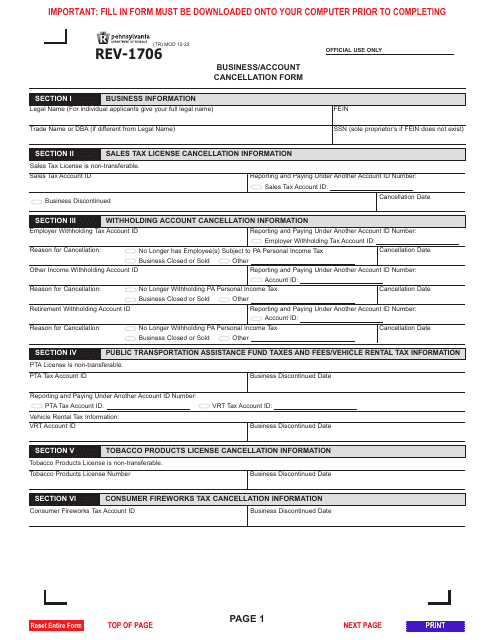

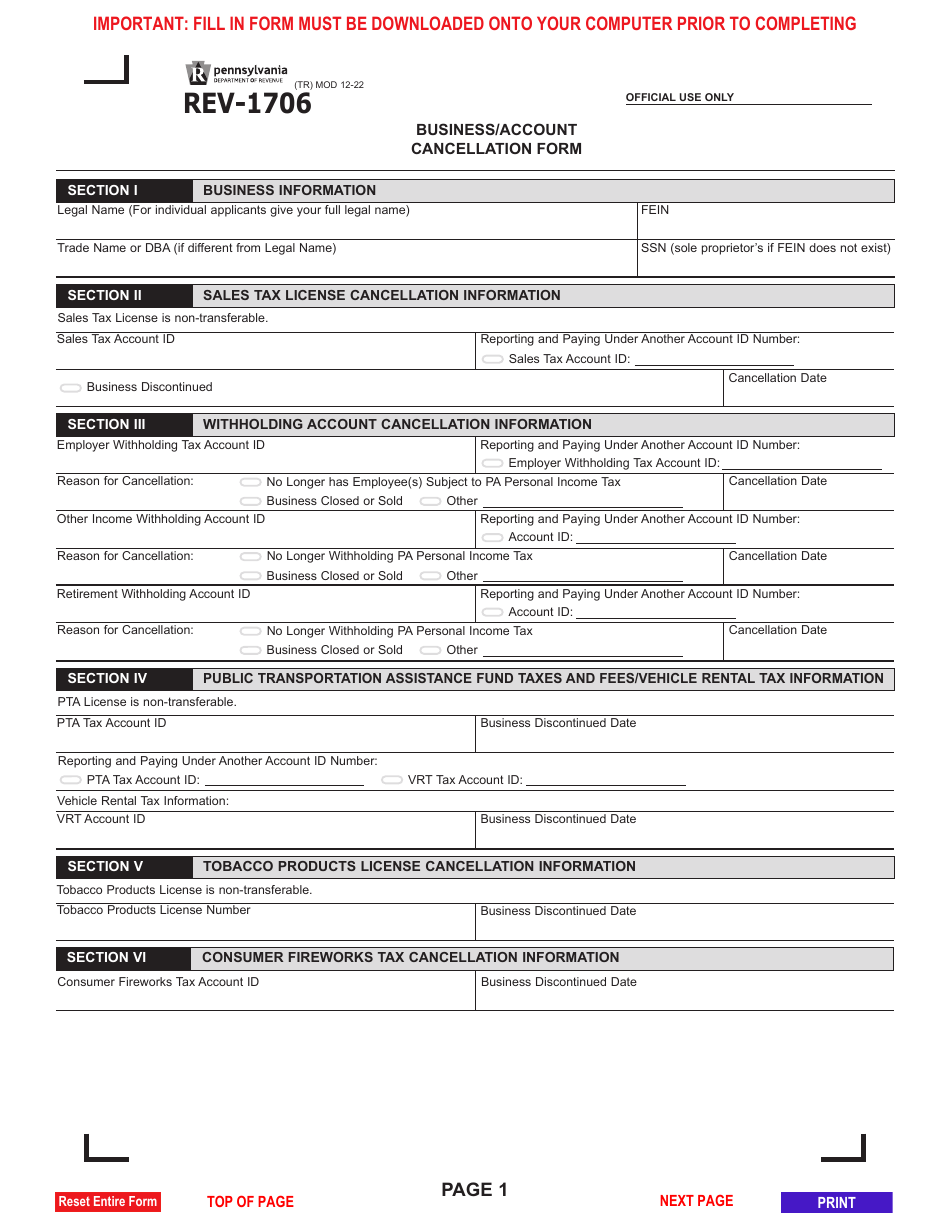

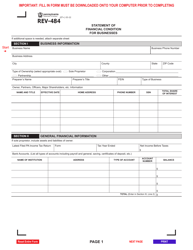

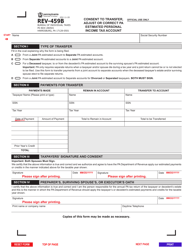

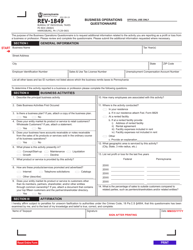

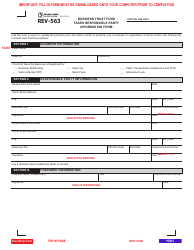

Form REV-1706 Business / Account Cancellation Form - Pennsylvania

What Is Form REV-1706?

Form REV-1706, Business/Account Cancellation Form , is a legal document you need to fill out if you discontinue or sell your business, and if you cease all business operations of an entity situated in Pennsylvania. It is completed to cancel miscellaneous licenses and taxes - state and local sales tax, employer withholding tax, public transportation assistance taxes and fees, vehicle rental tax, and a cigarette dealer's license.

Whatever the reasons for closing or selling your business in Pennsylvania - maybe, you are not making it financially, you are moving on to the next big thing, or you simply do not have the time or interest to manage it anymore - you need to make sure all filing requirementstax liabilities are satisfied and paid off. Close all the tax and revenue accounts of your company, including corporation tax, sales tax, and employer withholding accounts to protect yourself, your credit, and your reputation in the business community, especially if you ever want to own a business in the future.

This form was released by the Pennsylvania Department of Revenue . The latest version of the form was issued on December 1, 2022 , with all previous editions obsolete. You can download a fillable REV-1706 Form through the link below.

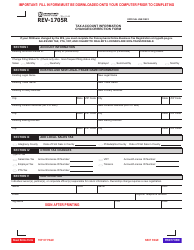

If you need to report a change in the tax account, correct the business address, select another filing status, or register to collect and remit local sales tax, complete Form REV-1705R, Tax Account Information Change/Correction Form.

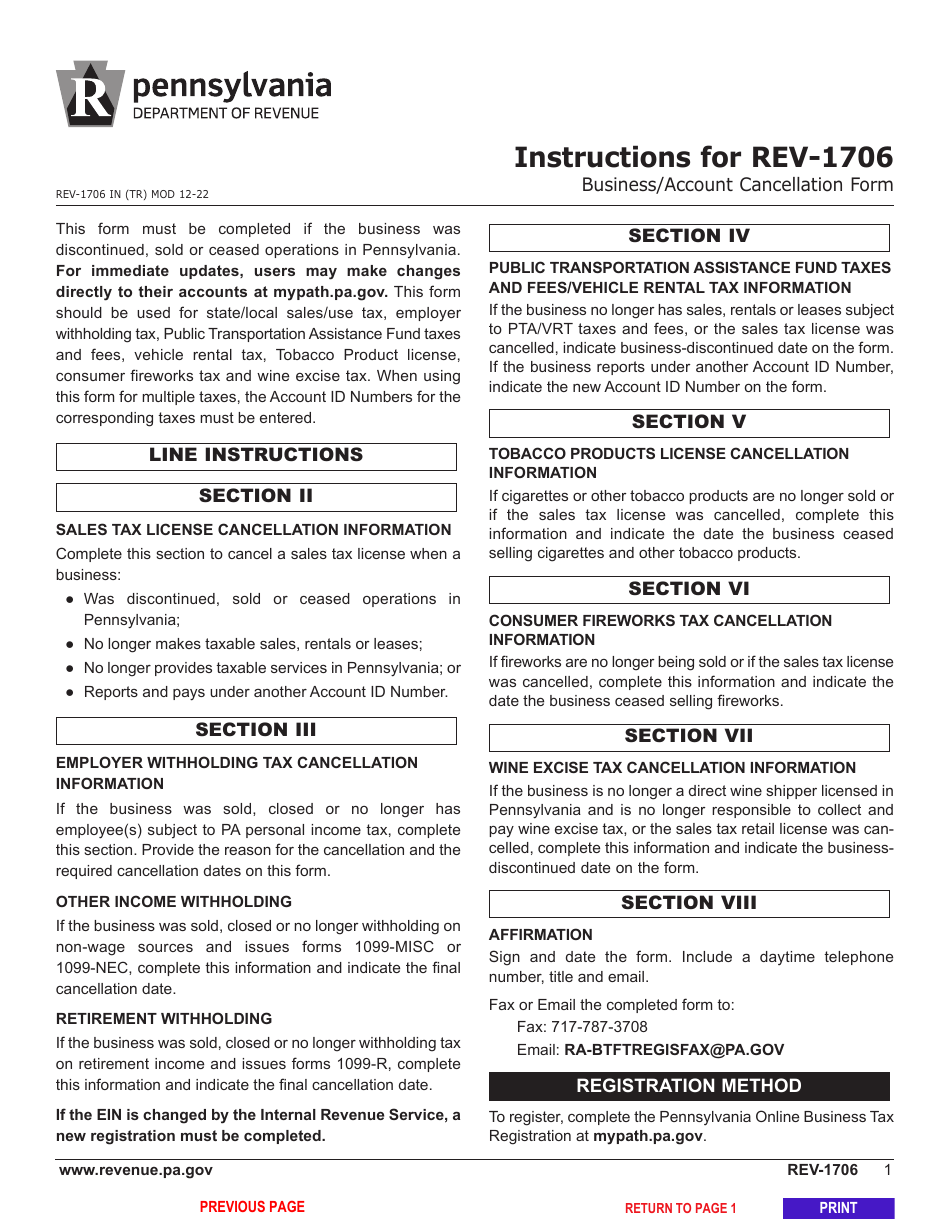

Form REV-1706 Instructions

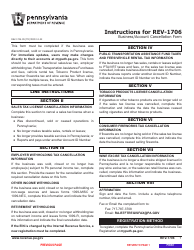

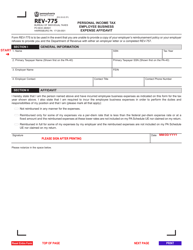

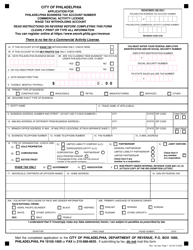

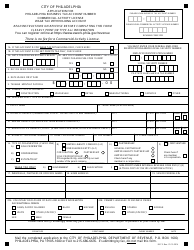

Provide the following details when filling out a REV-1706 Tax Form:

- State the legal and trade names of the entity. Indicate its ID - either an Employer Identification Number (EIN) or the owner's social security number. If your EIN was changed by the Internal Revenue Service, you will have to complete Form PA-100, Pennsylvania Enterprise Registration Form;

- Complete the first section of the form to cancel your state or local sales tax license - it is non-transferable. It is necessary if your business was sold, discontinued, ceased operations, does not make taxable sales, leases, and rentals, does not provide taxable services, or reports under another Account ID number. Indicate your sales tax Account ID number. If you have no taxable sales, record the date this information is relevant;

- If your entity was closed, sold, or no longer has employees subject to Pennsylvania personal income tax, you are required to fill out the second section. Indicate the reason for employer withholding tax cancellation and state cancellation dates;

- If the business no longer has sales, leases, or rentals subject to Public Transportation Assistance (PTA) Fund taxes or Vehicle Rental Tax (VRT) fees and charges, complete the third section of the form. Indicate the PTA tax Account ID or sales tax Account ID and the date of discontinuance;

- Complete the fourth section if you no longer sell cigarettes or your sales tax license was canceled. Record the cigarette dealer's license number, name, and social security number;

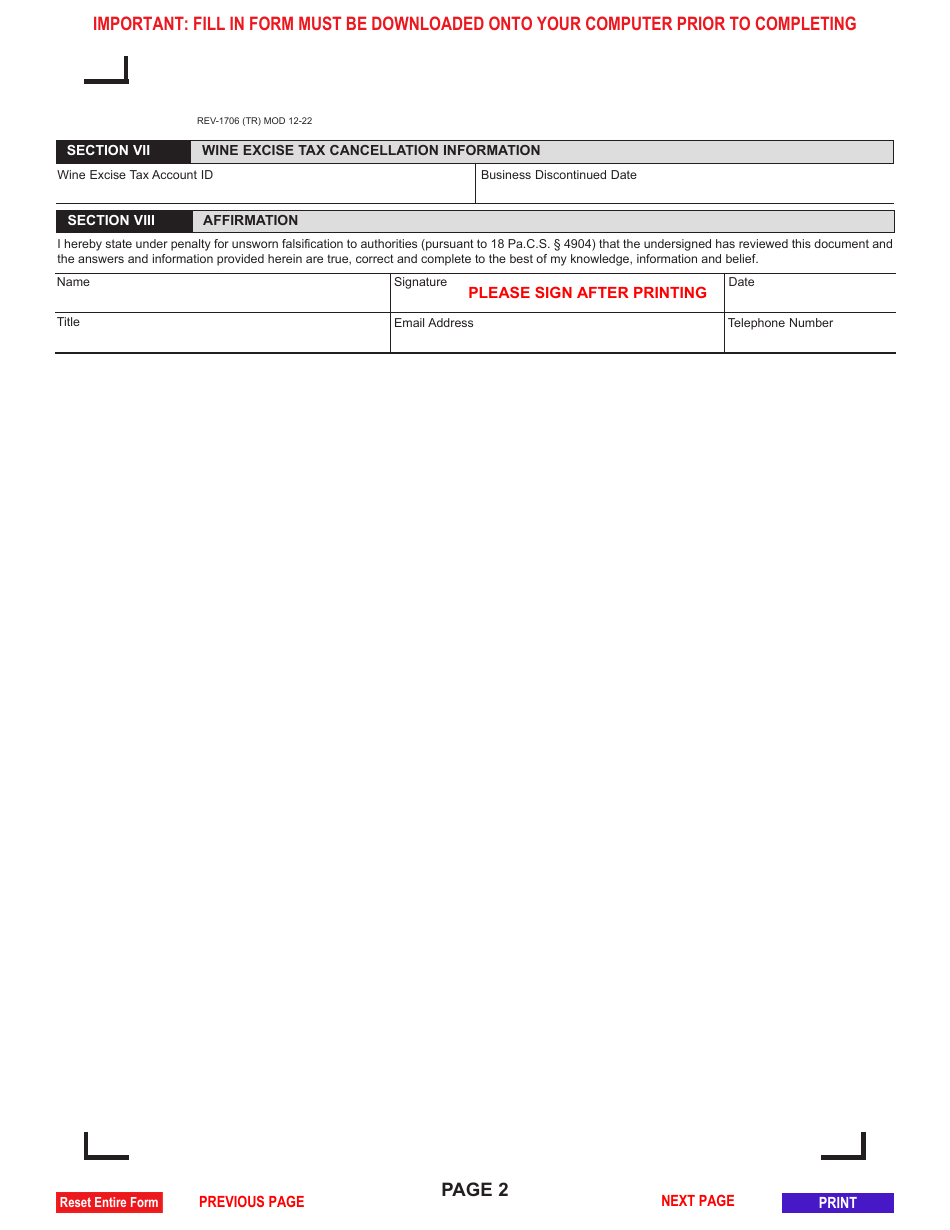

- Date the form, write down the daytime telephone number and email address, and sign the document adding your title if needed.

If you report and pay under another Account ID number, you are required to provide this information in Sections I, II, and III. When using Form PA REV-1706 for multiple taxes, you need to enter Account ID numbers for all the taxes.

How Do I Submit PA Form REV-1706?

It is not allowed to send Form REV-1706 to the Pennsylvania Department of Revenue by mail. Instead, you can choose between these two methods of filing:

- Email the form to RA-BTFTREGISFAX@PA.GOV.

- Fax the form to 717-787-3708.