This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form R-210R

for the current year.

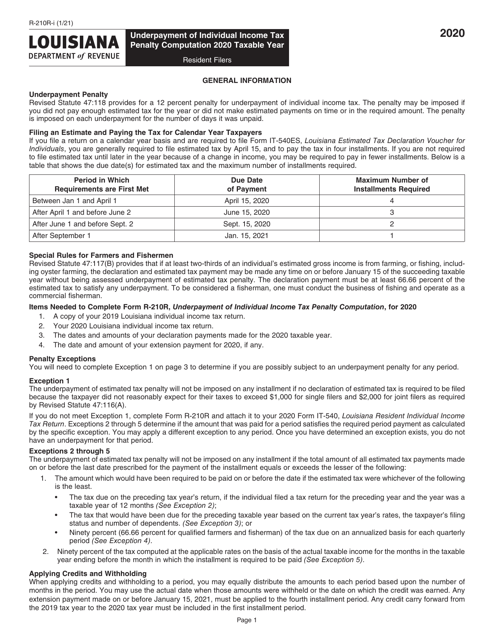

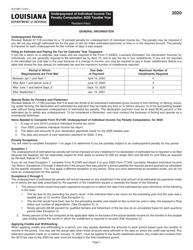

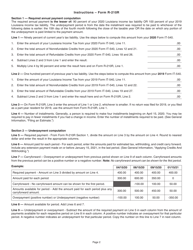

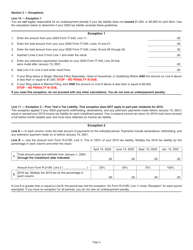

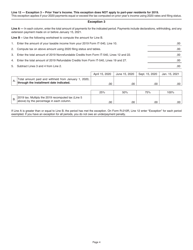

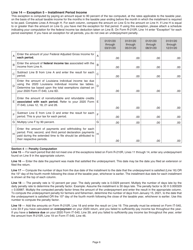

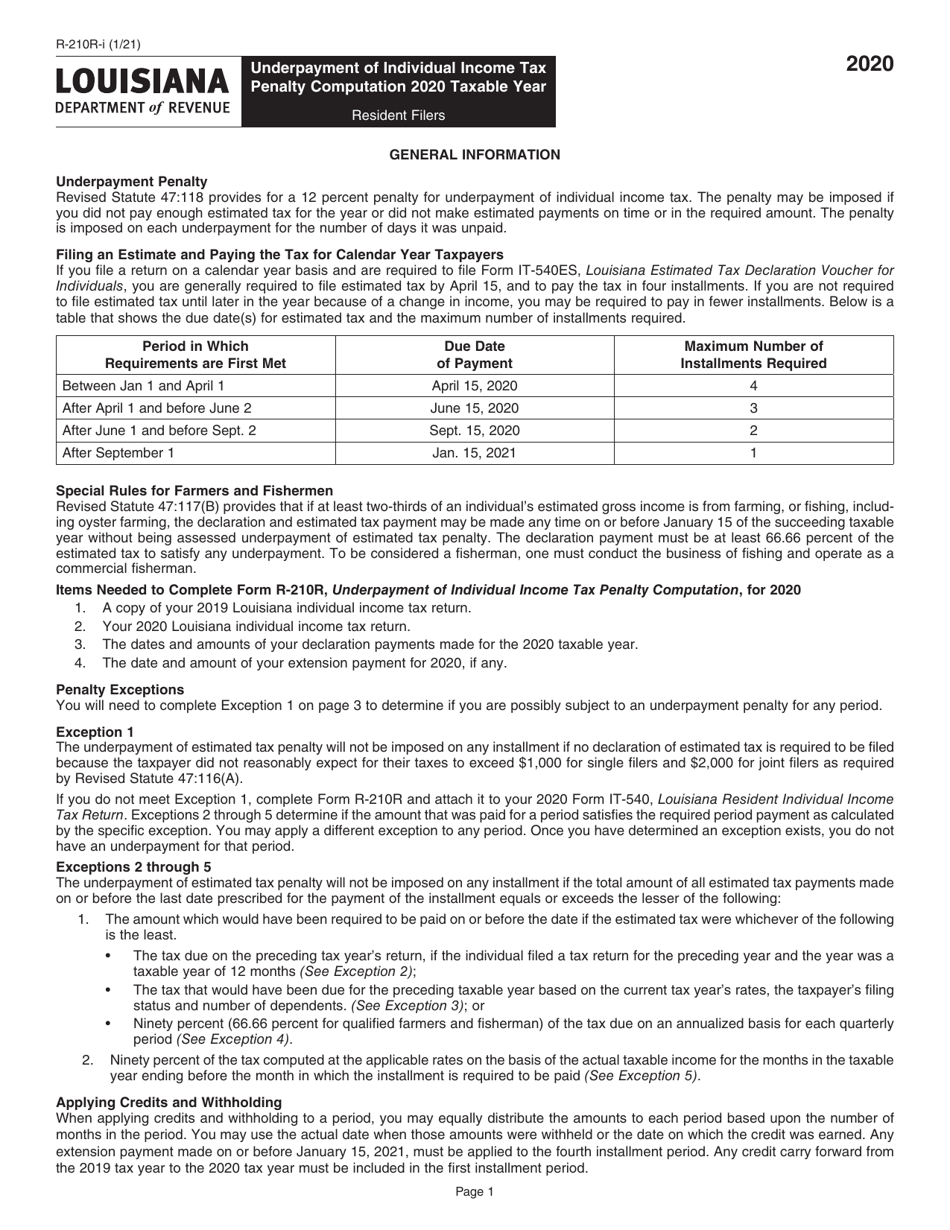

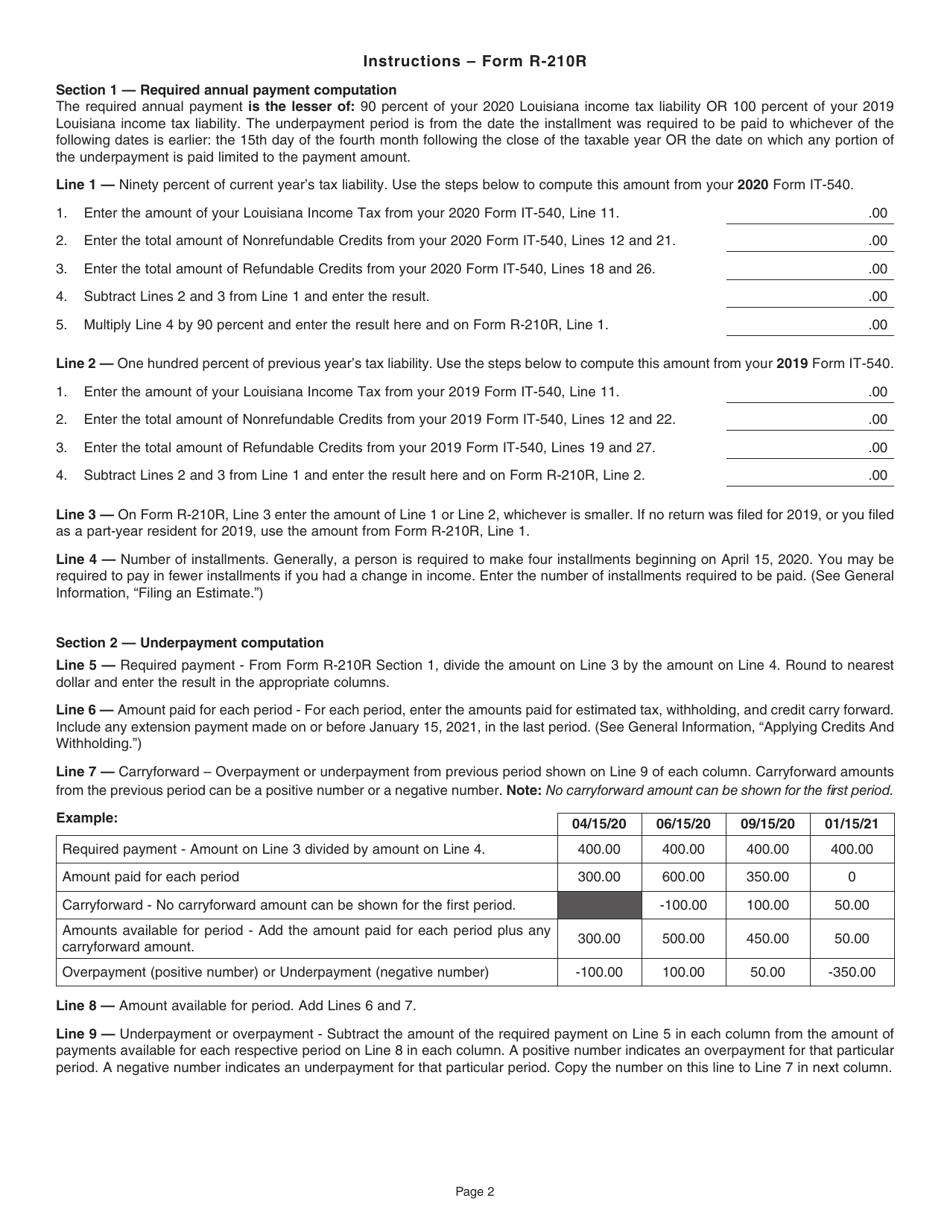

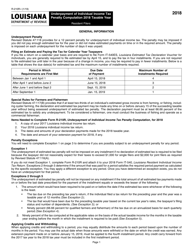

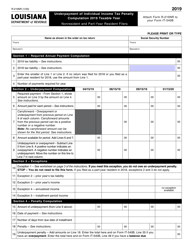

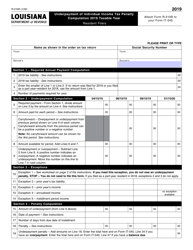

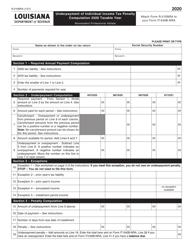

Instructions for Form R-210R Underpayment of Individual Income Tax Penalty Computation - Resident Filers - Louisiana

This document contains official instructions for Form R-210R , Underpayment of Tax Penalty Computation - Resident Filers - a form released and collected by the Louisiana Department of Revenue.

FAQ

Q: What is Form R-210R?

A: Form R-210R is a form used by Louisiana resident filers to compute the underpayment of individual income tax penalty.

Q: Who should use Form R-210R?

A: Louisiana resident filers should use Form R-210R to compute the underpayment of individual income tax penalty.

Q: What is the purpose of Form R-210R?

A: The purpose of Form R-210R is to calculate the penalty for underpayment of individual income tax.

Q: How do I fill out Form R-210R?

A: To fill out Form R-210R, you will need to provide information about your tax liability, your estimated tax payments, and any credits or withholdings.

Q: When is Form R-210R due?

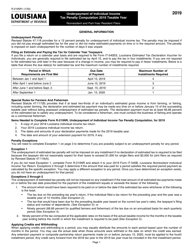

A: Form R-210R is due on the same date as your Louisiana income tax return, which is generally May 15th for calendar year filers.

Q: What happens if I don't file Form R-210R?

A: If you are required to file Form R-210R and you fail to do so, you may be subject to penalties and interest on the underpaid amount of income tax.

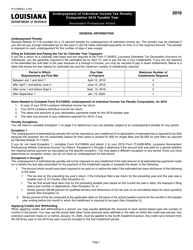

Q: Are there any exceptions to the underpayment penalty?

A: Yes, there are exceptions to the underpayment penalty. These exceptions include situations where the underpayment is due to casualty, disaster, or other unusual circumstances.

Q: Can I e-file Form R-210R?

A: Yes, you can e-file Form R-210R if you are using approved tax preparation software.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.