This version of the form is not currently in use and is provided for reference only. Download this version of

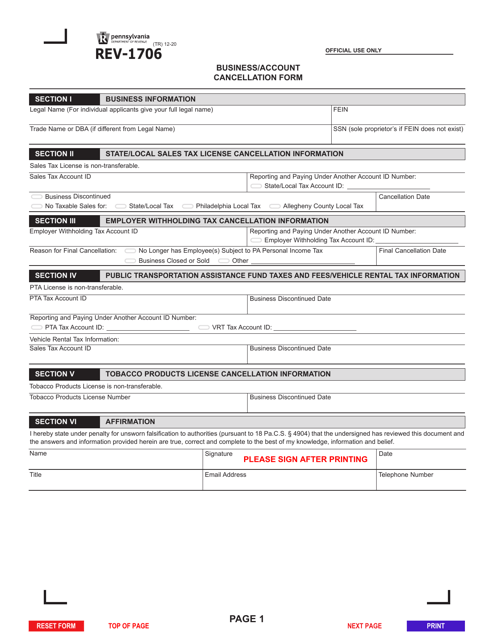

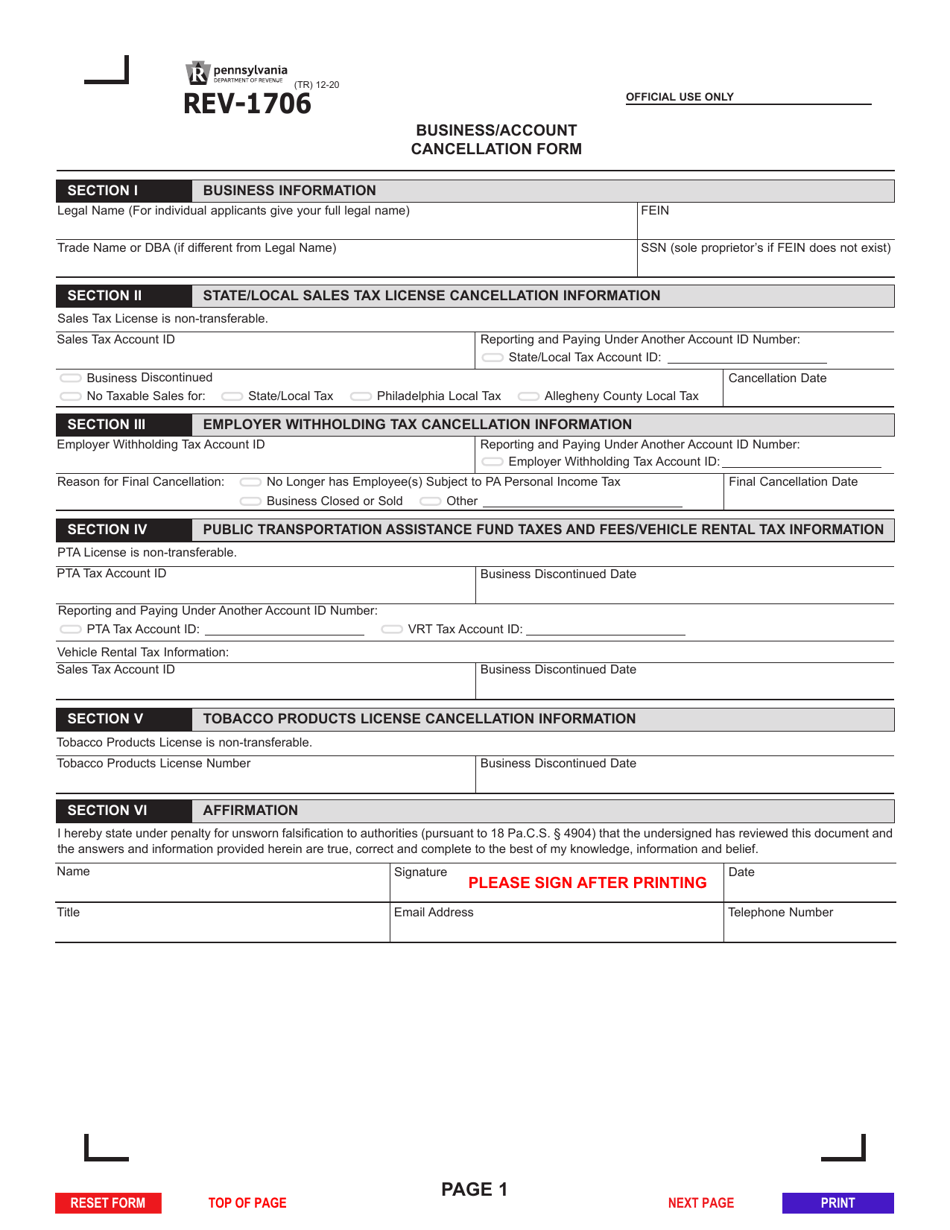

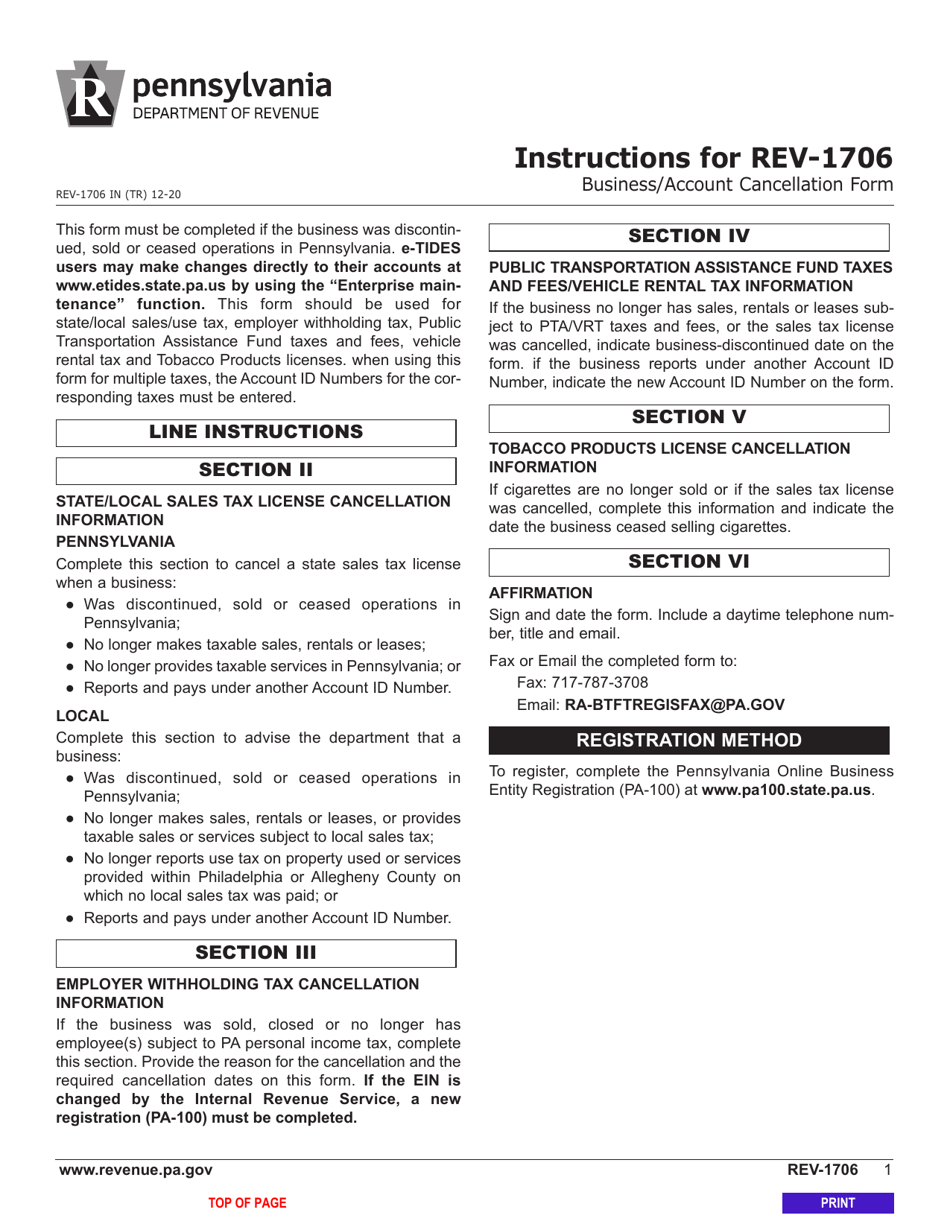

Form REV-1706

for the current year.

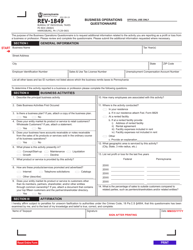

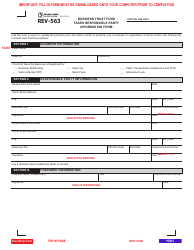

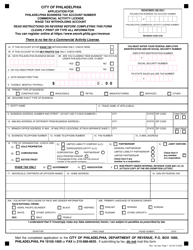

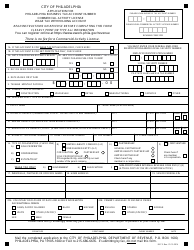

Form REV-1706 Business / Account Cancellation Form - Pennsylvania

What Is Form REV-1706?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-1706?

A: The Form REV-1706 is the Business/Account Cancellation Form used in Pennsylvania.

Q: What is the purpose of Form REV-1706?

A: The purpose of Form REV-1706 is to cancel a business or account in Pennsylvania.

Q: What information do I need to fill out Form REV-1706?

A: You will need to provide your business or account information, including your tax ID number and reason for cancellation.

Q: Is there a deadline for submitting Form REV-1706?

A: There is no specific deadline for submitting Form REV-1706, but it should be filed as soon as you decide to cancel your business or account.

Q: Are there any fees associated with submitting Form REV-1706?

A: There are no fees associated with submitting Form REV-1706.

Q: What should I do after submitting Form REV-1706?

A: After submitting Form REV-1706, you should receive confirmation from the Pennsylvania Department of Revenue. Make sure to keep a copy of the form for your records.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1706 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.