This version of the form is not currently in use and is provided for reference only. Download this version of

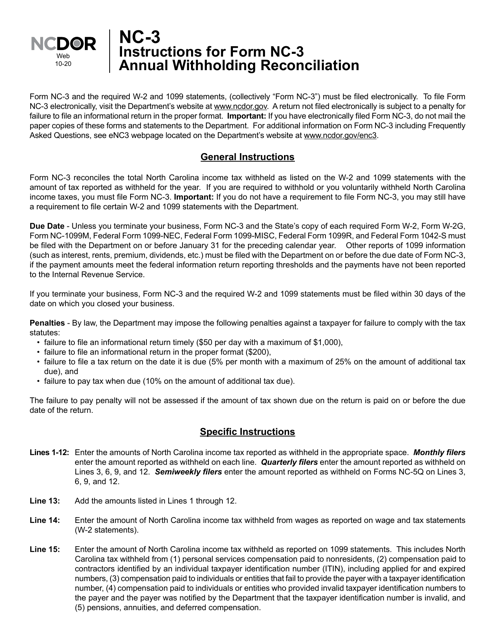

Instructions for Form NC-3

for the current year.

Instructions for Form NC-3 Annual Withholding Reconciliation - North Carolina

This document contains official instructions for Form NC-3 , Annual Withholding Reconciliation - a form released and collected by the North Carolina Department of Revenue. An up-to-date fillable Form NC-3 is available for download through this link.

FAQ

Q: What is Form NC-3?

A: Form NC-3 is an Annual Withholding Reconciliation form used in North Carolina.

Q: Who needs to file Form NC-3?

A: Employers in North Carolina who have employees subject to income tax withholding need to file Form NC-3.

Q: When is Form NC-3 due?

A: Form NC-3 is due on or before January 31st of the following year.

Q: What information do I need to complete Form NC-3?

A: You will need information such as the total amount of wages paid, total amount of North Carolina income tax withheld, and the number of employees.

Q: Can Form NC-3 be filed electronically?

A: Yes, you can file Form NC-3 electronically.

Q: Is there a penalty for late filing or failure to file Form NC-3?

A: Yes, there may be penalties for late filing or failure to file Form NC-3. It is important to file on time to avoid any penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Carolina Department of Revenue.