This version of the form is not currently in use and is provided for reference only. Download this version of

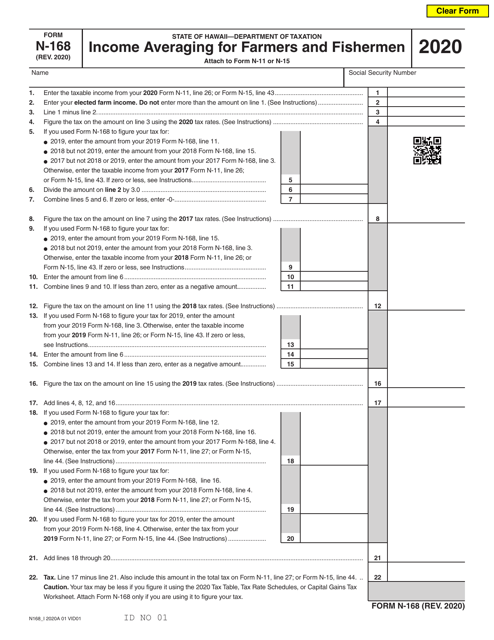

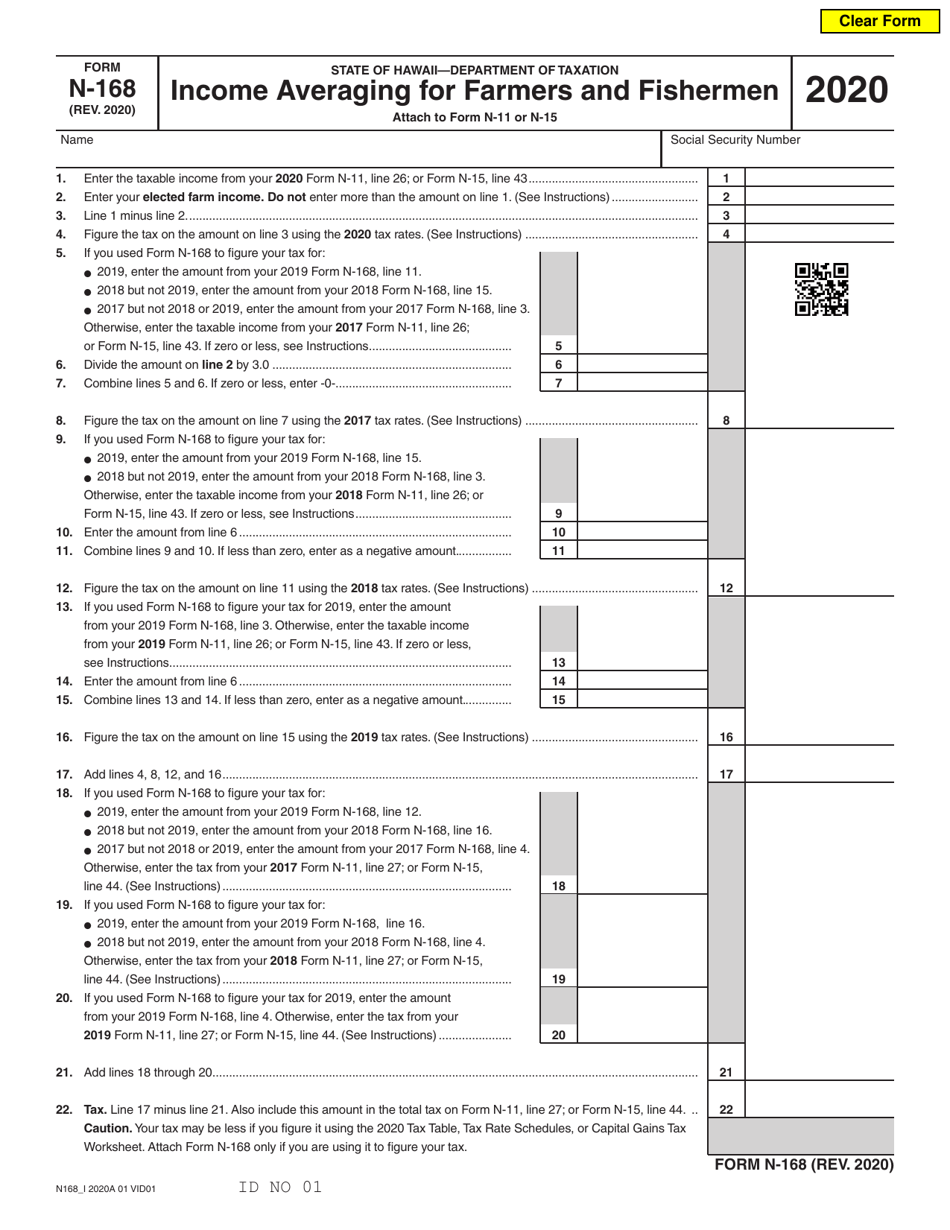

Form N-168

for the current year.

Form N-168 Income Averaging for Farmers and Fishermen - Hawaii

What Is Form N-168?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-168?

A: Form N-168 is a tax form used specifically for income averaging for farmers and fishermen in Hawaii.

Q: Who can use Form N-168?

A: Form N-168 is specifically for farmers and fishermen in Hawaii.

Q: What is income averaging?

A: Income averaging allows farmers and fishermen to reduce the tax burden by spreading income over a period of years.

Q: Why would farmers and fishermen use income averaging?

A: Farmers and fishermen may choose to use income averaging to lower their taxable income and pay less in taxes.

Q: How does income averaging work?

A: Income averaging allows farmers and fishermen to calculate their tax liability based on an average of their income over the past three years.

Q: Are there any limitations to income averaging?

A: Different rules and limitations may apply to income averaging based on the state and federal tax laws.

Q: When is Form N-168 due?

A: The due date for Form N-168 may vary each year, so it is important to check with the Hawaii Department of Taxation for the specific deadline.

Q: Can I e-file Form N-168?

A: Currently, Hawaii does not support e-filing for Form N-168. It must be filed by mail.

Q: Are there any penalties for not filing Form N-168?

A: If you are required to file Form N-168 and fail to do so, you may be subject to penalties and interest on any taxes owed.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-168 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.