This version of the form is not currently in use and is provided for reference only. Download this version of

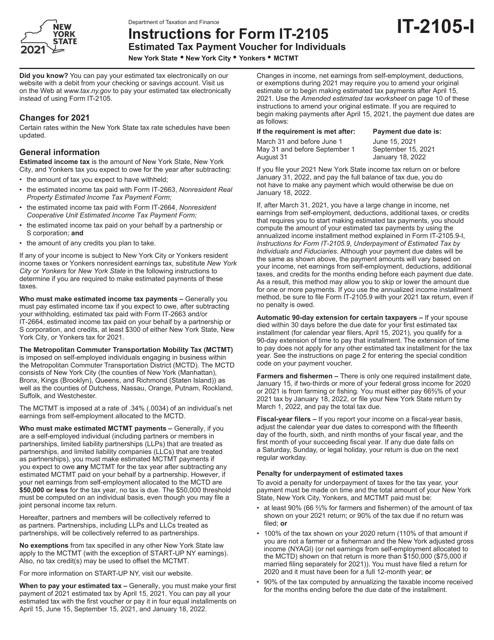

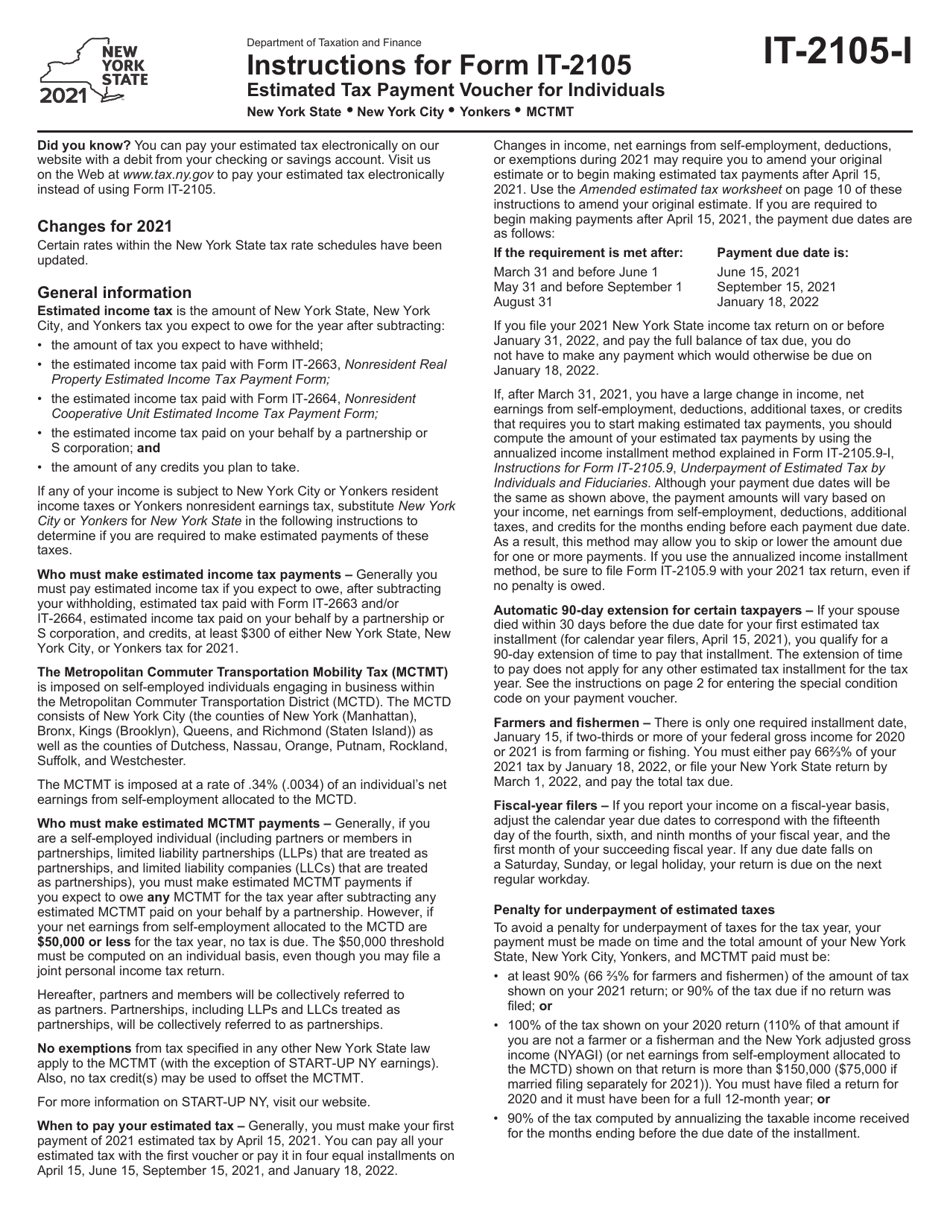

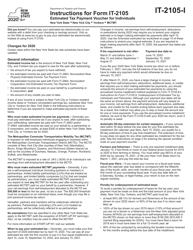

Instructions for Form IT-2105

for the current year.

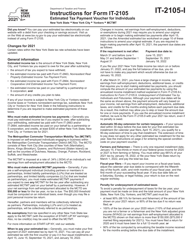

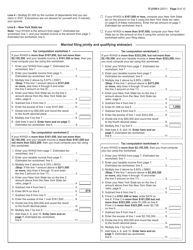

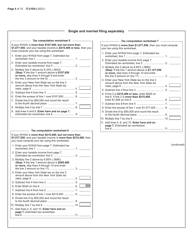

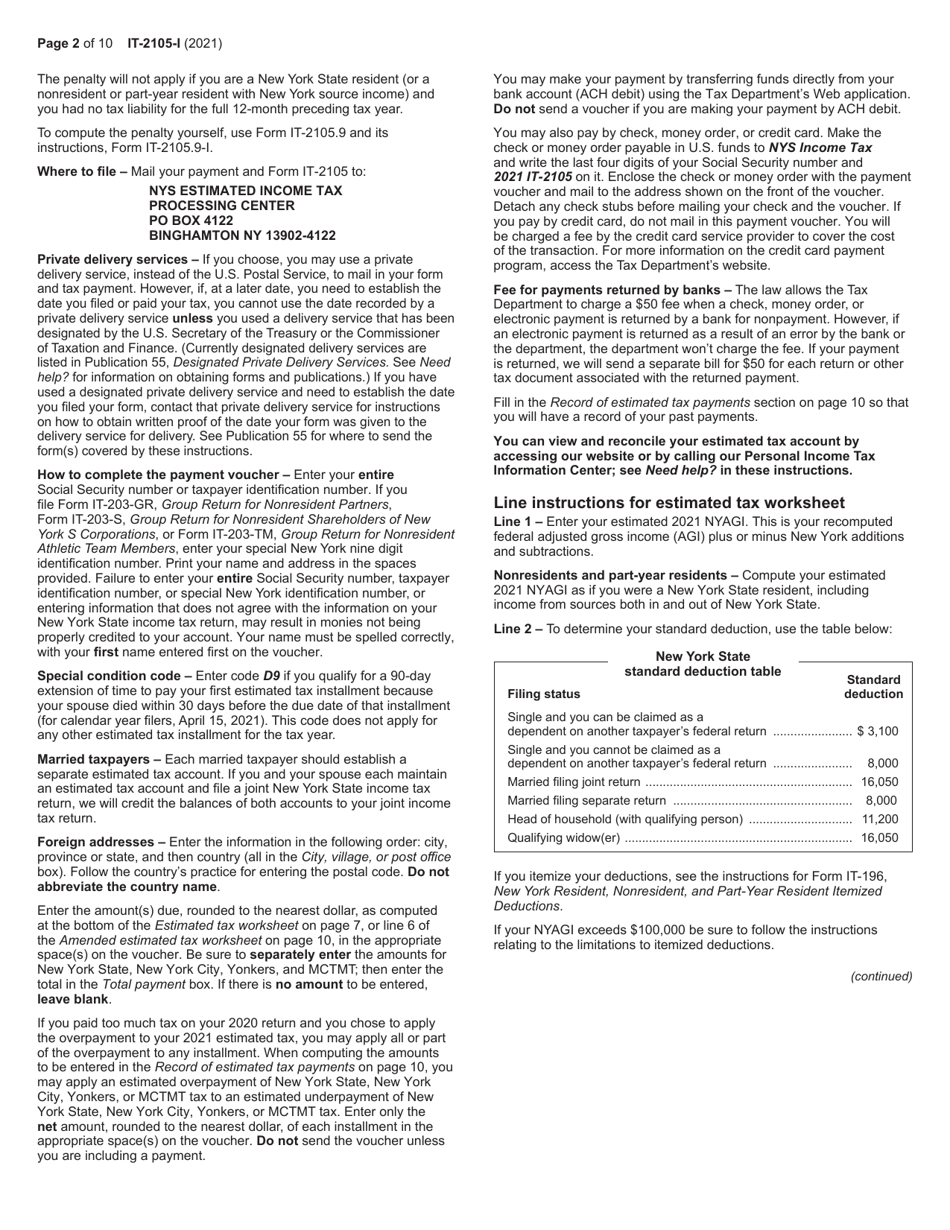

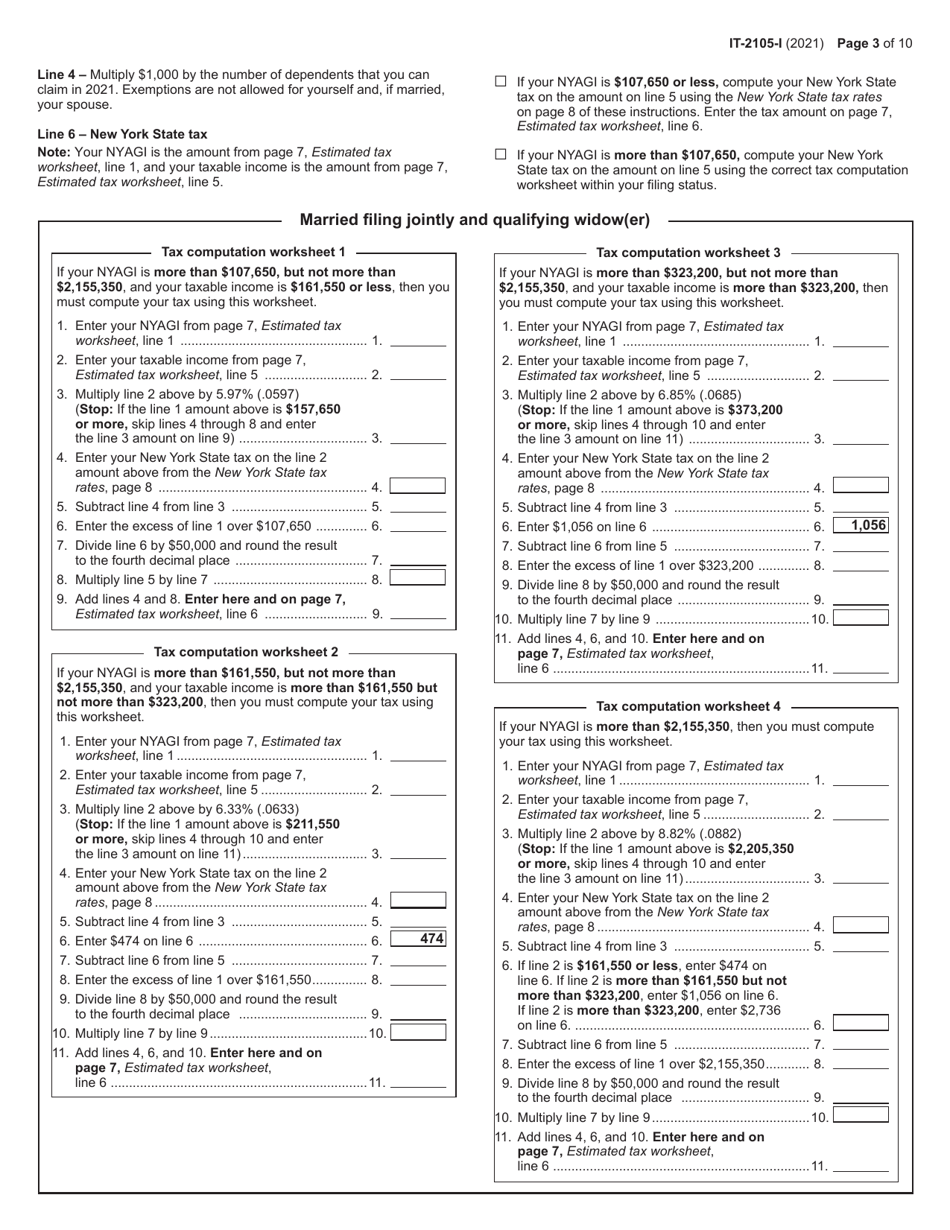

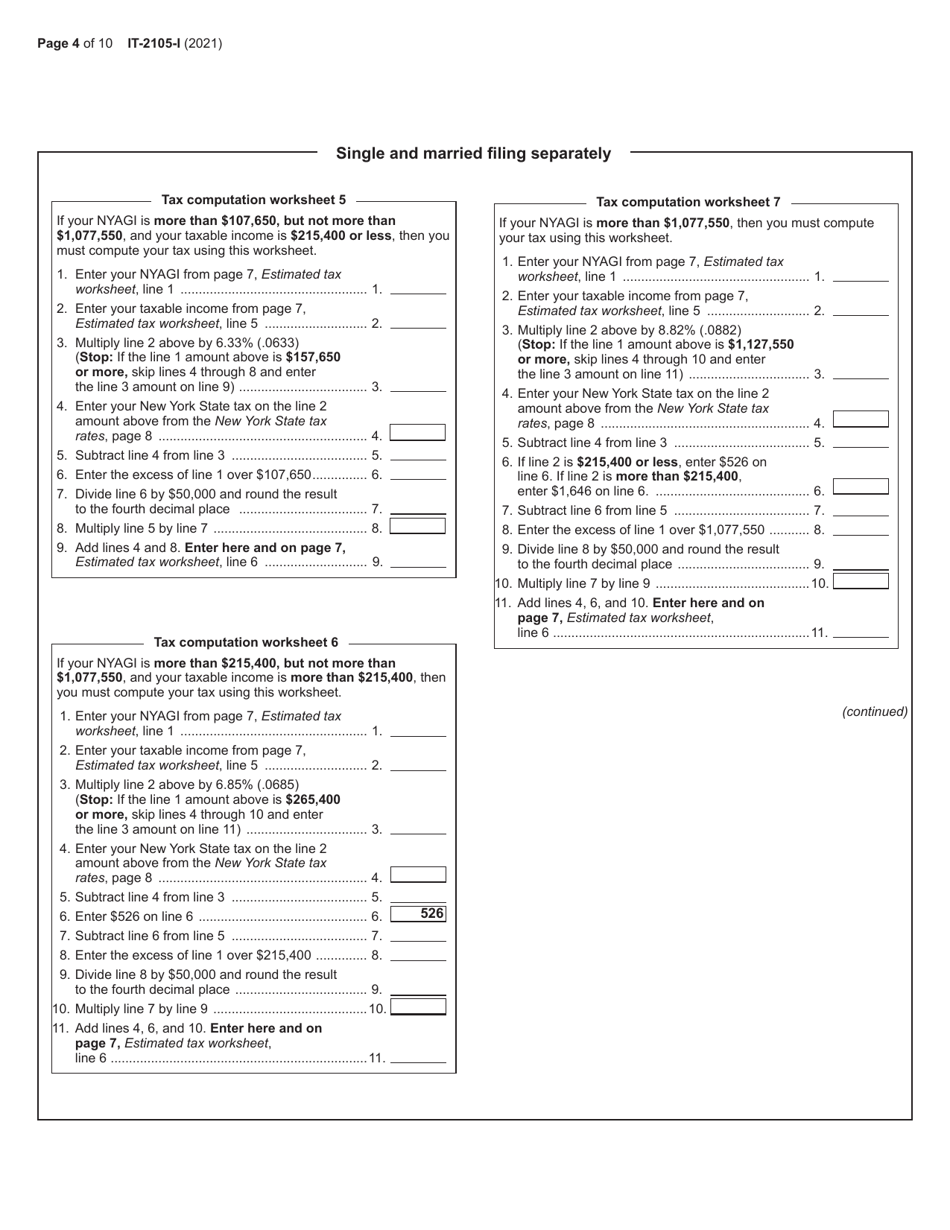

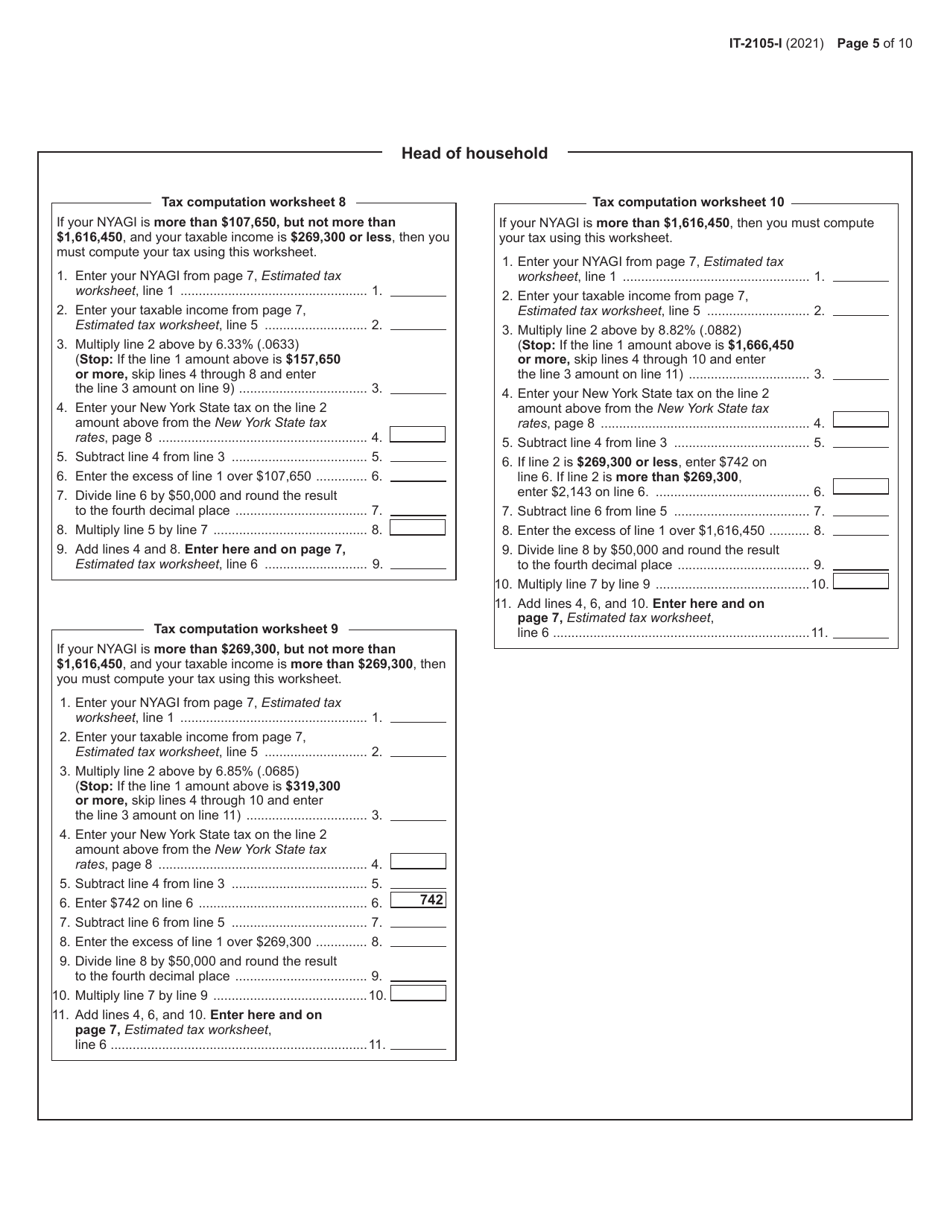

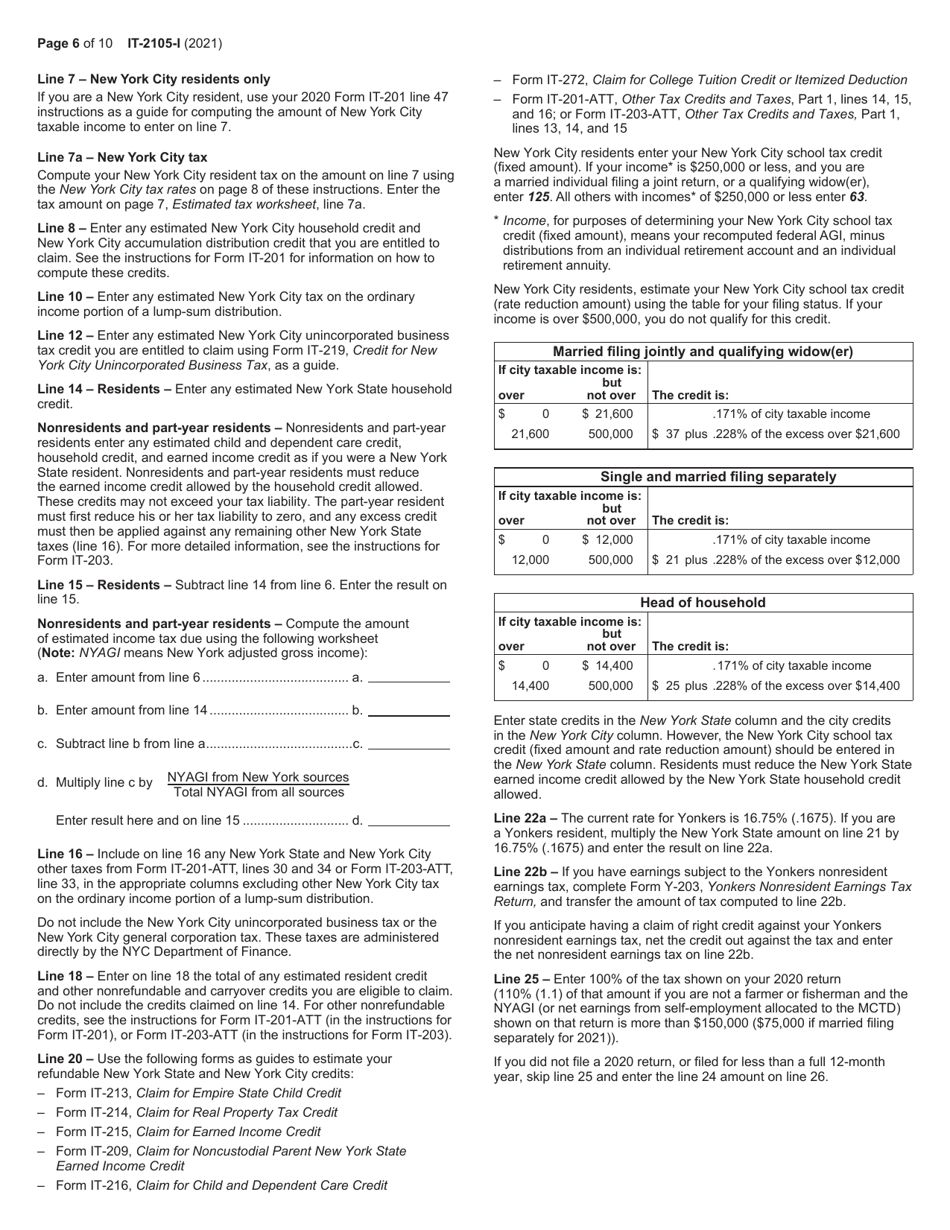

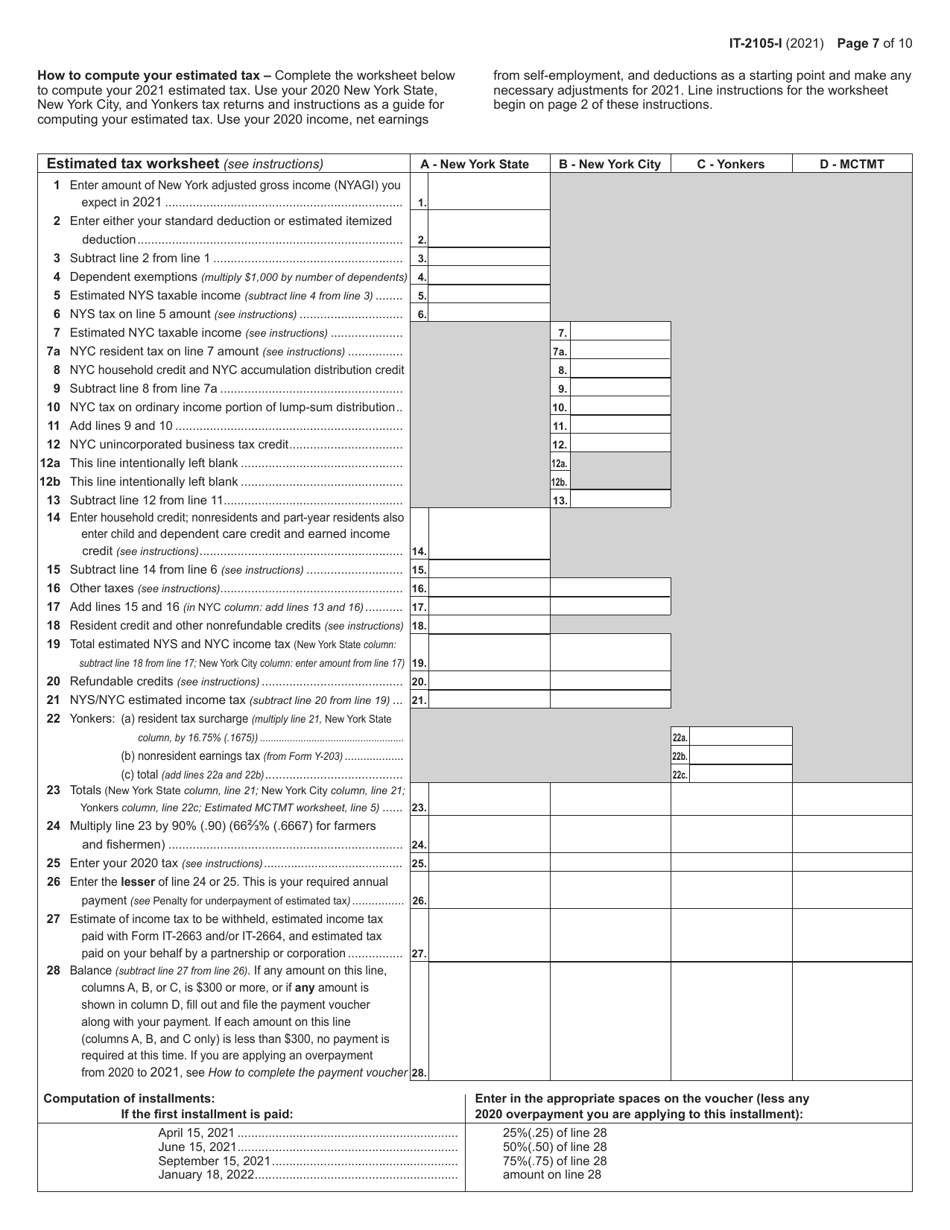

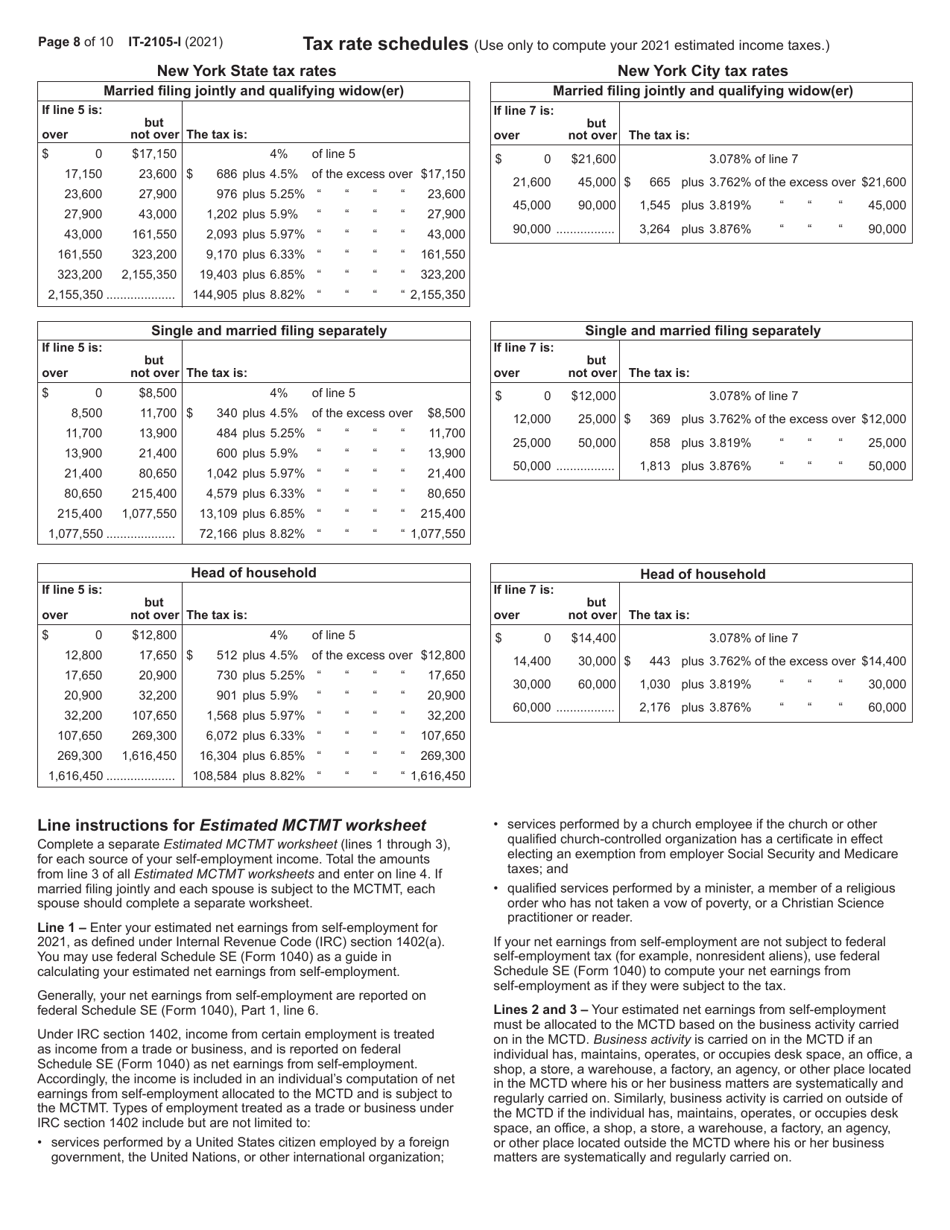

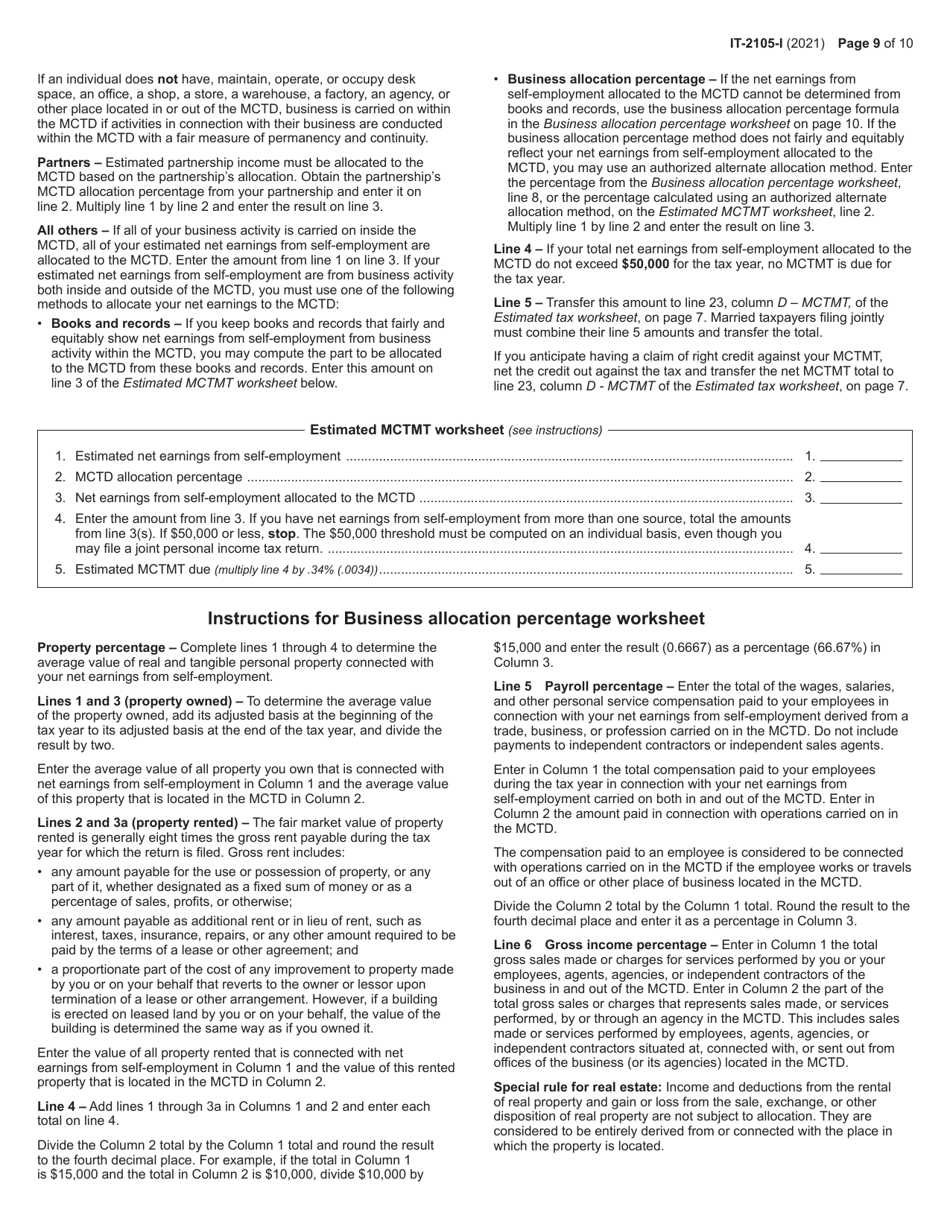

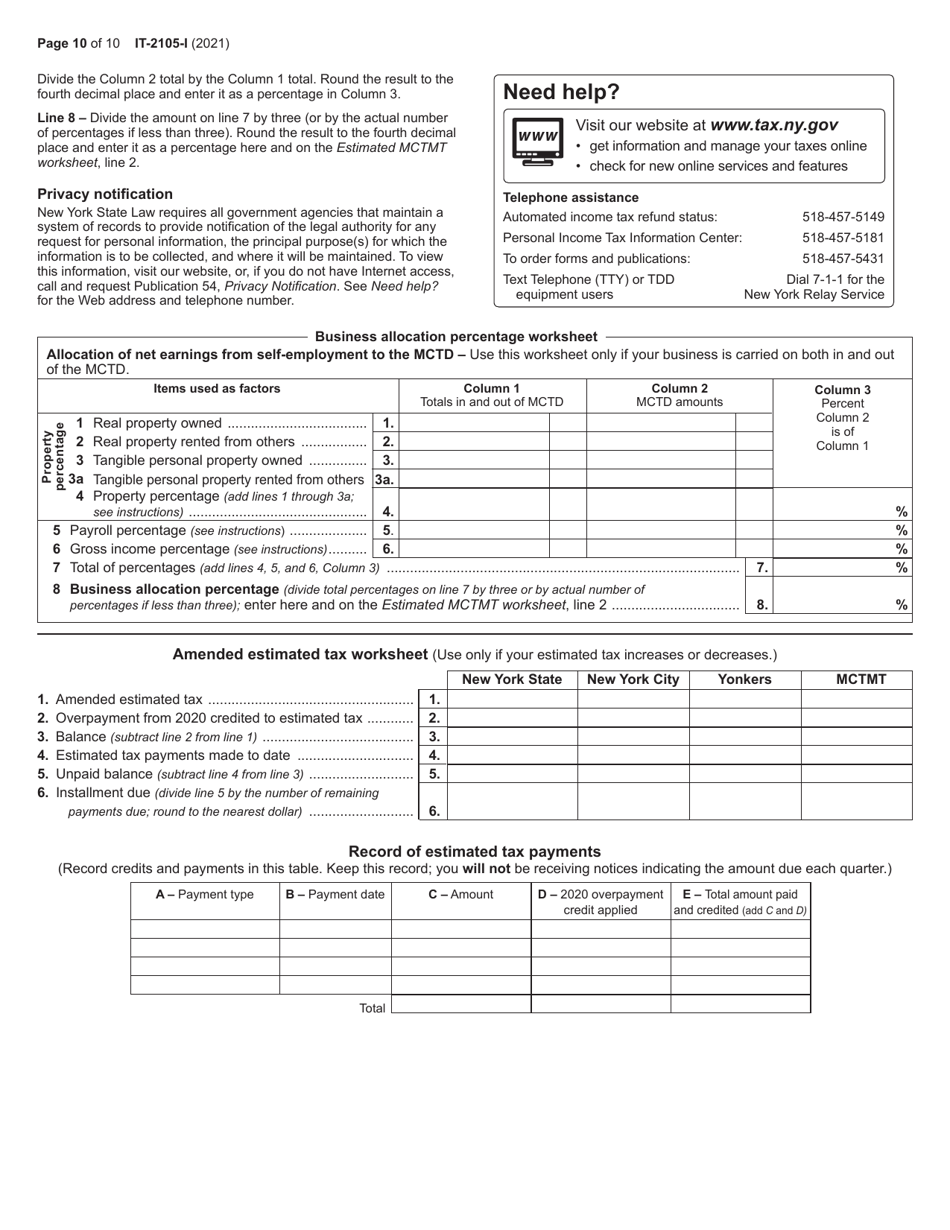

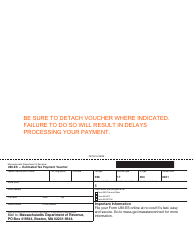

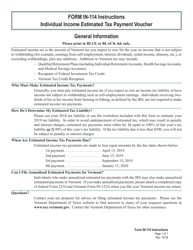

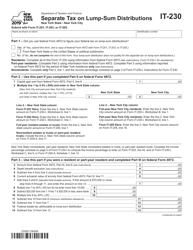

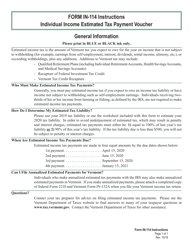

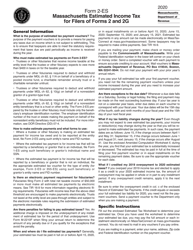

Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals - New York

This document contains official instructions for Form IT-2105 , Estimated Tax Payment Voucher for Individuals - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form IT-2105?

A: Form IT-2105 is an estimated tax payment voucher for individuals in New York.

Q: Who needs to file Form IT-2105?

A: Any individual in New York who expects to owe more than $300 in state income tax must file Form IT-2105.

Q: What is the purpose of Form IT-2105?

A: The purpose of Form IT-2105 is to make estimated tax payments throughout the year to avoid penalties for underpayment of taxes.

Q: How do I fill out Form IT-2105?

A: You can fill out Form IT-2105 by providing personal information, estimating your annual income, calculating your estimated tax liability, and completing the payment voucher section.

Q: When is Form IT-2105 due?

A: Form IT-2105 is due on April 15th of the tax year, or the next business day if April 15th falls on a weekend or holiday.

Q: What if I make a mistake on Form IT-2105?

A: If you make a mistake on Form IT-2105, you can correct it by filing an amended Form IT-2105 with the correct information.

Q: Do I need to keep a copy of Form IT-2105 for my records?

A: Yes, it is recommended to keep a copy of Form IT-2105 for your records in case it is needed in the future.

Instruction Details:

- This 10-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.