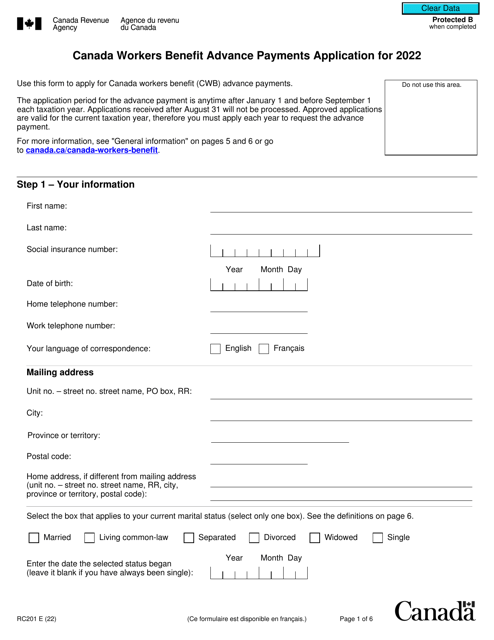

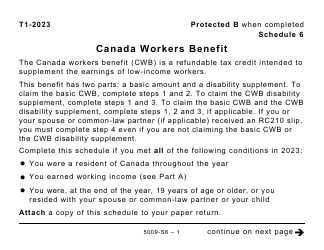

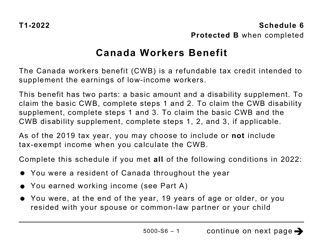

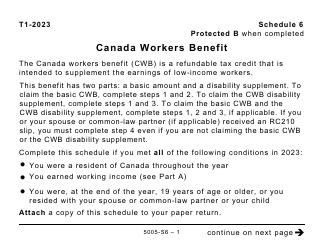

Form RC201 Canada Workers Benefit Advance Payments Application - Canada

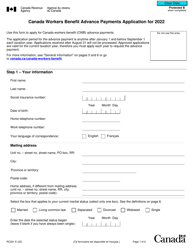

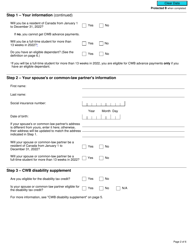

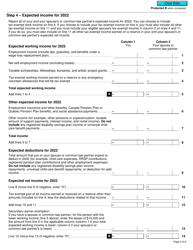

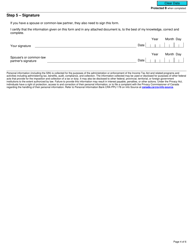

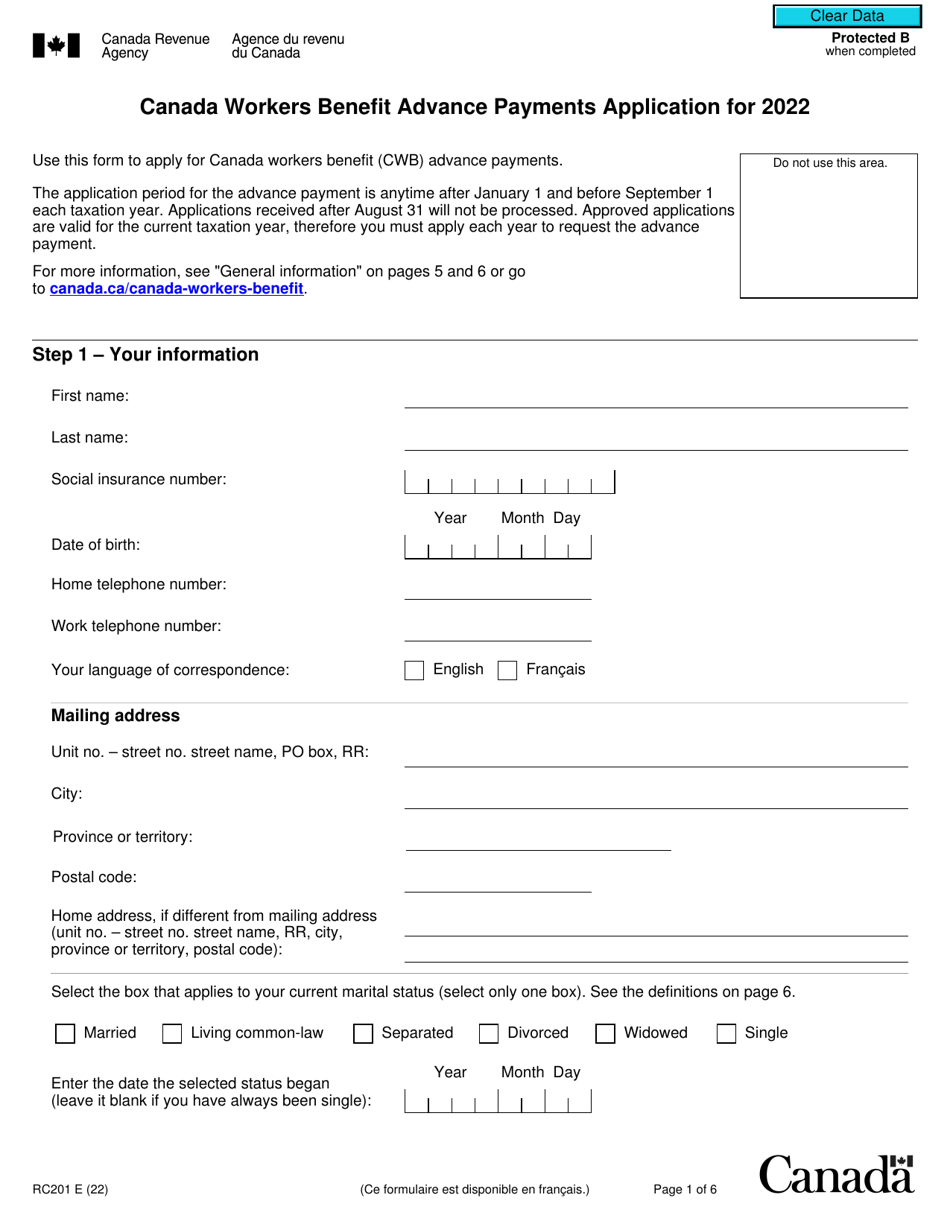

Form RC201 - Canada Workers Benefit Advance Payments Application is used for individuals in Canada to apply for advance payments of the Canada Workers Benefit (CWB). The CWB is a tax credit program that provides assistance to low-income individuals and families. The form helps determine if applicants are eligible for advance payments based on their income and other factors.

The Form RC201 Canada Workers Benefit Advance Payments Application is filed by individuals who are eligible for the Canada Workers Benefit.

Form RC201 Canada Workers Benefit Advance Payments Application - Canada - Frequently Asked Questions (FAQ)

Q: What is the Form RC201?

A: Form RC201 is an application form for Canada Workers Benefit Advance Payments.

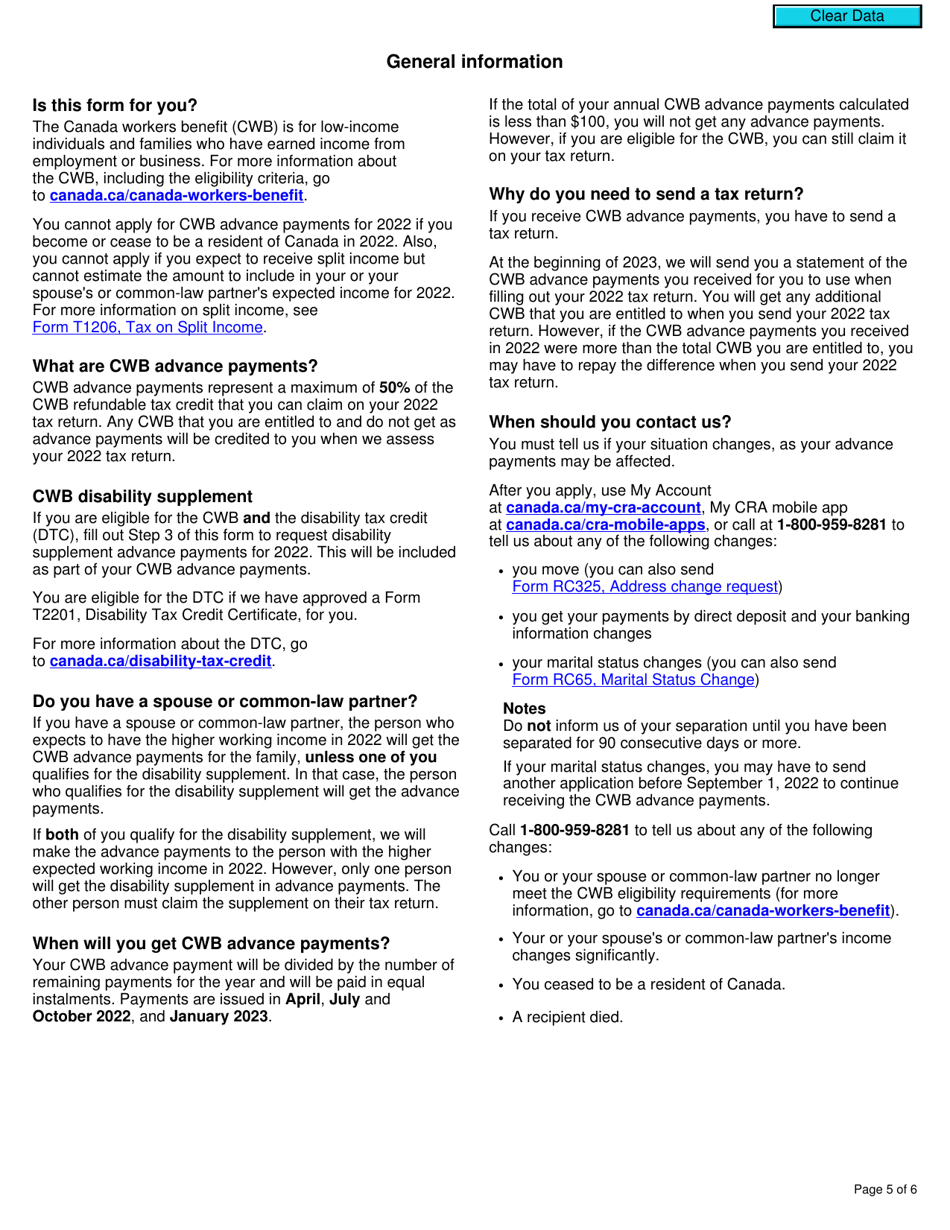

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit is a refundable tax credit for low-income individuals and families who are working.

Q: What are advance payments?

A: Advance payments are monthly payments made in advance based on an estimate of your Canada Workers Benefit for the year.

Q: Who can apply for advance payments?

A: Individuals and families who meet the eligibility criteria for the Canada Workers Benefit can apply for advance payments.

Q: How can I apply for advance payments?

A: You can apply for advance payments by completing Form RC201 and submitting it to the Canada Revenue Agency.

Q: What documents do I need to submit with the application?

A: You may need to submit supporting documents such as your notice of assessment or reassessment for the previous tax year.

Q: When should I apply for advance payments?

A: You should apply for advance payments as soon as possible to ensure that you receive the payments in a timely manner.

Q: How will I receive the advance payments?

A: The advance payments will be deposited directly into your bank account or sent to you by mail as a cheque.

Q: What is the deadline to apply for advance payments?

A: The deadline to apply for advance payments for a particular year is December 31 of that year.