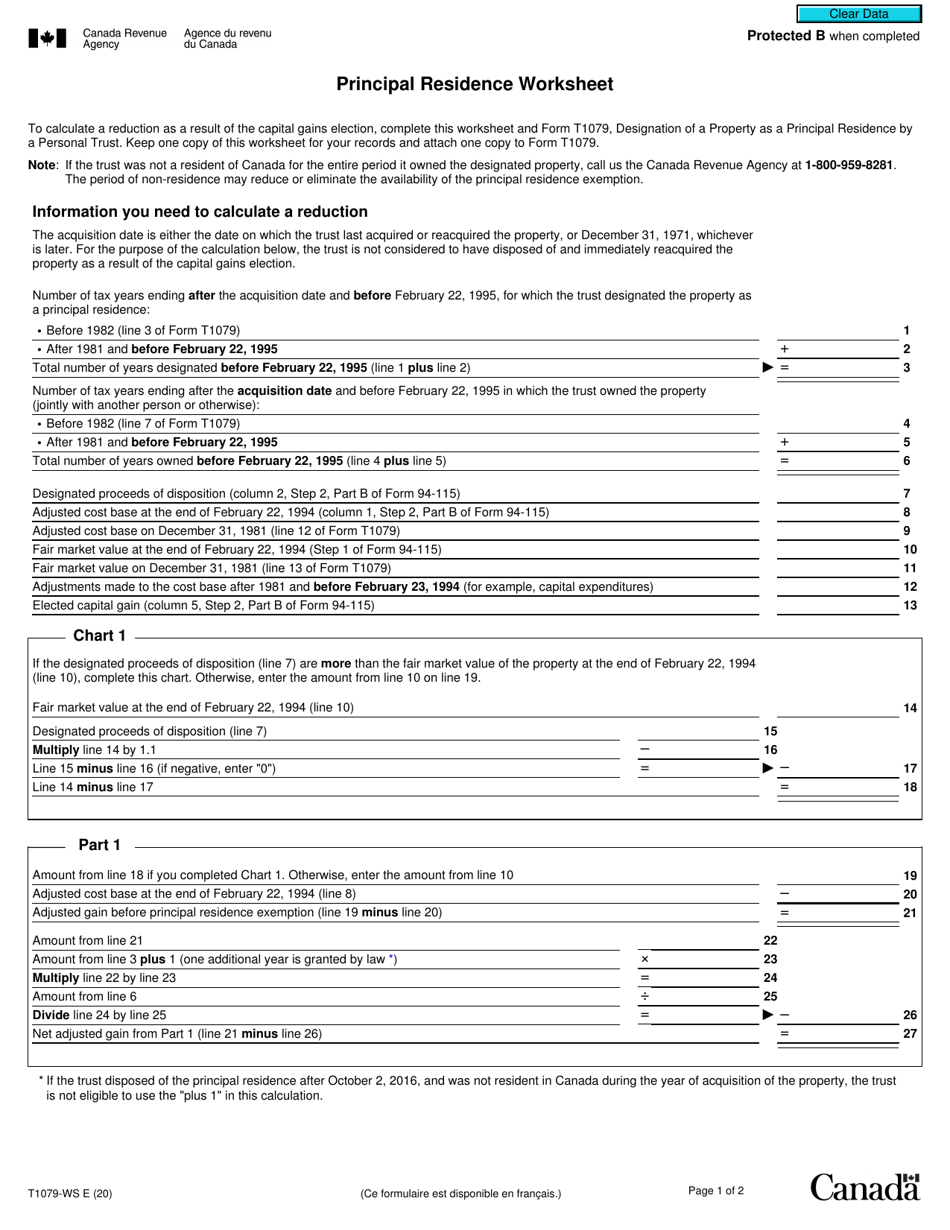

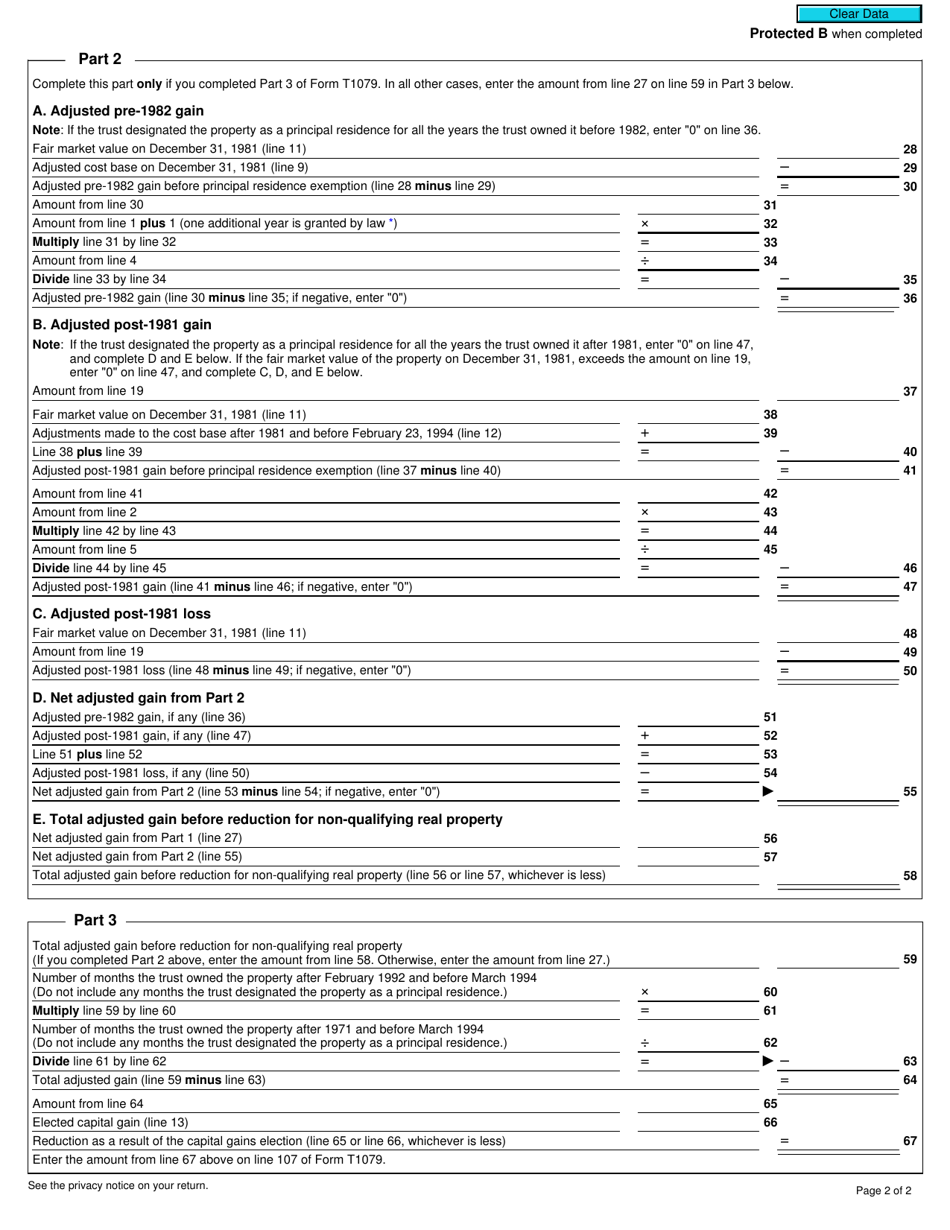

Form T1079-WS Principal Residence Worksheet - Canada

The Form T1079-WS Principal Residence Worksheet in Canada is used to calculate the capital gains tax when selling a property that was designated as your principal residence.

FAQ

Q: What is the Form T1079-WS?

A: Form T1079-WS is the Principal Residence Worksheet in Canada.

Q: What is a principal residence?

A: A principal residence is usually the home that you live in most of the time.

Q: Why do I need to fill out the Principal Residence Worksheet?

A: You need to fill out the Principal Residence Worksheet to claim the principal residence exemption on your taxes.

Q: What is the principal residence exemption?

A: The principal residence exemption allows you to avoid paying taxes on the capital gains from the sale of your principal residence.

Q: How do I fill out the Principal Residence Worksheet?

A: You need to provide information about the property, such as the address, acquisition date, and sale date, as well as calculate the capital gain.

Q: Do I need to include the Principal Residence Worksheet with my tax return?

A: No, you do not need to include the Principal Residence Worksheet with your tax return, but you should keep it for your records in case the Canada Revenue Agency requests it.