This version of the form is not currently in use and is provided for reference only. Download this version of

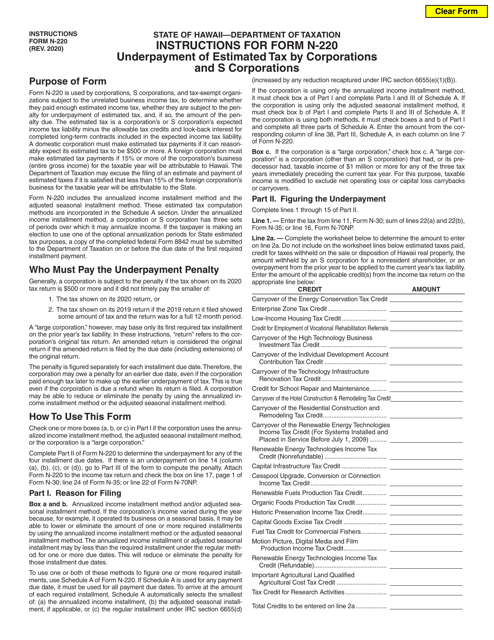

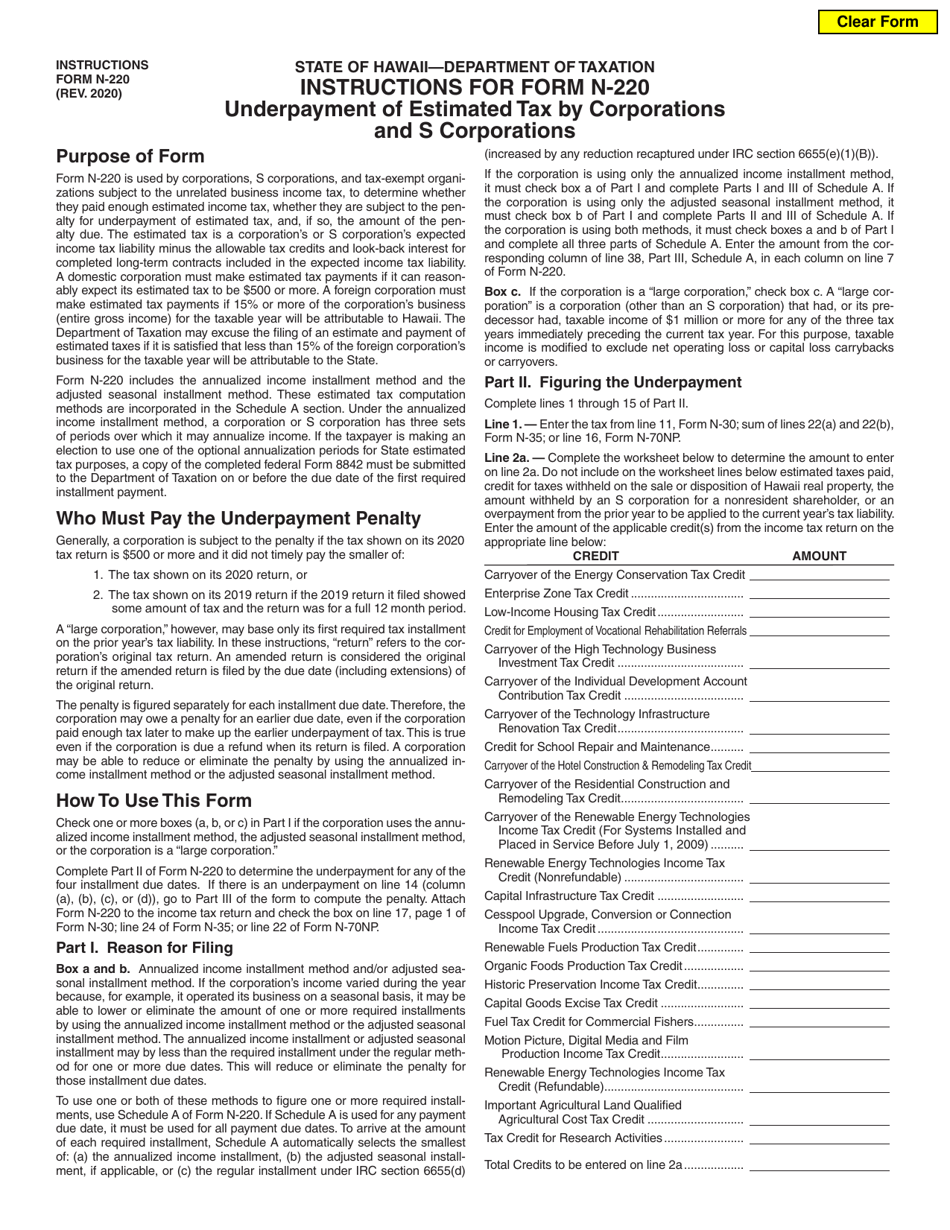

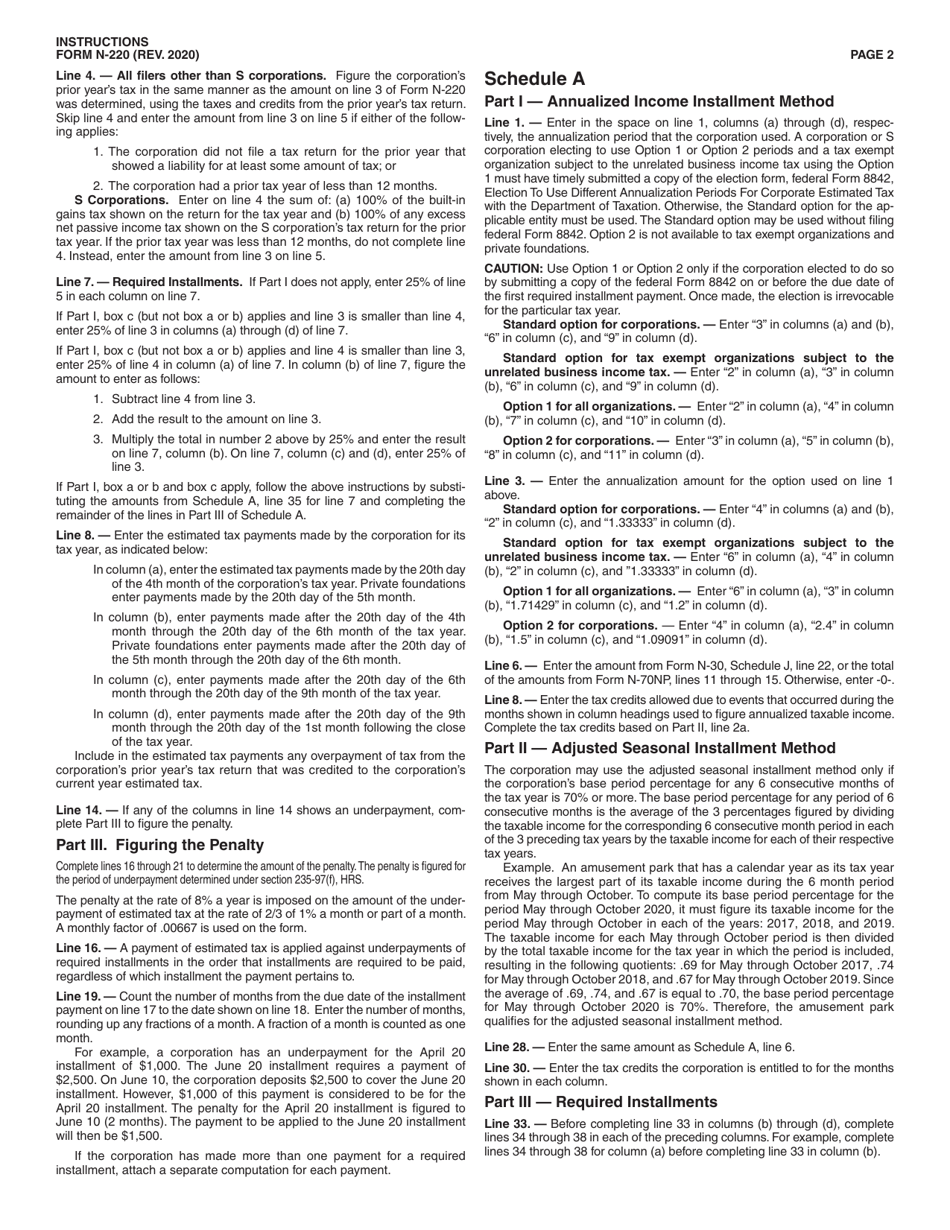

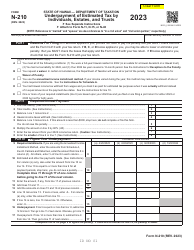

Instructions for Form N-220

for the current year.

Instructions for Form N-220 Underpayment of Estimated Tax by Corporations and S Corporations - Hawaii

This document contains official instructions for Form N-220 , Underpayment of Estimated Tax by Corporations and S Corporations - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-220 is available for download through this link.

FAQ

Q: What is Form N-220?

A: Form N-220 is used by corporations and S corporations in Hawaii to report and calculate any underpayment of estimated taxes.

Q: Who should file Form N-220?

A: Corporations and S corporations in Hawaii should file Form N-220 if they have underpaid their estimated taxes.

Q: What is considered underpayment of estimated taxes?

A: Underpayment of estimated taxes occurs when a corporation or S corporation did not pay enough in estimated taxes throughout the year.

Q: When is Form N-220 due?

A: Form N-220 is due on the 20th day of the 4th month following the close of the tax year.

Q: Are there any penalties for underpayment of estimated taxes?

A: Yes, there may be penalties for underpayment of estimated taxes. It is important to calculate and report any underpayment accurately.

Q: Are there any special instructions or requirements for completing Form N-220?

A: Yes, be sure to follow the instructions provided with the form carefully and accurately complete all required fields.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.