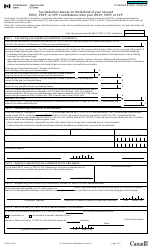

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1006

for the current year.

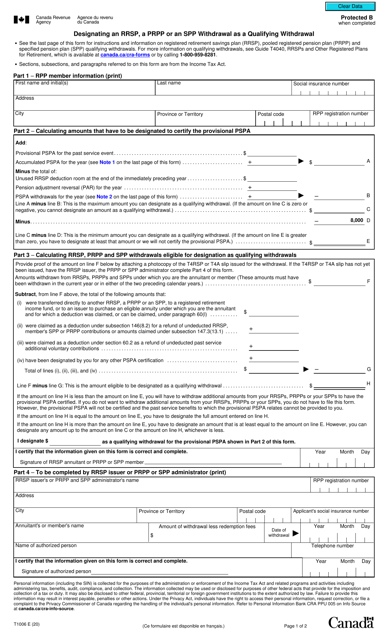

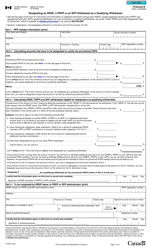

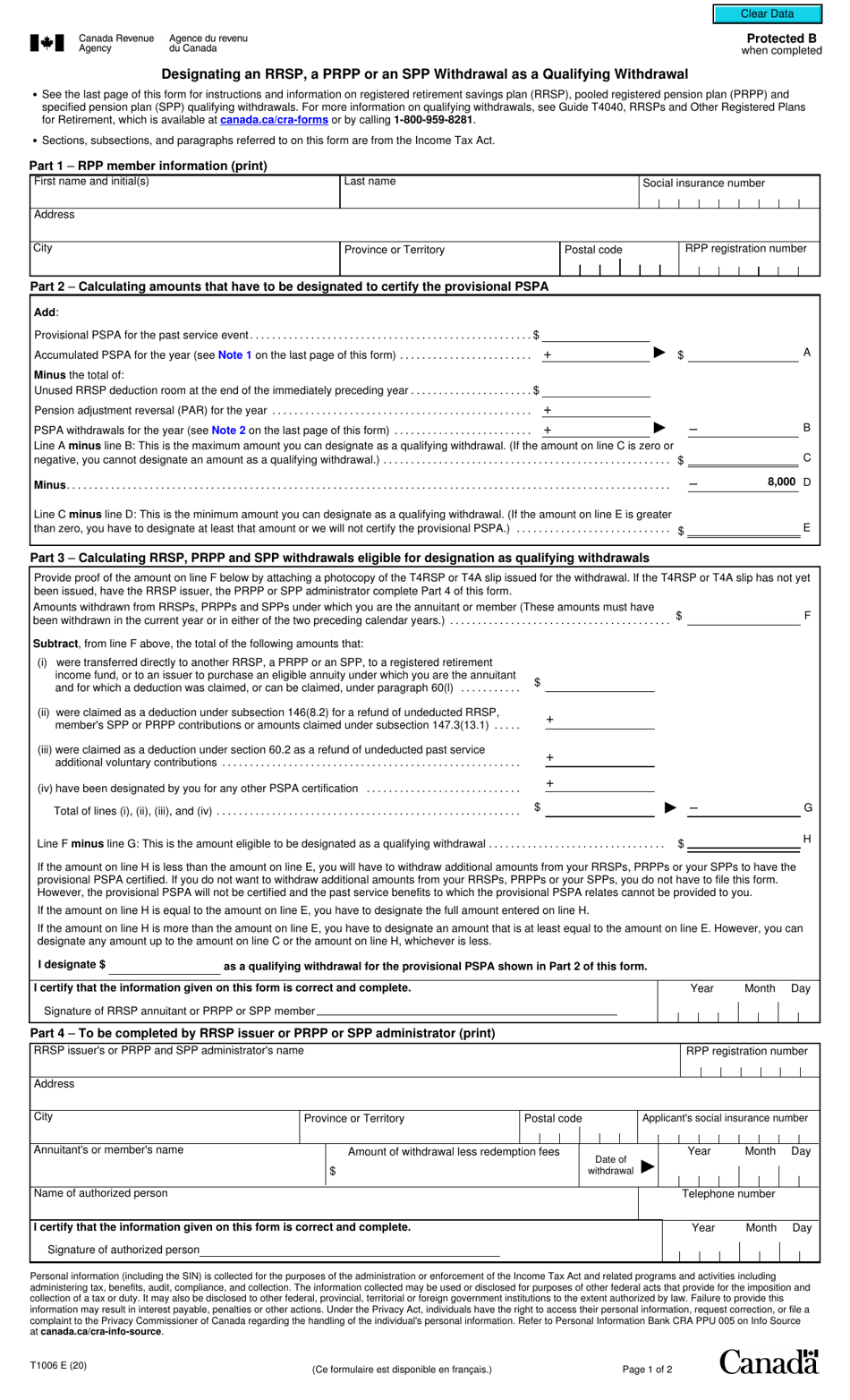

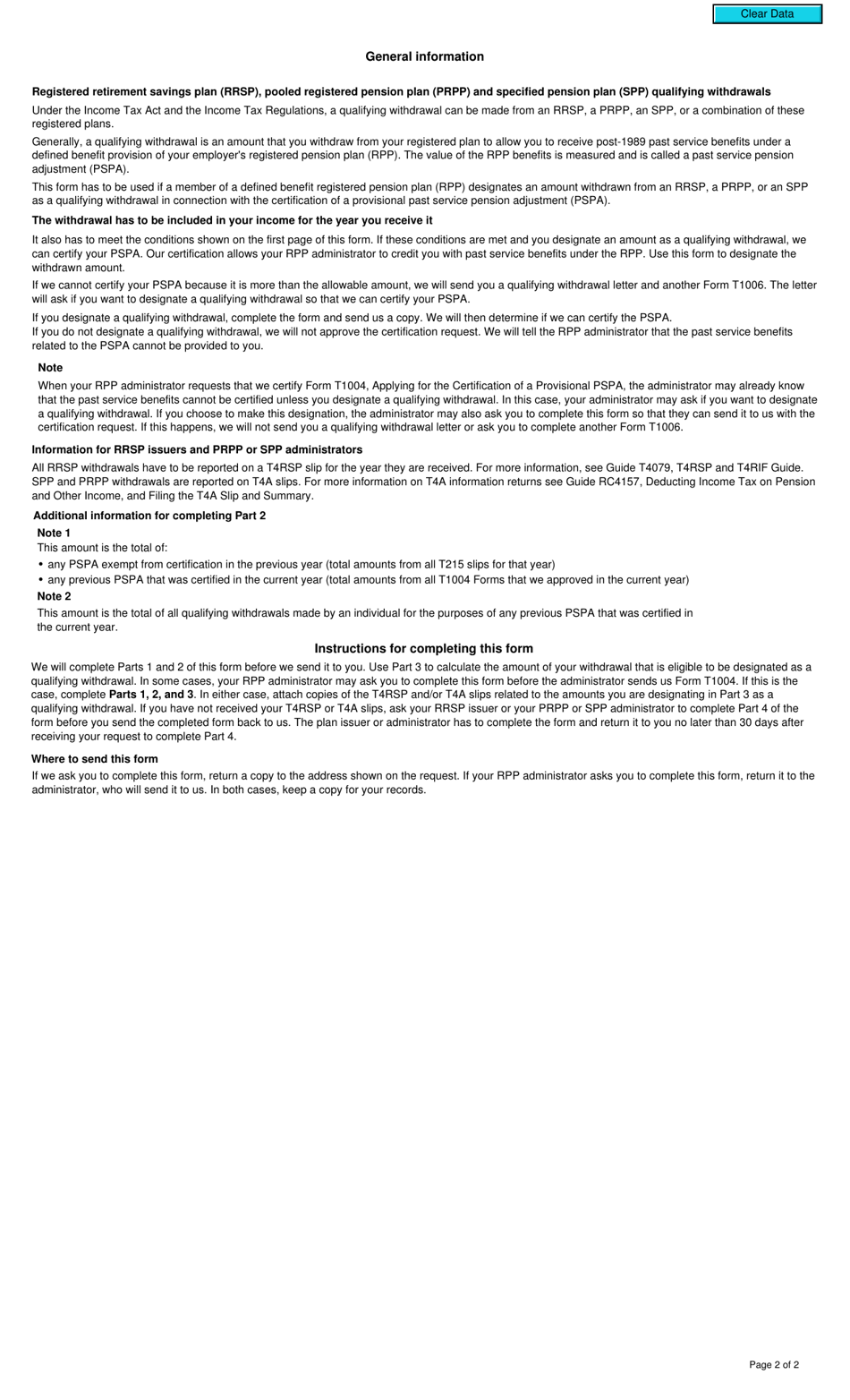

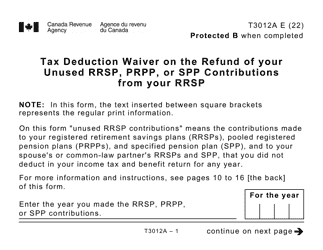

Form T1006 Designating an Rrsp, an Prpp or an Spp Withdrawal as a Qualifying Withdrawal - Canada

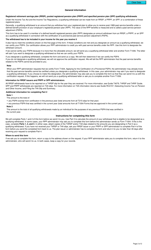

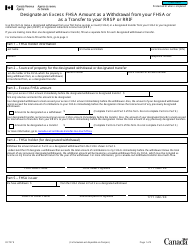

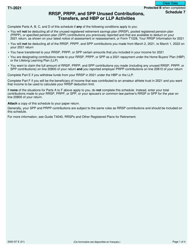

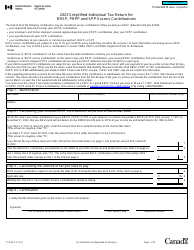

Form T1006 is used in Canada to designate a Registered Retirement Savings Plan (RRSP), a Pooled Registered Pension Plan (PRPP), or a Specified Pension Plan (SPP) withdrawal as a qualifying withdrawal. This form is used to determine the tax treatment of the withdrawal for the taxpayer.

The individual making the RRSP, PRPP, or SPP withdrawal files the Form T1006.

FAQ

Q: What is Form T1006?

A: Form T1006 is a form used in Canada to designate a withdrawal from an RRSP, PRPP, or SPP as a qualifying withdrawal.

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a tax-advantaged savings account for retirement.

Q: What is a PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a type of retirement savings plan offered by employers.

Q: What is an SPP?

A: SPP stands for Saskatchewan Pension Plan. It is a voluntary retirement savings plan for residents of Saskatchewan.

Q: What is a qualifying withdrawal?

A: A qualifying withdrawal is a withdrawal from an RRSP, PRPP, or SPP that meets certain criteria to be eligible for tax benefits.

Q: Why would I need to use Form T1006?

A: You would need to use Form T1006 to designate a withdrawal as a qualifying withdrawal and claim the associated tax benefits.

Q: What information is required on Form T1006?

A: Form T1006 requires information about the withdrawal, including the date, amount, and the type of plan (RRSP, PRPP, or SPP).

Q: Do I need to submit Form T1006 with my tax return?

A: Yes, you need to submit Form T1006 with your tax return to claim the tax benefits of a qualifying withdrawal.

Q: What are the tax benefits of a qualifying withdrawal?

A: The tax benefits of a qualifying withdrawal include a reduction in income tax payable and the ability to contribute the withdrawal amount back into your retirement savings without using your contribution room.