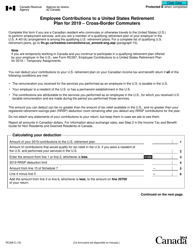

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC267

for the current year.

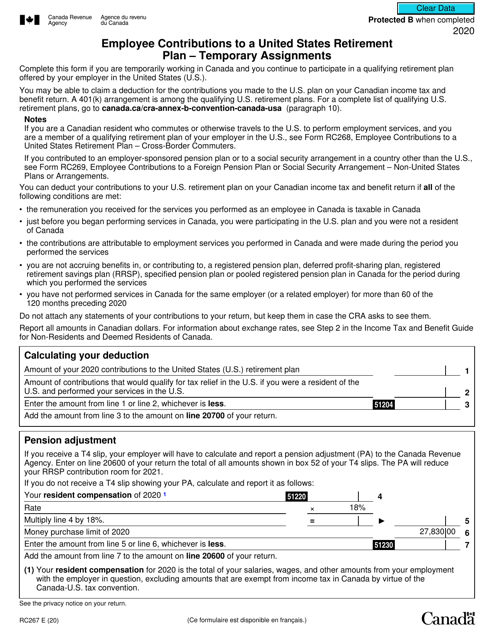

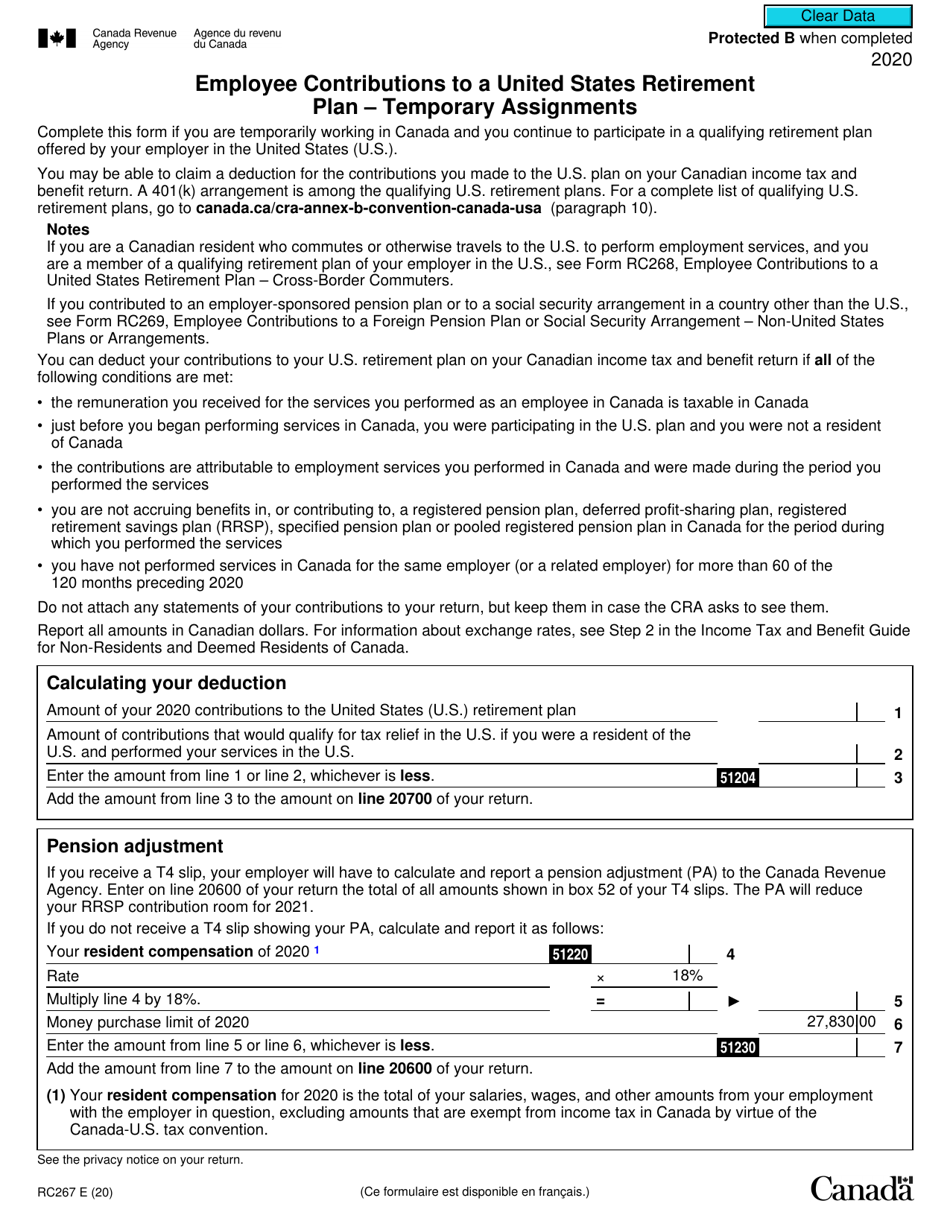

Form RC267 Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada

Form RC267, Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada, is used by Canadian residents who work temporarily in the United States and contribute to a U.S. retirement plan. The form helps individuals claim a foreign tax credit in Canada for contributions made to a U.S. retirement plan during their temporary assignment.

The Form RC267 Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada is filed by Canadian taxpayers who are temporarily working in the United States and contributing to a US retirement plan.

FAQ

Q: What is Form RC267?

A: Form RC267 is a document used in Canada to report an employee's contributions to a United States retirement plan during a temporary assignment.

Q: Who should use Form RC267?

A: Form RC267 should be used by Canadian employees who have made contributions to a United States retirement plan while on temporary assignments in the United States.

Q: Why is Form RC267 important?

A: Form RC267 is important because it allows Canadian employees to report and claim deductions for their contributions to a United States retirement plan while on temporary assignments.

Q: When should Form RC267 be filed?

A: Form RC267 should be filed by Canadian employees when they file their annual income tax return in Canada.

Q: Are there any deadlines for filing Form RC267?

A: Yes, Form RC267 must be filed by the deadline for filing your Canadian income tax return, which is usually April 30th of the following year.

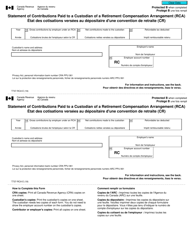

Q: What information should be included in Form RC267?

A: Form RC267 requires the employee's personal information, details of the United States retirement plan, and information about the temporary assignment.

Q: Can I claim deductions for my contributions to a United States retirement plan?

A: Yes, as a Canadian employee on a temporary assignment, you may be eligible to claim deductions for your contributions to a United States retirement plan.

Q: What supporting documents should I attach to Form RC267?

A: You should attach any relevant documents, such as statements or receipts, showing your contributions to the United States retirement plan.

Q: Can I file Form RC267 electronically?

A: Yes, you can file Form RC267 electronically using the NETFILE system, if you meet the eligibility requirements.