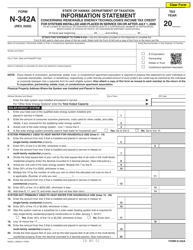

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-342

for the current year.

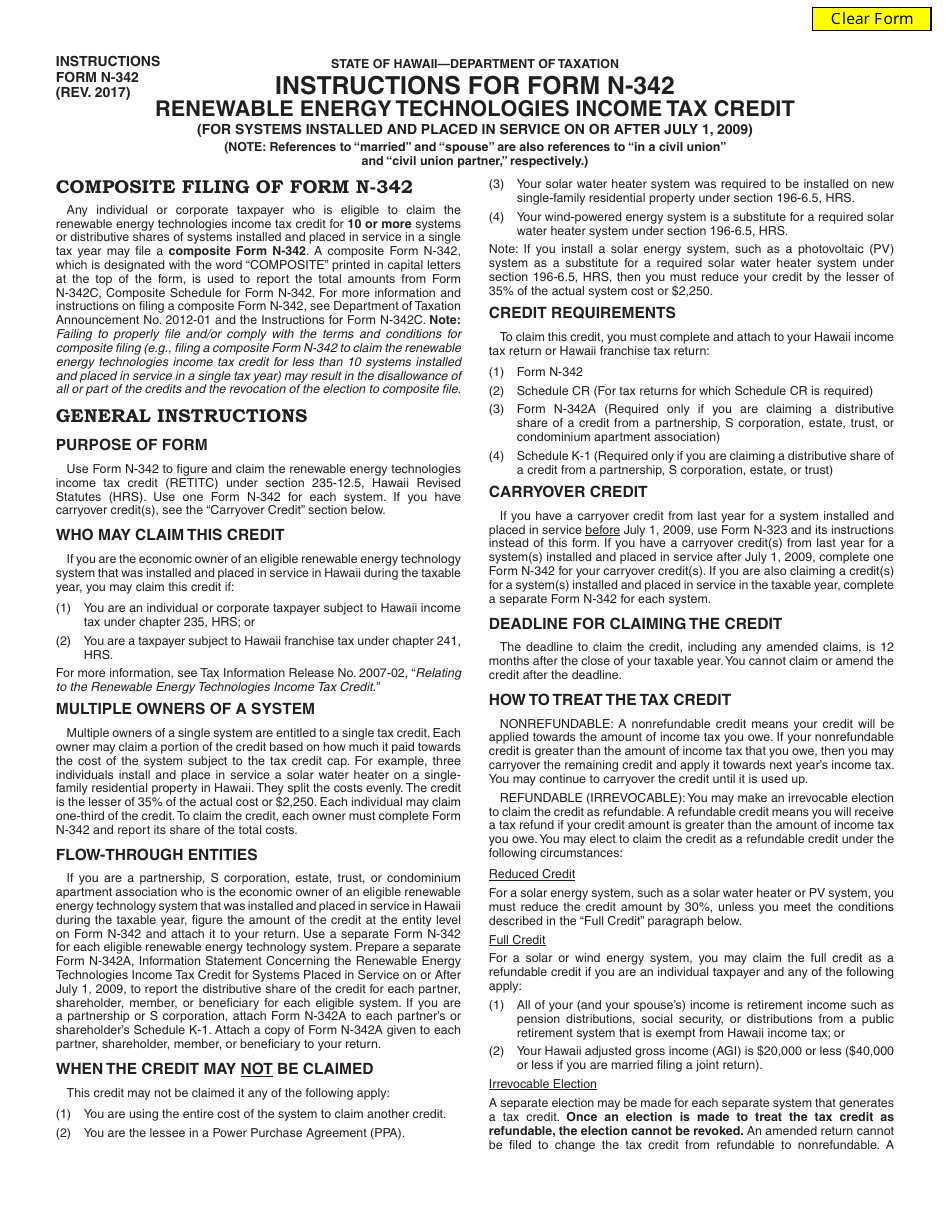

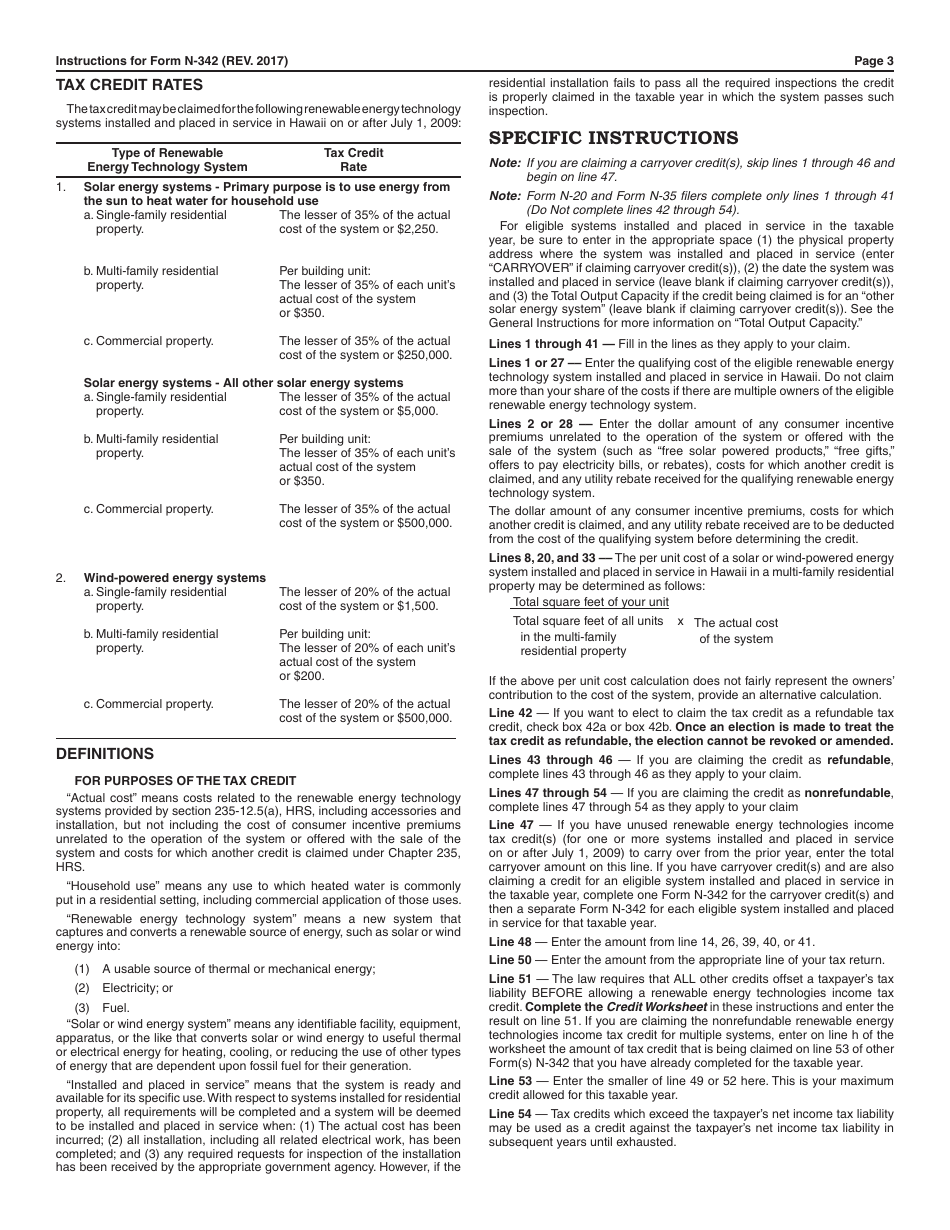

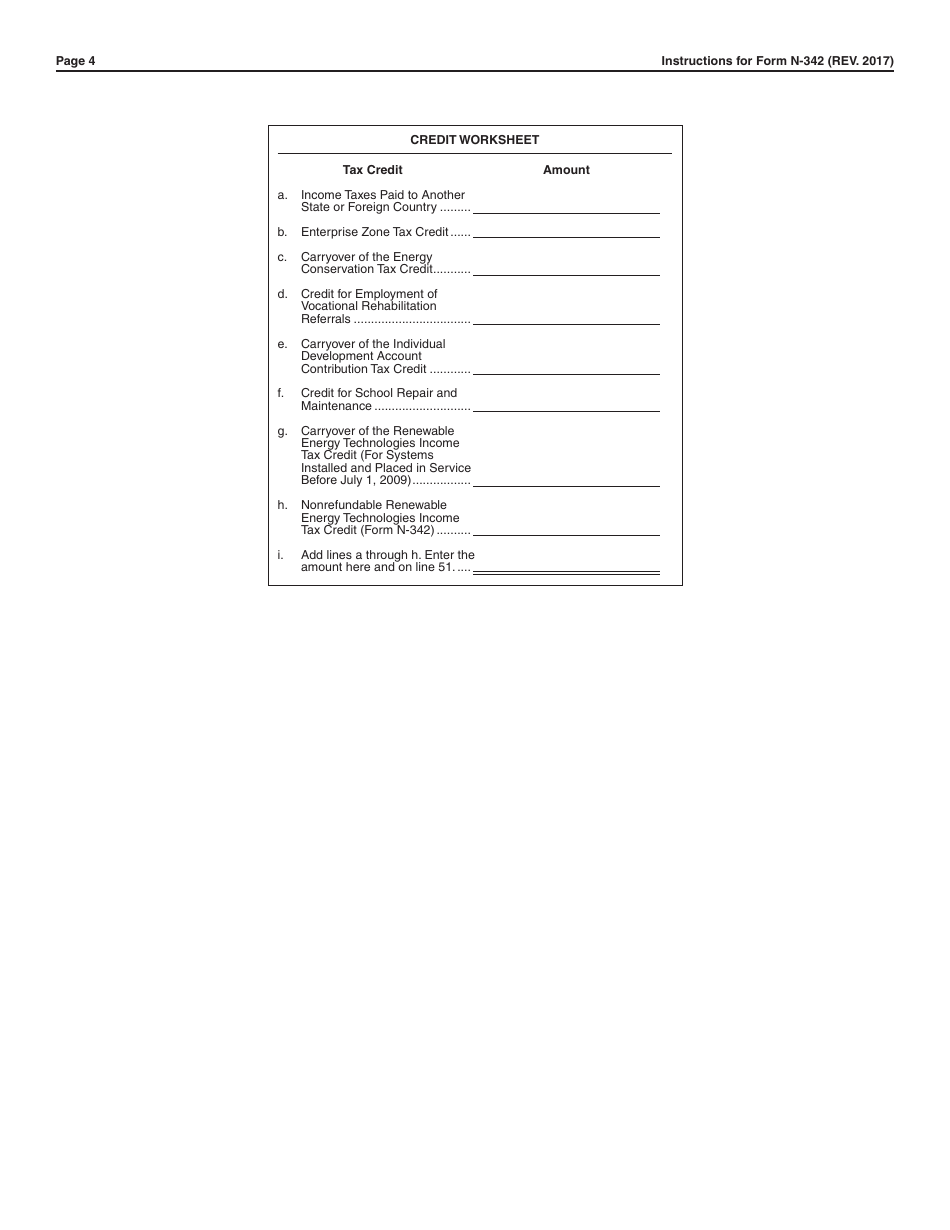

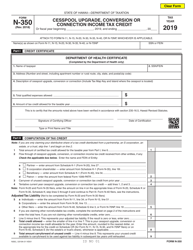

Instructions for Form N-342 Renewable Energy Technologies Income Tax Credit - Hawaii

This document contains official instructions for Form N-342 , Renewable Energy Technologies Income Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-342 is available for download through this link.

FAQ

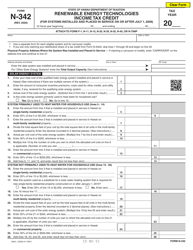

Q: What is Form N-342?

A: Form N-342 is a form used to claim the Renewable Energy Technologies Income Tax Credit in Hawaii.

Q: What is the Renewable Energy Technologies Income Tax Credit?

A: The Renewable Energy Technologies Income Tax Credit is a tax credit provided by the state of Hawaii for taxpayers who install renewable energy systems.

Q: Who is eligible for the Renewable Energy Technologies Income Tax Credit?

A: Taxpayers who install eligible renewable energy systems in Hawaii are eligible for the income tax credit.

Q: What is considered an eligible renewable energy system?

A: Eligible renewable energy systems include solar, wind, hydroelectric, and geothermal systems.

Q: How much is the income tax credit?

A: The amount of the income tax credit is 35% of the system cost, with a maximum credit of $5,000 per system.

Q: What is the deadline for filing Form N-342?

A: Form N-342 must be filed with your Hawaii state income tax return by the due date of the return.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.