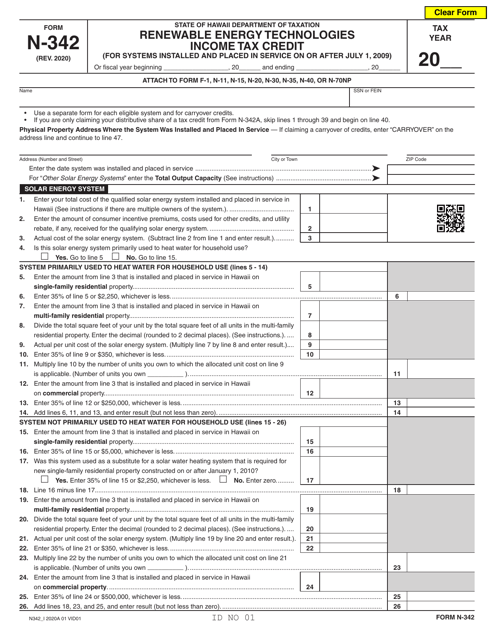

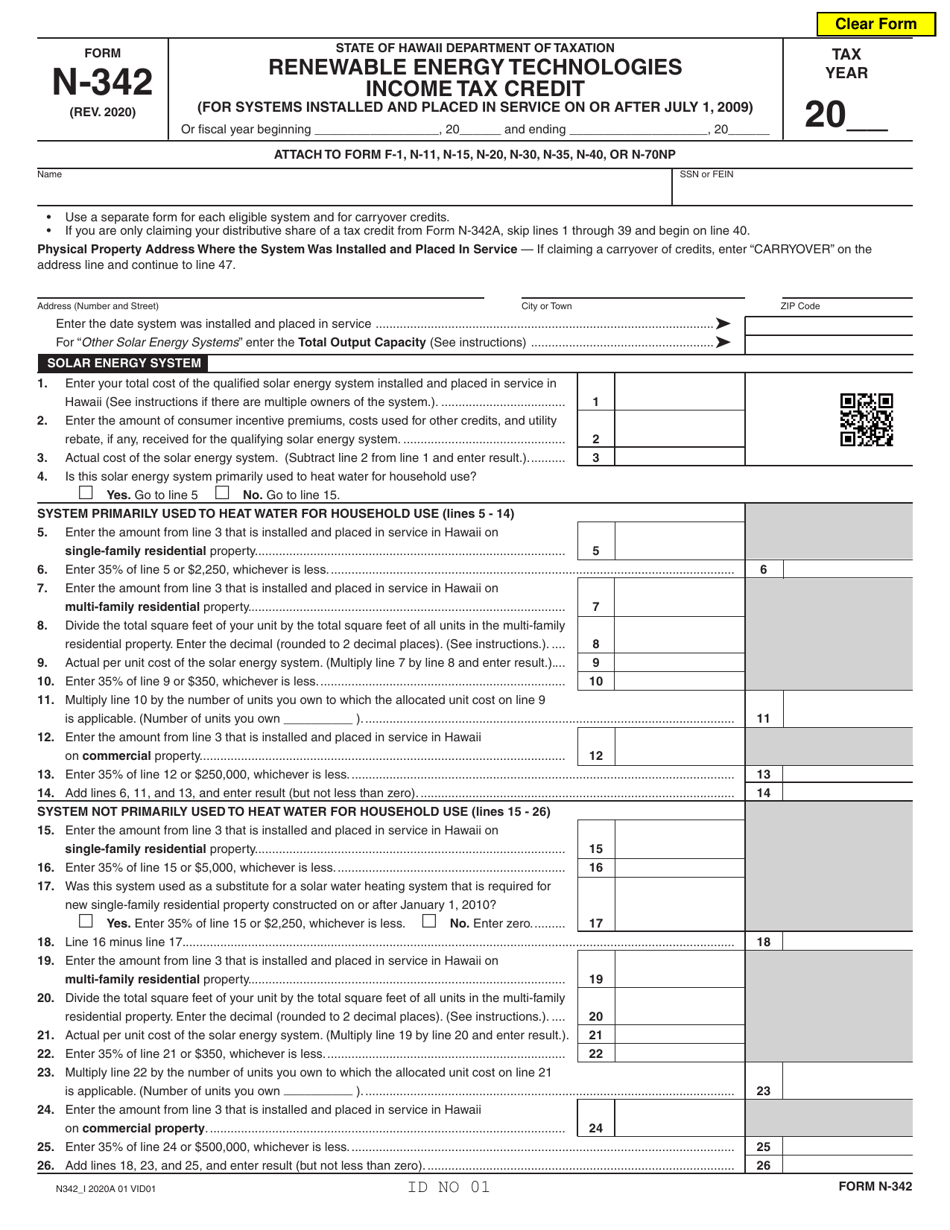

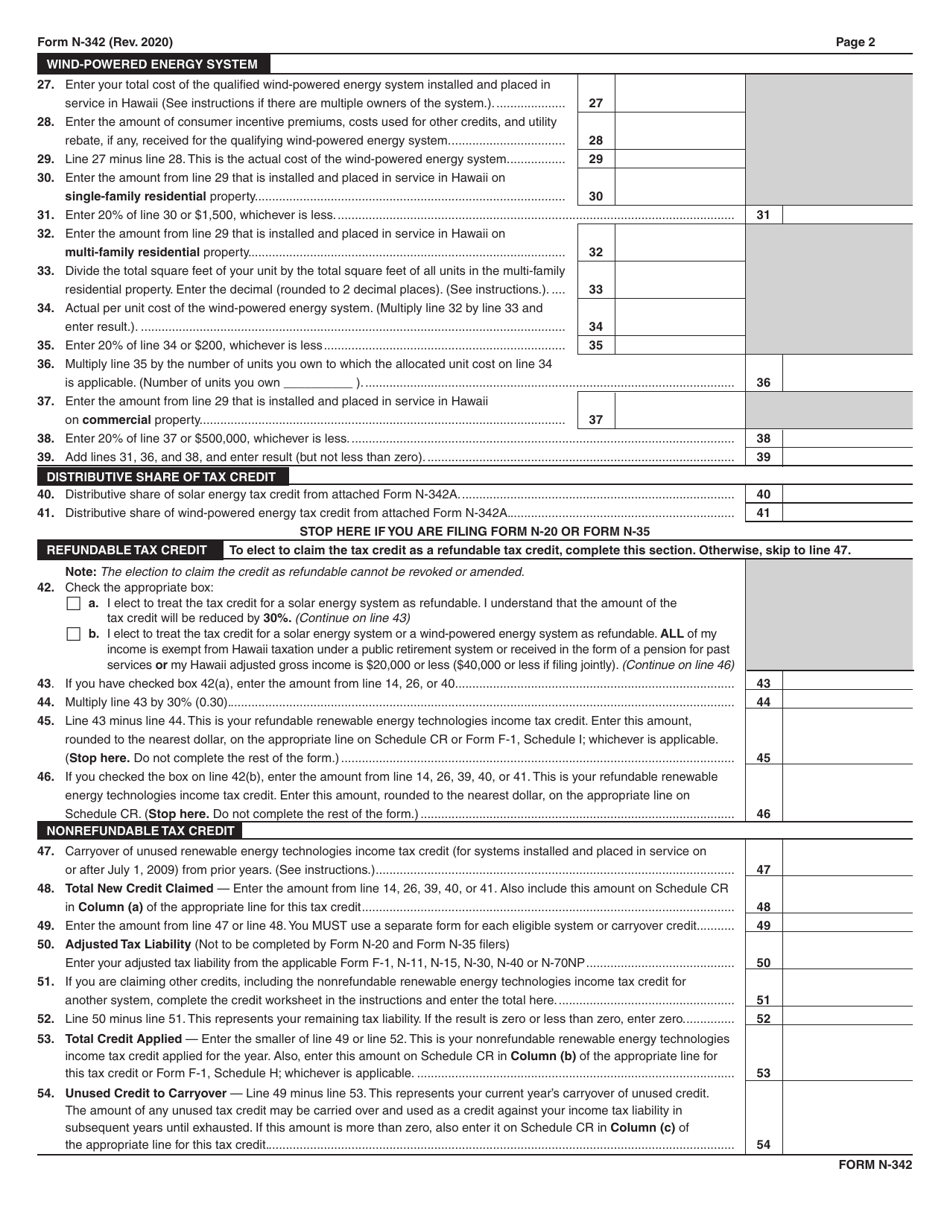

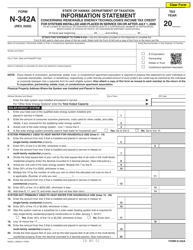

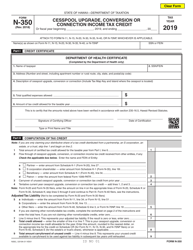

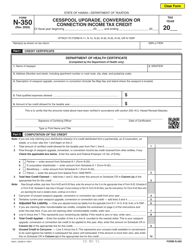

Form N-342 Renewable Energy Technologies Income Tax Credit - Hawaii

What Is Form N-342?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-342?

A: Form N-342 is the Renewable Energy Technologies Income Tax Credit form in Hawaii.

Q: What is the purpose of Form N-342?

A: The purpose of Form N-342 is to claim the Renewable Energy Technologies Income Tax Credit in Hawaii.

Q: What is the Renewable Energy Technologies Income Tax Credit in Hawaii?

A: The Renewable Energy Technologies Income Tax Credit is a tax credit provided to individuals or businesses that install eligible renewable energy systems.

Q: Who is eligible to claim the Renewable Energy Technologies Income Tax Credit in Hawaii?

A: Individuals or businesses who install eligible renewable energy systems in Hawaii are eligible to claim the tax credit.

Q: What are eligible renewable energy systems for the tax credit?

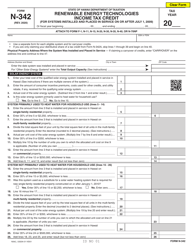

A: Eligible renewable energy systems for the tax credit include solar hot water systems, solar photovoltaic systems, wind-powered systems, ocean thermal energy conversion systems, and geothermal energy systems.

Q: How much is the tax credit for eligible renewable energy systems in Hawaii?

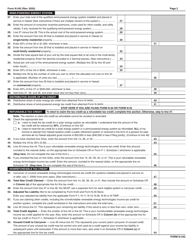

A: The tax credit for eligible renewable energy systems in Hawaii is equal to 35% of the cost of the system, up to a maximum credit of $5,000 per system.

Q: How tofill out Form N-342 to claim the tax credit?

A: To fill out Form N-342, provide the required information about the installed renewable energy system, including the cost of the system, the installation date, and the taxpayer's information.

Q: When is the deadline to file Form N-342?

A: Form N-342 must be filed with the Hawaii Department of Taxation by the due date of the taxpayer's income tax return for the year in which the system was installed.

Q: Can the tax credit be carried forward or transferred?

A: No, the tax credit cannot be carried forward or transferred to another taxpayer.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-342 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.