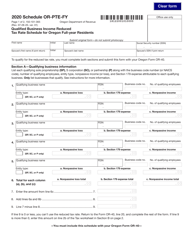

This version of the form is not currently in use and is provided for reference only. Download this version of

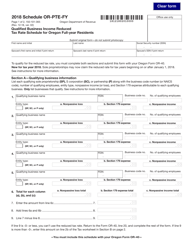

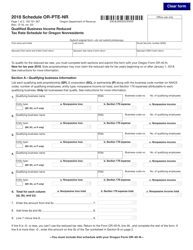

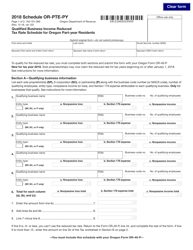

Instructions for Form 150-101-365 Schedule OR-PTE-FY

for the current year.

Instructions for Form 150-101-365 Schedule OR-PTE-FY Qualifying Business Income Reduced Tax Rate for Oregon Full-Year Residents - Oregon

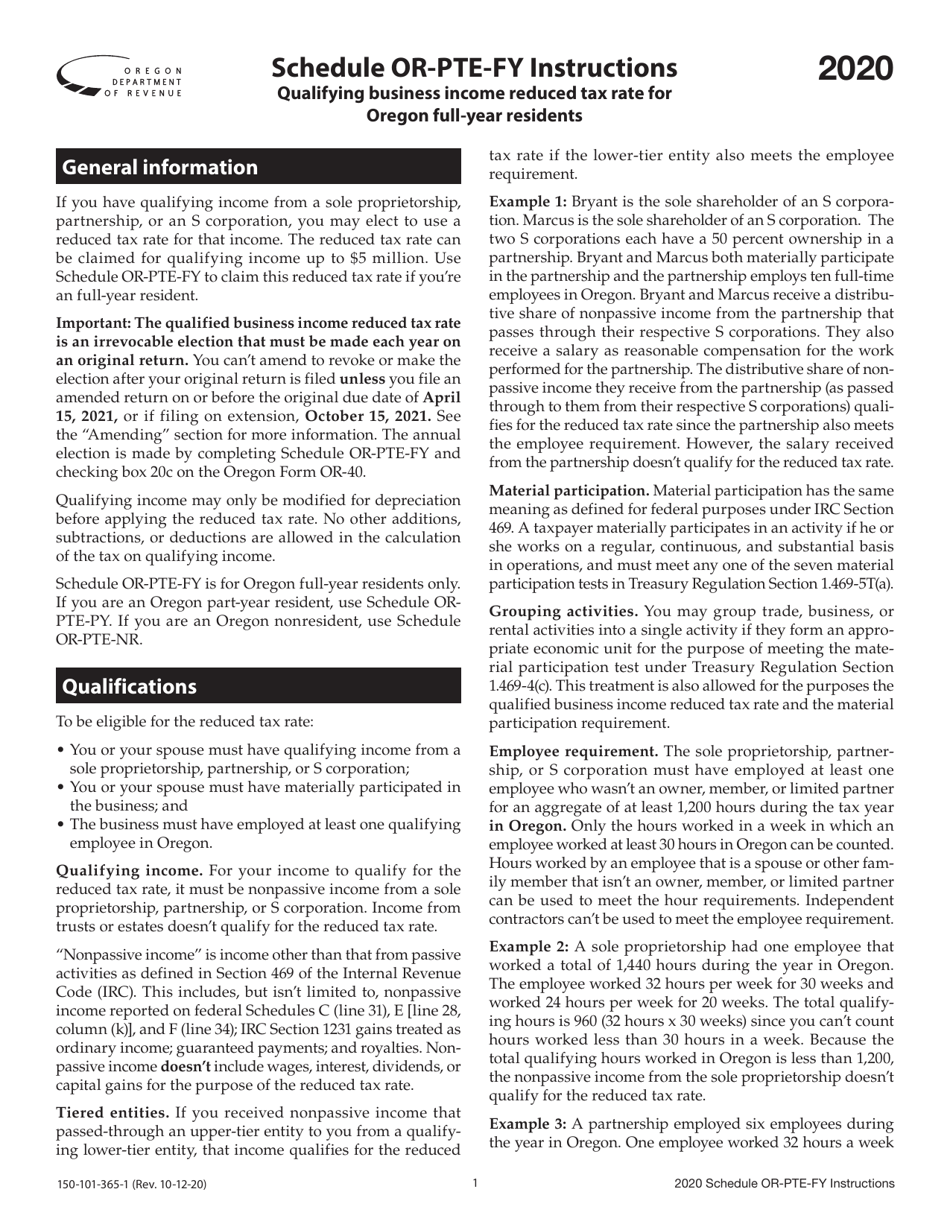

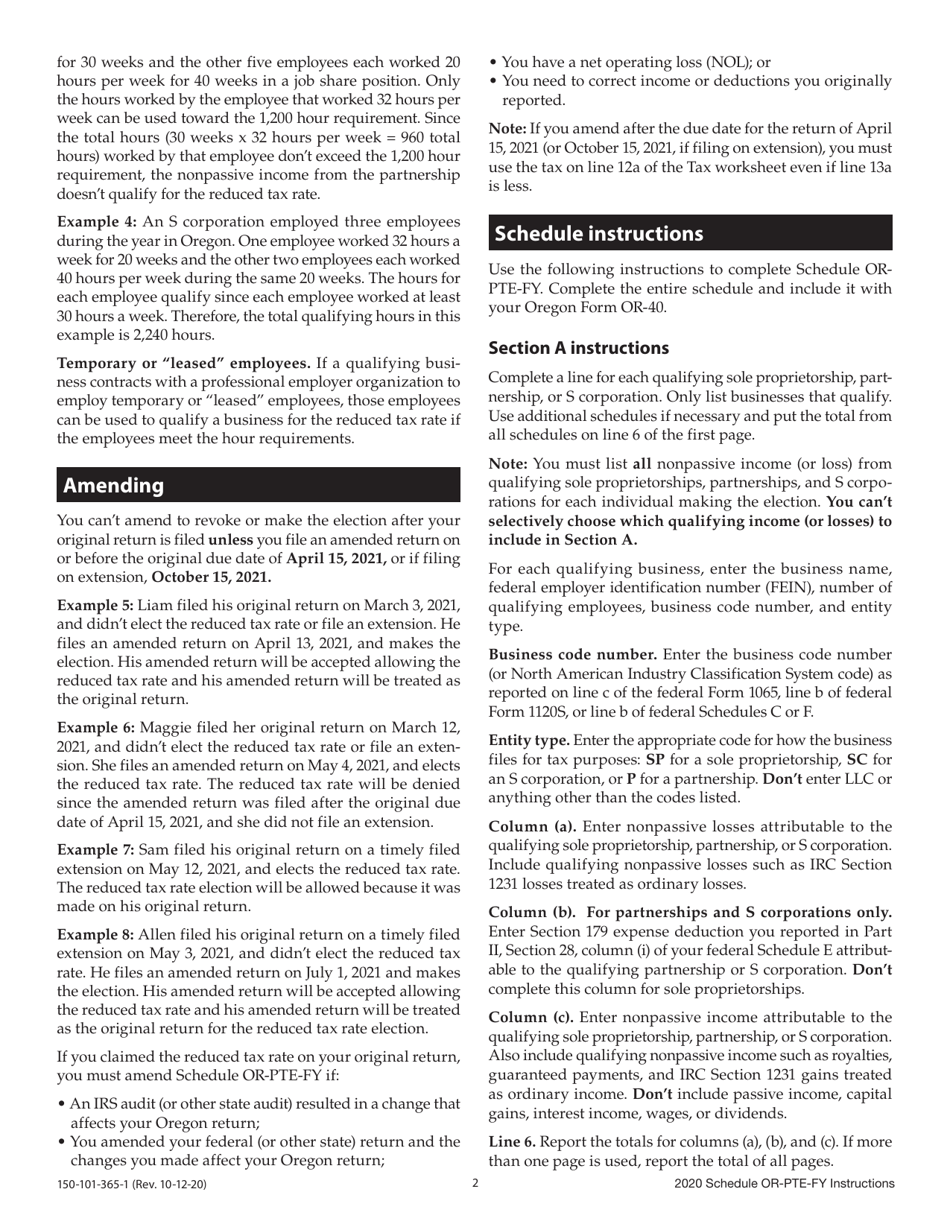

This document contains official instructions for Form 150-101-365 Schedule OR-PTE-FY, Tax Rate for Oregon Full-Year Residents - a form released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form 150-101-365 Schedule OR-PTE-FY?

A: Form 150-101-365 Schedule OR-PTE-FY is a form used by Oregon full-year residents to calculate their qualifying business incomereduced tax rate.

Q: Who needs to file Form 150-101-365 Schedule OR-PTE-FY?

A: Oregon full-year residents who have qualifying business income and want to apply for the reduced tax rate need to file Form 150-101-365 Schedule OR-PTE-FY.

Q: What is the purpose of Form 150-101-365 Schedule OR-PTE-FY?

A: The purpose of Form 150-101-365 Schedule OR-PTE-FY is to calculate the reduced tax rate for qualifying business income for Oregon full-year residents.

Q: What is qualifying business income?

A: Qualifying business income is income earned from a qualifying business, such as sole proprietorships, partnerships, and S corporations.

Q: What is the reduced tax rate for qualifying business income?

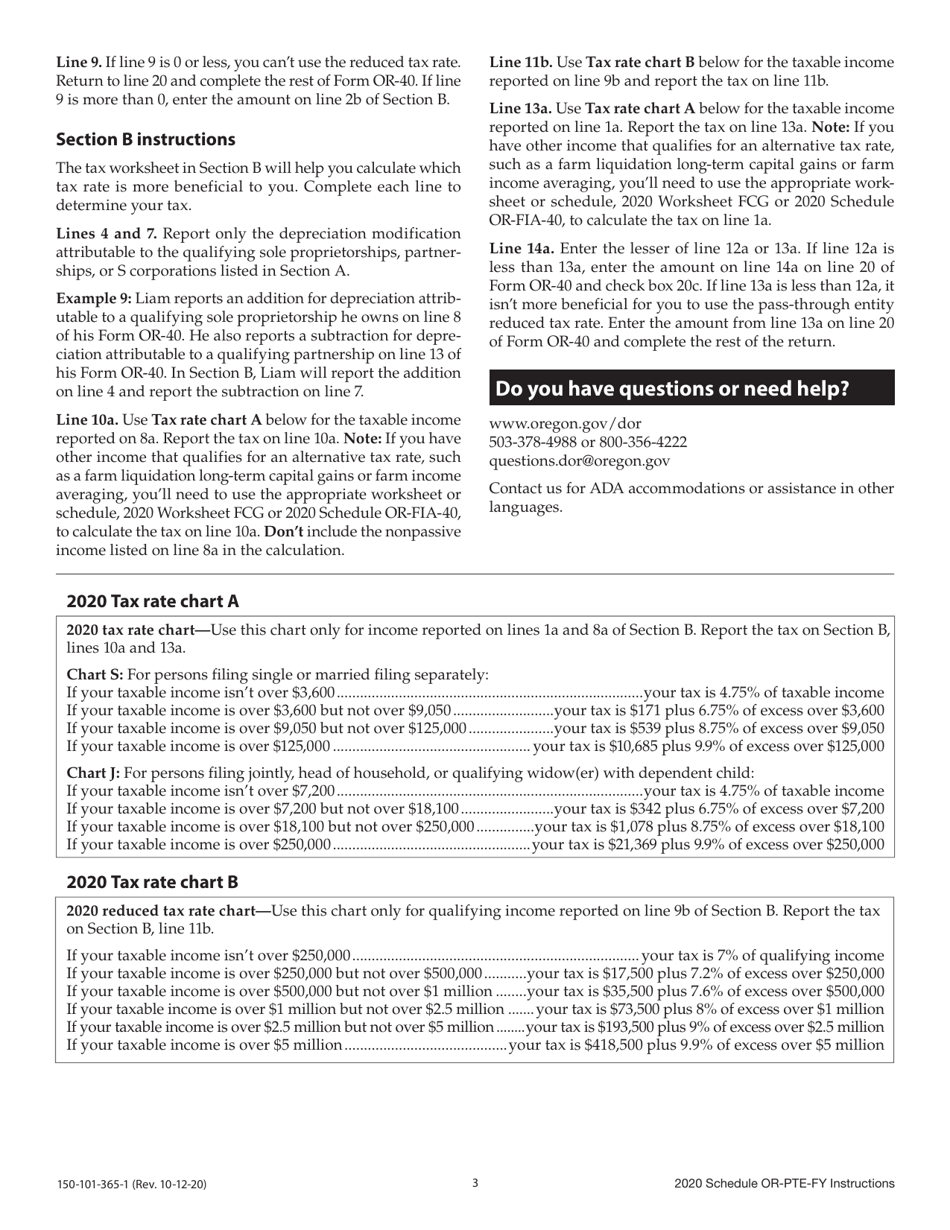

A: The reduced tax rate for qualifying business income for Oregon full-year residents is currently 9.9%.

Q: How do I fill out Form 150-101-365 Schedule OR-PTE-FY?

A: You need to fill out the required information on Form 150-101-365 Schedule OR-PTE-FY, including your personal information, qualifying business income, and any deductions or credits.

Q: Do I need to attach any additional documents with Form 150-101-365 Schedule OR-PTE-FY?

A: You may need to attach supporting documents, such as Schedule OR-PTE or federal Form 1065 or 1120S, depending on your specific situation.

Q: When is the deadline to file Form 150-101-365 Schedule OR-PTE-FY?

A: Form 150-101-365 Schedule OR-PTE-FY must be filed by the due date of your Oregon individual income tax return, which is usually April 15th or the same date as the federal tax deadline.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.