This version of the form is not currently in use and is provided for reference only. Download this version of

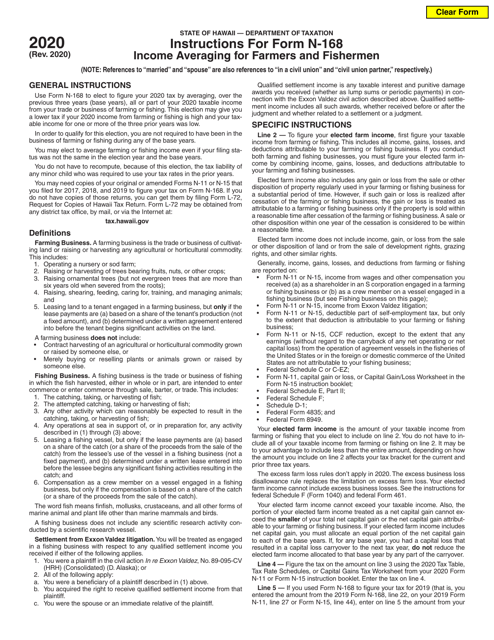

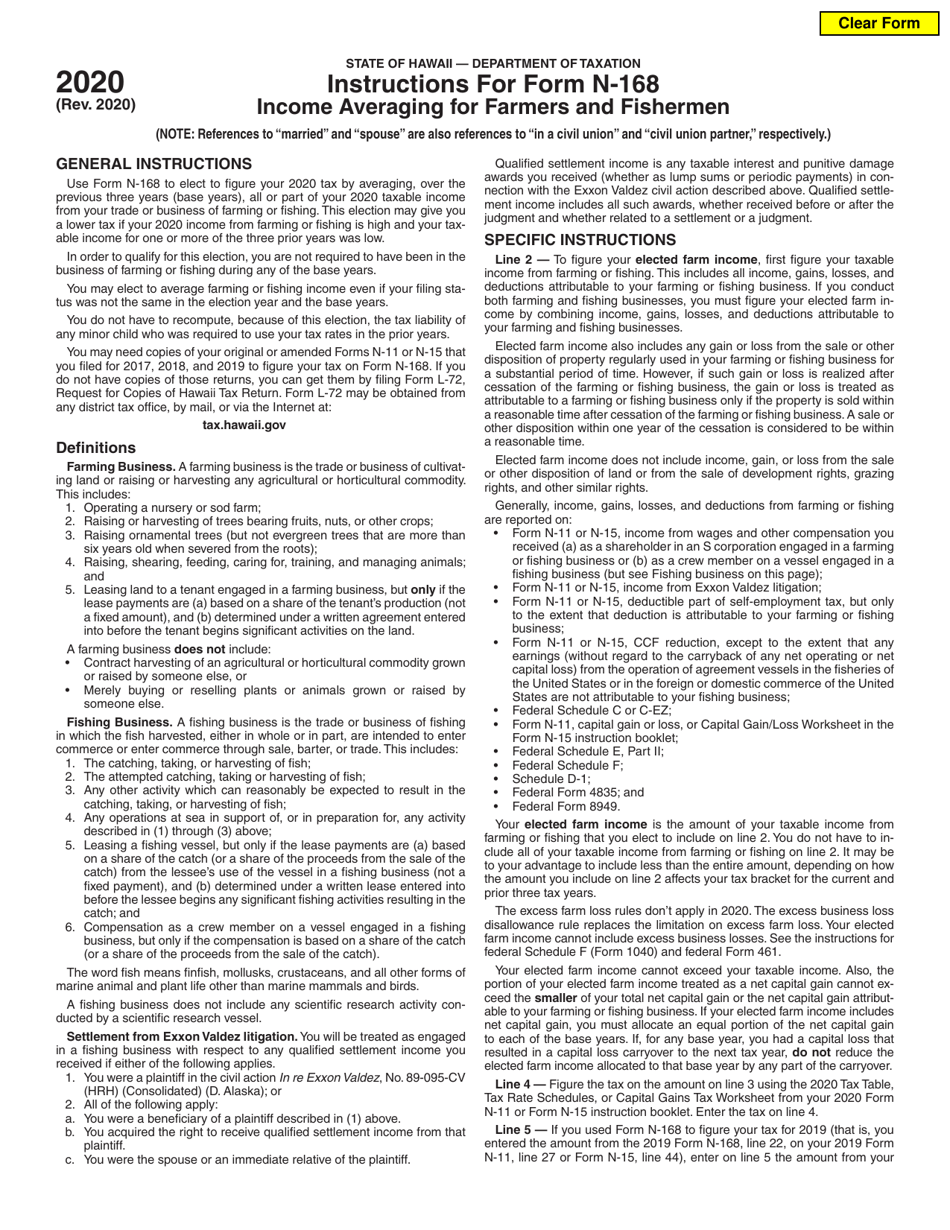

Instructions for Form N-168

for the current year.

Instructions for Form N-168 Income Averaging for Farmers and Fishermen - Hawaii

This document contains official instructions for Form N-168 , Income Averaging for Farmers and Fishermen - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-168 is available for download through this link.

FAQ

Q: What is Form N-168?

A: Form N-168 is a tax form specifically for farmers and fishermen in Hawaii.

Q: Who can use Form N-168?

A: Form N-168 can be used by farmers and fishermen in Hawaii who have uneven income from year to year.

Q: What is income averaging?

A: Income averaging is a method that allows farmers and fishermen to average their income over a period of years for tax purposes.

Q: Why would farmers and fishermen want to use income averaging?

A: Farmers and fishermen may want to use income averaging to reduce their tax liability by spreading their income over several years.

Q: How does income averaging work?

A: Income averaging works by calculating the average income over a specific number of years and applying a lower tax rate to that averaged income.

Q: What are the requirements to use Form N-168?

A: To use Form N-168, you must be a farmer or fisherman in Hawaii, and you must have had at least three consecutive years of income from farming or fishing.

Q: Can I use income averaging if I have income from sources other than farming or fishing?

A: No, income averaging is only available for income derived from farming or fishing activities.

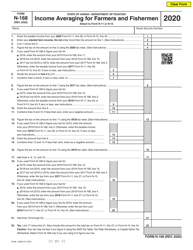

Q: How do I fill out Form N-168?

A: You can find detailed instructions and guidelines for filling out Form N-168 in the official IRS instructions for the form.

Q: Can I e-file Form N-168?

A: No, Form N-168 cannot be e-filed. It must be filed by mail with the appropriate tax office in Hawaii.

Q: When is the deadline to file Form N-168?

A: The deadline to file Form N-168 is the same as the deadline to file your federal income tax return for the year. It is usually April 15th, but it may vary depending on holidays and weekends.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.