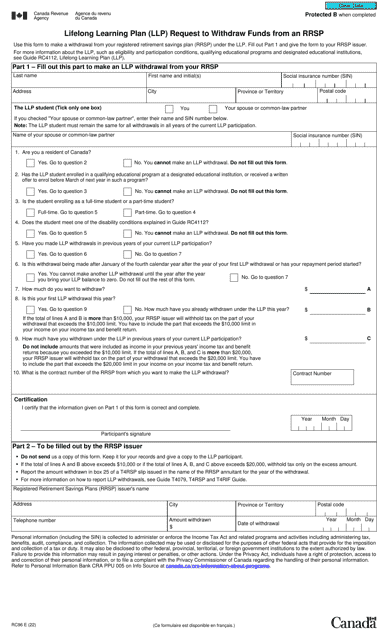

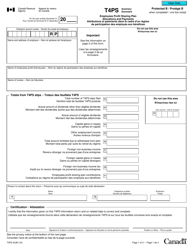

Form RC96 Lifelong Learning Plan (LLP ) Request to Withdraw Funds From an Rrsp - Canada

Form RC96 Lifelong Learning Plan (LLP) Request to Withdraw Funds from an RRSP in Canada is used to withdraw funds from a Registered Retirement Savings Plan (RRSP) for the purpose of financing full-time training or education. This form is specifically for the Lifelong Learning Plan, which allows individuals to withdraw funds from their RRSP to cover educational expenses.

The individual applying to withdraw funds from their Registered Retirement Savings Plan (RRSP) files the Form RC96 Lifelong Learning Plan (LLP) Request in Canada.

Form RC96 Lifelong Learning Plan (LLP ) Request to Withdraw Funds From an Rrsp - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC96?

A: Form RC96 is a Lifelong Learning Plan (LLP) Request to Withdraw Funds From an RRSP in Canada.

Q: What is the Lifelong Learning Plan (LLP)?

A: The Lifelong Learning Plan (LLP) is a program in Canada that allows you to withdraw funds from your Registered Retirement Savings Plan (RRSP) to finance your education or training.

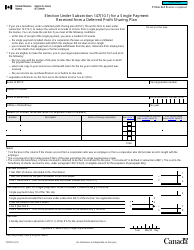

Q: When should I use Form RC96?

A: You should use Form RC96 when you want to withdraw funds from your RRSP under the Lifelong Learning Plan (LLP) program.

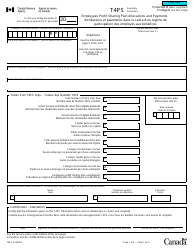

Q: Can anyone use the Lifelong Learning Plan (LLP)?

A: No, not everyone is eligible to use the Lifelong Learning Plan (LLP). You must meet certain criteria, such as being a Canadian resident and having a qualifying educational program.

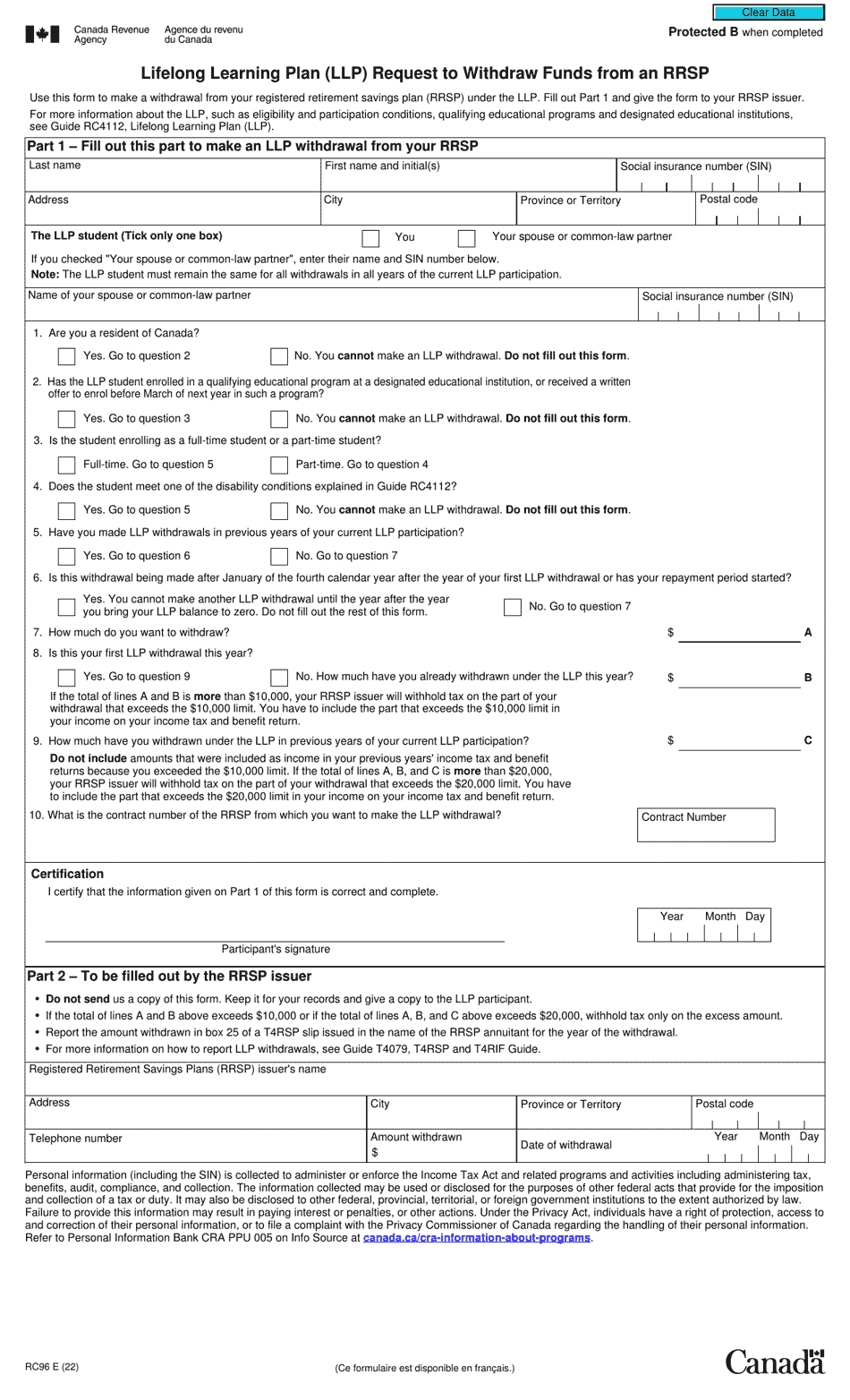

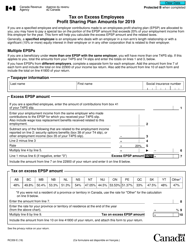

Q: How much can I withdraw from my RRSP under the Lifelong Learning Plan (LLP) program?

A: You can withdraw up to $20,000 from your RRSP under the Lifelong Learning Plan (LLP) program.

Q: Do I have to repay the amount withdrawn under the Lifelong Learning Plan (LLP)?

A: Yes, you have to repay the amount withdrawn under the Lifelong Learning Plan (LLP) within a specified period of time. Failure to repay the amount may result in taxes and penalties.

Q: Is there a deadline for submitting Form RC96?

A: Yes, there is a deadline for submitting Form RC96. It must be submitted before the end of the year in which you want to make the withdrawal from your RRSP.

Q: Are there any tax implications for using the Lifelong Learning Plan (LLP)?

A: There may be tax implications for using the Lifelong Learning Plan (LLP). It is recommended that you consult with a tax professional or the CRA for specific advice regarding your situation.