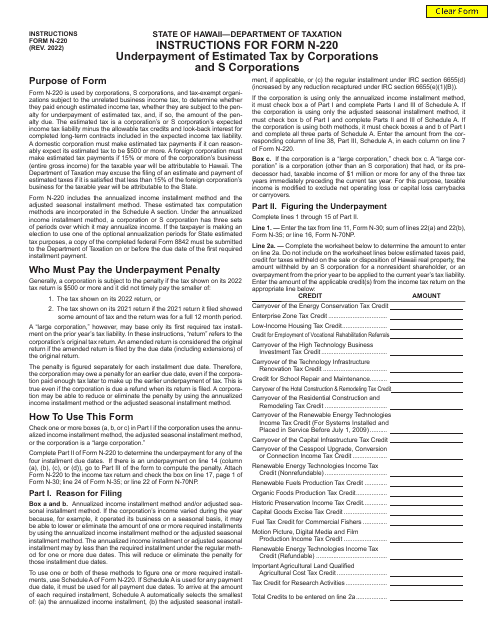

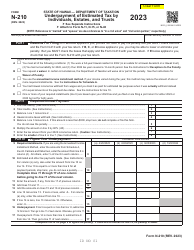

Form N-220 Underpayment of Estimated Tax by Corporations and S Corporations - Hawaii

What Is Form N-220?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-220?

A: Form N-220 is a tax form used by corporations and S corporations in Hawaii to report and calculate any underpayment of estimated tax.

Q: Who is required to use Form N-220?

A: Corporations and S corporations in Hawaii are required to use Form N-220 if they have underpaid their estimated tax.

Q: What is the purpose of Form N-220?

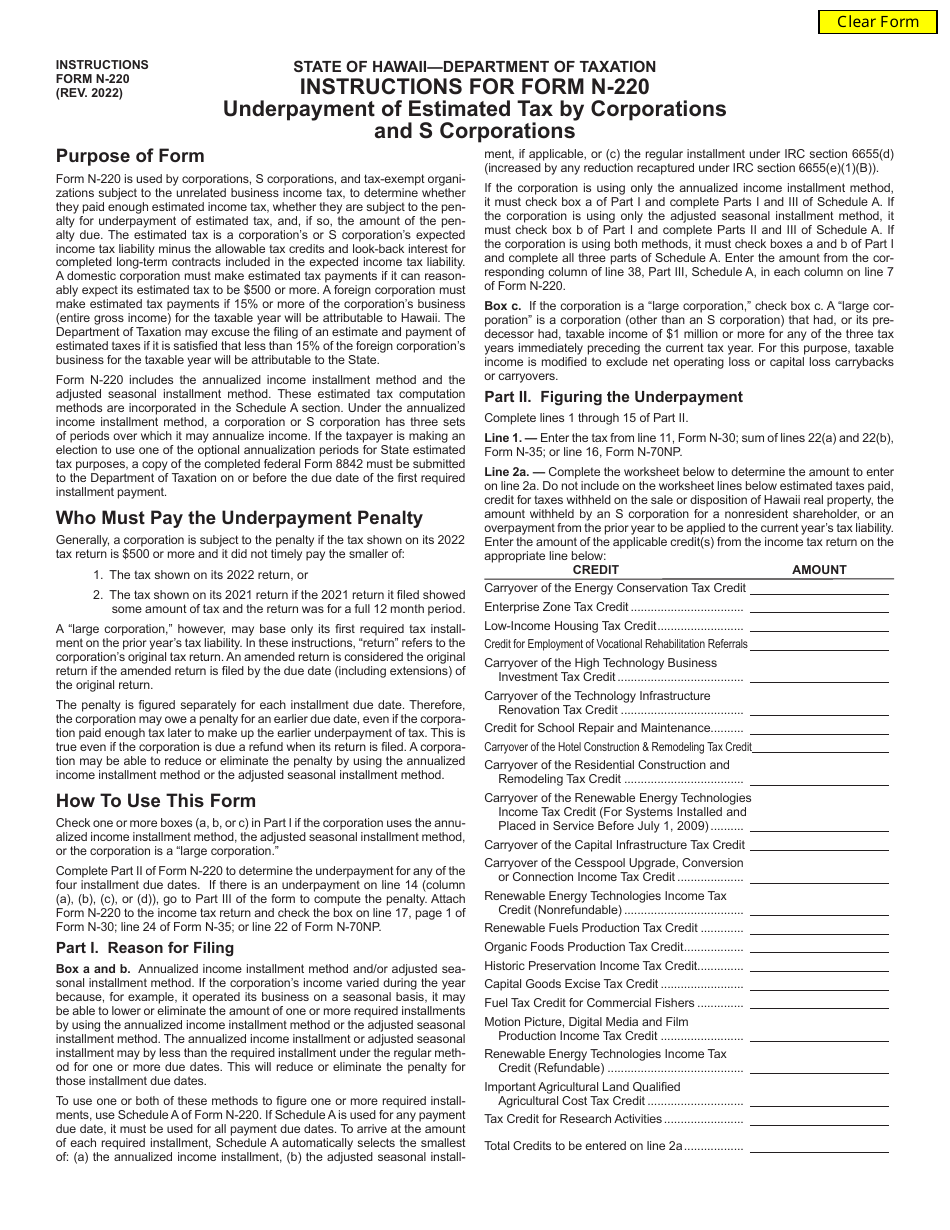

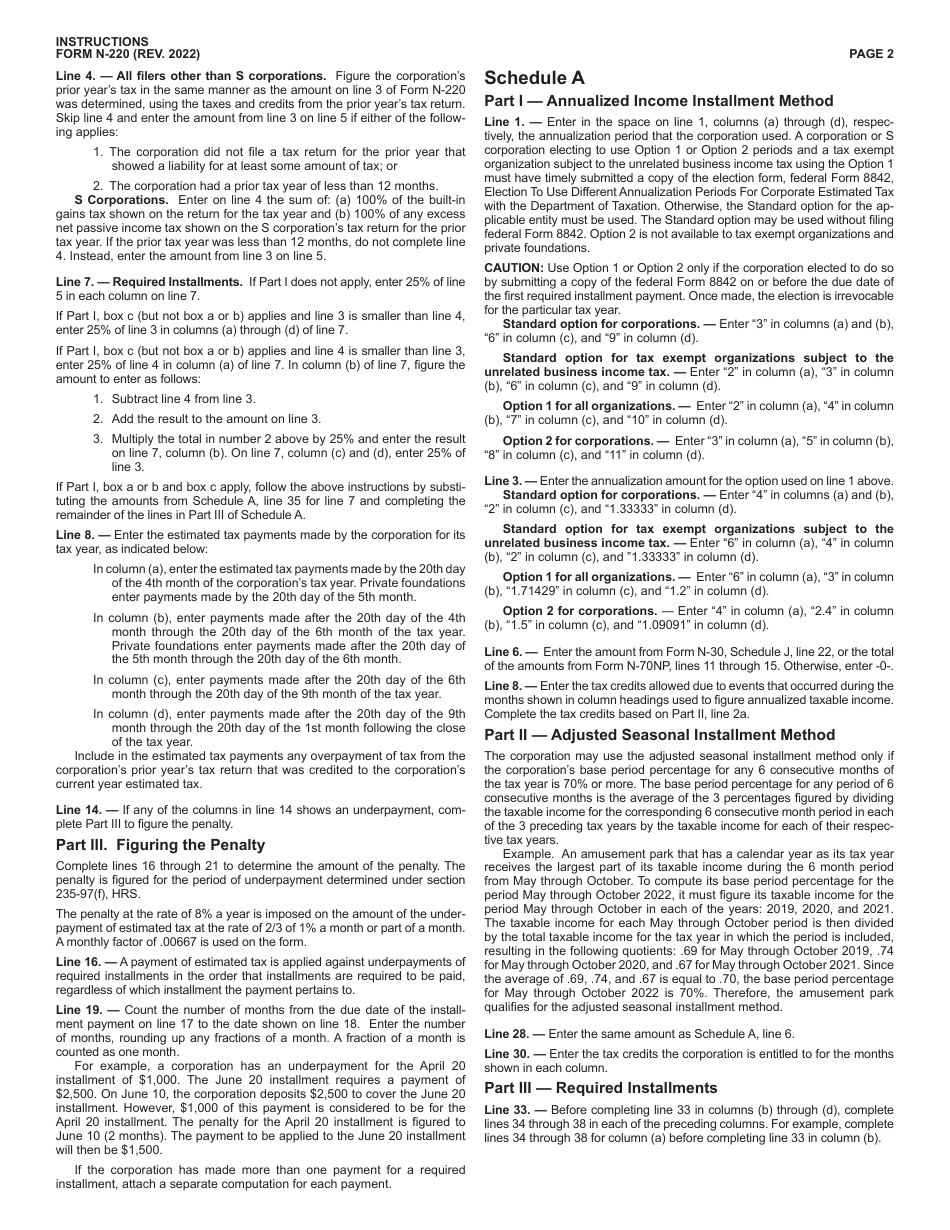

A: The purpose of Form N-220 is to determine if a corporation or S corporation in Hawaii has underpaid their estimated tax and to calculate any penalties or interest owed.

Q: How do I fill out Form N-220?

A: To fill out Form N-220, you'll need to provide information about your corporation or S corporation's estimated tax payments, any credits applied, and the total tax due.

Q: When is Form N-220 due?

A: Form N-220 is due on the 20th day of the 4th month following the close of the corporation or S corporation's tax year.

Q: What happens if I don't file Form N-220?

A: If you don't file Form N-220 or you file it late, you may be subject to penalties and interest on the underpayment of estimated tax.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-220 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.