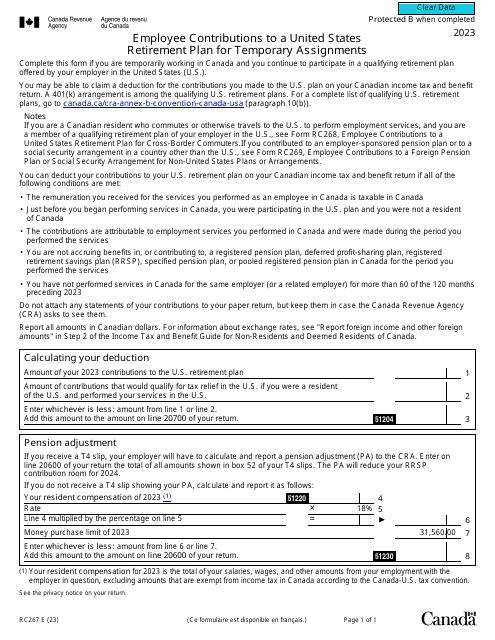

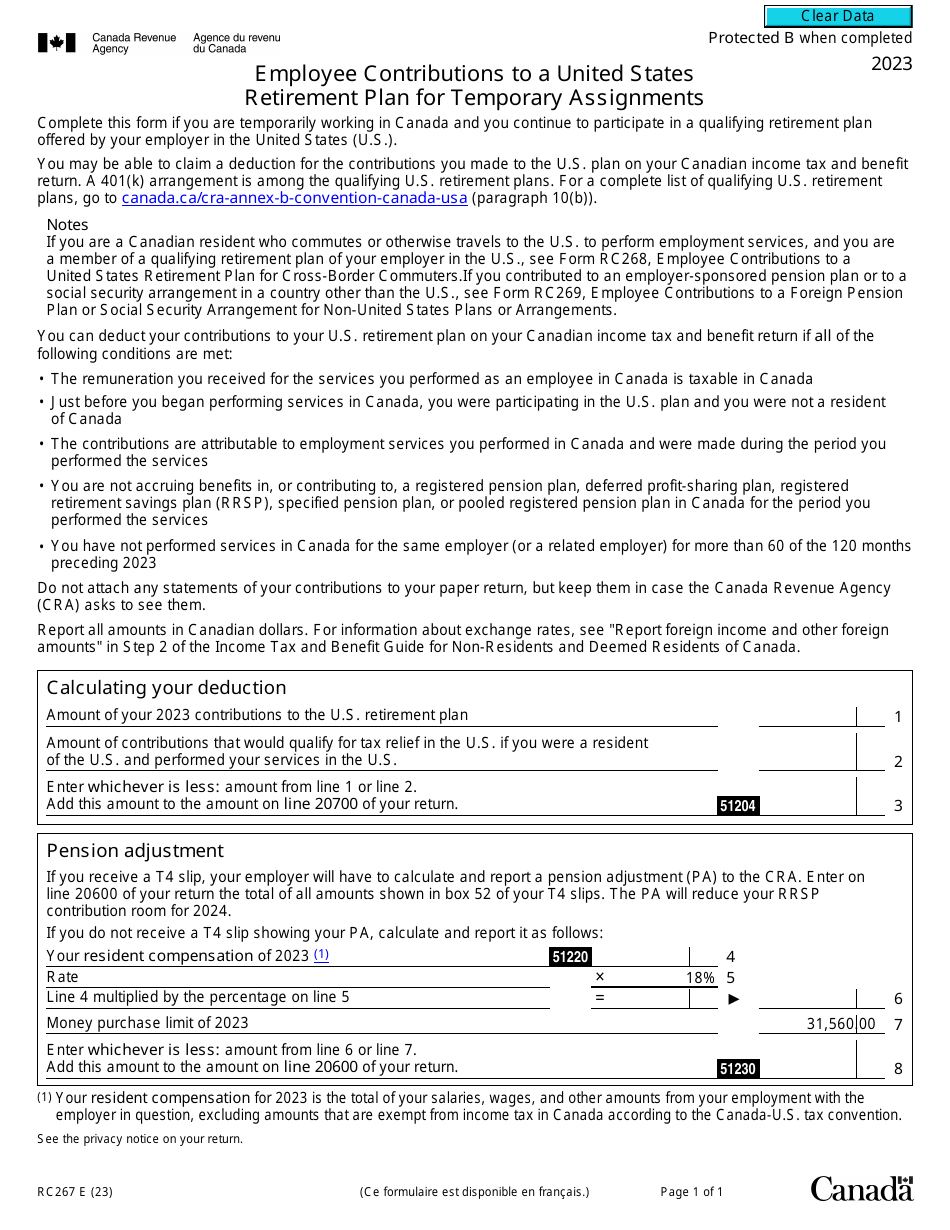

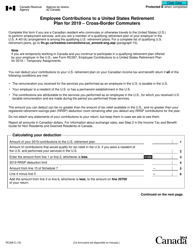

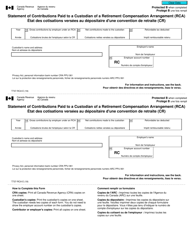

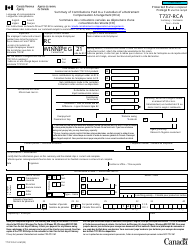

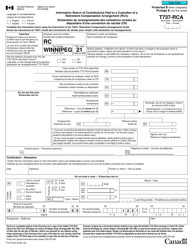

Form RC267 Employee Contributions to a United States Retirement Plan for Temporary Assignments - Canada

Form RC267, Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada, is used by Canadian residents who work temporarily in the United States and contribute to a U.S. retirement plan. The form helps individuals claim a foreign tax credit in Canada for contributions made to a U.S. retirement plan during their temporary assignment.

The Form RC267 Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada is filed by Canadian taxpayers who are temporarily working in the United States and contributing to a US retirement plan.

Form RC267 Employee Contributions to a United States Retirement Plan - Temporary Assignments - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC267?

A: Form RC267 is a document used in Canada to report an employee's contributions to a United States retirement plan during a temporary assignment.

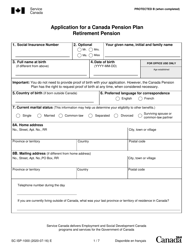

Q: Who should use Form RC267?

A: Form RC267 should be used by Canadian employees who have made contributions to a United States retirement plan while on temporary assignments in the United States.

Q: Why is Form RC267 important?

A: Form RC267 is important because it allows Canadian employees to report and claim deductions for their contributions to a United States retirement plan while on temporary assignments.

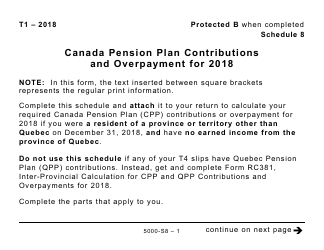

Q: When should Form RC267 be filed?

A: Form RC267 should be filed by Canadian employees when they file their annual income tax return in Canada.

Q: Are there any deadlines for filing Form RC267?

A: Yes, Form RC267 must be filed by the deadline for filing your Canadian income tax return, which is usually April 30th of the following year.

Q: What information should be included in Form RC267?

A: Form RC267 requires the employee's personal information, details of the United States retirement plan, and information about the temporary assignment.

Q: Can I claim deductions for my contributions to a United States retirement plan?

A: Yes, as a Canadian employee on a temporary assignment, you may be eligible to claim deductions for your contributions to a United States retirement plan.

Q: What supporting documents should I attach to Form RC267?

A: You should attach any relevant documents, such as statements or receipts, showing your contributions to the United States retirement plan.

Q: Can I file Form RC267 electronically?

A: Yes, you can file Form RC267 electronically using the NETFILE system, if you meet the eligibility requirements.