This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC201

for the current year.

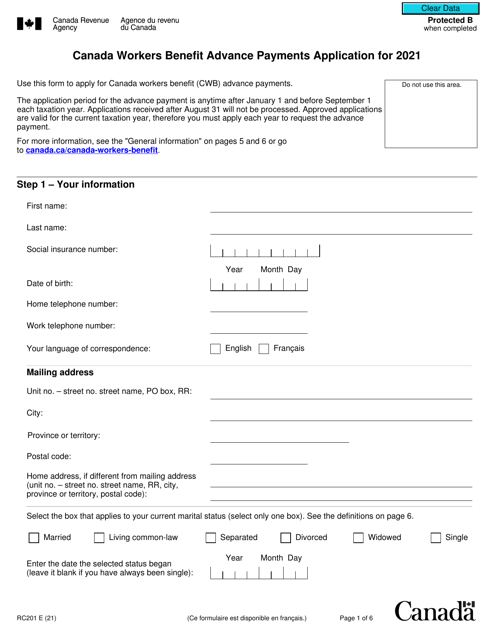

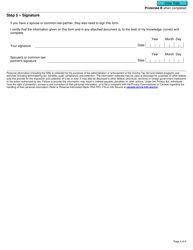

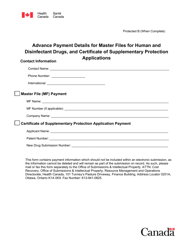

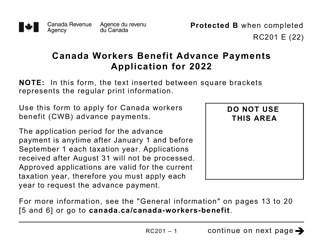

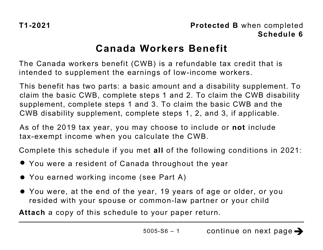

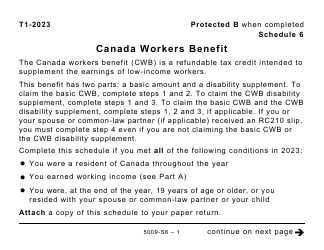

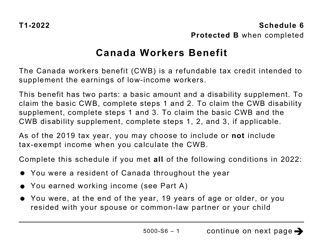

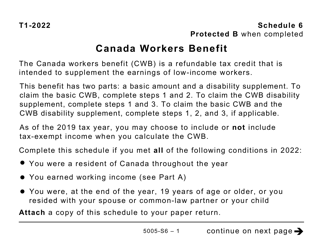

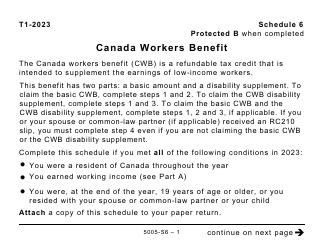

Form RC201 Canada Workers Benefit Advance Payments Application - Canada

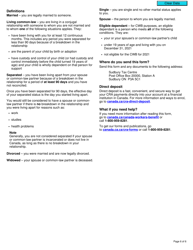

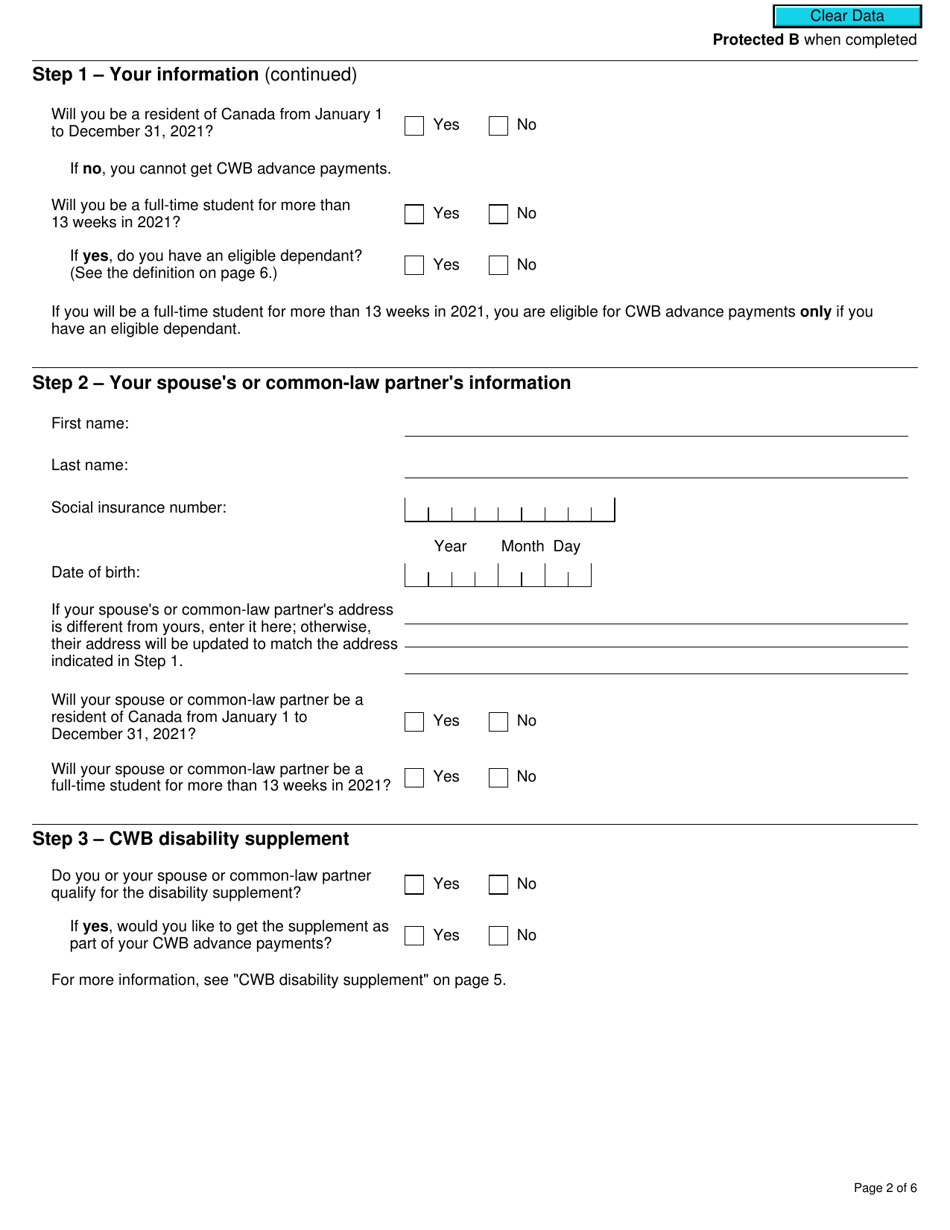

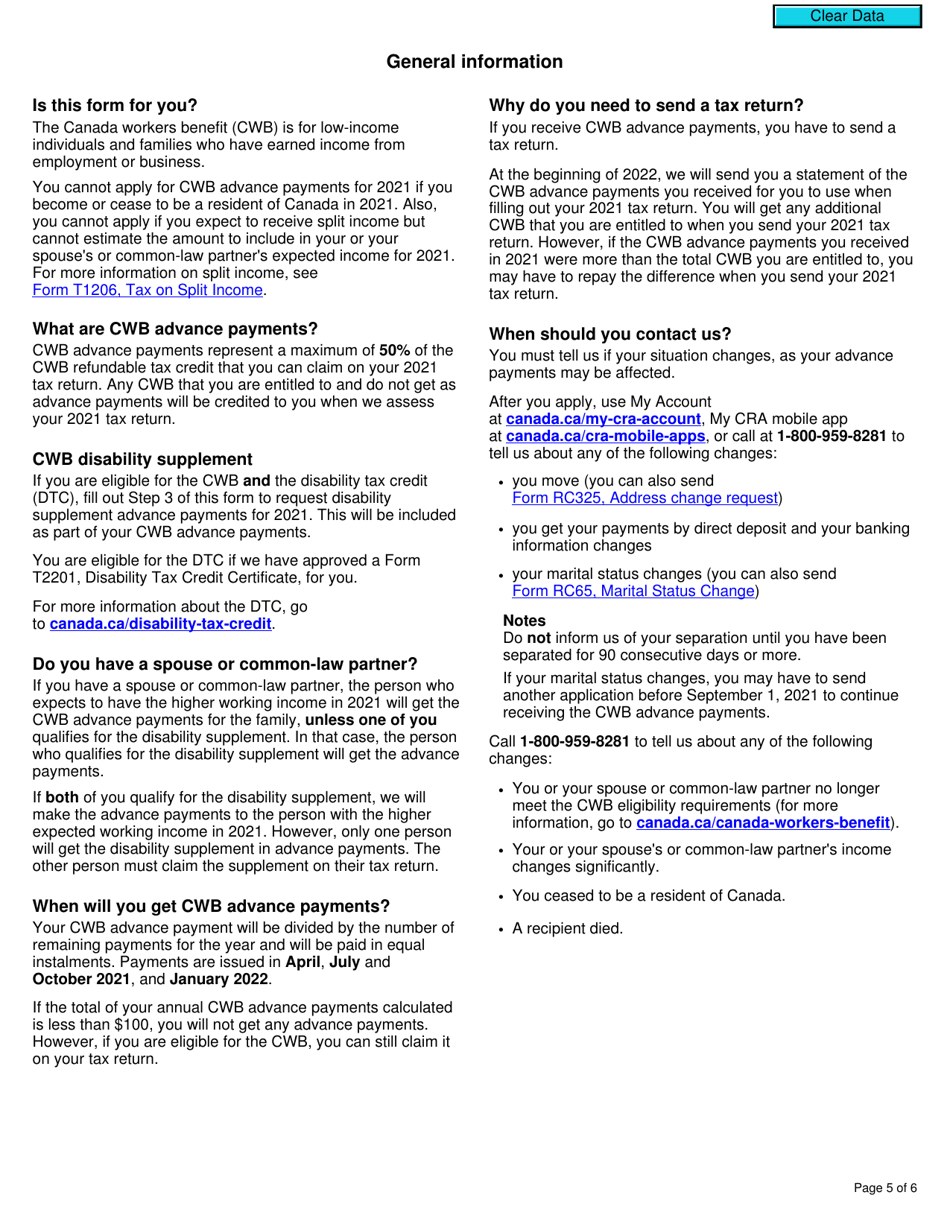

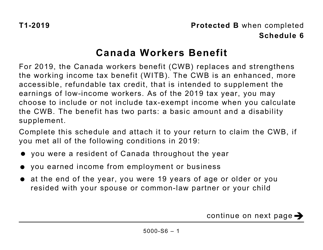

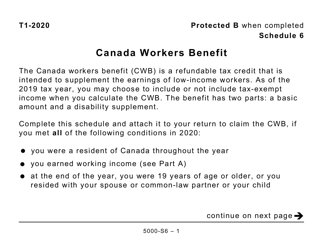

Form RC201 Canada Workers Benefit Advance Payments Application is used for applying to receive advance payments of the Canada Workers Benefit (CWB). The CWB is a refundable tax credit that provides financial assistance to low-income individuals and families. By completing this form, eligible individuals can apply to receive monthly advance payments of the CWB to help with their living expenses throughout the year.

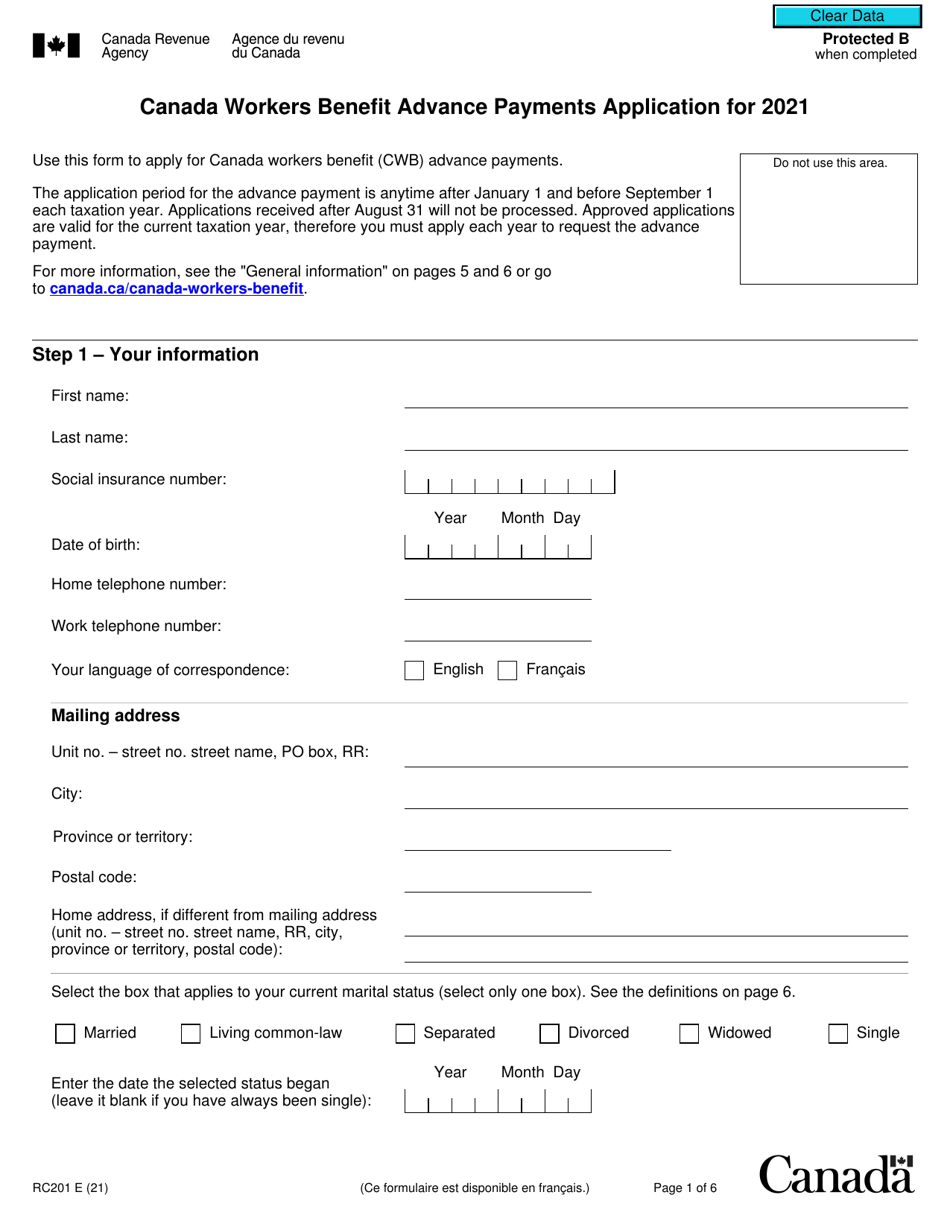

The Form RC201 Canada Workers Benefit Advance Payments Application is filed by individuals in Canada who are eligible for the Canada Workers Benefit and want to receive advance payments.

FAQ

Q: What is the Form RC201?

A: The Form RC201 is an application for the Canada Workers Benefit Advance Payments.

Q: What are Canada Workers Benefit Advance Payments?

A: Canada Workers Benefit Advance Payments are monthly payments made in advance to eligible individuals to help them with living expenses.

Q: Who can apply for Canada Workers Benefit Advance Payments?

A: Individuals who meet the eligibility criteria outlined by the Canada Revenue Agency can apply for Canada Workers Benefit Advance Payments.

Q: How do I apply for Canada Workers Benefit Advance Payments?

A: You can apply for Canada Workers Benefit Advance Payments by completing the Form RC201 and submitting it to the Canada Revenue Agency.

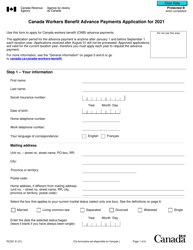

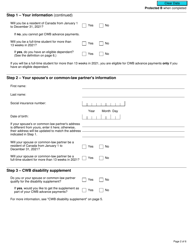

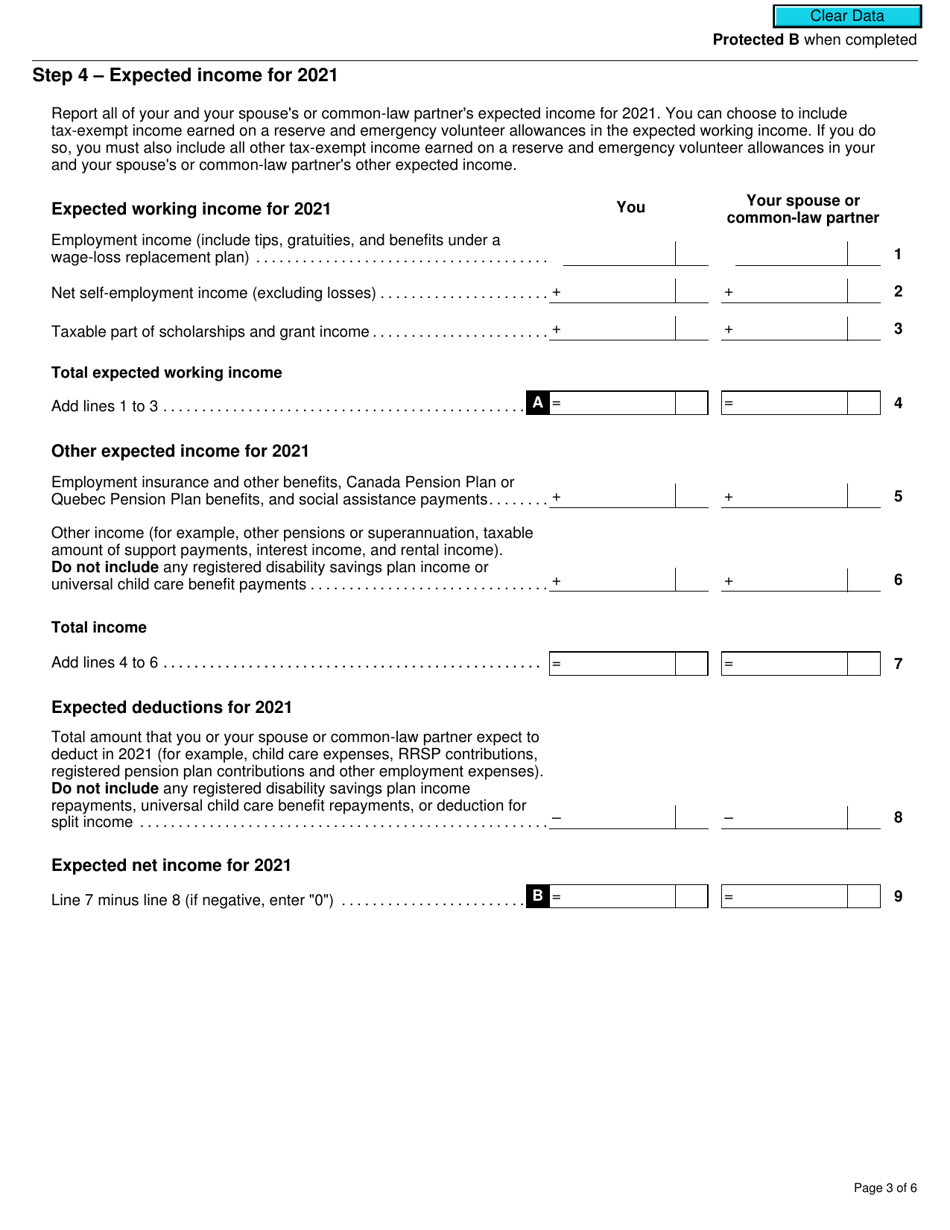

Q: What information do I need to provide on the Form RC201?

A: The Form RC201 requires you to provide personal information, employment details, and income information for yourself and your spouse or common-law partner.

Q: When should I apply for Canada Workers Benefit Advance Payments?

A: It is recommended to apply for Canada Workers Benefit Advance Payments as soon as you meet the eligibility criteria to ensure timely processing and receipt of payments.

Q: How often are Canada Workers Benefit Advance Payments made?

A: Canada Workers Benefit Advance Payments are made on a monthly basis.

Q: Will receiving Canada Workers Benefit Advance Payments affect my tax return?

A: Yes, receiving Canada Workers Benefit Advance Payments may affect your tax return. It is important to accurately report your income when filing your taxes.