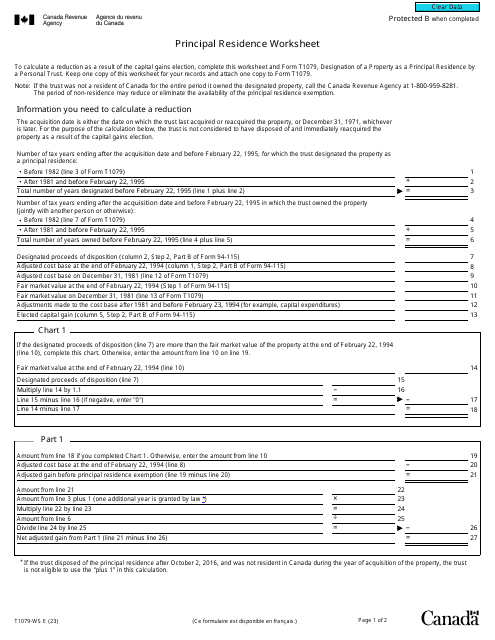

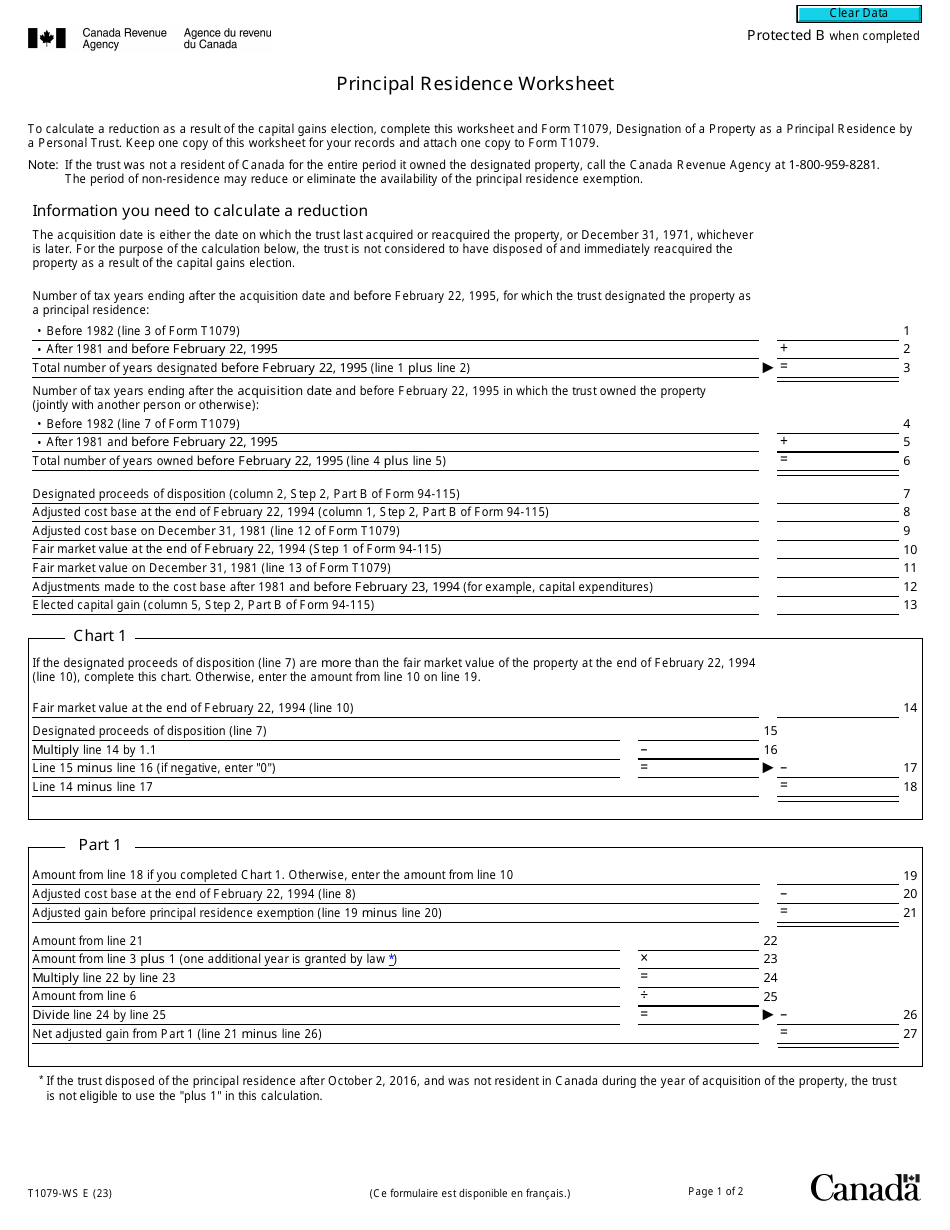

Form T1079-WS Principal Residence Worksheet - Canada

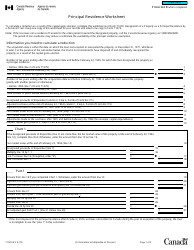

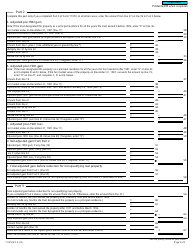

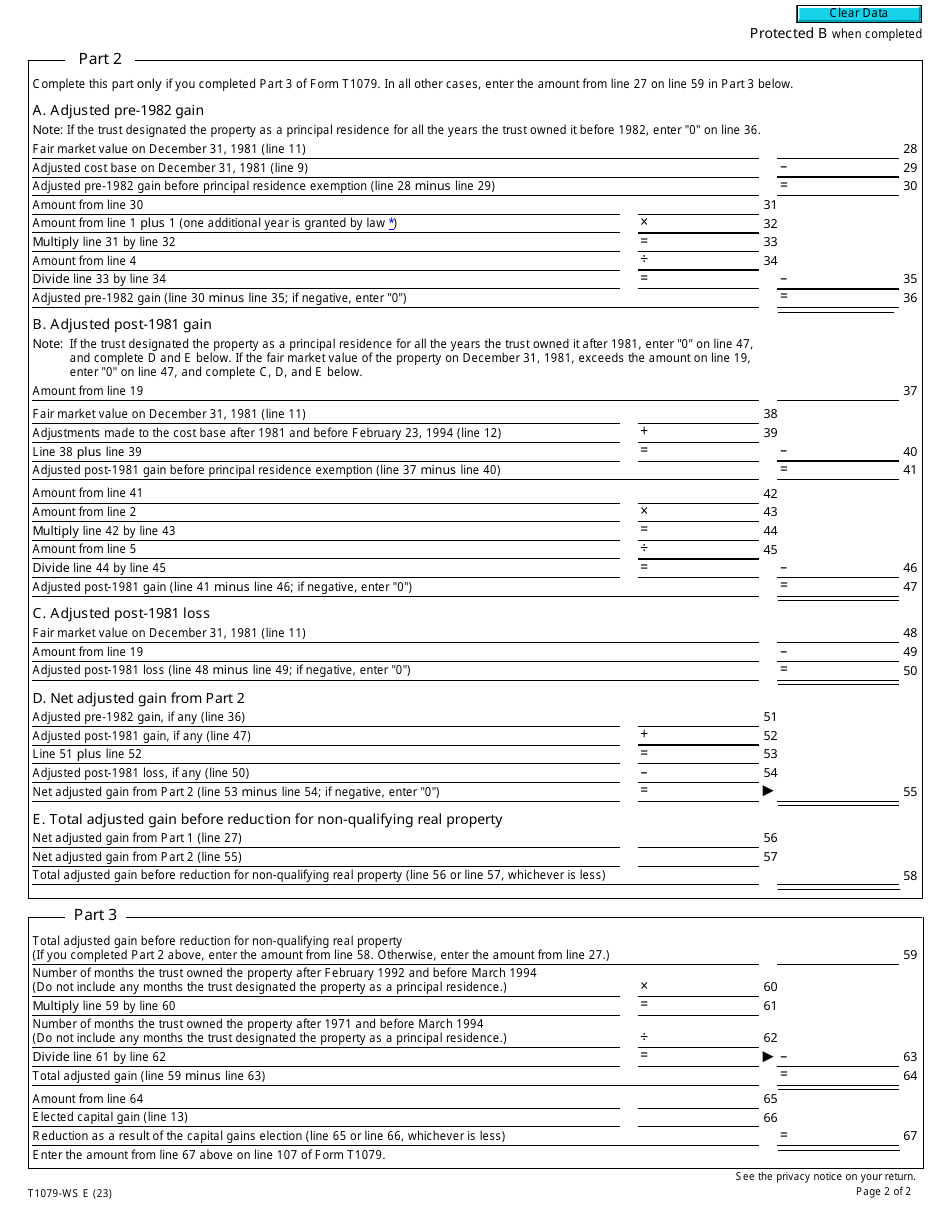

Form T1079-WS, the Principal Residence Worksheet, is used in Canada for calculating the capital gains or losses related to the sale of a principal residence. It helps individuals determine if they are eligible for the principal residence exemption, which can reduce or eliminate the amount of tax owed on the sale of their home. The worksheet requires details about the property, including the dates of acquisition and disposition, as well as any related costs. By completing this form, individuals can ensure they are accurately reporting their principal residence transactions to the Canada Revenue Agency.

The Form T1079-WS Principal Residence Worksheet in Canada is filed by individuals who need to calculate the principal residence exemption for tax purposes.

Form T1079-WS Principal Residence Worksheet - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1079-WS? A: Form T1079-WS is the Principal Residence Worksheet used in Canada to calculate the capital gains exemption on the sale of a principal residence.

Q: Who needs to complete Form T1079-WS? A: Individuals in Canada who are selling their principal residence may need to complete Form T1079-WS in order to determine if they are eligible for the capital gains exemption.

Q: What information is required on Form T1079-WS? A: Form T1079-WS requires information about the property, such as the address, acquisition date, and sale proceeds. It also asks for details about any changes in the use of the property.

Q: How do I determine if I am eligible for the capital gains exemption? A: To determine if you are eligible for the capital gains exemption, you need to calculate the principal residence portion of the gain using Form T1079-WS. If the gain is eligible for the exemption, it can be excluded from your taxable income.

Q: When do I need to submit Form T1079-WS? A: Form T1079-WS should be completed and submitted along with your income tax return for the year in which you sold your principal residence.