This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC96

for the current year.

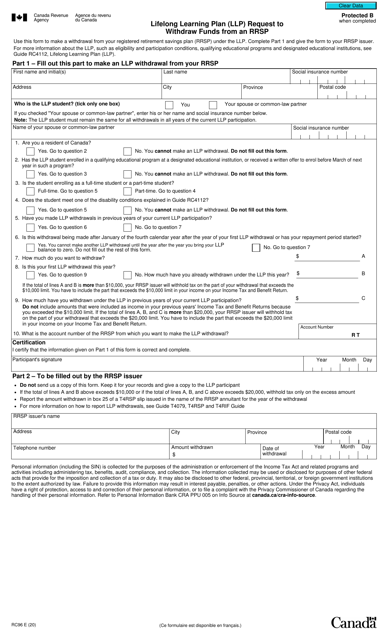

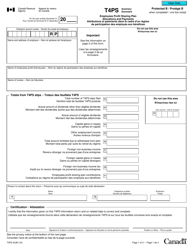

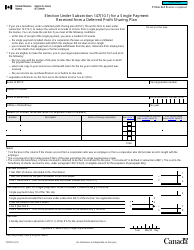

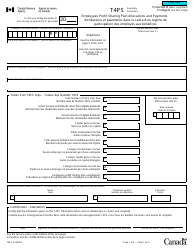

Form RC96 Lifelong Learning Plan (LLP ) Request to Withdraw Funds From an Rrsp - Canada

Form RC96 Lifelong Learning Plan (LLP) is used in Canada to request the withdrawal of funds from a Registered Retirement Savings Plan (RRSP) for the purpose of financing full-time training or education for the account holder or their spouse or common-law partner. The LLP allows individuals to access their RRSP savings without incurring tax penalties, provided certain conditions are met.

The individual who wishes to withdraw funds from their Registered Retirement Savings Plan (RRSP) under the Lifelong Learning Plan (LLP) files the Form RC96.

FAQ

Q: What is the Form RC96 Lifelong Learning Plan (LLP)?

A: The Form RC96 Lifelong Learning Plan (LLP) is a form used in Canada to request the withdrawal of funds from an RRSP (Registered Retirement Savings Plan) for educational purposes.

Q: Who is eligible to use the Lifelong Learning Plan (LLP)?

A: Canadian residents who have an RRSP and are enrolled in a qualifying educational program on a full-time basis may be eligible to use the Lifelong Learning Plan (LLP).

Q: What can the funds withdrawn through the LLP be used for?

A: The funds withdrawn through the Lifelong Learning Plan (LLP) can be used to finance eligible educational expenses, such as tuition fees, books, and living expenses for the individual or their spouse or common-law partner.

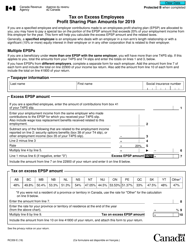

Q: How much can be withdrawn through the LLP?

A: The maximum amount that can be withdrawn through the Lifelong Learning Plan (LLP) is $20,000 per calendar year, up to a total maximum of $40,000.

Q: What are the repayment requirements for the funds withdrawn through the LLP?

A: The repayment requirements for the funds withdrawn through the Lifelong Learning Plan (LLP) start in the fifth year after the first withdrawal. The amount withdrawn must be repaid in equal installments over a 10-year period.

Q: What happens if the LLP repayments are not made on time?

A: If the Lifelong Learning Plan (LLP) repayments are not made on time, the remaining balance will be included as income on the individual's tax return and will be subject to taxes.