This version of the form is not currently in use and is provided for reference only. Download this version of

Form NC-3

for the current year.

Form NC-3 Annual Withholding Reconciliation - North Carolina

What Is Form NC-3?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

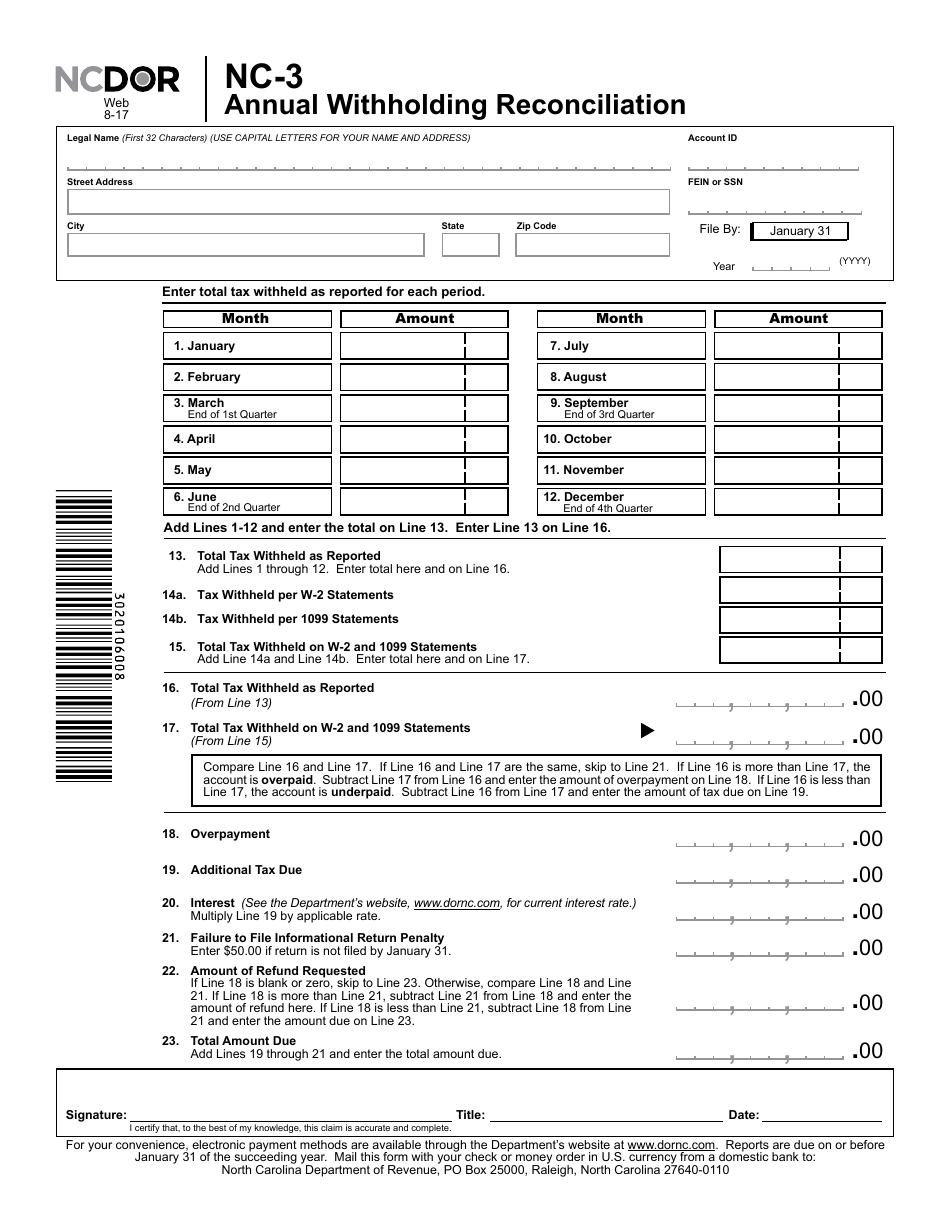

Q: What is Form NC-3?

A: Form NC-3 is the Annual Withholding Reconciliation form for North Carolina.

Q: Who needs to file Form NC-3?

A: Employers who withhold North Carolina income tax from their employees' wages need to file Form NC-3.

Q: When is Form NC-3 due?

A: Form NC-3 is due on or before January 31st of the following year.

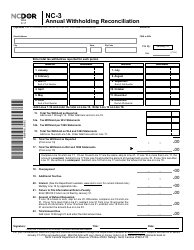

Q: What information is required on Form NC-3?

A: Form NC-3 requires information on the employer's identification, total number of employees, total wages paid, and total withholding.

Q: Are there any penalties for late filing of Form NC-3?

A: Yes, there are penalties for late filing of Form NC-3. It is important to file the form on time to avoid penalties.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-3 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.