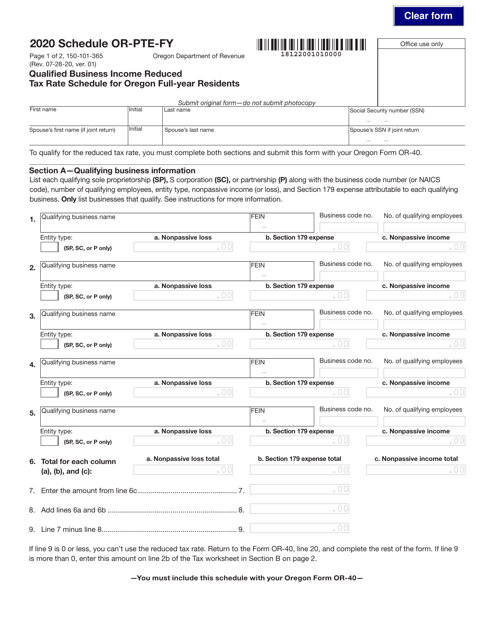

Form 50-101-365 Schedule OR-PTE-FY Qualified Business Income Reduced Tax Rate Schedule for Oregon Full-Year Residents - Oregon

What Is Form 50-101-365 Schedule OR-PTE-FY?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-101-365?

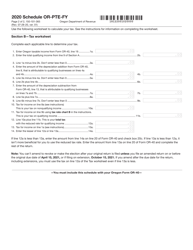

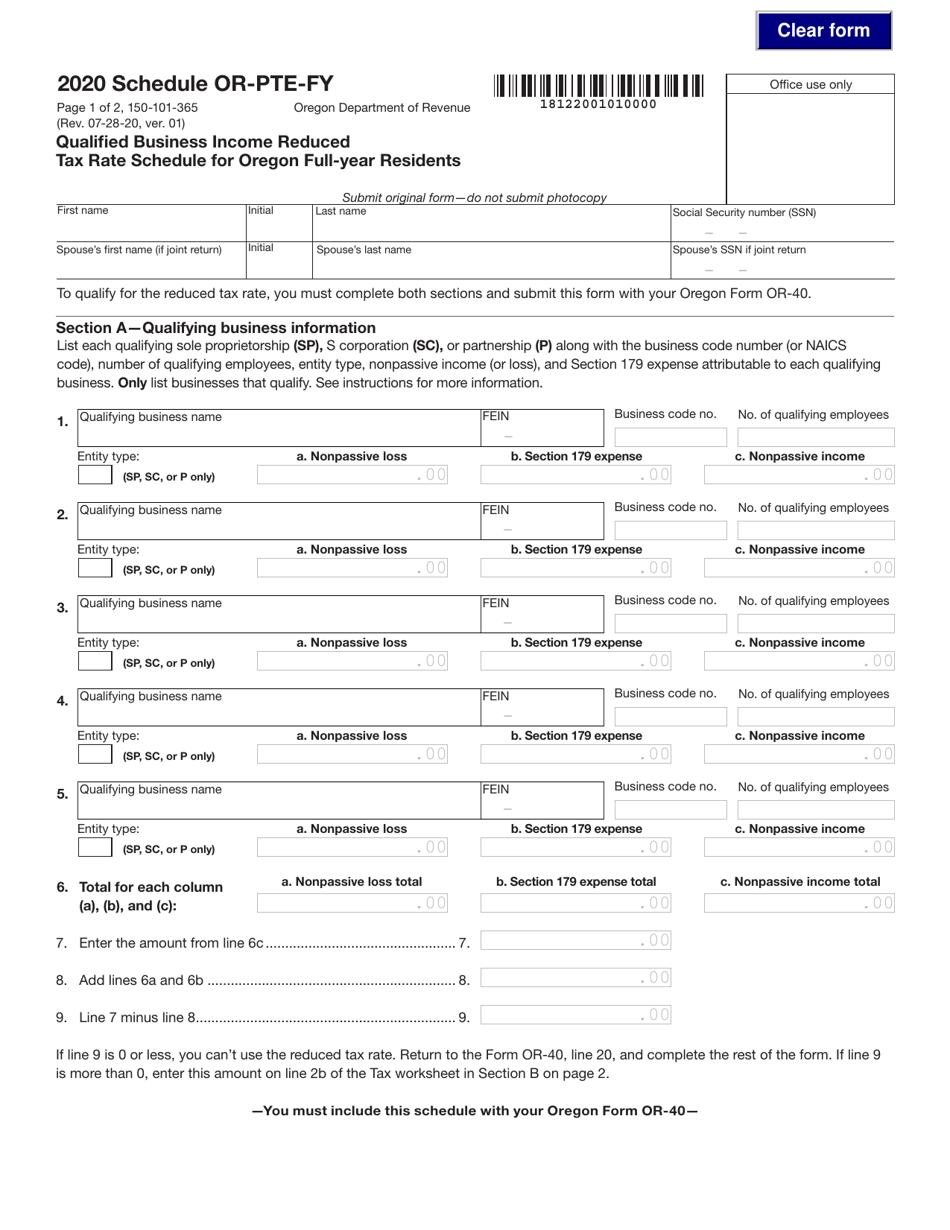

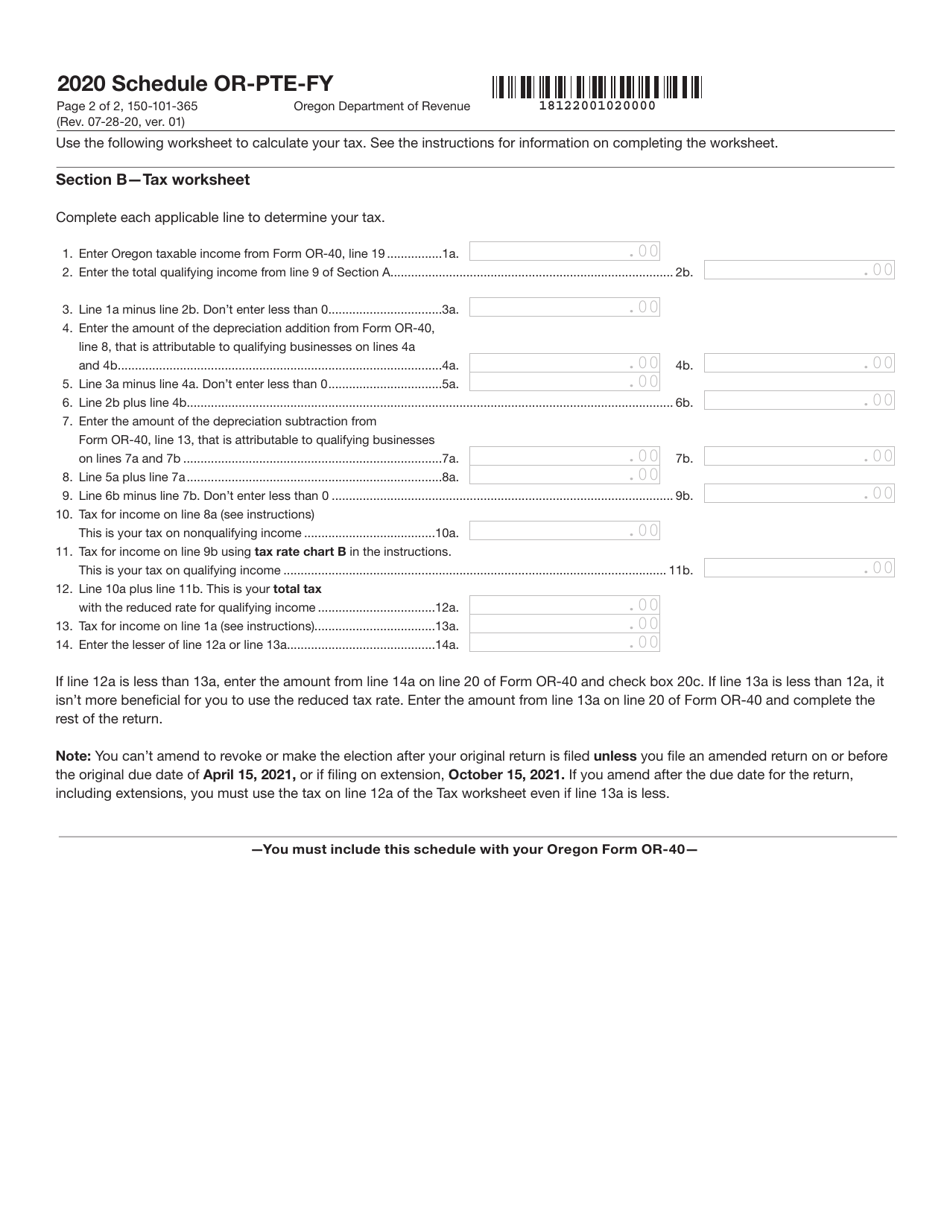

A: Form 50-101-365 is the Schedule OR-PTE-FY, which is used by Oregon full-year residents to calculate the reduced tax rate on qualified business income.

Q: Who should use Form 50-101-365?

A: Oregon full-year residents who have qualified business income and want to apply for the reduced tax rate should use Form 50-101-365.

Q: What does the Schedule OR-PTE-FY calculate?

A: The Schedule OR-PTE-FY calculates the reduced tax rate on qualified business income for Oregon full-year residents.

Q: What is qualified business income?

A: Qualified business income is income from certain pass-through entities such as partnerships, S corporations, and sole proprietorships.

Q: Why would someone want to use the reduced tax rate?

A: Using the reduced tax rate can lower the tax liability for individuals with qualified business income.

Q: Are there any eligibility criteria to use the reduced tax rate?

A: Yes, there are certain eligibility criteria to use the reduced tax rate. It is recommended to refer to the instructions provided with Form 50-101-365 for detailed eligibility requirements.

Q: Do I need any other forms or schedules to complete Form 50-101-365?

A: It is possible that you might need to fill out other forms or schedules, depending on your individual tax situation. It is recommended to review the instructions provided with Form 50-101-365 for any additional requirements.

Form Details:

- Released on July 28, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-101-365 Schedule OR-PTE-FY by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.